|

市场调查报告书

商品编码

1445476

塑胶加工机械:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Plastic Processing Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

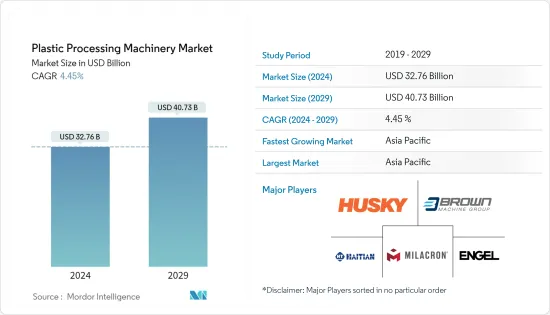

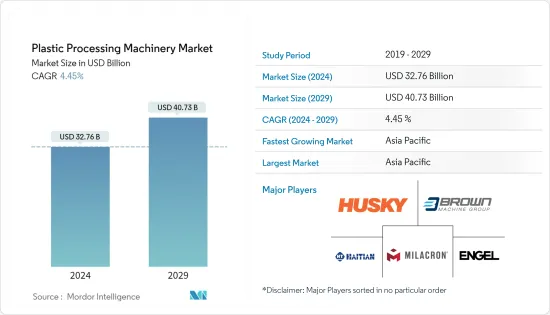

2024年塑胶加工机械市场规模预计为327.6亿美元,预计到2029年将达到407.3亿美元,在预测期内(2024-2029年)增长4.45%。复合年增长率为

随着人们越来越意识到塑胶加工技术的许多好处,例如设计弹性,以及食品和饮料等最终用途行业正在迅速采用此类机械,全球塑胶加工机械市场正在成长。预计将快速成长。

主要亮点

- 塑胶成型加工技术广泛应用于各种产品的生产,如汽车零件、连接器、显示器、行动电话、3C电子产品、塑胶光学镜片、生物医学应用产品以及一般日用品等。塑胶成型技术日益进步。这是因为越来越多的人以不同的方式使用产品,对其功能有不同的需求。

- 与金属、石材、木材等其他材料相比,塑胶具有成本低、可塑性强等优点。因此在经济和日常生活中广泛应用。塑胶製品和工业在世界上发挥着至关重要的作用。市场成长预计将受到增强塑胶和生物分解性塑胶需求不断增长等趋势的推动。该行业正在拥抱工业4.0的概念,它结合了数位技术和塑胶製造技术。

- 由于塑胶製品需求量快速增加,业界对塑胶加工设备的需求明显增加。与其他方法相比,塑胶射出成型是最受欢迎的塑胶成型方法之一。随着众多的工业应用,市场对该技术的需求不断增长和发展。客製化塑胶射出成型零件是许多需要以低成本大量生产高品质零件的行业的完美解决方案。

- 随着开发中国家塑胶加工厂的现代化,射出成型的更新需求预计将因更新需求的增加而增加。这种成长也是由技术变革推动的,技术变革降低了设备成本,使其在价格敏感的市场上更便宜。

- 在COVID-19感染疾病的早期阶段,对注射器、消毒剂瓶和清洁液瓶等吹塑成型医疗产品的需求庞大。俄罗斯和乌克兰之间的战争也为整个包装生态系统带来了变化。

塑胶加工机械市场趋势

包装产业对塑胶的需求增加

塑胶包装越来越多地应用于食品和饮料、消费品、电子产品甚至工业等行业。这意味着塑胶包装可以与较少的产品发生反应并保持产品的安全,所使用的材料可以是无味的,可以保护产品免受环境影响,并且产品可以密封且没有危险。这是因为它有很多好处,包括预防。

- 北美是塑胶包装的主要市场之一,零售业的很大一部分是有组织且受到严格监管的,各部门的货物储存都受到监管。正因为如此,需求大幅增加。例如,美国人口普查局表示,预计2024年塑胶包装材料和贴合加工薄膜将在美国产生380亿美元的销售额。

- 塑胶的轻质特性正在推动欧洲塑胶包装的成长。玻璃比塑胶重得多,因此在运输过程中需要更多的移动。这意味着更显着的环境影响。此外,玻璃对于最终消费者来说非常重,而塑胶则更轻且更容易运输。

根据国际瓶装水协会(IBWA)预测,2021年美国预计消耗156亿加仑瓶装水,比2020年成长4.5%。此外,Harris Poll 代表 IBWA 进行的一项新的全国线上民意调查发现,超过十分之九的美国人希望能够在任何出售其他饮料的地方购买瓶装水。据说确实如此。

预计亚太地区将占最大份额

中国是亚太地区的新兴经济体,製造业活动数量呈指数级增长。这是因为许多最终用户行业需要高性能塑胶零件。

- 在塑胶加工机械中,射出成型机预计在中国占有很大份额。此细分市场的知名企业包括海天国际控股有限公司、震雄集团、力劲科技控股有限公司、大同机械企业有限公司、富强鑫机械製造有限公司等。

- 此外,瓶装水产量资料表明,中国射出成型机市场在预测期内呈现成长趋势。与中国一样,射出成型机很可能占据该国塑胶加工机械市场的很大份额。

- 该细分市场的一些知名企业包括 Arburg GmbH、Engel Machinery India Pvt Ltd、Haitian Huayuan Machinery (India) Pvt Ltd、Husky Injection Molding Systems Pvt Ltd 等。据印度品牌股权基金会 (IBEF) 称,塑胶产业拥有 2,000 多家出口商,包括 30,000 多个加工单位。其中约85-90%是中小企业。

- 日本政府计划透过使用电动车来减少碳排放,从而对电动车基础设施进行大量投资。在日本,为了适应电动车数量的增加,电动车充电站的数量增加。这是因为政府已经开始向购买电动车的人提供补贴。

塑胶加工机械产业概况

由于布朗机械集团、海天国际控股有限公司等几家主要企业的存在,塑胶加工机械市场上竞争企业之间的竞争非常激烈。这些公司透过研究和开发不断创新产品,获得了竞争优势。透过创新和併购,这些公司能够在市场上留下深刻的印象并进一步发展他们的技术。

2022 年 6 月,ALPLA 集团、Brink 和 IPB Printing 与 ENGEL 合作推出 K 2022,是包装产业的巨大飞跃。现在,薄壁 PET 容器首次可以透过单一射出成型製造步骤进行生产。奥地利射出成型设备公司 ENGEL 的展位处理再生 PET。这是透过使用 ENGEL e-speed射出成型机来实现的,该注塑机配备了新创建的强大注塑装置。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌意强度

- 替代品的威胁

- 产业价值链分析

- 市场驱动因素

- 包装产业对塑胶的需求增加

- 汽车产业对轻量零件的需求不断增加,对所用塑胶的需求也随之增加

- 市场限制因素

- 收紧政府法规以尽量减少塑胶的使用

第五章市场区隔

- 类型

- 射出成型机

- 吹塑成型机

- 押出机械

- 热成型机械

- 3D塑胶印表机

- 其他类型

- 最终用户产业

- 包装

- 消费性产品

- 建造

- 车

- 其他最终用户产业

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争形势

- 公司简介

- KraussMaffei Group(ChemChina)

- Brown Machine Group

- Haitian International Holdings Limited

- Engel Austria GmbH

- Kautex Maschinenbau GmbH

- Graham Engineering Corporation

- Gurucharan Industries

- Milacron LLC(Hillenbrand Inc.)

- The Japan Steel Works Ltd

- Sumitomo Heavy Industries

- Arburg GmbH+Co KG

- Husky Injection Molding Systems Ltd

第七章 投资分析

第八章 未来趋势的市场机会

The Plastic Processing Machinery Market size is estimated at USD 32.76 billion in 2024, and is expected to reach USD 40.73 billion by 2029, growing at a CAGR of 4.45% during the forecast period (2024-2029).

The global plastic processing machinery market is expected to grow quickly because people are becoming more aware of the many benefits of plastic processing techniques, such as design flexibility, and because food and beverage and other end-use industries are quickly adopting this type of machinery.

Key Highlights

- Plastic molding processing technology has been widely used in the manufacturing of various products, such as auto parts, connectors, displays, mobile phones, 3C electronic products, plastic optical lenses, biomedical application products, general daily necessities, etc. Plastic molding processing technology is getting better and better every day. This is because more and more people are using products in different ways and have different needs for how they work.

- Compared to other materials, such as metal, stone, and wood, plastic has the advantages of low cost and strong plasticity. Thus, it is widely used in the economy and daily life. Plastic products and industry occupy an extremely important position in the world. Gains in the market are anticipated to be driven by trends, including the expanding demand for reinforced and biodegradable plastics. The industry is embracing the concept of "Industry 4.0" by fusing digital technology with plastic manufacturing techniques.

- Due to the sheer growth in demand for plastic products, the industry is seeing significant growth in demand for plastic processing equipment. Plastic injection molding is one of the most common ways to shape plastic out of other methods.With numerous industrial applications, the market demand for the technology is continually expanding and evolving. Plastic injection-molded parts that are made to order are the perfect solution for many industries that need to make a lot of high-quality parts at a low cost.

- The growing need for upgrades combined with the modernization of plastics processing plants in developing nations is expected to spur the replacement demand for injection molding machinery and other equipment. The growth is also helped by changes in technology, which are lowering the cost of equipment and making it more affordable in price-sensitive markets.

- During the beginning stages of the COVID-19 epidemic, there was a tremendous demand for blow-molded medical items, such as injection syringes, sanitizer bottles, and cleaning solution bottles. The war between Russia and Ukraine has also changed the packaging ecosystem as a whole.

Plastic Processing Machinery Market Trends

Increasing Demand for Plastics from the Packaging Industry

Plastic packaging is being used more and more in industries like food and drinks, consumer goods, electronics, and even industry. This is because plastic packaging has many benefits, such as how it reacts with fewer products and helps keep items safe, how the materials used can be made odorless, how it helps protect items from the environment, and how the product can be sealed to prevent leaks.

- North America is one of the major markets for plastic packaging, as a prominent share of the retail sector is organized and highly regulated, which regulates the safekeeping of items in various segments; owing to this, the demand is significantly higher. For example, the US Census Bureau says that plastic packaging materials and unlaminated films are expected to bring in USD 38 billion in sales in the US in 2024.

- The lightweight property of plastic is driving the growth of plastic packaging in Europe. Glass is much heavier compared to plastic, which means more trips would be required while transporting. This translates to a more significant environmental impact. Glass is also much heavier for the end consumer, whereas plastic is lightweight and much easier to carry.

As per the International Bottled Water Association (IBWA), the United States will consume 15.6 billion gallons of bottled water in 2021, a 4.5% increase over 2020. Also, a new national online poll done by The Harris Poll on behalf of the IBWA found that more than nine out of ten Americans expect to be able to buy bottled water wherever other drinks are sold.

Asia-Pacific is Expected to Hold the Largest Share

China is an emerging economy in the Asia-Pacific region, and the number of manufacturing activities there is growing at an exponential rate. This is because high-performance plastic components are needed in many end-user industries.

- Within the types of plastic processing machinery, injection molding machinery is expected to hold a significant share in China. Haitian International Holdings Limited, The Chen Hsong Group, L.K. Technology Holdings Limited, Cosmos Machinery Enterprises Limited, and Fu Chin Shin Machinery Manufacture Co. Ltd., among others, are well-known companies in this market segment.

- Also, the production data for bottled drinking water is indicative of the fact that the injection molding machinery market in China is poised to grow over the forecast period. Like in China, injection molding machines are likely to have a big share of the market for plastic processing machines in the country.

- Some of the prominent players operating in this segment of the market include Arburg GmbH, Engel Machinery India Pvt Ltd, Haitian Huayuan Machinery (India) Pvt Ltd, and Husky Injection Molding Systems Pvt Ltd, among others. According to the India Brand Equity Foundation (IBEF), the plastics industry hosts more than 2,000 exporters and comprises more than 30,000 processing units. About 85-90% of these units are small and medium-sized enterprises.

- The government of Japan plans to reduce its carbon footprint by using EVs, which has resulted in substantial investments toward EV infrastructure development. Japan saw a rise in the number of EV charging stations to keep up with the growing number of EVs. This is because the government started giving subsidies to people who bought EVs.

Plastic Processing Machinery Industry Overview

The competitive rivalry in the plastic processing machinery market is high owing to the presence of some key players, such as Brown Machine Group and Haitian International Holdings Limited, amongst others. Through research and development, these companies have gained a competitive advantage by continually innovating their offerings. These players, through innovation and mergers and acquisitions, have been able to gain a strong footprint in the market as well as be able to further develop the technology.

In June 2022, ALPLA Group, Brink, and IPB Printing partnered with ENGEL to introduce K 2022, a quantum leap for the packaging industry. PET thin-walled containers can now be constructed for the first time in a single injection molding production step. The stand of the Austrian injection molding equipment company ENGEL processes recycled PET. This is accomplished using an ENGEL e-speed injection molding machine with a freshly created, incredibly potent injection unit.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Increasing Demand for Plastics from the Packaging Industry

- 4.4.2 Increasing Demand for Light Weight Components From the Automotive Sector is Fueling the Demand for Plastic Being Used

- 4.5 Market Restraints

- 4.5.1 Stricter Government Regulations toward Minimal Usage of Plastics

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Injection Molding Machinery

- 5.1.2 Blow Molding Machinery

- 5.1.3 Extrusion Machinery

- 5.1.4 Thermoforming Machinery

- 5.1.5 3D Plastic Printers

- 5.1.6 Other Types

- 5.2 End-user Industry

- 5.2.1 Packaging

- 5.2.2 Consumer Products

- 5.2.3 Construction

- 5.2.4 Automotive

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 KraussMaffei Group (ChemChina)

- 6.1.2 Brown Machine Group

- 6.1.3 Haitian International Holdings Limited

- 6.1.4 Engel Austria GmbH

- 6.1.5 Kautex Maschinenbau GmbH

- 6.1.6 Graham Engineering Corporation

- 6.1.7 Gurucharan Industries

- 6.1.8 Milacron LLC (Hillenbrand Inc.)

- 6.1.9 The Japan Steel Works Ltd

- 6.1.10 Sumitomo Heavy Industries

- 6.1.11 Arburg GmbH + Co KG

- 6.1.12 Husky Injection Molding Systems Ltd