|

市场调查报告书

商品编码

1445483

託管应用服务:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Managed Application Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

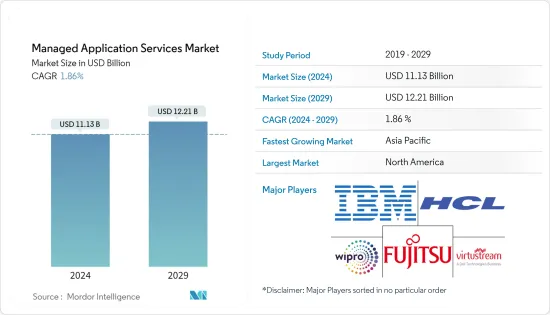

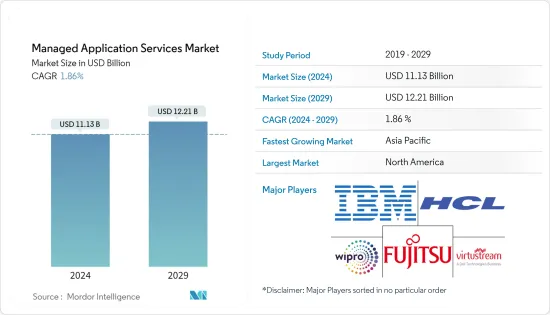

託管应用服务市场规模预计到 2024 年为 111.3 亿美元,预计到 2029 年将达到 122.1 亿美元,预测期内(2024-2029 年)复合年增长率为 1.86%。

预计在预测期内,对端到端应用程式託管服务的需求将会增加。託管应用程式服务允许组织将特定的 IT 需求外包给第三方服务供应商。企业可以降低成本、提高生产力并提高应用程式效能,而无需花费时间实施、维护或升级 IT 相关应用程式。智慧型手机设备的日益普及和组织内物联网服务的实施预计将在预测期内推动市场发展。自 COVID-19 爆发以来,随着企业采用远距工作模式,对云端基础的解决方案的需求显着增加。然而,过去几年,零售、製造业和 BFSI 等各行业的收益都出现了大幅下降。

主要亮点

- 随着客户将工作负载转移到云端,云端原生架构(尤其是微服务)的使用正在增加。基于微服务的架构有助于提高可扩展性和速度,但实施它们可能会带来挑战。对于许多 Java 开发人员来说,Spring Boot 和 Spring Cloud 协助解决了这些挑战,提供了一个强大的平台,具有用于开发和操作微服务服务应用的既定模式。去年,为了简化 Spring Cloud 应用程式的部署和管理,微软与 Pivotal 合作创建了 Azure Spring Cloud。

- 最近,VSHN 发布了 Project Syn,这是一个新一代开放原始码託管服务框架,适用于基于 Kubernetes 的任何基础架构上的 DevOps 和应用程式操作。 Project Syn 是一组预先整合工具,用于在云端上对 Kubernetes 和生产应用程式进行设定、更新备份、监控、回应或发出警报。使用容器、Kubernetes 和 GitOps 透过完整的自助服务和自动化来支援 DevOps。 Syn 专案即将成为一个开放原始码计划。它充当生产框架,由多个组件组成,提供在 Kubernetes 上运行生产中的应用程式所需的功能。

- 去年,AWS 推出了 Amazon Managed Apache Cassandra Service,这是一项可扩展、高度可用、託管且与 Apache Cassandra 相容的资料库服务。这允许使用者利用相同的 Cassandra 应用程式程式码(由 Apache 2.0 授权)在 AWS 云端上执行 Cassandra 工作负载。使用协助者、工具等。託管 Cassandra 服务无需配置、修补和管理伺服器以及安装、维护和操作软体。表可以根据请求流量自动扩展和缩小,吞吐量和储存几乎不受限制。使用者可以使用 AWS Identity and Access Management (IAM) 管理对其表的访问,并透过整合日誌记录和监控保持应用程式平稳运行。

- 近年来,由于 COVID-19感染疾病导致经济放缓,组织减少了技术投资,资讯技术支出可能会下降。不过,企业和政府机构持续投资软体和IT服务,市场预计将稳定下来。儘管短期计划被叫停,但为服务供应商带来可观收益的託管应用服务产业并未受到疫情影响。最近,作为其COVID-19 响应计划计划的一部分,XenonStack 向直接参与救援工作的任何人(包括医疗保健、非政府组织和政府机构)提供三个月的免费託管IT 支援、应用程式管理和云端支持。到。

託管应用服务市场趋势

IT和通讯预计将占据很大份额

- 由于各种技术的高采用率、BYOD 策略检查频率的增加以及组织之间资料的快速增长对高端安全性的需求不断增加,IT 和通讯行业已成为託管应用程式服务的重要市场。我是。过去几年,通讯业经历了显着成长。电信业者始终面临以低成本提供创新服务的压力,以便在竞争激烈的市场中留住客户。

- 根据最近对 SD-WAN 託管服务的调查,64% 的受访网路和 IT 管理员计划在未来几年内添加 SD-WAN 託管服务。这是因为我们相信最终用户将享受增强的安全性、改进的云端应用程式效能和灵活的管理。这种需求正在推动 IT 和通讯服务供应商从第三方购买硬体、软体和日常网路管理。许多 SD-WAN 託管服务供应商透过各种安全产品脱颖而出。

- 根据与英特尔合作製作的 Hazlecast Infinity Data 报告,IT 决策者认为云端应用效能 (40%) 是利润的最大驱动力,此外还有金融服务 (49%)、电讯(42%) 和电子服务。-商业。我们认为这是一个机会。 (40%) 在受访产业中排名最高。然而,迁移到云端时最大的挑战是安全性 (97%) 和效能 (90%)。

- 去年,Hazelcast 宣布在 Amazon Web Services (AWS) 上推出 Hazelcast Cloud Enterprise。这是 Hazelcast 软体的低延迟部署,作为託管服务,旨在提高云端基础的应用程式的效能、安全性和可管理性。凭藉内建保护和与云端无关的架构,Hazelcast Cloud Enterprise 为大规模企业部署提供了超越现有商品化云端资料储存服务的速度、规模、安全性和高可用性功能。

预计北美将占据主要份额

- 由于IT基础设施形势不断变化,尤其是中小型企业 (SME),北美託管应用服务市场正在不断增长,并持续关注外包网路安全解决方案。例如,美国新兴的 IT 用品製造商和分销商之一 Kpaul Properties LLC 部署了富士通,以虚拟环境取代实体伺服器。这使公司的成本降低了 15%,运作了 95%。随着现代技术的快速发展以及对简化 IT 功能的需求,该地区越来越多的企业正在寻找跟上 MSP 的最佳方式。

- 此外,加拿大多重云端环境中的应用程式正在激增,自动化的采用也不断增加。在该地区,云端、行动和社交技术迫使企业采取主动的IT安全方法,从而导致对跨所有安全管理层提供的强大託管服务实施的需求不断增加。整合通讯即服务和相关的客服中心即服务市场为託管服务供应商提供了机会。这是因为新兴企业提供了云端基础的创新解决方案,这些解决方案易于以最少的投资进行部署。

- 近日,美国控股云端运算公司Rackspace宣布,已同意收购亚马逊网路服务(AWS)合作伙伴网路(APN)首要咨询合作伙伴及AWS託管服务供应商Onica。此次收购将 Onica 的创新专业服务能力(包括策略咨询、架构、工程和应用开发)添加到 Rackspace 产品组合中,并补充了其现有的託管云端服务能力。 Rackspace 的混合云端产品组合使企业能够利用从IT安全到软体开发的各种技术增强功能。

- 去年,Infosys 在亚利桑那州凤凰城推出了 Infosys Live Enterprise Suite,这是一套全面的平台、解决方案和数位服务,可协助企业加速数位创新。用户可以采用云端提供者的最佳创新,并透过 Infosys Polycloud 平台建立与云端无关的应用程式堆迭。该平台提供了一个公共云端云和私有云端的背板,可让您透过标准介面和目录在整个企业中选择、配置、移动和管理平台和应用程式服务工作负载。

託管应用服务产业概述

託管应用服务市场内的市场参与者之间的竞争非常激烈,没有特定的主导参与者存在。竞赛结果基于公司最重要的特点:高品质和价格合理的服务。该市场的一些主要参与者包括 IBM 公司、HCL Technologies Limited、WIPRO Limited 和 Fujitsu Limited。市场的最新发展包括:

- 2022 年 5 月 - Microsoft 推出了一个新的託管服务类别,称为 Microsoft 安全专家。该服务为组织提供外部安全专家的协助,他们可以执行威胁搜寻以及託管侦测和回应任务。对于企业而言,该服务允许现场安全团队在异地Microsoft 专家的帮助下补充其能力。

- 2022 年 2 月 - IBM 与 SAP(NYSE:SAP)合作,提供技术帮助客户采用混合云端方法,并将关键任务工作负载从SAP 解决方案转移到受监管和不受监管行业的云中,并咨询了专家。 IBM 是第一个提供云端基础架构和技术管理服务(作为 RISE with SAP 产品的一部分)的合作伙伴。

- 此外,当客户考虑混合云端策略时,他们将需要一个安全可靠的云端环境来移动作为企业营运支柱的工作负载和应用程式。随着针对 RISE with SAP 的 IBM 供应商选项的推出,客户现在拥有了加速将本机 SAP 软体工作负载迁移到 IBM Cloud 的工具,并得到了业界领先的安全功能的支援。我可以。

- 此外,IBM 还推出了一项名为 BREAKTHROUGH with IBM for RISE with SAP 的新计画。它包括一系列解决方案和咨询服务,可加速和扩展您向 SAP S/4HANA Cloud 的迁移。建构在灵活、可扩展平台上的解决方案和服务使用智慧工作流程来简化营运。它们提供了一个参与模型来帮助规划、执行和支持全面的业务转型。它还为客户提供了利用深厚的行业专业知识将 SAP 解决方案工作负载迁移到公共云端的选择和弹性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 对端到端应用程式託管的需求不断增长

- 改进和保护关键业务应用程式的要求

- 提高应用基础设施水平

- 市场限制因素

- 与应用程式资料相关的安全风险

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

- PESTLE分析

第五章市场区隔

- 组织规模

- 中小企业

- 大公司

- 最终用户产业

- BFSI

- 零售与电子商务

- 资讯科技与电信

- 製造业

- 卫生保健

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东地区

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 併购

- 公司简介

- Fujitsu Limited

- IBM Corporation

- HCL Technologies Limited

- Wipro Limited

- VIRTUSTREAM INC.

- RACKSPACE INC.

- CenturyLink, Inc.

- DXC Technology Company

- BMC Software, INC.

- Mindtree Limited

- Unisys Corporation

第七章市场机会与未来趋势

The Managed Application Services Market size is estimated at USD 11.13 billion in 2024, and is expected to reach USD 12.21 billion by 2029, growing at a CAGR of 1.86% during the forecast period (2024-2029).

Demand for end-to-end application hosting services will increase in the forecast period. The managed application services allow the organization to outsource specific IT requirements to a third-party service provider. The companies can reduce costs, boost productivity, and enhance application performance without spending time on implementation, maintenance, and upgradation of their IT-related application. The increase in the adoption of smartphone devices and the implementation of IoT services in the organization will drive the market in the forecast period. Since the outbreak of COVID-19, the demand for cloud-based solutions has seen significant growth owing to remote working models being adopted by enterprises; however, various industries such as retail, manufacturing, BFSI, and others have seen a significant slump in their revenues in the past years.

Key Highlights

- As customers have moved their workloads to the cloud, there is a growth in the usage of cloud-native architectures, particularly microservices. Microservice-based architectures help improve scalability and velocity, but implementing them can pose challenges. For many Java developers, Spring Boot and Spring Cloud have helped address these challenges, providing a robust platform with well-established patterns for developing and operating microservice applications. In the previous year, to help make it simpler to deploy and manage Spring Cloud applications, together with Pivotal, Microsoft created Azure Spring Cloud.

- Recently, VSHN announced Project Syn, the next generation Open Source managed services framework for DevOps and application operations on any infrastructure based on Kubernetes. Project Syn is a pre-integrated set of tools to provision, update backup, observe, and react or alert production applications on Kubernetes and in the cloud. It supports DevOps through complete self-service and automation with the help of containers, Kubernetes, and GitOps. Project Syn is about to become an Open Source project shortly. It consists of several components that bring the necessary features for running applications in production on Kubernetes, acting as an operations framework.

- During the previous year, AWS launched Amazon Managed Apache Cassandra Service, a scalable, highly available, and managed Apache Cassandra-compatible database service that enables the user to run the Cassandra workloads in the AWS Cloud utilizing the same Cassandra application code, Apache 2.0 licensed drivers, and tools that are used. With Managed Cassandra Service, there is no need to provision, patch, or manage servers and install, maintain, or operate the software. Tables could scale up and down automatically based on request traffic, with virtually unlimited throughput and storage. The user can manage access to the tables using AWS Identity and Access Management (IAM) and keep the applications running smoothly with integrated logging and monitoring.

- Information Technology spending in recent years is likely to fall as organizations trim investments in technology in the wake of the COVID-19 pandemic-led slowdown. However, enterprises and government agencies continue to invest in software and IT services, which is expected to stabilize the market. While short-term projects are getting stopped, the managed application services segment, which fetches significant revenue for service providers, has not been impacted by the outbreak. Recently, XenonStack offered a free 3-month Managed IT Support, Application Management, and Migration to the Cloud as part of their COVID-19 response plan program to anyone directly involved in relief initiatives like Healthcare, NGOs, and government bodies.

Managed Application Services Market Trends

IT and Telecom is Expected to Hold Major Share

- The IT and telecom sector is a significant market for managed application services due to the high rate of various technological adoptions, increased frequency of confirmation of the BYOD policy, and an increased need for high-end security due to the rapidly growing data among organizations. The telecom industry has observed extensive growth during the past few years. Telecommunication companies are constantly pressured to deliver innovative services at lower costs to retain their customers in the competitive market.

- According to the SD-WAN Managed Services recent survey, 64% of the surveyed network and IT managers plan to add an SD-WAN managed service in the upcoming years. This is because the end-users believe it will deliver better security, improved cloud application performance, and flexible management. This demand is encouraging IT and Telcom service providers to purchase hardware, software, and regular administration of their networks from a third party. Many SD-WAN-managed service providers are differentiating themselves with a wide range of security offerings.

- According to Hazlecast Infinity Data report in collaboration with Intel, IT decision-makers identified cloud application performance (40%) as the number one opportunity to unlock profits, with financial services (49%), telecommunications (42%), and e-commerce (40%) ranking it the highest among verticals surveyed. However, security (97%) and performance (90%) were the top challenges when migrating to the cloud.

- In the previous year, Hazelcast announced the availability of Hazelcast Cloud Enterprise on Amazon Web Services (AWS), a low-latency deployment of Hazelcast software as a managed service designed to improve the performance, security, and ease of management of cloud-based applications. Featuring built-in protection and a cloud-agnostic architecture, Hazelcast Cloud Enterprise exceeds the speed, scale, safety, and high availability capabilities of existing commoditized cloud data storage services for large-scale enterprise deployments.

North America is Expected to Hold Major Share

- The North American Managed Application Services market is growing due to the changing IT infrastructure landscape, especially in small and medium enterprises (SMEs), continually focusing on outsourcing cybersecurity solutions. For instance, Kpaul Properties LLC, one of the emerging manufacturers and distributors of IT supplies in the United States, onboarded FUJITSU to replace physical servers with a virtualized environment. This has reduced the company's cost by 15% and delivered 95% uptime. With the speedy acceleration of modern technology and the need for streamlined IT functions, an increasing number of businesses in the region find the best way to keep pace with MSP.

- Besides, Canada is witnessing a high rise in the application of multi-Cloud environments and increased adoption of automation. In the region, Cloud, mobile, and social technologies demand that businesses take a proactive approach toward IT security, thus boosting the demand for deploying robust managed services that would deliver in all security management layers. Unified Communications as a Service and related Contact Center as a Service market represent a business opportunity for managed service providers. This is because emerging players offer innovative cloud-based solutions, which require a minimum investment and are easy to deploy.

- Recently, Rackspace, an American-managed Cloud computing company, announced that it has agreed to acquire Onica, an Amazon Web Services (AWS) Partner Network (APN) Premier Consulting Partner and AWS Managed Service Provider. This acquisition brings Onica's innovative professional services capabilities, including strategic advisory, architecture, engineering, and application development, to the Rackspace portfolio, complementing its existing managed cloud services capabilities. Rackspace's hybrid cloud portfolio enables enterprises to leverage various technical enhancements, from IT security to software development.

- In the previous year, Infosys unveiled the Infosys Live Enterprise Suite in Phoenix, Arizona, a comprehensive set of platforms, solutions, and digital services that helps enterprises to accelerate their digital innovation journey. The user can embrace the best innovations across cloud providers and build a cloud-agnostic application stack through the Infosys Polycloud Platform. The platform provides a backplane that abstracts the public and private clouds, enabling a standard interface and catalog to select, provision, move and manage platform and application services workloads across the enterprise.

Managed Application Services Industry Overview

The competition within the managed application services market is high among the market players without any specific dominating player. The competition results are based on the enterprise's best features of high quality and services at a reasonable price. Some significant players in the market are IBM Corporation, HCL Technologies Limited, WIPRO Limited, Fujitsu Ltd., and others. Some of the recent trends in the market are as follows:

- May 2022 - Microsoft launched a new managed service category known as Microsoft Security Experts. The service provides organizations with assistance from external security experts who can perform threat hunting and managed detection and response tasks. For businesses, the service enables on-site security teams to supplement their capabilities with assistance from off-site Microsoft experts.

- February 2022 - IBM partnered with SAP (NYSE: SAP) to provide technology and consult experts to help clients embrace a hybrid cloud approach and migrate mission-critical workloads from SAP solutions to the cloud in regulated and non-regulated industries. As part of the RISE with an SAP offering, IBM is the first partner to provide cloud infrastructure and technical managed services.

- Moreover, as clients consider hybrid cloud strategies, moving the workloads and applications that are the backbone of their enterprise operations necessitates a highly secure and reliable cloud environment. With the launch of the IBM supplier option for RISE with SAP, clients have the tools to help accelerate the migration of their on-premise SAP software workloads to IBM Cloud, backed by industry-leading security capabilities.

- In addition, IBM is launching a new program called BREAKTHROUGH with IBM for RISE with SAP, which includes a portfolio of solutions and consulting services to help accelerate and amplify the journey to SAP S/4HANA Cloud. The solutions and services, built on a flexible and scalable platform, use intelligent workflows to streamline operations. They offer an engagement model that aids in the planning, execution, and support of holistic business transformation. Clients are also given the option and flexibility to migrate SAP solution workloads to the public cloud with the help of deep industry expertise.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased demand for end-to-end application hosting

- 4.2.2 The requirement to improve and secure critical business applications

- 4.2.3 Increase in the level of application infrastructure

- 4.3 Market Restraints

- 4.3.1 Security risks associated with application data

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porters 5 Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Organization Size

- 5.1.1 Small & Medium-scale Enterprises

- 5.1.2 Large Enterprises

- 5.2 End-user Verticals

- 5.2.1 BFSI

- 5.2.2 Retail & E-Commerce

- 5.2.3 IT & Telecom

- 5.2.4 Manufacturing

- 5.2.5 Healthcare

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.5 Middle East

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Fujitsu Limited

- 6.3.2 IBM Corporation

- 6.3.3 HCL Technologies Limited

- 6.3.4 Wipro Limited

- 6.3.5 VIRTUSTREAM INC.

- 6.3.6 RACKSPACE INC.

- 6.3.7 CenturyLink, Inc.

- 6.3.8 DXC Technology Company

- 6.3.9 BMC Software, INC.

- 6.3.10 Mindtree Limited

- 6.3.11 Unisys Corporation