|

市场调查报告书

商品编码

1445519

硫酸:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Sulfuric Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

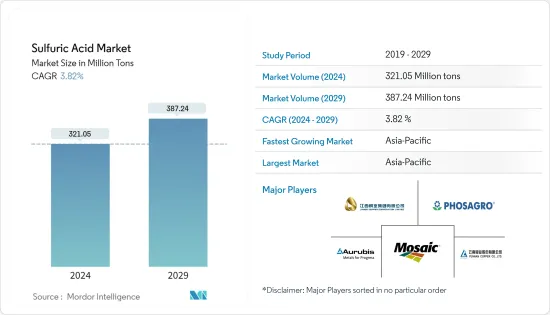

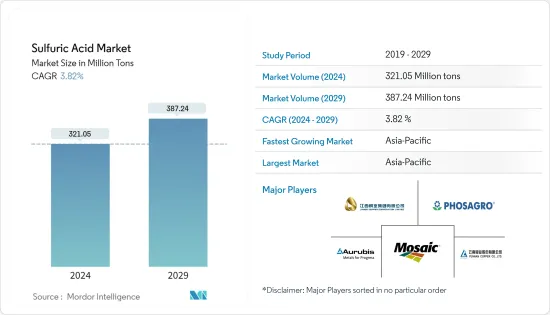

2024年硫酸市场规模预估为3,2,105万吨,预估至2029年将达到3,8,724万吨,在预测期内(2024-2029年)复合年增长率为3.82%。

COVID-19大流行对2020年硫酸市场产生了中等影响。各国实施的封锁和供应中断影响了化学工业。然而,由于硫酸是化学行业使用的主要化学品之一,因此预计在预测期内需求将会很高。

主要亮点

- 短期内,市场研究是由磷基肥料中硫酸的高需求以及全球化学和製药行业不断增长的需求所推动的。

- 另一方面,原物料价格的波动可能会减缓未来几年硫酸市场的成长。

- 发烟硫酸在医疗和其他行业中的使用不断增加,可以被视为一个巨大的市场机会。

- 亚太地区主导全球硫酸市场,其中中国、印度和日本等国家的消费量最大。

硫酸市场趋势

化肥领域消费扩大

- 硫酸是由硫、氢和氧组成的强无机酸。它是一种透明油状液体,有强烈气味,具有强腐蚀性。即使是稀释形式,也应始终小心处理。当用水稀释时,陶瓷排气反应会释放热量。它是肥料製造过程中使用的重要工业化学品。

- 世界上大约一半的硫酸供应用于农业和农业,特别是用作肥料。硫酸用于生产磷肥,例如过磷酸钙和硫酸铵。硫酸可以提高作物产量,并透过生产更有营养的作物帮助农民赚更多的收益。

- 肥料替代作物从土壤中吸收的养分。如果没有化肥,作物产量和农业生产力将会大幅下降。因此,矿物肥料用于补充土壤的养分,其中含有易于被作物吸收和利用的矿物质。

- 农业是全世界生计的主要来源。印度和美国的农业正在经历积极成长。因此,未来几年市场可能会受到化肥需求的推动。

- 例如,根据联合国粮食及农业组织的数据,2021年全球氨、磷酸盐和钾肥产能为315,973吨,预计2022年将达到318,652吨,导致硫酸市场需求增加。预测期。

- 2021年,农产品及相关产品出口总额达412.5亿美元。灌溉投资的增加扩大了灌溉面积,创造了化肥需求,并刺激了硫酸市场。

- 拉丁美洲和加勒比地区的农业部门过去经历了显着增长。根据经济合作暨发展组织(OECD)和联合国粮食及农业组织(FAO)的预测,2018年至2028年农业和渔业产量预计将增加17%。预计这一增长的约 53% 将归因于作物产量的增加。因此,农业的发展增加了对化肥的需求。预计这将影响硫酸市场的成长。

- 根据国际肥料工业协会的数据,2021 年全球消耗了 199,884 吨农业肥料(氮、磷、钾 (NPK))。在总消费量量中,2021年东亚、南亚、拉丁美洲、加勒比海和北美分别消费了61,936千吨、38,694千吨、28,817千吨和25,730千吨。

- 因此,未来几年肥料中硫酸使用量的增加可能会推动市场的发展。

亚太地区主导市场

- 预计亚太地区在预测期内将主导硫酸市场。由于中国、印度和日本等化工、化肥和其他製造业的高需求,硫酸市场正在迅速扩张。

- 根据中国国家统计局数据,2021年中国硫酸产量为9,383万吨,较2020年的9,238万吨增加1.5%以上。我国硫酸产量持续增加,2022年产能达1.29亿吨,年增1.59%。

- 在中国,企业计划将硫酸产能提高至每年2,108万吨。 2022年至2024年产能增加后,预计国内硫酸市场供应格局将发生重大变化,包括出口增加、进口减少、货流变化等。

- 中国是世界上最大的化肥生产国。根据国家统计局数据,2021年我国氮磷钾肥产量5,544万吨,比2020年的5,496万吨增加0.87%。

- 在印度,2021 年 7 月,奥里萨邦首席部长为肥料合作社 IFFCO 帕拉迪普分部的硫酸生产设施奠基。该计划将耗资约 40 亿印度卢比(约 4,836 万美元),预计将于 2023 年投入营运。这个新生产厂将减少我们对化学品进口的依赖。这是 IFFCO 的第三座硫酸生产厂,产能约为每天 2,000 吨 (MT)。

- 此外,印度是高度依赖农业的经济体之一。农业仍是55%以上人口的主要生计来源。根据印度2020-21年经济调查报告,20财年印度粮食总产量为2.9665亿吨,比2019财年的2.8521亿吨增加1144万吨。

- 所有上述因素预计将在预测期内增加亚太地区对硫酸的需求。

硫酸产业概况

全球硫酸市场高度分散。主导市场的前五名公司是 Mosaic、PhosAgro Group of Companies、江西铜业集团、云南铜业和 Aurubis AG。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 磷基肥料对硫酸的需求量大

- 化学和製药行业需求不断增长

- 抑制因素

- 原物料价格波动

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

- 贸易分析

- 原料分析

- 区域产能

第五章市场区隔

- 原料类型

- 单质硫

- 黄铁矿

- 其他类型原料

- 最终用户产业

- 肥料

- 化学和製药

- 车

- 石油精製

- 其他最终用户产业(纸浆和造纸、金属加工)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 合併、收购、合资、合作和协议

- 市场占有率(%)分析

- 主要企业采取的策略

- 公司简介

- Aarti Industries Limited

- Aurubis AG

- Bodal Chemicals Ltd

- Boliden Group

- Hindustan Zinc

- Jiangxi Copper Group Co. Ltd

- KANTO KAGAKU

- Nouryon

- Panoli Intermediates India Private Limited

- PhosAgro Group of Companies

- PVS

- Mosaic

- WeylChem International GmbH

- Yunnan Copper Co. Ltd

第七章市场机会与未来趋势

- 发烟硫酸在医疗和其他行业的使用增加

The Sulfuric Acid Market size is estimated at 321.05 Million tons in 2024, and is expected to reach 387.24 Million tons by 2029, growing at a CAGR of 3.82% during the forecast period (2024-2029).

The COVID-19 pandemic moderately affected the sulfuric acid market in 2020. The imposition of lockdowns across various countries and disruptions in supply affected the chemical sector. However, since sulfuric acid is among the primary chemicals used in the chemical sector, high demand is anticipated in the forecast period.

Key Highlights

- In the short term, the market study is being driven by the high demand for sulfuric acid in phosphate-based fertilizers and the growing demand from the chemical and pharmaceutical industries around the world.

- On the other hand, changes in the prices of raw materials are likely to slow the growth of the sulfuric acid market in the coming years.

- The growing use of oleum in medical and other industries can be seen as a major opportunity for the market.

- The Asia-Pacific region dominated the sulfuric acid market globally, with the highest consumption coming from countries such as China, India, and Japan.

Sulfuric Acid Market Trends

Growing Consumption from Fertilizer Segment

- Sulfuric acid is a strong mineral acid made up of sulfur, hydrogen, and oxygen. It has a strong smell and is an extremely corrosive, oily, and clear liquid. It should always be handled with caution, even in its diluted form. When diluted with water, it releases heat in a ceramic exhaust reaction. It is an important industrial chemical used in fertilizer manufacturing processes.

- Around half of the global sulfuric acid supply is used in agriculture and farming, especially as fertilizer. Sulfuric acid is used to manufacture phosphate fertilizers, such as the superphosphate of lime and ammonium sulfate. Sulfuric acid increases crop yield, which helps farmers generate more revenue by producing highly nutritional crops.

- Fertilizers replace the nutrients that crops remove from the soil. Without fertilizers, crop yields and agricultural productivity would be significantly reduced. Due to this, mineral fertilizers are used to supplement the soil's nutrient stocks with minerals that may be quickly absorbed and used by crops.

- Agriculture is the major source of livelihood globally; India and the United States are witnessing positive growth in agriculture. So, the market is likely to be driven by the need for fertilizers over the next few years.

- For instance, according to the Food and Agriculture Organization, the global capacity for producing ammonia, phosphoric acid, and potash in 2021 was 315,973 metric tons, which is expected to reach 318,652 metric tons in 2022, thereby boosting the market demand for sulfuric acid in the forecast period.

- The total agricultural and allied products exports stood at USD 41.25 billion in 2021. The growing investments in irrigation enhanced the gross irrigated area, creating a demand for fertilizers and stimulating the sulfuric acid market.

- The agriculture sector in Latin America and the Caribbean has witnessed significant growth in the past. According to the Organization for Economic Co-operation and Development (OECD) and the Food and Agriculture Organization of the United Nations (FAO), agricultural and fisheries production is expected to grow by 17% during 2018-2028. Around 53% of this growth is expected to come from increased crop production. Hence, the growing agricultural industry boosted the demand for fertilizers. This is expected to impact the growth of the sulfuric acid market.

- According to the International Fertilizer Industry Association, the consumption of agricultural fertilizer (nitrogen, phosphorus, and potassium (NPK)) across the globe accounted for 199,884 kilotons in 2021. Out of the total consumption, East Asia, South Asia, Latin America and the Caribbean, and North America consumed 61,936 kilotons, 38,694 kilotons, 28,817 kilotons, and 25,730 kilotons, respectively, in 2021.

- So, the market is likely to be driven by the growing use of sulfuric acid in fertilizers over the next few years.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the sulfuric acid market during the forecast period. Due to the high demand from the chemical, fertilizer, and other manufacturing sectors in countries like China, India, and Japan, the sulfuric acid market has been rapidly increasing.

- In 2021, the sulfuric acid production in China was 93.83 million metric tons, compared to 92.38 million metric tons in 2020, registering a growth of over 1.5%, according to the National Bureau of Statistics of China. The sulfuric acid production output continued to rise in China, with a manufacturing capacity of 129 million tons in 2022, registering a growth of 1.59% from the same period in the previous year.

- In China, companies are planning to increase the manufacturing capacity of sulfuric acid to 21.08 million tons annually. After the capacity increase in 2022-2024, the supply pattern of the sulfuric acid market is expected to undergo significant changes in the country, including increasing exports, shrinking imports, and changes in goods flow.

- China is the largest fertilizer manufacturer in the world. According to the National Bureau of Statistics of China, the nitrogen, phosphate, and potash fertilizer production volume in China accounted for 55.44 million tons in 2021, compared to 54.96 million tons in 2020, registering a growth of 0.87%.

- In India, in July 2021, the Chief Minister of Odisha laid the foundation stone for a sulfuric acid manufacturing facility on the premises of the fertilizer cooperative IFFCO at its Paradip division. The project will cost around INR 400 crore (~USD 48.36 million), with operations estimated to start by 2023. This new production plant will reduce dependency on the import of chemicals. This is IFFCO's third sulfuric acid manufacturing plant, with a capacity of about 2,000 metric tons (MT) per day.

- Furthermore, India is one of the economies largely dependent on agriculture. Agriculture is still the primary source of livelihood for more than 55% of the population. According to The Economic Survey of India 2020-21 report, in FY20, the total food grain production in the country was recorded at 296.65 million tons, which increased by 11.44 million tons compared with 285.21 million tons in FY19.

- All the factors mentioned above are expected to boost the demand for sulfuric acid in the Asian-Pacific region over the forecast period.

Sulfuric Acid Industry Overview

The global sulfuric acid market is highly fragmented. The top five players dominating the market are Mosaic, PhosAgro Group of Companies, Jiangxi Copper Group Co. Ltd, Yunnan Copper Co. Ltd, and Aurubis AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 High Demand for Sulfuric Acid in Phosphate-based Fertilizers

- 4.1.2 Growing Demand from Chemical and Pharmaceutical Industries

- 4.2 Restraints

- 4.2.1 Volatility In Raw Material Pricing

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Trade Analysis

- 4.6 Feedstock Analysis

- 4.7 Regional Production Capacities

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Raw Material Type

- 5.1.1 Elemental Sulfur

- 5.1.2 Pyrite Ore

- 5.1.3 Other Raw Material Types

- 5.2 End-user Industry

- 5.2.1 Fertilizer

- 5.2.2 Chemical and Pharmaceutical

- 5.2.3 Automotive

- 5.2.4 Petroleum Refining

- 5.2.5 Other End-user Industries (Pulp and Paper, Metal Processing)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aarti Industries Limited

- 6.4.2 Aurubis AG

- 6.4.3 Bodal Chemicals Ltd

- 6.4.4 Boliden Group

- 6.4.5 Hindustan Zinc

- 6.4.6 Jiangxi Copper Group Co. Ltd

- 6.4.7 KANTO KAGAKU

- 6.4.8 Nouryon

- 6.4.9 Panoli Intermediates India Private Limited

- 6.4.10 PhosAgro Group of Companies

- 6.4.11 PVS

- 6.4.12 Mosaic

- 6.4.13 WeylChem International GmbH

- 6.4.14 Yunnan Copper Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Use of Oleum in Medical and Other Industries