|

市场调查报告书

商品编码

1445521

光触媒:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Photocatalyst - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

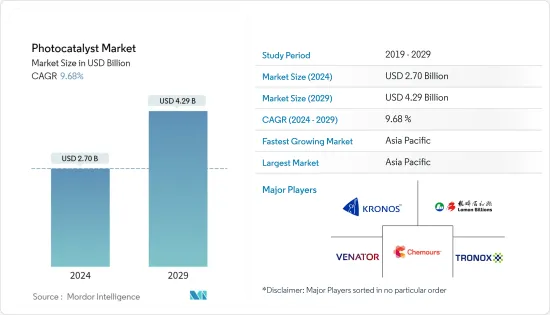

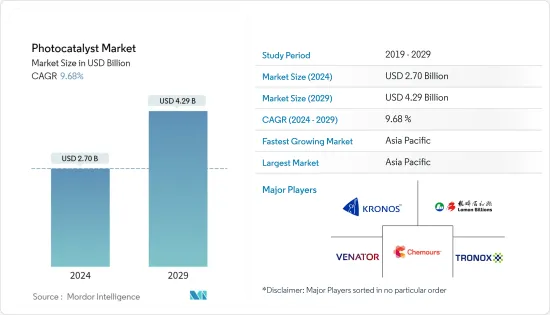

光催化剂市场规模预计到2024年为27亿美元,预计到2029年将达到42.9亿美元,在预测期内(2024-2029年)复合年增长率为9.68%。

COVID-19感染疾病对光催化剂市场产生了负面影响。市场现已从疫情中恢復,并正在经历显着成长。

主要亮点

- 短期内,对二氧化钛的高需求以及水处理和空气净化应用的增加可能会增加对光催化剂市场的需求。

- 然而,高资本投资预计将阻碍市场成长。

- 儘管如此,增加消毒剂的研究和开发预计将产生有吸引力的市场成长,并在预测期内提供巨大的潜力。

- 预计亚太地区将主导全球市场,大部分消费来自中国和印度。

光触媒市场趋势

自清洁应用的需求不断增加

- 光催化自清洁可能是建筑施工中使用最广泛的奈米特征。世界各地的许多建筑物都利用了这项功能。其主要作用是显着降低污垢对錶面的附着程度。另一个好处是玻璃和半透明薄膜的透光性得到改善,从而降低了照明能源成本,因为表面污垢或遮挡污垢吸收的阳光更少。

- 近年来,光催化油漆和涂料已被开发用于涂覆建筑物的外部和内部。光触媒涂料不仅可以洗去污垢,还可以分解污染物和污垢,例如空气中的污染物和建筑物外部的烟雾。此外,光催化涂层可以去除建筑物室内家具中的异味并分解挥发性有机化合物、空气传播的病毒和细菌。此外,光催化涂料是保护建筑物内木质表面的主要选择之一。

- 光催化材料的应用并不限于大型建筑。例如,它同样适用于温室和冬季花园。在道路建设中,透明涂料也可用于隔音墙等。具有耐用涂层的瓷砖可在室内和室外使用。同样,另一种常见的混凝土建筑材料建筑幕墙也可以配备自清洗表面。因此,预计建筑业在预测期内将对自清洁光催化材料的需求做出重大贡献。

- 全球建设产业正在稳步成长。由于存在大量的市场机会,亚太地区以及中东和非洲地区的建筑业正在遭受巨额投资。

- 根据国家统计局的数据,中国的建筑产值将于2021年达到约29.3兆元(4.2兆美元)的峰值,而2020年将达到26.39兆元(3.79兆美元)。

- 据日本国土交通省称,2021财年日本建筑投资总额超过66.6兆日圆(约4.981亿美元),其中建筑工程占这一支出的一半以上。 2022财年建筑支出总额预计将达到约67兆日圆(约5.0109亿美元)。

- 在欧洲,德国引领了建筑业的发展。亚历山大柏林的首都大厦和埃斯特雷大厦是该国目前正在开发的一些主要高层建筑。由于基础设施领域的大量投资和住宅需求的不断增长,该国建筑业正在进一步增长。

- 根据世界银行预测,2021年建设产业支出预计将成长至12.9兆美元,年增率为3%。这包括住宅和商业房地产开发、基础设施和工业建设。建筑支出资料包括人事费用和材料成本、建筑和土木工程以及税收。

- 自清洁光催化涂料是一种光学透明涂料,可用于许多应用,包括汽车挡风玻璃、窗玻璃、高层建筑、显微镜、眼镜、太阳能电池板盖、厨房用具以及许多电子设备的萤幕。用于涂覆玻璃材质。光学设备。

- 低成本、轻质且柔性的 PC基板上的自清洗光催化涂层对于多功能自清洗设备的实用性至关重要。因此,汽车、电子、医疗和太阳能能源产出等其他最终用户产业预计也将在预测期内对自清洗光催化材料的需求做出重大贡献。

- 所有上述因素都将有助于预测期内该行业的成长。

亚太地区主导市场

- 就市场占有率和市场收益而言,亚太地区在光催化剂市场上占据主导地位。预计该地区在预测期内将继续保持其主导地位。

- 光催化剂的超亲水性质提供了自清洁特性。例如,二氧化钛形成光催化保护膜,并透过变得超氧化和亲水而具有自清洁特性。光催化剂的这种特性使其适合作为油漆和涂料的自清洗助剂的高要求应用。此外,作为一种光催化剂,它具有独特的清洗和抗菌特性。因此,随着建设活动的增加,对油漆和涂料的需求预计将增加,这正在推动光催化剂的市场需求。

- 由于建筑、汽车和包装需求的增加,对油漆和涂料的需求不断增加,预计将在预测期内推动光催化剂市场的发展。中国生产的油漆和涂料产量约占全球总量的30%,由于油漆和涂料中光催化剂的自清洗特性,中国是光催化剂消费的主要来源国。

- PPG工业公司计划在2022年投资6.2亿元人民币(8,903万美元)在华南地区建造研发和生产基地。亚士也签署了在湖南长沙建设新生产基地的协议,总投资6亿元人民币(8,616万美元),其中将包括20万吨优质架构涂料和其他建筑材料。包括。

- BASF涂料(广东)是BASF汽车修补漆在亚洲唯一的生产基地。该公司正在建造一座新的汽车修补漆工厂,并将于 2022 年上半年开始生产。

- 根据中国国家统计局的数据,中国已成长为全球最大的建筑市场。 2021年,中国建筑业产值为11174.2亿美元。由于政府打算专注于发展中小型社区的基础设施,建筑业预计将以每年 5% 的速度成长。

- 日本的油漆和涂料工业是亚太地区第二大工业,在汽车、化学、消费性电子和电子产业拥有成熟的製造地,是油漆和涂料行业最大的消费者。

- 日本的油漆和涂料生产主要是由建筑和其他工业部门不断增长的需求所推动的。根据国土交通省的数据,2021财年日本的建筑投资总额为66.6兆日圆(4.9903亿美元),其中建筑工程占这笔支出的一半以上。 2022财年建设总投资预计将达到约67兆日圆(5.0203亿美元)。

- 涂料产量的扩张以及国内需求的增加预计将在预测期内进一步推动光催化剂的市场需求。

光触媒产业概况

光触媒市场本质上是一体化的,前五名的企业都拥有主要的产能。主要公司包括科慕公司、Tronox Holdings PLC、Venator Materials PLC、Lomon Billions 和 KRONOS Worldwide Inc。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 钛白粉需求快速成长

- 水处理和空气净化领域的应用不断增加

- 抑制因素

- 资金投入大

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争程度

第五章市场区隔

- 类型

- 二氧化钛

- 氧化锌

- 其他类型

- 目的

- 自清洁

- 空气净化

- 水处理

- 防雾

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业采取的策略

- 公司简介

- Daicel Miraizu Ltd

- Green Millennium

- Hangzhou Harmony Chemical Co. Ltd

- ISHIHARA SANGYO KAISHA Ltd

- KRONOS Worldwide Inc.

- Lomon Billions

- Nanoptek Corp.

- SHOWA DENKO KK

- TAYCA

- The Chemours Company

- TitanPE Technologies Inc.

- Tronox Holdings PLC

- Venator Materials PLC

第七章市场机会与未来趋势

- 消毒剂的研究和开发取得进展

The Photocatalyst Market size is estimated at USD 2.70 billion in 2024, and is expected to reach USD 4.29 billion by 2029, growing at a CAGR of 9.68% during the forecast period (2024-2029).

The COVID-19 pandemic had a negative impact on the market for photocatalysts. Currently, the market has recovered from the pandemic and growing at a significant rate.

Key Highlights

- Over the short term, high demand for titanium dioxide and increasing water treatment and air purification applications are likely to drive the demand for the photocatalyst market.

- However, high capital investments are expected to hinder the growth of the market.

- Nevertheless, increasing research and development as a disinfectant is expected to generate attractive market growth and give substantial potential in the forecast period.

- The Asia-Pacific region is expected to dominate the global market, with the majority of the consumption coming from China and India.

Photocatalyst Market Trends

Increasing Demand from Self Cleaning Application

- Photocatalytic self-cleaning is probably the most widely used nano-function in building construction. Numerous buildings around the world make use of this function. Its primary effect is that it greatly reduces the extent of dirt adhesion on surfaces. Another advantage is that light transmission for glazing and translucent membranes is improved since surface dirt and obscure grime sunshine are less, which can reduce lighting energy costs.

- Photocatalytic paints and coatings have been developed in recent years to coat the outer surface and interiors of the building. Photocatalytic coatings not only wash off dirt but also break down contaminants and stains: airborne pollutants, and smog from the exterior surfaces of the building. Furthermore, photocatalyst coatings remove odors and break down VOC, airborne viruses, and bacteria from the interior furniture of the building. Moreover, photocatalyst coating is one of the major options preferred to protect wooden surfaces in the interior of the building.

- The application of photocatalytic material is not limited exclusively to large buildings. It can be equally appropriate, for example, for conservatories and winter gardens. In road building, the transparent coating can also be used, for example, for noise barriers. Tiles with baked-on durable coatings are available for use both indoors and outdoors. Likewise, concrete, another common building material for facades, can also be equipped with a self-cleaning surface. Hence the construction sector will contribute majorly to the demand for self-cleaning photocatalytic materials in the forecast period.

- The global construction industry is growing at a healthy rate. Asia-Pacific, along with the Middle East and African regions, is witnessing huge investments in the construction sector due to numerous market opportunities available in these markets.

- According to the National Bureau of Statistics of China, China's construction output value peaked in 2021 at roughly CNY 29.3 trillion (USD 4.2 trillion), compared to CNY 26.39 trillion (USD 3.79 trillion) in 2020.

- According to The Ministry of Land, Infrastructure, Transport, and Tourism (Japan), total construction investment in Japan was over JPY 66.6 trillion (~USD 498.10 million) in the fiscal year 2021, with building construction accounting for more than half of this expenditure. Total construction spending is expected to reach almost JPY 67 trillion (~USD 501.09 million) in the fiscal year 2022.

- In Europe, Germany has taken the lead in developments in the construction sector. Alexander Berlin's Capital Tower and Estrel Tower are some of the major high-rise buildings the country is developing at present. The construction sector is further rising in the country owing to significant investments in its infrastructural sector and further due to the rising demand for residential units.

- According to World Bank, the construction industry grew to a spending value of USD 12.9 trillion in 2021 and is expected to grow by three percent per annum. This comprises real estate developments, both residential and commercial, as well as infrastructural and industrial constructions. Data on construction spending cover labor and material costs, architectural and engineering work, and taxes.

- The self-cleaning photocatalytic coating is used to coat optically transparent glass materials, which are used in many applications, including automobile windshields, window glass, skyscrapers, microscopes, eyeglasses, solar cell panel covers, kitchen appliances, screens of many electronic devices, and optical instruments.

- The self-cleaning photocatalytic coating on low-cost, lightweight, and flexible PC substrates is crucial for multifunctional self-cleaning devices to be useful. Therefore, other end-user industries, such as automobile, electronics, medical, and solar energy generation, will also contribute significantly to the demand for self-cleaning photocatalytic material in the forecast period.

- All the aforementioned factors will contribute towards industry growth during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominates the photocatalyst market in terms of market share and market revenue. The region is set to continue its dominance over the forecast period.

- The super-hydrophilic nature of photocatalysts imparts the self-cleaning nature. For instance, titanium dioxide provides a photocatalytic protective film, which possesses the property of self-cleaning by becoming super-oxidative and hydrophilic. This property of photocatalyst caters to its high-demand application as self-cleaning aid in paints and coatings. Moreover, as a photocatalyst, it transmits unique cleaning and anti-microbial properties. Hence, with the increasing construction activity, the demand for paint and coatings is expected to increase, which is driving the market demand for photocatalysts.

- The growing demand for paint and coatings due to the growing demand from construction, automotive, and packaging is expected to drive the market for photocatalysts during the forecast period. China produces around 30% of the total global paints and coatings, which is acting as a major source in the consumption of photocatalysts, owing to their self-cleaning properties when induced in paints and coatings.

- PPG Industries plans to construct its South Chinese R&D and production base by 2022, with an investment of CNY 620 million (USD 89.03 million). Asia Cuanon also signed an agreement to construct a new production base in Changsha, Hunan province, with a total investment of CNY 600 million (USD 86.16 million), which will include 200 thousand metric tons of high-quality architecture coatings and other construction materials.

- BASF Coatings (Guangdong) Co. Ltd has the only automotive refinish coatings production site for BASF in Asia. The company is constructing a new facility for automotive refinish coatings that have started production in the first half of 2022.

- According to the National Bureau of Statistics of China, China has grown to become the world's largest construction market. The value of China's construction industry was USD 1,117.42 billion in 2021. Since the government intends to focus on upgrading infrastructure in small and medium-sized communities, the construction industry is expected to increase at a five percent yearly rate.

- The paints and coatings industry in Japan was the second largest in Asia-Pacific, as it has well-established manufacturing bases in the automotive, chemicals, appliance, and electronic industries, which are the largest consumers of the paints and coatings industry.

- The production of paints and coatings in Japan is mainly driven by the growing demand from the construction and other industrial sectors. According to The Ministry of Land, Infrastructure, Transport, and Tourism (MLIT Japan), total construction investment in Japan was YPY 66.6 trillion (USD 499.03 million) in the fiscal year 2021, with building construction accounting for more than half of this expenditure. Total construction investment is expected to reach almost YPY 67 trillion (USD 502.03 million) in the fiscal year 2022.

- All such expansions in paint production with the growing demand in the country are further expected to drive the market demand for photocatalysts during the forecast period.

Photocatalyst Industry Overview

The photocatalyst market is consolidated in nature, with the top five players having major production capacities. Some of the key players are The Chemours Company, Tronox Holdings PLC, Venator Materials PLC, Lomon Billions, KRONOS Worldwide Inc., and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapidly Growing Demand for Titanium dioxide

- 4.1.2 Increasing Applications in Water Treatment and Air Purification

- 4.2 Restraints

- 4.2.1 High Capital Investment

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Titanium dioxide

- 5.1.2 Zinc Oxide

- 5.1.3 Other Types

- 5.2 Application

- 5.2.1 Self-Cleaning

- 5.2.2 Air Purification

- 5.2.3 Water Treatment

- 5.2.4 Anti-Fogging

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Daicel Miraizu Ltd

- 6.4.2 Green Millennium

- 6.4.3 Hangzhou Harmony Chemical Co. Ltd

- 6.4.4 ISHIHARA SANGYO KAISHA Ltd

- 6.4.5 KRONOS Worldwide Inc.

- 6.4.6 Lomon Billions

- 6.4.7 Nanoptek Corp.

- 6.4.8 SHOWA DENKO KK

- 6.4.9 TAYCA

- 6.4.10 The Chemours Company

- 6.4.11 TitanPE Technologies Inc.

- 6.4.12 Tronox Holdings PLC

- 6.4.13 Venator Materials PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Research and Development as a Disinfectant