|

市场调查报告书

商品编码

1445523

碳酸伸乙酯:市场占有率分析、产业趋势与统计、成长预测 (2024:2029)Ethylene Carbonate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

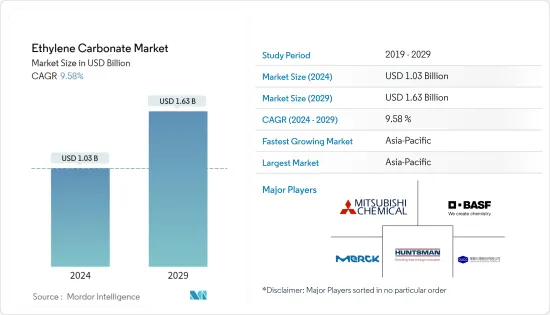

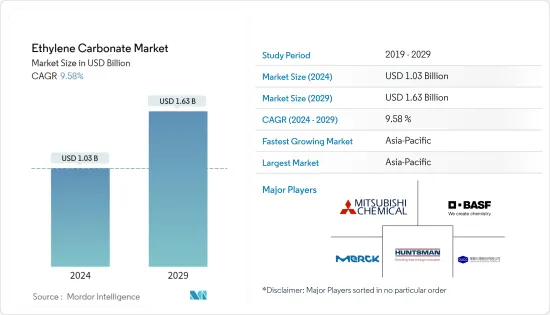

碳酸伸乙酯市场规模预计2024年为10.3亿美元,预计到2029年将达到16.3亿美元,在预测期内(2024-2029年)增长9.58%,以复合年增长率增长。

碳酸伸乙酯的生产和消费受到 COVID-19 疾病的影响。封锁、生产限制和全球景气衰退减缓了对碳酸伸乙酯和其他化学品的需求。由于需求减少,碳酸伸乙酯和其他化学物质变得越来越便宜。疫情结束后,随着电动车用锂离子电池和可再生能源储存系统的出现,对碳酸伸乙酯的需求增加。

主要亮点

- 碳酸伸乙酯市场最近有所成长。随着电动车(EV)和装置製造设备的需求不断增加,锂电池和锂消费量不断增加,导致碳酸伸乙酯市场正成长。

- 中期影响碳酸伸乙酯市场成长的因素包括化学产业中间体使用的增加以及汽车产业对锂电池的需求不断增长。

- 然而,另一方面,由于碳酸伸乙酯的毒性和其他替代品替代的前景而增加的健康危害预计将阻碍市场成长。

- 由于电子业高度发展和锂离子电池产量高,亚太地区预计将主导全球市场。

碳酸伸乙酯市场趋势

锂电池需求增加

- 碳酸伸乙酯是一种有机溶剂,用作锂离子电池电解的成分。电解是锂离子电池的关键组成部分,因为它提供离子导电性,使锂离子能够在阳极和阴极之间移动,使电池能够储存和释放能量。

- 除了充当溶剂之外,碳酸伸乙酯可以稳定电解并防止阳极形成锂金属。这非常重要,因为锂金属可能会导致短路和其他电池性能问题。令人兴奋的新兴商业和工业产业正在增加对锂离子电池的需求。近年来,资料中心和物料输送产业对锂离子电池的需求迅速增长,特别是在新兴国家。

- 根据国际能源总署统计, 与前一年同期比较成长135%。

- 政府对石化燃料引擎的限制正在迅速增加对电动车的需求,这对锂电池产生了重大影响。

- 电子设备数量的增加、行动装置需求的增加、节能电源的增加以及已开发国家的技术进步推动了对电池的需求。在预测期内,碳酸伸乙酯市场预计将受到这些原因的推动。

亚太地区主导市场

- 由于电子业高度发展、中国和日本锂离子电池的高生产率,以及多年来该地区持续投资以推进锂技术的发展,亚太地区预计将主导市场。

- 此外,亚洲政府对内燃机的监管日益严格,增加了中国、日本和印度对各种电动车的需求,从而增加了各种应用中对碳酸伸乙酯的需求。

- 电子涂料、黏剂和电介质可以使用碳酸伸乙酯作为溶剂来製造。碳酸伸乙酯可以溶解并与其他成分混合,其低挥发性增加了产品稳定性。碳酸伸乙酯也可用于製造聚碳酸酯和其他电子应用聚合物。

- 日本的电子工业是世界上最大的电子工业之一。根据电子情报技术产业协会(JEITA)的报告,到2021年,日本将生产全球10%的电子产品。 2021年,国内电子製造业产值突破800亿美元,年平均成长11%。

- 韩国的电子工业是世界上最先进的工业之一。消费性电器产品、半导体和其他电子元件製造领域的世界领导者。韩国是一些世界上最大的电子公司的所在地,包括三星和 LG。根据韩国国际贸易协会统计,2021年韩国产值为2,007.7亿美元,与前一年同期比较成长25%(KITA)。

- 在製药工业中,碳酸亚乙酯经常被用作製造固体剂型(例如锭剂和胶囊)的溶剂。碳酸伸乙酯的溶剂特性有助于溶解活性药物成分 (API),并改善最终产品的混合和流动特性。

- 中国是全球第二大医药市场。由于中国中产阶级的扩大和老化、收益的增加以及都市化的加快,医药市场正在显着扩大。

- 根据 CEIC资料,中国药品销售额从 2021 年 8 月的 21,015 亿元人民币(2,968.992 亿美元)增至 2021 年 9 月的 23,740.6 亿元人民币(3,506.487 亿美元)。

- 所有上述因素预计将在未来几年增加该地区对碳酸伸乙酯的需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 电动车製造商的需求增加

- 增加化学中间体的使用

- 抑制因素

- 毒性和新替代品的替代前景

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(市场规模的金额和数量)

- 目的

- 锂电池

- 润滑剂

- 医疗产品

- 中介机构和代理人

- 其他用途

- 最终用户产业

- 车

- 药品

- 油和气

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 合併、收购、合资、合作和协议

- 市场占有率(%)分析**/排名分析

- 主要企业采取的策略

- 公司简介

- BASF SE

- Huntsman International LLC

- Liaoning Ganglong Chemical Co. Ltd

- Lixing Chemical

- Merck KGaA

- Mitsubishi Chemical Corporation

- OUCC

- Shandong Senjie Cleantech Co. Ltd

- Shandong Shida Shenghua Chemical Group Co. Ltd

- Taixing Taida Fine Chemical Co. Ltd

- Toagosei Co. Ltd

- Tokyo Chemical Industry Co. Ltd

- Zibo Donghai Industries Co. Ltd

第七章市场机会与未来趋势

- 锂硫电池需求不断成长

The Ethylene Carbonate Market size is estimated at USD 1.03 billion in 2024, and is expected to reach USD 1.63 billion by 2029, growing at a CAGR of 9.58% during the forecast period (2024-2029).

Ethylene carbonate output and consumption have been affected by COVID-19. Due to lockdowns, production limits, and global economic recession, ethylene carbonate and other chemical demands have slowed. Ethylene carbonate and other chemicals are cheaper due to lower demand. After the pandemic, the ethylene carbonate demand increased because of lithium-ion batteries for electric cars and systems that store energy from renewable sources.

Key Highlights

- The ethylene carbonate market grew recently. With the increase in demand for electric vehicles (EV) and device manufacturing units, there is an increase in lithium battery and lithium consumption, resulting in positive growth for the ethylene carbonate market.

- Over the medium term, the factors affecting the ethylene carbonate market growth include the rising number of applications for intermediates in the chemical sector and the growing need for lithium batteries in the automobile sector.

- However, on the flip side, rising health hazards due to the toxicity of ethylene carbonate and replacement prospects by other substitutes are expected to hinder the market's growth.

- Asia-Pacific is expected to dominate the global market due to its highly developed electronics sector and high production of lithium-ion batteries.

Ethylene Carbonate Market Trends

Increasing Demand for Lithium Batteries

- Ethylene carbonate is a type of organic solvent utilized as a component in the electrolyte solution of lithium-ion batteries. The electrolyte solution is a crucial component of lithium-ion batteries because it provides the ionic conductivity that enables lithium ions to travel between the anode and cathode, allowing the battery to store and release energy.

- In addition to acting as a solvent, ethylene carbonate stabilizes the electrolyte solution, avoiding the production of lithium metal on the anode. It is crucial, as lithium metal can create short circuits and other battery performance difficulties. New and exciting industries with commercial and industrial uses have increased the need for lithium-ion batteries. In recent years, demand for lithium-ion batteries from the data center and material handling industries surged, particularly in developing countries.

- According to the International Energy Agency, global sales of battery-electric vehicles reached 4.7 million in 2021, a 135% increase over the previous year.

- Government limits on fossil fuel engines have led to a rapid increase in the demand for electric vehicles, which substantially impacts lithium batteries.

- The need for batteries is driven by the increasing number of electronic devices, the growing demand for mobile devices, the increase in energy-efficient sources, and technological breakthroughs in developed nations. During the forecast period, the ethylene carbonate market is anticipated to be driven by these reasons.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the market owing to its highly developed electronics sector and high production of lithium-ion batteries in China and Japan, coupled with continuous investments in the region over the years to advance lithium technology.

- Besides, the growing government regulations on combustion engines in Asia increased the need for various electric vehicles in China, Japan, and India, increasing the demand for ethylene carbonate in various applications.

- Electronic coatings, adhesives, and dielectrics can be made using ethylene carbonate as a solvent. Ethylene carbonate can dissolve and mix other components, and its low volatility can increase product stability. Ethylene carbonate can also make polycarbonates and other polymers for electronics applications.

- The Japanese electronics industry is one of the largest in the world. Japan produced 10% of the world's electronics by 2021, as the Japan Electronics and Information Technology Industries Association (JEITA) reported. In 2021, domestic electronics manufacturing exceeded USD 80 billion, a growth of 11% annually.

- South Korea's electronics industry is among the most advanced in the world. It is a global leader in producing consumer electronics, semiconductors, and other electronic components. South Korea is home to some of the world's largest electrical companies, including Samsung and LG. According to the Korea International Trade Association, South Korea produced USD 200.77 billion in 2021, up 25% from the year before (KITA).

- In the pharmaceutical industry, ethylene carbonate is frequently used as a solvent for manufacturing solid dosage forms, such as tablets and capsules. Ethylene carbonate's solvent qualities can aid in dissolving active pharmaceutical ingredients (APIs) and improving the mixing and flow properties of the finished product.

- China is the second-largest medicines market in the world. The medicines market is expanding significantly due to the country's expanding middle class and aging population, rising earnings, and expanding urbanization.

- According to CEIC Data, pharmaceutical sales in China increased to CNY 2,374,060 million (USD 350,648.7 million) in September 2021 from CNY 2,010,150 million (USD 296,899.2 million) in August 2021.

- All the abovementioned factors are expected to augment the demand for ethylene carbonate in the region over the coming years.

Ethylene Carbonate Industry Overview

The ethylene carbonate market is partially consolidated, with a few major players dominating a significant portion of the market. Some major companies include BASF SE, Huntsman International LLC, Mitsubishi Chemical Corporation, OUCC, and Merck KGaA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Electric Vehicle Manufacturers

- 4.1.2 Increasing Applications of Chemical Intermediates

- 4.2 Restraints

- 4.2.1 Toxicity and Replacement Prospects by New Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Application

- 5.1.1 Lithium Batteries

- 5.1.2 Lubricants

- 5.1.3 Medical Products

- 5.1.4 Intermediates and Agents

- 5.1.5 Other Applications

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Pharmaceuticals

- 5.2.3 Oil and Gas

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis** / Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Huntsman International LLC

- 6.4.3 Liaoning Ganglong Chemical Co. Ltd

- 6.4.4 Lixing Chemical

- 6.4.5 Merck KGaA

- 6.4.6 Mitsubishi Chemical Corporation

- 6.4.7 OUCC

- 6.4.8 Shandong Senjie Cleantech Co. Ltd

- 6.4.9 Shandong Shida Shenghua Chemical Group Co. Ltd

- 6.4.10 Taixing Taida Fine Chemical Co. Ltd

- 6.4.11 Toagosei Co. Ltd

- 6.4.12 Tokyo Chemical Industry Co. Ltd

- 6.4.13 Zibo Donghai Industries Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Lithium-sulfur Batteries