|

市场调查报告书

商品编码

1445565

聚醚胺:市场占有率分析、产业趋势与统计、成长预测 (2024:2029)Polyetheramine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

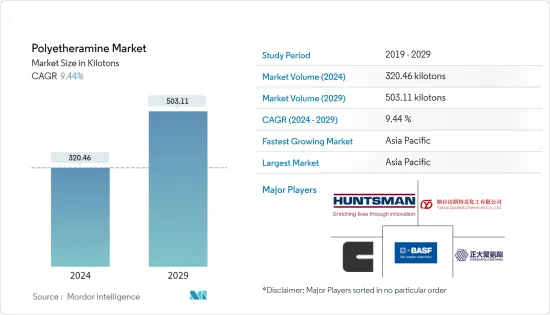

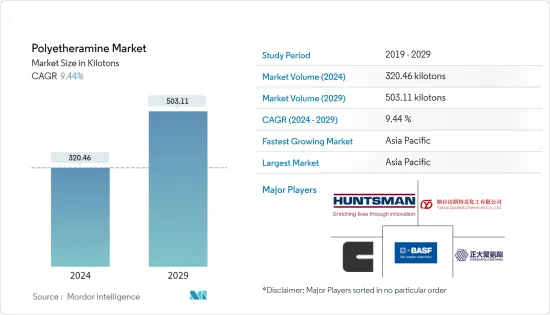

预计2024年聚醚胺市场规模为320,460吨,预计2029年将达到503,110吨,在预测期(2024-2029年)复合年增长率为9.44%。

主要亮点

- 聚醚胺市场受到 COVID-19感染疾病的负面影响。然而,由于汽车、建筑和航太等各个最终用户产业的消费增加,市场在 2021 年显着復苏。

- 建设产业需求的增加和环境可再生能源发电的成长趋势预计将在预测期内推动市场成长。

- 另一方面,由于过度使用聚醚胺而引起的环境问题预计将阻碍预测期内的市场成长。

- 此外,预计航太工业中环氧复合材料的成长趋势将创造市场机会。

- 亚太地区是最大的市场,由于中国、印度和日本等国家的消费增加,预计未来几年将成长最快。

聚醚胺市场趋势

复合材料应用的需求增加

- 聚醚胺是由聚醚和胺分子组成的典型固化剂,用于增强最终产品的性能,如弹性、疏水性、亲水性和韧性。

- 聚醚胺广泛用于复合材料应用,因为其独特的性能提供了强度和弹性之间的关键平衡。

- 此外,聚醚胺基复合材料旨在取代木材、金属和混凝土。它们的轻量化设计、高介电强度和高耐环境劣化能力使其可用于航太、汽车零件和风力发电机叶片等要求严苛的应用。

- 汽车产业是复合材料领域的主要贡献者之一。根据OICA预测,2022年全球汽车产量将超过8,500万辆,与前一年同期比较成长约6%。

- 此外,2022年美国汽车产量与前一年同期比较增加10%。加拿大、墨西哥和美国的产量增加了10%,汽车产量分别达到12,28,735辆、35,09,072辆和1,000辆。 ,分别为 60,339 个单位。在南美洲,哥伦比亚的产量与前一年同期比较增幅最大,达51,455辆,成长26%。阿根廷产量也大幅增加24%,达5,36,893辆。

- 从整体来看,2022年汽车产量的增加预计将扩大用于车身复合材料的聚醚胺市场。

- 根据中国汽车工业协会统计,2022年12月全国新能源汽车产量与前一年同期比较%。因此,不断扩大的电动车市场预计将在预测期内进一步扩大对聚醚胺的需求。

- 总体而言,所有这些因素预计将决定预测期内该应用中聚醚胺的需求。

亚太地区主导市场

- 预计亚太地区将在预测期内主导聚醚胺市场。中国和印度等国家对风力发电以及建筑和建筑应用的需求增加正在推动该地区对聚醚胺的需求。

- 聚醚胺广泛用作黏剂来黏合叶片的两个部分,以及用作风力发电机叶片复合材料中的添加剂。风力发电应用对聚醚胺的高需求预计将在预测期内推动其市场发展。

- 住宅建部预计,到2025年,中国建筑业将持续贡献国内生产毛额的6%。考虑到上述预测,中国政府于 2022 年 1 月宣布了一项五年计划,重点关注:使建筑业更加永续和以品质为导向。中国计划增加装配式建筑的建设,以减少建筑工地的污染和废弃物。此外,建设产业正在走向现代化方法,这将增加对聚醚胺等产品的需求。

- 此外,印度政府正在积极推动住宅建设,为约13亿人提供住宅。预计未来六到七年,该国的住宅投资将达到约 1.3 兆美元。该国可能会建造 6000 万套新住宅,这将成为研究市场的主要驱动力。

- 此外,根据国土交通省的数据,2022年日本住宅开工量约为859,500套,与前一年同期比较增加0.4%。

- 上述因素和政府支持导致预测期内聚醚胺需求增加。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建设产业需求增加

- 环保可再生能源发电的成长趋势

- 其他司机

- 抑制因素

- 过度使用聚醚胺所引起的环境问题

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔

- 类型

- 单胺

- 二胺

- 三胺

- 目的

- 聚脲

- 燃料添加剂

- 复合材料

- 环氧涂层

- 黏剂和密封剂

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业采取的策略

- 公司简介

- BASF SE

- Huntsman International LLC

- Clariant

- Dasteck

- Qingdao IRO Surfactant Co., Ltd.

- Shanghai Chenhua International Trade Co., Ltd.

- Chia Tai New Materials(Zibo Zhengda Polyurethane Co. Ltd.)

- Wuxi Acryl Technology Co. Ltd.

第七章市场机会与未来趋势

简介目录

Product Code: 69102

The Polyetheramine Market size is estimated at 320.46 kilotons in 2024, and is expected to reach 503.11 kilotons by 2029, growing at a CAGR of 9.44% during the forecast period (2024-2029).

Key Highlights

- The polyetheramine market was negatively impacted by the COVID-19 pandemic. However, the market recovered significantly in 2021, owing to rising consumption from various end-user industries such as automotive, construction, aerospace, and others.

- The increasing demand from the construction industry and the growing trend of eco-friendly and renewable energy generation are expected to drive market growth during the forecast period.

- On the other hand, environmental concern due to the excessive use of polyetheramines is expected to hinder the growth of the market during the forecast period.

- Further, growing trends toward epoxy composites in the aerospace industry are projected to create market opportunities.

- The Asia-Pacific region is the biggest market and is expected to grow the fastest over the next few years owing to the increasing consumption from countries such as China, India, and Japan.

Polyetheramine Market Trends

Increasing Demand from Composite Application

- Polyetheramines are typical curing agents that comprise polyether and amine molecules and are used to enhance the properties of end products, such as flexibility, hydrophobicity, hydrophilicity, and toughness.

- Due to their unique properties, polyetheramines are widely used in composite applications as they provide a critical balance between strength and flexibility.

- Furthermore, polyether amine-based composites are designed to replace wood, metal, and concrete. They are useful in highly demanding applications such as aerospace, automotive parts, and wind turbine blades owing to their lightweight design, high dielectric strength, and high resistance to environmental degradation.

- The automotive industry is one of the major contributors to the composites segment. According to OICA, global automobile production stood at over 85 million units in 2022, approximately 6% more than the previous year.

- Additionally, America's automotive production grew by 10% year on year in 2022. Canada, Mexico, and the United States saw a production increase of 10%, with motor vehicle production reaching 12,28,735 units, 35,09,072 units, and 1,00,60,339 units, respectively. In the South American region, Colombia saw the greatest jump in year-on-year production, reaching 51,455 units, an increase of 26%. Argentina also saw a massive 24% increase, with production reaching 5,36,893 units.

- From an overall perspective, higher production of automobiles in 2022 presented a bigger market for polyetheramines in terms of their usage in their bodies as composites.

- According to the China Association of Automobile Manufacturing (CAAM), the production of new energy vehicles (NEVs) in the country witnessed a year-on-year increase of 96.9 percent in December 2022. Thus, the expanding electric vehicle market is expected to increase the demand for polyetheramine during the forecast period.

- Overall, all such factors are expected to determine the demand for polyetheramine in this application over the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for polyetheramine during the forecast period. In countries like China and India, owing to the increasing demand for wind energy and construction & building applications, the demand for polyetheramine has been increasing in the region.

- Polyetheramine is widely used as an additive in adhesives to adhere to two parts of blades and in composites used in wind turbine blades. A high demand for polyetheramine in wind energy applications will propel its market during the forecast period.

- The Ministry of Housing and Urban-Rural Development predicts that China's construction industry will continue to contribute 6% of the nation's GDP through the year 2025. Keeping in view the given forecasts, the Chinese government unveiled a five-year plan in January 2022 focused on making the construction sector more sustainable and quality-driven. China is planning to increase the construction of prefabricated buildings to reduce pollution and waste from construction sites. Furthermore, the construction industry will be transitioning to modernized practices, which will increase the demand for products like polyetheramine.

- Moreover, the Indian government has been actively boosting housing construction to provide homes to about 1.3 billion people. The country is likely to witness around USD 1.3 trillion of investment in housing over the next six to seven years. It is likely to witness the construction of 60 million new homes in the country, which is a major boosting factor for the market studied.

- Furthermore, according to the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) Japan, in 2022, approximately 859.5 thousand housing starts began in Japan, which represented an increase of 0.4% as compared to the previous year.

- The aforementioned factors, coupled with government support, are contributing to the increasing demand for polyetheramine during the forecast period.

Polyetheramine Industry Overview

The polyetheramine market is consolidated in nature. Some of the major players in the market include Huntsman International LLC, BASF SE, Clariant, Dasteck, and Chai-Tai New Materials (Zibo Zhengda Polyurethane Co., Ltd.), among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Construction Industry

- 4.1.2 Growing Trend of Eco-friendly and Renewable Energy Generation

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental Concern Due to Excessive Use of Polyetheramines

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Monoamine

- 5.1.2 Diamine

- 5.1.3 Triamine

- 5.2 Application

- 5.2.1 Polyurea

- 5.2.2 Fuel Additives

- 5.2.3 Composites

- 5.2.4 Epoxy Coatings

- 5.2.5 Adhesives and Sealants

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Huntsman International LLC

- 6.4.3 Clariant

- 6.4.4 Dasteck

- 6.4.5 Qingdao IRO Surfactant Co., Ltd.

- 6.4.6 Shanghai Chenhua International Trade Co., Ltd.

- 6.4.7 Chia Tai New Materials (Zibo Zhengda Polyurethane Co. Ltd.)

- 6.4.8 Wuxi Acryl Technology Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Trends Toward Epoxy Composites in the Aerospace Industry

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219