|

市场调查报告书

商品编码

1445566

区块链物联网 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Blockchain IoT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

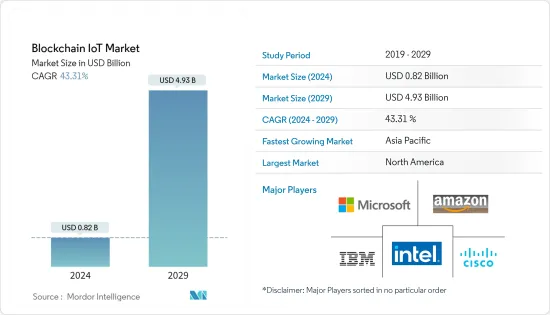

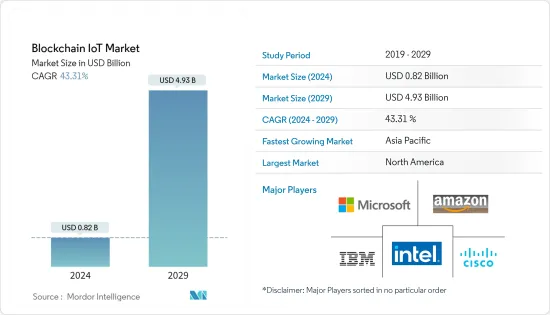

2024年区块链物联网市场规模预计为8.2亿美元,预计到2029年将达到49.3亿美元,在预测期内(2024-2029年)CAGR为43.31%。

物联网(IoT)是一种透过互联网连接所有设备的先进技术,而区块链是一种分散式金融技术。将区块链用于物联网的主要优势包括降低共谋和操纵的可能性以及降低交易结算和成本。

主要亮点

- 随着通讯技术的快速发展,物联网(IoT)的研究和工业正在经历指数级增长。随着产生、传输和处理的资料量的增加,它正在从起步阶段进入成熟阶段。

- 传统的物联网系统由集中式拓扑提供支持,其中资料从实体设备传输到云端,并在云端使用分析来处理资料。输出被接收回 IoT 设备。儘管如此,网路设备频率的增加限制了物联网平台的可扩展性,并使其面临漏洞的风险,最终会损害用户的网路安全和隐私。

- 由去中心化架构和加密技术支援的区块链透过确保点对点网路中的隐私和安全来利用物联网平台。然而,它需要较高的运算能力,从而导致较高的频宽开销和延迟。

- 物联网生态系统相当多元化。创建与区块链技术相容的物联网设备涉及许多挑战。可扩展性涉及处理广泛的感测器网路产生的大量资料,是物联网面临的主要挑战之一。在基于区块链的生态系统中加密所有物联网设备所需的处理能力和时间未达预期。将帐本保留在边缘节点的区块链系统的另一个关键挑战是储存。边缘的物联网智慧型设备目前无法储存大量资料或处理大量运算能力。

- COVID-19 大流行影响了许多部门,包括个人和企业。互联网生态系统在全球范围内发挥着至关重要的作用。由于COVID-19疫情,对网路企业的依赖急剧增加。 BFSI、医疗保健和生命科学、製造、汽车、零售、运输和物流正在利用互联网为客户提供所需的服务。供应商注意到对区块链物联网解决方案的需求下降。全球停工影响了区块链物联网所需的特定硬体组件的需求和可用性。未来,医疗保健和政府垂直产业预计将适度采用物联网感测器和区块链,以在流行病期间保护医院、政府建筑和人口。

- 在新冠肺炎 (COVID-19) 疫情之后,政府也一直在研究实施多种智慧城市技术的潜力,以提高城市在危机时期的復原能力,这可能会推动市场的成长。

区块链物联网市场趋势

智慧城市最终用户细分市场预计将占据重要市场份额

- 在过去的几十年里,世界经历了前所未有的城市成长,这主要是由于人口增加、资源稀缺和气候变迁。根据联合国统计,约有54% 的人口居住在城市,预计到2050 年这一比例将达到66%。政府机构专注于物联网、无线通讯和区块链等现代技术,以应对城市成长、降低成本并优化城市资源。

- 提供永续的环境是智慧城市的关键特征之一。鑑于快速的工业和城市化趋势,追踪环境指标至关重要。环境监测的主要挑战是使用可靠且精确的监测工具进行即时资料收集。智慧城市平台的主要角色可能有利于预测期内市场的扩张。

- 资料安全是大都市中部署的设备和服务的重要约束之一,借助区块链的去中心化平台,确保公众的信任并促进市场的成长。

- 根据《经济学人》智慧城市指数评级,哥本哈根是 2022 年全球领先的数位城市之一,得分为 80.3。首尔、北京、阿姆斯特丹和新加坡则名列最佳数位城市前五名。

- 此外,世界各地的政府措施也开始认识到区块链的潜力,因为它提供了交易管理所需的基础设施,同时确保透明度和安全性,而这将是智慧城市实施的关键要素。

- 在全球范围内,许多智慧城市计画和努力正在实施,鼓励城市化带来的全球投资。经合组织估计,2010 年至 2030 年间,全球所有大都会基础设施项目对智慧城市计画的投资总额将达到约 1.8 兆美元。

亚太地区预计将成为成长最快的市场

- 由于该地区科技公司不断涌入,以及对物联网技术、智慧城市部署、政府倡议和城市发展的投资不断增加,预计亚太地区在预测期内将以最高的速度增长。人口。

- 快速的城市化和地方政府措施促进了对智慧城市的需求。智慧城市必然存在资料中心营运成本高、物联网安全性差、设备维护等问题。然而,区块链物联网等技术将为交易管理、资产追踪和智慧合约提供必要的基础设施,同时确保安全性和透明度,从而提高营运效率。

- 2023年2月,Conflux Network与中国电信合作开发以区块链为基础的SIM卡。区块链协议 Conflux Network 将与中国电信合作开发基于区块链的 SIM 卡。中国电信是中国最大的无线供应商之一,估计拥有 3.9 亿用户。

- 2022 年11 月,中国国家区块链基础设施星火区块链基础设施与设施与马来西亚数位服务供应商MY EG Services Berhad (MyEG) 签署协议,在北京扩大其国际区块链发展之际,拥有并营运一个「国际超级节点」。

区块链物联网产业概况

区块链物联网市场高度分散,主要参与者包括IBM公司、英特尔公司、微软公司、思科系统公司和亚马逊公司。市场参与者正在采取合作、创新、併购等策略来增强他们的产品供应并获得永续的竞争优势。

- 2022 年 5 月 - IBM 与 Web3 合作创建数位原生体验,加速和发展企业区块链的未来。混合企业区块链解决方案可以帮助企业实现新的业务成果,例如细粒度的安全性、隐私性、可审计的监管合规性和竞争优势保护。适应市场可能有助于公司获得竞争优势。随着摩擦的减少、成本的降低和效率的提高,所有参与成员都可以近乎即时地看到单一事实来源。

- 2022 年 4 月 - 英特尔发布了有关其新型英特尔 Blockscale ASIC 的资讯。基于英特尔多年的研发,其专用积体电路(ASIC)将为客户提供工作量证明共识网路的节能运算。围绕区块链技术的讨论日益增多。它支援去中心化和分散式计算,为新的商业模式铺平道路。英特尔正在开发能够独立于客户营运环境提供运算吞吐量和能源效率的适当组合的技术,以实现这个新的运算时代。英特尔在加密、杂凑演算法和超低电压电路方面数十年的研究和开发使区块链应用程式能够在不影响永续性的情况下提高其运算能力。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

- 价值链/供应链分析

- COVID-19 对产业影响的评估

第 5 章:市场洞察

- 市场驱动因素

- 对物联网安全的需求不断成长

- 市场限制

- 可扩展性、处理能力和储存问题

第 6 章:市场细分

- 透过提供

- 硬体

- 软体

- 基础设施

- 按应用

- 资料安全

- 智能合约

- 数据通讯

- 资产追踪和管理

- 其他应用

- 按最终用户

- 製造业

- 能源公用事业

- 运输与物流

- 大楼管理

- 零售

- 智慧城市

- 按地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太

- 印度

- 中国

- 日本

- 亚太其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第 7 章:竞争格局

- 公司简介

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Cisco Systems Inc.

- Amazon Inc.

- Robert Bosch GmbH

- The Linux Foundation

- KrypC Technologies

- Ethereum Foundation

- R3 LLC

- IoTA

- Waltonchain

第 8 章:市场机会与未来趋势

The Blockchain IoT Market size is estimated at USD 0.82 billion in 2024, and is expected to reach USD 4.93 billion by 2029, growing at a CAGR of 43.31% during the forecast period (2024-2029).

The Internet of Things (IoT) is an advanced technology that connects all devices over the Internet, and blockchain is a kind of distributed financial technology. The main advantages of using blockchain for IoT include lower chances of collusion and manipulation and lower transaction settlement and costs.

Key Highlights

- With the rapid development of communication technologies, IoT ( Internet of Things) is experiencing exponential growth in research and industry. It is getting out of its infancy to a maturity phase with the volume of data generated, transmitted, and processed.

- The traditional IoT systems are powered by centralized topology, where data is transmitted from physical devices to the cloud, where the data is processed using analytics. Output is received back to the IoT device. Still, the increase in the frequency of network devices limits the scalability of the IoT platforms and risks them with vulnerabilities that would eventually compromise users' network security and privacy.

- The blockchain powered by decentralized architecture and cryptographic encryptions leverages the IoT platform by ensuring privacy and security in a peer-to-peer network. However, it requires high computational power, resulting in higher bandwidth overhead and delay.

- The Internet of Things ecosystem is quite diversified. Creating IoT devices that are compatible with blockchain technology involves many challenges. Scalability, which involves processing a huge volume of data generated by a wide network of sensors, is one of the primary challenges IoT faces. The processing power and time necessary to encrypt all IoT devices in a blockchain-based ecosystem are not as anticipated. Another key challenge in blockchain systems that keep the ledger on edge nodes is storage. IoT smart devices at the edge are currently incapable of storing large amounts of data or processing large amounts of computational power.

- The COVID-19 pandemic has impacted many sectors, including individuals and corporations. The internet ecosystem has played a critical role worldwide. The reliance on internet enterprises has grown dramatically due to the COVID-19 epidemic. BFSI, healthcare and life sciences, manufacturing, automotive, retail, transportation, and logistics are embracing the Internet to offer customers the required services. Suppliers have noticed a decrease in demand for a blockchain IoT solution. The global shutdown impacts the demand and availability of specific hardware components necessary for blockchain IoT. In the future, the healthcare and government verticals are expected to see moderate adoption of IoT sensors and blockchain to protect hospitals, government buildings, and populations during epidemics.

- Post-COVID-19, the government has also been investigating the potential for implementing a number of smart city technologies to increase urban resilience in times of crisis, which may propel the market's growth.

Blockchain IoT Market Trends

Smart City End Users Segment is Expected to Hold Significant Market Share

- Over the last few decades, the world has experienced unparalleled urban growth, majorly due to increased population, scarcity of resources, and climate changes. According to the United Nations, about 54% of people dwell in cities, which is expected to reach 66% by 2050. Government bodies focus on modern technologies like IoT, wireless communication, and blockchain to cope with urban growth, reduce costs, and optimize resources.

- Providing a sustainable environment is one of the key characteristics of smart cities. Keeping track of the environmental indicators in light of the rapid industrial and urbanization trends is critical. The primary challenge in environmental monitoring is real-time data collection using reliable and precise monitoring tools. The major role of smart city platforms may benefit the market's expansion during the forecast period.

- Data security is one of the vital constraints for devices and services deployed in a metropolitan city, which, leveraged with the blockchain's decentralized platform, ensures the public's trust and fosters the market's growth.

- According to The Economist's smart city index rating, Copenhagen was one of the leading global digital cities in 2022, with a score of 80.3. Seoul, Beijing, Amsterdam, and Singapore completed the top five list of finest digital cities.

- Also, government initiatives across the world are starting to appreciate the potential of blockchain as it provides the infrastructure necessary for transaction management while ensuring transparency and security, which stand to be critical elements in smart city implementation.

- Globally, many smart city projects and efforts are being implemented, encouraging global investments due to urbanization. The OECD estimates that between 2010 and 2030, worldwide investments in smart city initiatives would total around USD 1.8 trillion for all metropolitan city infrastructure projects.

Asia-Pacific is Expected to Be the Fastest-growing Market

- The Asia-Pacific region is expected to grow at the highest rate over the forecast period, owing to the rising influx of technology companies in the area and the increasing investments in IoT technology, smart city deployments, government initiative, and the growth of the urban population.

- Rapid urbanization and regional government initiatives foster the demand for smart cities. Smart cities are entitled to problems, such as high data center operation costs, poor IoT security, and equipment maintenance. However, technologies like blockchain IoT would provide the necessary infrastructure for transaction management, asset tracking, and smart contracts while ensuring security and transparency, thereby increasing operational efficiency.

- In February 2023, Conflux Network collaborated with China Telecom to develop blockchain-based SIM cards. Conflux Network, a blockchain protocol, will develop blockchain-based SIM cards in collaboration with China Telecom, one of the country's largest wireless providers with an estimated 390 million users.

- In November 2022, China's state blockchain infrastructure, Xinghuo Blockchain Infrastructure and Facility, signed an agreement with Malaysian digital service provider MY EG, Services Berhad (MyEG), to own and run an "international supernode," as Beijing expands its international blockchain push.

Blockchain IoT Industry Overview

The blockchain IoT market is highly fragmented, with the presence of major players like IBM Corporation, Intel Corporation, Microsoft Corporation, Cisco Systems Inc., and Amazon Inc. Players in the market are adopting strategies such as partnerships, innovations, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2022 - IBM collaborated with Web3 to create a digital native experience, accelerating and evolving the future of enterprise blockchain. A hybrid enterprise blockchain solution may assist enterprises in achieving new business outcomes, such as fine-grained security, privacy, auditable regulatory compliance, and competitive advantage protection. Adaptability to the market may help the company gain a competitive edge. With decreased friction, cost reductions, and efficiency, a single source of truth is visible to all participating members in near real-time.

- April 2022 - Intel released information on its new Intel Blockscale ASIC. Its application-specific integrated circuit (ASIC) would provide customers with energy-efficient computing for proof-of-work consensus networks, based on years of Intel R&D. The buzz surrounding blockchain technology is growing. It enables decentralized and distributed computing, paving the path for new business models. Intel is developing technologies that can offer an appropriate mix of computing throughput and energy efficiency independent of a customer's operating environment to enable this new era of computing. Intel's decades of research and development in encryption, hashing algorithms, and ultra-low voltage circuits enable blockchain applications to increase their computational capacity without affecting sustainability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defnition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET INSIGHTS

- 5.1 Market Drivers

- 5.1.1 Growing Need for IoT Security

- 5.2 Market Restraints

- 5.2.1 Scalability, Processing Power, and Storage Issues

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Infrastructure

- 6.2 By Application

- 6.2.1 Data Security

- 6.2.2 Smart Contracts

- 6.2.3 Data Communication

- 6.2.4 Asset Tracking and Management

- 6.2.5 Other Applications

- 6.3 By End User

- 6.3.1 Manufacturing

- 6.3.2 Energy Utility

- 6.3.3 Transportation and Logistics

- 6.3.4 Building Management

- 6.3.5 Retail

- 6.3.6 Smart City

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 India

- 6.4.3.2 China

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Intel Corporation

- 7.1.3 Microsoft Corporation

- 7.1.4 Cisco Systems Inc.

- 7.1.5 Amazon Inc.

- 7.1.6 Robert Bosch GmbH

- 7.1.7 The Linux Foundation

- 7.1.8 KrypC Technologies

- 7.1.9 Ethereum Foundation

- 7.1.10 R3 LLC

- 7.1.11 IoTA

- 7.1.12 Waltonchain