|

市场调查报告书

商品编码

1445569

智慧温室:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Smart Greenhouse - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

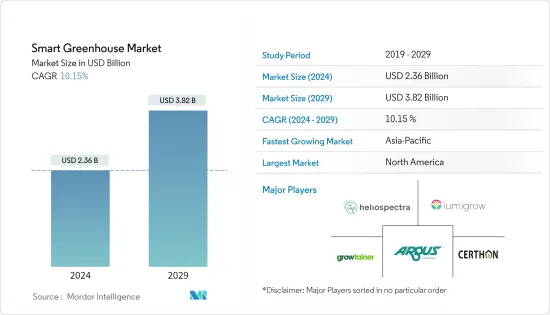

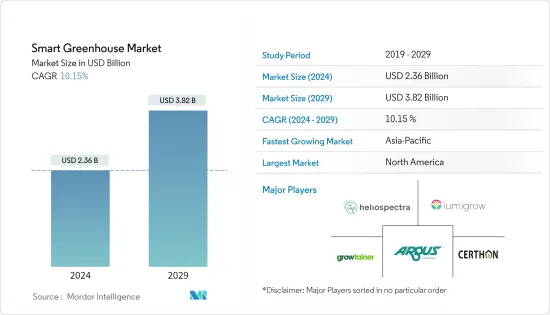

智慧温室市场规模预计到 2024 年为 23.6 亿美元,预计到 2029 年将达到 38.2 亿美元,预测期内(2024-2029 年)复合年增长率为 10.15%。

主要亮点

- 在当今时代,农业成长是直接影响一国经济成长的核心因素之一,因为它透过生产粮食和原材料提供收入,是进出口的主要来源。有一个。它还创造了更大的就业机会。这有助于各国利用从条约经济体向已开发经济体的经济转型,并促进市场成长。

- 智慧温室配备了最新的传感器和通讯技术,24/7 自动记录和传播有关环境和作物的信息。资料被收集并输入物联网平台,其中分析演算法将其转化为可操作的见解,以识别瓶颈和异常情况。因此,暖通空调和照明操作、灌溉和喷洒操作都可以按需控制。持续资料监测有助于建立预测模型来估计作物病害和感染风险。

- 农民可以使用物联网感测器以前所未有的详细程度收集各种资料点。这些提供了关键气候因素的即时资料,例如整个温室的温度、湿度、光照和二氧化碳。这些资讯会导致暖通空调和照明设定发生适当的变化,以维持工厂发育的理想条件,同时提高能源经济性。同时,运动/加速感应器可侦测无意打开的门,确保严格控制的环境。

- HVAC、物料物流、感测器和 LED 生长灯都是智慧温室技术的一部分。不同的公司为受监管的环境提供不同的功能,因此很难将所有技术整合到温室中。因此,建造智慧温室需要企业共同努力,提供受监管的环境,以产生最佳产量。这是扩大智慧温室市场的关键挑战。

- 由于 COVID-19感染疾病,智慧温室市场受到生产、分销和需求不确定性的打击。由于与 COVID-19 相关的进出口限制扰乱了供应链,供应商旨在促进智慧农场出口。例如,2021 年 12 月,韩国正在中东建造智慧农场,其技术可以在使用最少水的情况下种植各种作物。政府旨在以技术和价格竞争力为基础,促进智慧农场向该地区的出口。

智慧温室市场趋势

农民和农业工人更常采用物联网和人工智慧

- 智慧温室配备了最新的传感器和通讯技术,24/7 自动记录和传播环境和作物资讯。资料被收集并输入物联网平台,其中分析演算法将其转化为可操作的见解,以识别瓶颈和异常情况。

- 因此,暖通空调和照明操作、灌溉和喷洒操作都可以按需控制。持续资料监测有助于建立预测模型来估计作物病害和感染风险。

- 此外,物联网和人工智慧等先进技术的日益采用正在增加市场成长潜力。例如,根据 IDATE DigiWorld 和 ETNO资料,据报导,欧盟 (EU) 农业领域的物联网 (IoT) 活跃连线数量已从 2016 年的 51 万个增加到 2025 年的 7,026 万个。

- 农民可以使用物联网感测器以前所未有的详细程度收集各种资料点。这些提供了关键气候因素的即时资料,例如整个温室的温度、湿度、光照和二氧化碳。这些资讯会导致暖通空调和照明设定发生适当的变化,以保持理想的植物生长条件,同时提高能源经济性。同时,动作感测器和加速感应器可以侦测无意打开的门,确保严格控制的环境。

- 种植高价值作物的温室很容易成为骇客的目标。建立具有CCTV的标准监控网路成本高昂,因此许多农民需要高效的安全系统。智慧温室物联网感测器提供了一种经济高效的基础设施,用于监控门状况并检测这种情况下的可疑活动。连接到自动警报系统可以在出现安全风险时立即向农民发出警报。

亚太地区市场显着成长

- 农业部门长期以来一直是印度经济的支柱,僱用了该国约60%的劳动力。印度意识到这个农业国家的庞大市场,在向世界各地出口大量食品的同时也赚取了巨额利润。根据政府资料,2021-22年4月至11月期间,印度农产品和加工食品出口以美元计算与去年同期相比成长了13%以上。

- 然而,印度农业部门仍主要依赖气候,技术渗透率有限。人口增长和饮食习惯的变化给印度的土地带来了巨大的压力。随着土壤持续劣化、作物产量趋于平稳、水资源短缺加剧、自然灾害更加频繁发生以及生物多样性下降,农民正在努力维持生产。

- 这些综合因素正在推动对现代农业技术的需求,以满足不断增长的农产品需求。温室已成为一种非常有益的园艺解决方案,特别是在极端天气条件下,因为它们提供了一个可保证持续产量的受控环境。

- 同样,印度、日本和澳洲等其他亚太国家也支持该地区智慧温室市场的成长。例如,在中国,智慧温室象征智慧农业的发展。将此技术与最新技术结合,中国农民可以利用巨量资料支援的智慧系统,即时监测土壤状况,进行预警控制,高效进行病虫害监测,你一定能做到。

- 此外,据新南威尔斯州政府称,到 2030 年,农业技术或农业科技预计将成为澳洲下一个价值 1,000 亿美元的产业。由于全球暖化、自然资源减少、人事费用上升、能源、化肥和除草剂等因素,种子促进了农业科技的发展。

- 这些趋势以及该国对智慧温室的需求不断增加,导致人们更加重视研发创新解决方案。例如,2022 年初,澳洲农业技术新兴企业公司 Farm 4.0 宣布将与韩国公司 Green Plus 合作,在澳洲图文巴 (Toowoomba) 占地超过 4 公顷的土地上开发草莓温室。

智慧温室产业概况

智慧温室市场分散,各公司在区域范围内竞争以获得市场占有率。市场上的供应商预计将在大型计划上展开激烈竞争,而规模较小的供应商预计将保持其在当地市场的主导地位。拥有整合产品的大型供应商预计其解决方案的采用率会更高,因为它们在整个价值链中拥有更广泛的影响力,并且可以降低风险。

2022 年 8 月,Signify 韩国公司在韩国忠清南道论山市占地 2.8 公顷的棕榈农场温室中安装了飞利浦园艺 LED 生长灯解决方案,用于番茄生产。棕榈农场安装了飞利浦 GreenPower 顶光紧凑型产品,以提高产量、促进植物生长并生产出更高品质的作物。

2022 年 1 月,BFG Supply 超越了商业和业余温室结构及相关产品经销商 International Greenhouse Co. Greenhouse Megastore。收购GMS扩大了BFG的温室能力和产品选择,并进一步提高了园艺市场的客户服务水准。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 农民和农业工人更常采用物联网和人工智慧

- 由于世界人口的持续成长,粮食需求不断增加

- 市场挑战

- 智慧温室安装昂贵的系统,投资成本高

第六章市场区隔

- 按类型

- 水耕

- 水耕栽培

- 依技术

- LED植物生长灯

- 空调设备

- 物料输送

- 控制系统

- 感光元件和相机

- 阀门和泵

- 灌溉系统

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Heliospectra AB

- Rough Brothers Inc.(Gibraltar Industries INC.)

- Lumigrow Inc.

- Certhon

- GreenTech Agro LLC

- Argus Control System Ltd

- Logigs

- Greenhouse Megastore(BFG Supply)

- Netafim

- Desert Growing

- Sensaphone

- CarbonBook(Motorleaf)

第八章市场机会及未来趋势

The Smart Greenhouse Market size is estimated at USD 2.36 billion in 2024, and is expected to reach USD 3.82 billion by 2029, growing at a CAGR of 10.15% during the forecast period (2024-2029).

Key Highlights

- In the current era, agriculture growth is considered one of the core components that can directly influence a country's economic growth as it provides revenue through the production of food and raw materials, which thereby counts as a primary source for imports and exports. It additionally generates employment opportunities on a larger scale. It helps countries leverage their economic transformation from a convention to an advanced economy, hence fostering the market's growth.

- Smart greenhouses, equipped with current sensors and communications technology, automatically record and disseminate information on the environment and crop 24/7. Data is collected and supplied into an IoT platform, where analytical algorithms turn it into actionable insight to identify bottlenecks and irregularities. As a result, HVAC and lighting operations and irrigation and spraying operations may all be controlled on demand. The creation of predictive models to estimate crop disease and infection risks is aided by continuous data monitoring.

- Farmers can collect various data points in unprecedented detail using IoT sensors. They provide real-time data on critical climate factors such as temperature, humidity, light exposure, and carbon dioxide throughout the greenhouse. This information leads to appropriate changes to HVAC and lighting settings to maintain the ideal conditions for plant development while also increasing the energy economy. Simultaneously, motion/acceleration sensors help detect doors left open unintentionally, ensuring a tightly controlled environment.

- HVAC, material logistics, sensors, and LED grow lights are all part of a smart greenhouse's technology. Because different companies supply distinct features for a regulated environment, integrating all technology in greenhouses is difficult. As a result, to create a smart greenhouse, companies must collaborate and provide a regulated environment to produce optimal yields. This is a significant challenge for the smart greenhouse market's expansion.

- The smart greenhouse market has suffered in terms of production, distribution, and uncertainty in demand due to the global COVID-19 pandemic. COVID-19-related restrictions on exports and imports have resulted in supply chain disruptions and vendors aiming to promote smart farm exports. For instance, in December 2021, in the Middle East, South Korea was building a smart farm with technology that allows it to grow various crops while using the least amount of water possible. The government aims to promote smart farm exports to the region based on technology and price competitiveness.

Smart Greenhouse Market Trends

Increasing Adoption of IoT and AI by Farmers and Agriculturists

- Smart greenhouses, equipped with current sensors and communications technology, automatically record and disseminate environmental and crop information 24/7. Data is collected and supplied to an IoT platform, where analytical algorithms turn it into actionable insight to identify bottlenecks and irregularities.

- As a result, HVAC and lighting operations, irrigation, and spraying operations may all be controlled on demand. The creation of predictive models to estimate crop disease and infection risks is aided by continuous data monitoring.

- Moreover, the increasing adoption of advanced technologies such as IoT and AI is fostering market growth potential. For instance, according to the data from IDATE DigiWorld and ETNO, the number of Internet of Things (IoT) active connections in agriculture in the European Union (EU) is reported to have increased from 0.51 million in 2016 to 70.26 million by 2025.

- Farmers can collect various data points in unprecedented detail using IoT sensors. They provide real-time data on critical climate factors such as temperature, humidity, light exposure, and carbon dioxide throughout the greenhouse. This information leads to appropriate changes to HVAC and lighting settings to maintain ideal plant development conditions while increasing the energy economy. Simultaneously, motion and acceleration sensors help detect doors left open unintentionally, ensuring a tightly controlled environment.

- Greenhouses with high-value crops are a viable target for hackers. Many farmers need an efficient security system since standard surveillance networks with CCTVs are costly to establish. IoT sensors in smart greenhouses provide a cost-effective infrastructure for monitoring door status and detecting suspicious activity in this context. They can immediately alert farmers if a security risk emerges when linked to an automatic alarm system.

Asia-Pacific to Witness Significant Growth in the Market

- The agriculture sector has remained the backbone of the Indian economy for a long time, as it employs about 60% of the country's workforce. Sensing the big market of the farming-based country, India also gains huge profits while exporting large amounts of food products across the globe. According to government data, India's exports of agricultural and processed food products increased by more than 13% in USD from April to November for the fiscal year 2021-22, compared to the previous year's period.

- However, the agriculture sector in India is still primarily climate-based, with limited technology penetration. The rising population and changing diets have created huge pressure on land in India. Farmers struggle to keep up as soil degradation rises, crop yields level off, water shortages increase, natural calamities become more frequent, and biodiversity declines.

- These combined factors drive the demand for modern farming techniques to cater to the ever-increasing demand for agricultural products. Greenhouses have emerged as highly beneficial gardening solutions, especially in extreme weather conditions, as they offer a controlled environment that guarantees higher yields sustainably.

- Similarly, other APAC countries such as India, Japan, and Australia also support smart greenhouse market growth in the region. For instance, in China, smart greenhouses epitomize the development of smart agriculture. This technique, combined with the latest technology, enables Chinese farmers to monitor the conditions of the soil in real-time and achieve warning and control, as well as efficient pest monitoring, using smart systems backed up by big data.

- Further, according to the New South Wales government, agricultural technology, or Agtech, is predicted to become Australia's next USD 100 billion industry by 2030. Factors such as global warming, diminishing natural resources, rising labor costs, energy, fertilizer, herbicides, and seeds have allowed Agtech to grow.

- Such trends drive the demand for smart greenhouses in the country, leading to a growing emphasis on R&D to develop innovative solutions. For instance, in early 2022, Australian agri-tech start-up Farm 4.0 announced a collaboration with Korea-based company Green Plus to develop a strawberry greenhouse on more than 4 hectares in Toowoomba, Australia.

Smart Greenhouse Industry Overview

The smart greenhouse market is fragmented, and various companies compete on a regional scale to gain market share. Vendors in the market are expected to compete intensely for large-scale projects, but smaller vendors are expected to hold prominence over the market in the local space. Major vendors that offer integrated products are expected to command a higher share of the adoption of their solutions due to the spread of their presence over the value chain and the ability to mitigate the risk.

In August 2022, Signify Korea installed a Philips horticulture LED grow light solution at the 2.8 ha Parm Farm Greenhouse for tomato production in Nonsan, Chungcheongnam-do, Korea. Parm Farm installed Philips GreenPower toplighting compact to produce higher yields, accelerate plant growth, and enable higher-quality crop production.

In January 2022, BFG Supply overtook International Greenhouse Co. Greenhouse Megastore, a distributor of commercial and hobby greenhouse structures and related products. The acquisition of GMS will expand BFG's greenhouse capabilities and product selection, further improving customer service levels in the horticulture market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of IoT and AI by Farmers and Agriculturists

- 5.1.2 Growing Demand for Food due to Continuously Increasing Global Population

- 5.2 Market Challenges

- 5.2.1 High Investment Costs due to the Deployment of Expensive Systems in Smart Greenhouses

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hydroponic

- 6.1.2 Non-hydroponic

- 6.2 By Technology

- 6.2.1 LED Grow Light

- 6.2.2 HVAC

- 6.2.3 Material Handling

- 6.2.4 Control Systems

- 6.2.5 Sensors and Cameras

- 6.2.6 Valves and Pumps

- 6.2.7 Irrigation Systems

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Heliospectra AB

- 7.1.2 Rough Brothers Inc. (Gibraltar Industries INC.)

- 7.1.3 Lumigrow Inc.

- 7.1.4 Certhon

- 7.1.5 GreenTech Agro LLC

- 7.1.6 Argus Control System Ltd

- 7.1.7 Logigs

- 7.1.8 Greenhouse Megastore (BFG Supply)

- 7.1.9 Netafim

- 7.1.10 Desert Growing

- 7.1.11 Sensaphone

- 7.1.12 CarbonBook (Motorleaf)