|

市场调查报告书

商品编码

1445575

计算摄影:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Computational Photography - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

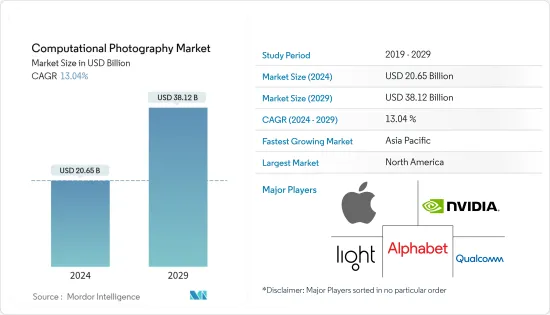

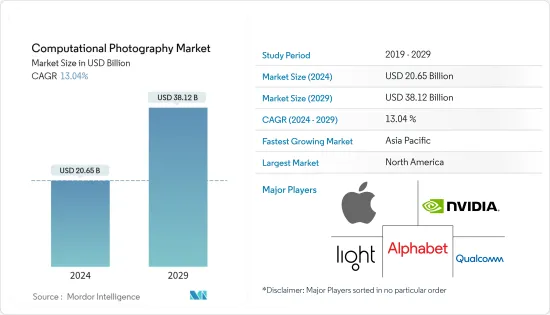

计算摄影市场规模预计在2024年为206.5亿美元,预计到2029年将达到381.2亿美元,在预测期内(2024-2029年)市场规模将增加130.4亿美元,复合年增长率为%。

主要亮点

- 计算摄影透过影像处理演算法减少运动模糊、结合人工景深以及改善色彩、对比度和光线范围来增强影像。

- 该市场是由越来越多地使用图片融合方法来产生高品质影像所推动的。近年来,随着影像融合技术在多种应用中的快速发展,人们认识到迫切需要能够客观、系统化、统计地分析或评估各种融合技术性能的方法。改善夜间彩色影像对于计算摄影和电脑视觉非常重要。

- 该设备具有用于成像计算的先进计算能力。这些软体解决方案透过压缩、放大和镶嵌影像来增强和扩展基于计算摄影的设备的功能。随着计算摄影技术的发展,业余摄影师将能够使用智慧型手机创建更高品质的照片。

- 此外,在预测期内,由于感测器影像解析度的提高、相机模组、组件和设计的技术创新以及电脑视觉领域对卓越视觉技术的需求不断增长,电脑相机产业预计将成长。

- 然而,计算相机模组的市场成长受到高昂的维护成本和製造成本的限制。随着行动电话手机供应商努力提高影像质量,手机价格不断上涨。

- 全球计算摄影市场因 COVID-19感染疾病而受到严重干扰。全球新措施的开发停止,导致模拟半导体市场萎缩。

计算摄影市场趋势

智慧型手机相机市场显着成长

- 计算摄影现在可用于独立相机、机器视觉相机、智慧型手机独立相机、混合实境成像、数位成像、扩增实境成像和其他应用的相机软体和相机模组。

- 基于软体的成像技术在机器视觉中的使用越来越多、4K 和超高清技术的发展、智慧型手机的普及以及配备先进相机的高阶智慧型手机的采用。

- 此外,计算摄影使用电脑软体来增强相机产生的影像。它主要用在行动电话上。事实上,计算摄影可以产生人们在智慧型手机照片库中看到的令人惊嘆的照片。

- 过去10年,智慧型手机拍照的能力不断增强,相机近年来也迅速发展。行动电话製造商已宣布计划将机器学习和人工智慧 (AI) 融入其产品中。

- 过去几年智慧型手机相机的快速进步很大程度上归功于更好的软体,而不是改变相机感测器。苹果和谷歌等几家智慧型手机製造商年復一年地不断增强其产品的摄影功能,而没有对实际相机感测器进行重大改变。

亚太地区预计将拥有最高的市场成长

计算摄影市场预计将快速成长,华为、小米等中国厂商数量迅速增加。

- 这些公司开发先进的基于人工智慧的相机,配备强大的晶片组和处理器,用于尖端成像应用。然而,在印度、韩国、澳洲和日本等国家,计算相机相对于单眼相机的采用将主要取决于定价实践和大众对这些好处的理解。

- 推动该地区市场扩张的关键因素是智慧型手机相机中越来越多地使用计算摄影、越来越多地使用图像融合技术来创建高品质照片以及复杂的摄影,这是实现这一目标的高端演算法。

- 由于以更低的成本提供更好的机器视觉系统,以及利用更好的色彩、对比度和照明技术升级照片的能力等优势,计算摄影在整个全部区域不断发展。 HDR(高动态范围)全景成像是一种流行的计算摄影技术,它有效地结合了在不同曝光下拍摄的多个重迭或曝光不足的照片的资料。

计算摄影行业概况

计算摄影市场是分散的,领先的公司透过新产品发布、协议、合作伙伴关係和收购等策略扩大了在该市场的足迹。主要企业包括 Alphabet Inc. 和 Apple Inc.。

2023 年 2 月,高通科技公司与三星合作伙伴宣布建立合作关係。他们在全球推出了适用于Galaxy 的Snapdragon 8 Gen 2,为三星Galaxy S23 系列提供动力,带来了性能改进,使其成为有史以来最快的Snapdragon、桌面级游戏功能、专业级摄影功能等.定义了连网型的新标准计算包括:世界各地的消费者。相较之下,Galaxy S23 系列的发布凸显了高通科技公司和三星公司共同致力于为旗舰 Galaxy 装置提供优质消费者体验。

2022 年 9 月,苹果发布了最先进的 Pro 系列:iPhone 14 Pro 和 iPhone 14 Pro Max,配备动态岛。这种新设计引入了一种直观的方式来体验 iPhone 和常亮显示器。 iPhone 14 Pro 引进了全新的专业相机系统,配备首款配备四像素感应器和光子引擎的 iPhone 48MP 主相机。这种增强的影像管道极大地改善了低照度摄影。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 影像融合技术越来越多地被采用以实现更高的影像质量

- 自动驾驶汽车机器视觉对高解析度运算相机的需求不断增长

- 市场限制因素

- 製造和维护成本高

第六章市场区隔

- 透过提供

- 相机模组

- 软体

- 按类型

- 单眼相机和双镜头相机

- 16镜头相机

- 按用途

- 智慧型手机相机

- 机器视觉相机

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 世界其他地区

第七章 竞争形势

- 公司简介

- Apple Inc.

- Alphabet Inc.

- Qualcomm Technologies Inc.

- Nvidia Corporation

- Light Labs Inc.

- CEVA Inc.

- FotoNation Inc.

- Algolux Inc.

- Pelican Imaging Corporation

- Almalence Inc.

第八章投资分析

第九章市场机会与未来趋势

The Computational Photography Market size is estimated at USD 20.65 billion in 2024, and is expected to reach USD 38.12 billion by 2029, growing at a CAGR of 13.04% during the forecast period (2024-2029).

Key Highlights

- Computational photography enhances images through image processing algorithms by reducing motion blur, incorporating artificial depth of field, and improving color, contrast, and light range.

- The market is driven by the increasing use of the Picture Fusion Method to produce high-quality images. Methods that may objectively, methodically, and statistically analyze or evaluate the performance of various fusion technologies have been recognized as urgently needed since picture fusion techniques have developed quickly in multiple applications in recent years. Improving nighttime color images is crucial to computational photography and computer vision.

- The device has sophisticated computational capabilities that are used in computing imaging. By compressing, enlarging, and mosaicking an image, these software solutions enhance and extend the capabilities of computational photography-based devices. Smartphones enable amateur photographers to create photographs of higher quality as computational photography technology develops.

- Additionally, during the forecast period, the industry for computer cameras is anticipated to experience growth due to improvements in sensor image resolution, technological innovation in camera modules, components, and design, and a rise in demand for superior vision technology in the computer vision sector.

- However, the market growth of computational camera modules is held back by high maintenance and manufacturing costs. Mobile phone prices rise as smartphone vendors strive to improve image quality.

- The global market for computational photography was considerably disrupted by the COVID-19 epidemic. The development of new initiatives around the globe halted, which consequently reduced the market for analog semiconductors.

Computational Photography Market Trends

Smartphone Cameras to Witness Significant Market Growth

- Computational photography is now available in-camera software and camera modules for standalone cameras, machine vision cameras, standalone cameras for smartphones, mixed reality imaging, digital imaging, augmented reality imaging, and other applications.

- The growing use of software-based imaging techniques in machine vision, the development of 4K and super HD technologies, the penetration of smartphones, and the adoption of high-end smartphones with sophisticated cameras.

- Moreover, computational photography uses computer software to improve pictures produced by cameras. It is primarily utilized in cell phones. In reality, computational photography produces the stunning photographs people see in their smartphone photo galleries.

- The ability to take pictures on smartphones has increased over the past ten years, and the cameras have advanced rapidly in recent years. Mobile phone manufacturers are announcing their plans to include machine learning and artificial intelligence (AI) in their products.

- Instead of modifying the camera sensor, the fast progress in smartphone cameras over the past few years may largely be credited to better software. Several smartphone producers, such as Apple and Google, consistently enhance the photo-taking capabilities of their products year after year without ever significantly modifying the actual camera sensors.

Asia Pacific region is set to witness highest market growth

The market for computational photography is predicted to see rapid growth and a surge in the number of Chinese manufacturers like Huawei and Xiaomi.

- These companies develop sophisticated AI-based cameras with potent chipsets and processors for cutting-edge image applications. However, the adoption of computational cameras over DSLR cameras in other nations like India, South Korea, Australia, and Japan will primarily depend on pricing practices and public understanding of these advantages.

- An important driver boosting market expansion in the region is the increasing usage of computational photography in smartphone cameras, the growing use of image fusion techniques to produce high-quality photographs, and high-end algorithms to have sophisticated photography.

- Computational photography has grown throughout the region due to its benefits, which include providing better machine vision systems at a reduced cost and upgrading photographs with better color, contrast, and lighting techniques. The popular computational photography technique, HDR (High Dynamic Range) Imaging with Panoramic, effectively combines data from several overlapping and underexposed shots that are exposed differently.

Computational Photography Industry Overview

The computational photography market is fragmented, and the major players have used strategies such as new product launches, agreements, partnerships, acquisitions, and others to increase their footprints in this market. Key players are Alphabet Inc., Apple Inc., etc.

In February 2023, Qualcomm Technologies, Inc and Samsung Partner announced a collaboration. They launched Snapdragon 8 Gen 2 for Galaxy powers Samsung Galaxy S23 series globally, bringing accelerated performance, making it the fastest Snapdragon ever, and defining a new standard for connected computing, including desktop-level gaming features, professional-grade photography, and more to consumers around the world. In contrast, the Galaxy S23 series launch underscores Qualcomm Technologies and Samsung's mutual commitment to delivering premium consumer experiences for flagship Galaxy devices.

In September 2022, Apple announced the iPhone 14 Pro and iPhone 14 Pro Max, the most advanced Pro lineup, featuring Dynamic Island. This new design introduces an intuitive way to experience iPhone and the Always-On display, iPhone 14 Pro introduces a new class of pro camera system, with the first-ever 48MP Main camera on iPhone featuring a quad-pixel sensor and Photonic Engine. This enhanced image pipeline dramatically improves low-light photos.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Image Fusion Technique to Achieve High-quality Image

- 5.1.2 Increasing Demand for High-resolution Computational Cameras in Machine Vision for Autonomous Vehicle

- 5.2 Market Restraints

- 5.2.1 High Manufacturing and Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Offerings

- 6.1.1 Camera Modules

- 6.1.2 Software

- 6.2 By Type

- 6.2.1 Single- and Dual-Lens Cameras

- 6.2.2 16-Lens Cameras

- 6.3 By Application

- 6.3.1 Smartphone Cameras

- 6.3.2 Machine Vision Cameras

- 6.3.3 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 South America

- 6.4.5 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Apple Inc.

- 7.1.2 Alphabet Inc.

- 7.1.3 Qualcomm Technologies Inc.

- 7.1.4 Nvidia Corporation

- 7.1.5 Light Labs Inc.

- 7.1.6 CEVA Inc.

- 7.1.7 FotoNation Inc.

- 7.1.8 Algolux Inc.

- 7.1.9 Pelican Imaging Corporation

- 7.1.10 Almalence Inc.