|

市场调查报告书

商品编码

1445582

纤维增强塑胶 (FRP) 回收:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Fiber-reinforced Plastic (FRP) Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

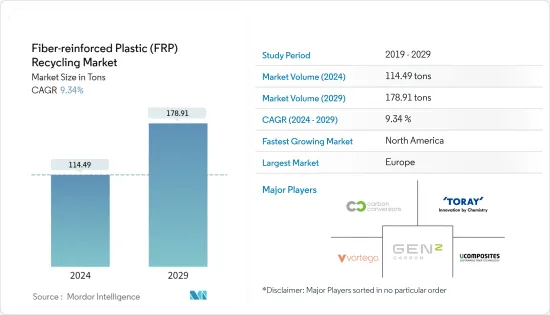

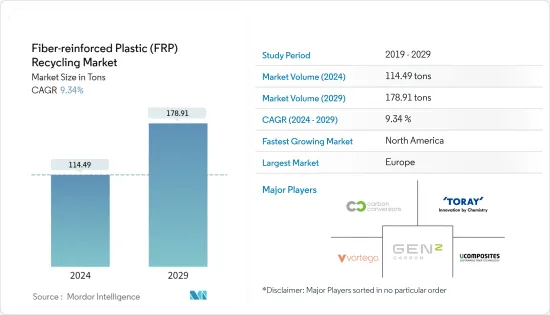

纤维增强塑胶回收再利用市场规模预计到2024年为114.49吨,预计到2029年将达到178.91吨,在预测期内(2024-2029年)复合年增长率为9.34%。

由于各种贸易和营运限制,COVID-19 大流行对 2020 年市场产生了负面影响。然而,在2021年下半年监管放鬆和疫情结束后,由于汽车、建筑和建筑等各个最终用户行业中再生纤维塑料复合材料的使用增加,市场出现了正增长。建造。 。

主要亮点

- 从中期来看,复合材料废弃物累积的增加、对复合材料废弃物的更严格监管以及促进碳纤维增强塑胶(CFRP)回收的新策略预计将推动市场成长。

- 另一方面,回收过程中面临的困难、缺乏适当的 CFRP 回收技术以及由于 CFRP 使用寿命长而可用的复合废弃物有限,阻碍了所研究市场的成长。

- 儘管如此,再生复合材料的持续发展可能为所研究的市场提供机会。

- 欧洲地区主导了市场。然而,北美地区在预测期内可能会出现最快的成长。

纤维增强塑胶市场趋势

建筑和施工主导市场

- 建设产业是利用再生纤维增强塑胶 (FRP)废弃物进行多种应用的主要行业之一。再生玻璃钢在建设产业的使用包括使用100%再生玻璃钢和使用任意比例的再生玻璃钢。

- 回收的玻璃钢重量轻、易于安装、热稳定性好、电绝缘,并且在高腐蚀性环境中耐用,使其可用于建筑和建设产业。玻璃纤维增强塑胶回收物,以及一定量的碳纤维增强塑胶回收物,是主要用于建筑的回收物。

- 回收玻璃钢在建设产业的常见用途包括用作传统建筑材料(如钢材和混凝土)的替代品。

- 新冠病毒大流行后,全球建设产业支出预计将增至约13兆美元,每年增长3%。根据世界银行的数据,2022 年全球建筑业支出为 13.4 兆美元。

- 根据美国人口普查局的数据,2022 年美国私人建筑支出将增加至政府建筑支出的四倍左右。就美国各地的建筑支出而言,德克萨斯州和加州处于领先地位。

- 回收的玻璃钢可用于製造结构梁、柱和其他载重构件,以及覆材、面板和建筑幕墙等非结构构件,也可用于製造门窗等预製建筑构件。 。

- 此外,机械回收的玻璃钢废弃物在新型复合材料中的潜在应用包括波特兰水泥,对此已经进行了大量的研究,这些回收的材料预计将用作增强材料、骨料或填充材替代品。

- 所有上述因素都在推动建筑领域的发展,预计将在预测期内增加对纤维增强塑胶(FRP)回收的需求。

欧洲主导市场

- 由于德国、英国和英国等主要国家的需求不断增长,预计欧洲地区将主导全球市场。

- 包括德国在内的欧洲国家禁止掩埋,因此越来越多地使用再生塑胶和复合材料。回收的玻璃钢可用于建筑、航太和风力发电产业。

- 回收的玻璃纤维应用于风车叶片。风力发电是德国向可再生能源转型的最重要推动力之一。预计德国和西班牙将退役最多的刀片,其次是丹麦。汉莎航空已永久退役 40 多架飞机,并取消了德国之翼的低成本部门。

- Wind Europe 倡导到 2025 年禁止在欧洲各地处置废弃旧风力发电机叶片。欧洲风电企业正在积极致力于再利用、回收或 100% 回收其废弃叶片。在此之前,许多行业领先的公司宣布了雄心勃勃的叶片回收和回收计划。掩埋禁令可以鼓励环保回收技术的发展。

- 根据Offshore Renewable Energy Catapult的数据,到2050年,德国离岸风力发电机退役容量将超过10W,而陆上风力发电机退役容量约为80GW。风力发电机退役的增加导致风力发电行业的玻璃钢废弃物量增加。加强欧盟框架以确保有效实施,掩埋和焚烧以及加强有关玻璃钢废弃物管理的政策正在推动玻璃钢回收市场的发展。

- 2021 年 11 月,一项在三年内耗资 20 亿欧元(21.4 亿美元)的风力发电机叶片回收重大倡议在英国首次获得批准。此外,政府也针对国内废弃物制定了严格的环境法。

- 此外,义大利积极参与玻璃钢回收市场,包括建立试点工厂。 Karborek Recycling Carbon Fibers 是一家专门从事碳纤维回收和回收的义大利先驱。该公司的回收产品主要用于航太、汽车、工业、军事和体育产业。

- 所有上述因素都可能对未来几年的市场需求产生重大影响。

纤维增强塑胶产业概况

纤维增强塑胶(FRP)回收市场高度分散。主要回收公司与复合材料製造商和OEM设备製造商合作收集和回收废弃物。主要回收公司包括(排名不分先后)Toray Industries Inc.、Vartega Inc.、Gen 2 Carbon Limited、Ucomposites AS 和 Carbon Conversions。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 复杂废弃物的累积不断增加

- 其他司机

- 抑制因素

- 缺乏适当的CFRP回收技术以及FRP回收製程困难

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(市场规模(数量))

- 产品类别

- 玻璃钢

- 碳纤维增强塑料

- 其他产品类型

- 回收技术

- 热感/化学回收

- 焚烧及混合燃烧

- 机械回收(减容)

- 最终用户产业

- 工业的

- 交通设施

- 建筑与建造

- 运动的

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 世界其他地区

- 南美洲

- 中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- Producer Recycler Partnerships

- 主要企业采取的策略

- 公司简介

- Aeron Composite Pvt. Ltd

- Carbon Conversions

- Carbon Fiber Recycle Industry Co. Ltd

- Carbon Fiber Recycling

- Conenor Ltd

- Eco-Wolf Inc.

- Gen 2 Carbon Limited

- Global Fiberglass Solutions

- Karborek Recycling Carbon Fibers

- MCR Mixt Composites Recyclables

- Mitsubishi Chemical Advanced Materials GmbH

- Neocomp GmbH

- Procotex

- Toray industries Inc.

- Ucomposites AS

- Vartega Inc.

第七章市场机会与未来趋势

- 再生复合材料领域发展

The Fiber-reinforced Plastic Recycling Market size is estimated at 114.49 tons in 2024, and is expected to reach 178.91 tons by 2029, growing at a CAGR of 9.34% during the forecast period (2024-2029).

The COVID-19 pandemic adversely impacted the market in 2020 due to various trade and operational restrictions. However, after the loosening of restrictions and retracting the pandemic in the latter half of 2021, the market recorded a positive growth rate due to the increased use of recycled fiber plastic composites in various end-user industries, such as automotive, building and construction, and others.

Key Highlights

- Over the medium term, the growing accumulation of composite waste, stringent regulations on composite disposal, and new strategies to promote the reuse of carbon-fiber-reinforced plastic (CFRP) are expected to drive the market's growth.

- On the flip side, difficulties faced during the recycling process, lack of proper recycling techniques for CFRP, and the long service life of CFRP resulting in the limited composite waste availability, are expected to hinder the growth of the market studied.

- Nevertheless, continuous developments in the recycling composites will likely act as an opportunity for the studied market.

- The European region dominated the market. However, the North American region will likely witness the fastest growth during the forecast period.

Fiber Reinforced Plastic Market Trends

Building and Construction Dominates the Market

- The construction industry is among the major industries utilizing recycled fiber-reinforced plastics (FRPs) waste for different applications. Utilization of recycled FRPs in the construction industry includes using 100% recycled FRPs and recycled FRPs in any percentage.

- Recycled FRPs are lightweight, easy to install, and possess thermal and stability, electrical insulation, and durability in very corrosive environments, making these recycled FRPs useful for application in the building and construction industry. Recyclates of glass FRPs are the majorly used recyclates in construction, along with recyclates of carbon FRPs in certain significant amounts.

- The common application of recycled FRPs in the construction industry includes its use as an alternative to traditional building materials such as steel and concrete.

- After the coronavirus pandemic, the global construction industry increased to a spending value of around USD 13 trillion, predicted to rise by 3% annually. According to the World Bank, the construction industry spending worldwide in 2022 was USD 13.4 trillion.

- According to the US Census Bureau, in the United States, private construction spending increased in 2022 and was roughly four times more than governmental construction spending. Regarding construction spending throughout the 50 United States, Texas, and California came out on top.

- Recycled FRPs can be used to create structural beams, columns, and other load-bearing elements, as well as non-structural elements such as cladding, panels, and facades, and used in manufacturing prefabricated building components, such as doors and windows.

- Furthermore, the potential applications of mechanically recycled FRP waste in new composite materials, on which a significant amount of research is carried out, include Portland cement, where these recyclates are expected to use as reinforcement, aggregate, or filler replacement.

- All the factors above are expected to drive the building and construction segment, enhancing the demand for fiber-reinforced plastic (FRP) recycling during the forecast period.

Europe to Dominate the Market

- The European region is expected to dominate the global market due to the increasing demand from major countries like Germany, Italy, and the United Kingdom.

- In European countries, including Germany, landfilling is prohibited, so adopting recycled plastics/composites is gaining momentum. Recycled FRPs may be used in the construction, aerospace, and wind power industries.

- Recycled FRPs find applications in windmill blades. Wind power is one of the most important drivers of Germany's transition to renewable energy. The biggest number of decommissioned blades is expected in Germany and Spain, followed by Denmark. Lufthansa permanently decommissioned more than 40 aircraft and axed its Germanwings low-cost arm.

- Wind Europe advocated a waste ban on obsolete wind turbine blades throughout Europe by 2025. The wind business in Europe is aggressively committed to reusing, recycling, or recovering 100% of decommissioned blades. It follows the announcement of ambitious blade recycling and recovery plans by numerous industry-leading companies. A landfill ban may hasten the development of environment-friendly recycling technology.

- According to the Offshore Renewable Energy Catapult, Germany's projected offshore wind turbine decommissioning is more than 10 W, and the projected onshore wind turbine decommissioning is about 80 GW by 2050. These rising decommissions of wind turbines increase the amount of FRP waste from the wind sector. The rising EU framework to ensure effective implementation, landfill, and incineration, coupled with more policies on FRP waste management, is driving the market for FRP recycling.

- In November 2021, for the first time in the United Kingdom, a large initiative to develop wind turbine blade recycling was granted the go-light, costing EUR 2 billion (USD 2.14 billion) over three years. Furthermore, the government initiated strict environmental legislation regarding waste disposal in the country.

- Furthermore, Italy is active in the FRP recycling market, including an established pilot plant. Karborek Recycling Carbon Fibers is a pioneer in Italy and specializes in recycling and recovering carbon fibers. The company's recycled products are majorly used in the aerospace, automotive, industrial, military, and sports industries.

- All the factors mentioned above are likely to significantly impact the demand in the market in the years to come.

Fiber Reinforced Plastic Industry Overview

The fiber-reinforced plastic (FRP) recycling market is highly fragmented. Major recycling companies partner with composites and OEM manufacturers to collect and recycle the waste. Some major recycling companies (not in a particular order) include Toray Industries Inc., Vartega Inc., Gen 2 Carbon Limited, Ucomposites AS, and Carbon Conversions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Accumulation of Composite Waste

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Lack Of Proper Recycling Techniques For CFRP And Difficult Recycling Process Of FRP

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Glass Fiber-reinforced Plastic

- 5.1.2 Carbon Fiber-reinforced Plastic

- 5.1.3 Other Product Types

- 5.2 Recycling Technique

- 5.2.1 Thermal/chemical Recycling

- 5.2.2 Incineration and Co-incineration

- 5.2.3 Mechanical Recycling (Size Reduction)

- 5.3 End-user Industry

- 5.3.1 Industrial

- 5.3.2 Transportation

- 5.3.3 Building And Construction

- 5.3.4 Sports

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest Of Asia-pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East & Africa

- 5.4.1 Asia-pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Producer Recycler Partnerships

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aeron Composite Pvt. Ltd

- 6.4.2 Carbon Conversions

- 6.4.3 Carbon Fiber Recycle Industry Co. Ltd

- 6.4.4 Carbon Fiber Recycling

- 6.4.5 Conenor Ltd

- 6.4.6 Eco-Wolf Inc.

- 6.4.7 Gen 2 Carbon Limited

- 6.4.8 Global Fiberglass Solutions

- 6.4.9 Karborek Recycling Carbon Fibers

- 6.4.10 MCR Mixt Composites Recyclables

- 6.4.11 Mitsubishi Chemical Advanced Materials GmbH

- 6.4.12 Neocomp GmbH

- 6.4.13 Procotex

- 6.4.14 Toray industries Inc.

- 6.4.15 Ucomposites AS

- 6.4.16 Vartega Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Developments in the Field of Recycling Composites