|

市场调查报告书

商品编码

1689950

叶蜡石-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Pyrophyllite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

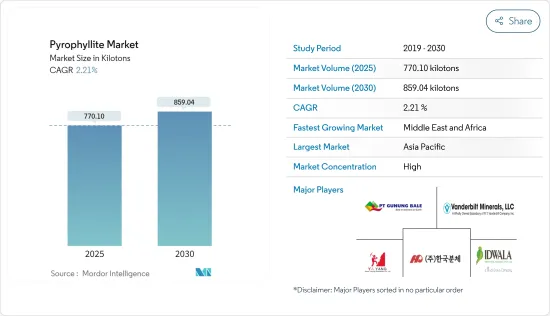

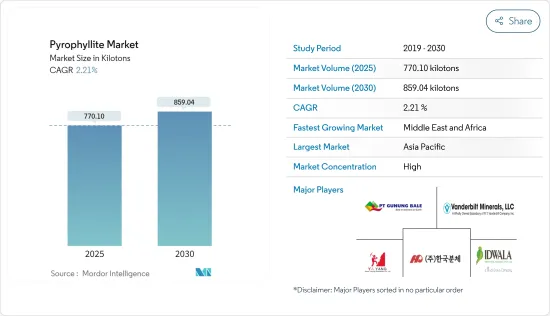

叶蜡石市场规模预计在 2025 年为 770.10 千吨,预计在 2030 年达到 859.04 千吨,预测期内(2025-2030 年)的复合年增长率为 2.21%。

关键亮点

- 陶瓷对叶蜡石的需求增加以及耐火材料和铸造厂的消费成长是推动叶蜡石需求的主要因素。建设活动的增加以及对陶瓷和玻璃纤维的需求不断增长也在推动市场成长。

- 然而,采矿过程中叶蜡石粉尘造成的健康问题以及替代品的可用性预计会阻碍市场成长。

- 产品开发和加工技术的创新有望为市场带来新的机会。

- 预计亚太地区将主导市场,其中大部分需求来自中国和印度。

叶蜡石市场趋势

陶瓷对叶蜡石的需求不断增加

- 叶蜡石是一种独特而着名的矿物,常见于板岩、千枚岩、某些片岩和其他早期变质岩中。

- 叶蜡石是陶瓷的重要原料。它不仅降低了烧成温度,还最大限度地减少了热膨胀、收缩和开裂。此外,最终成品具有先进的玻璃化性能,可提高抗热震性和强大的机械抗性。

- 由于其韧性、电阻性和化学惰性,预计未来几年建筑和汽车行业对叶蜡石陶瓷的需求将会增加。

- 中国是世界上最大的陶瓷生产国之一。根据中国陶瓷协会预测,2023年中国工业陶瓷製造业市场规模预计将达347亿美元,较2022年成长5.2%。

- 各行业对陶瓷的需求拉动了陶瓷出口。根据印度商业情报和统计总局(DGCI&S)的资料,2023年印度陶瓷产品出口额约3,002亿印度卢比(约36亿美元)。印度陶瓷产业的蓬勃发展刺激了国内消费。

- 建筑业的蓬勃发展增加了对瓷砖的需求。亚洲是全球磁砖製造中心,根据《陶瓷世界》的资料,2022 年亚洲磁砖出口量超过 13.5 亿平方公尺,出口额排名第一。欧盟是第二大出口国,出口量达9.65亿平方公尺。

- 美国商务部资料显示,2023年美国磁砖出口量与前一年同期比较年增0.5%,达到470万平方公尺(5,100万平方英尺),创历史新高。主要出口目的地为加拿大(65.8%)和墨西哥(19.7%)。以以金额为准,美国出口额为 5,330 万美元,比 2022 年成长 1.4%。

- 由于上述因素,预计陶瓷应用将在预测期内占据主导地位。

亚太地区可望主导市场

- 预计预测期内亚太地区将主导叶蜡石市场。中国和印度等国家对叶蜡石的需求不断增加,主要是因为陶瓷在建筑业的应用不断扩大。随着建筑业的蓬勃发展,对瓷砖的需求也随之增长。

- 根据《陶瓷世界》资料显示,印度瓷砖产业一直备受全球关注,尤其是出口到各大洲的产业都呈现稳定成长。值得注意的是,2023年印度瓷砖出口量达5.895亿平方公尺,较2022年大幅成长39.6%。

- 叶蜡石是造纸和油漆工业中的重要填充材。根据印度造纸工业协会(IPMA)的报告,2023年印度纸和纸板产品出口额约为30.4亿美元。

- 在农业中,叶蜡石充当肥料的载体,增强土壤养分的保留并最大限度地减少淋失。中国是全球化肥生产大国,根据中国国家统计局的数据,2022年中国氮磷钾肥产量为5,573万吨,与前一年同期比较增加0.5%。

- 叶蜡石的独特性能(热稳定性、耐火性、耐化学性和机械强度)使其成为耐火材料行业必不可少的材料。从耐火材料製造商为提高生产能力而进行的投资可以看出这一点,显示市场将呈现强劲的成长轨迹。

- 例如,2023年2月,维苏威集团宣布了一项6,100万美元的投资计划,旨在未来三到五年内扩大其在印度的耐火材料製造地。这项策略性倡议将特别增强其位于加尔各答的塔拉塔拉工厂的产能,使该公司的每月生产能力提高 35%。

- 考虑到这些动态,预测期内亚太地区的叶蜡石市场将会显着成长。

叶蜡石产业概况

叶蜡石市场高度整合。主要企业(排名不分先后)包括 Hankook Mineral Powder、Hebei Yayang Spodumene、Idwala Industrial Holdings (Pty) Ltd、Pt. Gunung Bale 和 RT Vanderbilt Holding Company Inc.

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 陶瓷对叶蜡石的需求不断增加

- 耐火材料和铸造厂的消耗增加

- 其他驱动因素

- 市场限制

- 采矿过程中叶蜡石粉尘引起的健康问题

- 替代产品的可用性

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按类型

- 天然叶蜡石

- 其他等级(Ceramit 10、Ceramit 14 等)

- 按应用

- 陶瓷製品

- 玻璃纤维

- 填充材(纸张、杀虫剂、油漆)

- 肥料(土壤改良剂)

- 橡胶和屋顶材料(防尘剂)

- 耐火材料

- 装饰石材

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Anand Talc

- Avani Group of Industries

- Hankook Mineral Powder Co. Ltd

- Hebei Yayang Spodumene Co. Ltd

- Idwala Industrial Holdings(Pty)Ltd

- Ningbo Inno Pharmchem Co. Ltd

- Ningbo Jiahe New Materials Technology Co. Ltd

- Pt. Gunung Bale

- Rt Vanderbilt Holding Company Inc.

- Samirock Company

- SEPRA

- SKKU Minerals

- Wonderstone

第七章 市场机会与未来趋势

- 产品开发与加工技术创新

- 其他机会

简介目录

Product Code: 69499

The Pyrophyllite Market size is estimated at 770.10 kilotons in 2025, and is expected to reach 859.04 kilotons by 2030, at a CAGR of 2.21% during the forecast period (2025-2030).

Key Highlights

- The growing demand for pyrophyllite from ceramics and increasing consumption in refractory and foundry are the major factors driving the demand for pyrophyllite. Increasing construction activities and the rising demand for ceramics and fiberglass are also boosting the growth of the market studied.

- However, health issues due to pyrophyllite dust during mining and the availability of substitutes are expected to hinder the market's growth.

- Nevertheless, innovations in product development and processing techniques are expected to create new opportunities for the market.

- Asia-Pacific is expected to dominate the market, with the majority of demand coming from China and India.

Pyrophyllite Market Trends

Growing Demand for Pyrophyllite from Ceramics

- Pyrophyllite is a distinctive and notable mineral commonly found in slate, phyllite, certain schists, and other early-stage metamorphic rocks.

- Pyrophyllite is a vital raw material in ceramics. It not only lowers firing temperatures but also minimizes thermal expansion, shrinking, and cracking. Moreover, it enhances thermal shock resistance, resulting in a finished product with a high degree of vitrification and robust mechanical resistance.

- Due to its toughness, electrical resistance, and chemical inertness, the demand for pyrophyllite in ceramics is likely to increase in the construction and automotive industries in the coming years.

- China is one of the largest producers of ceramics worldwide. According to the China Ceramic Association, the market value of the industrial ceramic manufacturing industry in China was USD 34.7 billion in 2023, which witnessed an increase of 5.2% compared to 2022.

- The demand for ceramics in various industries propelled ceramics exports. India's ceramic product exports in 2023 were valued at approximately INR 300.2 billion (~USD 3.6 billion), as per data from the Directorate General of Commercial Intelligence and Statistics (DGCI&S). This surge in India's ceramics industry boosted domestic consumption.

- The booming construction sector has increased the demand for ceramic tiles. Data from Ceramic World highlights Asia as the premier global hub for ceramic tile manufacturing, being the top exporter in 2022, shipping over 1.35 billion square meters. The European Union followed as the second-largest exporter, with 965 million square meters.

- Data from the US Department of Commerce reveals that in 2023, ceramic tile exports from the United States reached a record high of 4.7 million square meters (51 million sq. ft.), marking a 0.5% increase from the previous year. The vast majority of these exports went to Canada (65.8%) and Mexico (19.7%). In terms of value, the US exports were worth USD 53.3 million, up by 1.4% from 2022.

- Due to the aforementioned factors, the application of ceramics is likely to dominate during the forecast period.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific is expected to dominate the pyrophyllite market during the forecast period. The rising demand for pyrophyllite in countries such as China and India is primarily fueled by the growing application of ceramics in their construction industries. As the construction industry surges, so does the demand for ceramic tiles.

- Data from Ceramic World highlights that India's ceramic tile industry is gaining global prominence, especially with its exports witnessing steady growth across continents. Notably, in 2023, India exported a record 589.5 million square meters of ceramic tiles, marking a 39.6% surge from 2022.

- Pyrophyllite serves as a crucial filler in the paper and paint industries. The Indian Paper Manufacturers Association (IPMA) reported that in 2023, India's paper and paperboard product exports were valued at around USD 3.04 billion.

- In agriculture, pyrophyllite acts as a fertilizer carrier, enhancing soil nutrient retention and minimizing leaching. Dominating the global fertilizer landscape, China produced 55.73 million tons of nitrogen, phosphate, and potash fertilizers in 2022, reflecting a 0.5% year-on-year increase, as per the National Bureau of Statistics of China.

- Pyrophyllite's unique attributes (thermal stability, refractoriness, chemical resistance, and mechanical strength) make it indispensable in the refractory industry. This is further underscored by refractory manufacturers' investments to bolster their production capacities, signaling a robust growth trajectory for the market.

- For instance, in February 2023, Vesuvius Group unveiled a USD 61 million investment plan aimed at amplifying its refractory manufacturing footprint in India over the next three to five years. This strategic move is set to elevate the company's monthly production capacity by 35%, particularly with enhancements at its Taratala unit in Kolkata.

- Given these dynamics, Asia-Pacific is set for significant growth in the pyrophyllite market during the forecast period.

Pyrophyllite Industry Overview

The pyrophyllite market is highly consolidated in nature. The major players (not in any particular order) include Hankook Mineral Powder Co. Ltd, Hebei Yayang Spodumene Co. Ltd, Idwala Industrial Holdings (Pty) Ltd, Pt. Gunung Bale, and R.T. Vanderbilt Holding Company Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Demand for Pyrophyllite from Ceramics

- 4.1.2 Increasing Consumption in Refractory and Foundry

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Health Issues Due to Pyrophyllite Dust During Mining

- 4.2.2 Availability of Substitutes

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Type

- 5.1.1 Pyrophyllite Natural

- 5.1.2 Other Grades (Ceramit 10, Ceramit 14, etc.)

- 5.2 By Application

- 5.2.1 Ceramics

- 5.2.2 Fiberglass

- 5.2.3 Filler Materials (Paper, Insecticides, Paints)

- 5.2.4 Fertilizer (Soil Conditioner)

- 5.2.5 Rubber and Roofing (As Dusting Agents)

- 5.2.6 Refractory

- 5.2.7 Ornamental Stones

- 5.2.8 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anand Talc

- 6.4.2 Avani Group of Industries

- 6.4.3 Hankook Mineral Powder Co. Ltd

- 6.4.4 Hebei Yayang Spodumene Co. Ltd

- 6.4.5 Idwala Industrial Holdings (Pty) Ltd

- 6.4.6 Ningbo Inno Pharmchem Co. Ltd

- 6.4.7 Ningbo Jiahe New Materials Technology Co. Ltd

- 6.4.8 Pt. Gunung Bale

- 6.4.9 R.t. Vanderbilt Holding Company Inc.

- 6.4.10 Samirock Company

- 6.4.11 SEPRA

- 6.4.12 SKKU Minerals

- 6.4.13 Wonderstone

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovations in Product Development and Processing Techniques

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219