|

市场调查报告书

商品编码

1445594

乙太网路控制器:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Ethernet Controller - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

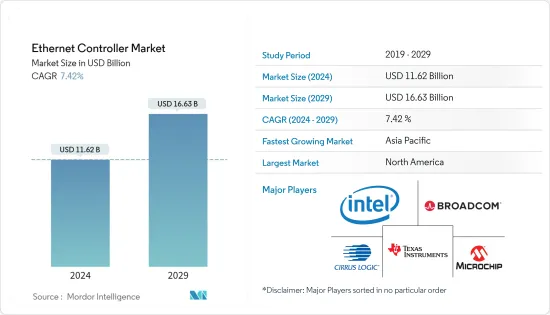

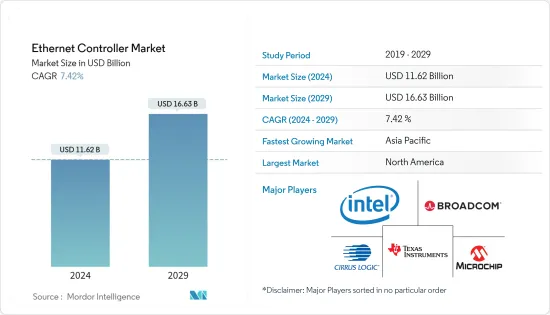

乙太网路控制器市场规模预计2024年为116.2亿美元,预计到2029年将达到166.3亿美元,在预测期内(2024-2029年)成长7.42%,以复合年增长率成长。

研究的市场是由现代数位经济中资料中心和云端运算的日益采用所推动的。从科学发现到人工智慧 (AI),现代资料中心对于解决世界上一些最大的挑战至关重要。这些现代资料中心正在经历转型,以增加网路频宽、优化工作负载以及人工智慧。

主要亮点

- 整个商业生态系中的巨量资料量不断增加且日趋成熟。根据埃森哲的一项研究,大约 79% 的企业主管认为,不实施巨量资料的公司可能会失去竞争地位并面临灭绝。随着企业走向巨量资料,资料流量预计将增加,对乙太网路控制器的需求也会增加。

- 控制自动化技术乙太网路 (EtherCAT) 是基于 CANopen通讯协定和乙太网路。儘管如此,它与互联网和网路通讯的不同之处在于它明确地针对工业自动化控制进行了最佳化。透过利用 OSI 网路模型,乙太网路和 EtherCAT 依赖相同的实体层和资料链结层。此外,这两个网路在设计上也有所不同,因为它们针对不同的任务进行了最佳化。

- USB 转乙太网路转换器在多种情况下都很有用。例如,使用者笔记型电脑的 Wi-Fi 选项可能会遇到技术问题,或者使用者需要网路访问,但出于安全原因在特定位置停用了 Wi-Fi。您可能会注意到在这种情况下,一个乙太网路连接埠和一个简单的适配器就足够了。电缆提供更快、更稳定的连接。

- 预计市场将为更快的技术更新製造障碍,因为带有延期的长期合约将使市场饱和并影响市场成长。如果产业趋势引导解决方案和服务供应商使用新技术乙太网路控制器,那么长期合约可能会在市场上产生反作用。此外,市场竞争的加剧将影响现有供应商的报酬率和成长。供应商之间的竞争如此激烈,以至于乙太网路控制器产品在全球范围内变得商品化。

- 在家工作(WFH) 政策已将资讯安全的重点从企业基础设施转移到云端和虚拟基础设施。根据去年的 IBM 安全报告,大约 54% 的组织在 COVID-19 爆发期间对远距工作做出了积极回应。这些市场发展促进了对云端基础的解决方案的需求不断增长,这也将增加对乙太网路控制器的需求。

乙太网路控制器市场趋势

占据最大市场占有率的伺服器

- 大多数企业都需要资料存储,例如电子邮件、网站、线上交易等,而这可能发生在伺服器上。伺服器是连接到公司本地网路(大多数情况下是 Internet)的特殊电脑。如果您的公司足够小,您可能会决定将伺服器保留在内部并自行运行。然而,随着您的组织及其需求的增长,它会产生更多资料,因此需要更多伺服器和储存空间。典型的资料中心基础设施包括许多伺服器,这些伺服器都是功能强大的电脑。据爱立信称,未来四年,全球每台行动 PC 的每月流量预计将达到每台活动装置 25.88 GB。

- 随着伺服器为资料中心提供动力并支援云端环境,伺服器产业已成为无数关键任务和客户端企业运算业务的支柱。随着企业寻求满足巨量资料和进阶工作负载要求,对更高效能伺服器的需求持续成长。随着云端运算、人工智慧、巨量资料、资料中心的兴起,对伺服器的需求也将大幅增加。随着对伺服器的需求增加,对乙太网路控制器的需求也增加。

- 底板管理控制器 (BMC) 监控大多数现代伺服器中的温度、电压和风扇。 BMC 通常可以设定为在系统内发生需要管理员注意的情况(例如 CPU 过热)时发送通知(以电子邮件和 SNMP 警报的形式)。

- 英特尔乙太网路 800 系列控制器包括应用程式装置伫列 (ADQ)、动态装置个人化 (DDP),并支援 iWARP 和 RoCEv2 远端直接记忆体存取 (RDMA)。提供工作负载最佳化的效能和弹性,以满足不断变化的网路需求。对于 NFV、储存、HPC-AI 和混合云端等高效能伺服器应用,800 系列控制器可提供高达 100GbE 的速度。

- NetXtreme-E系列BCM57414 50G PCIe 3.0乙太网路控制器基于Broadcom的可扩充10/25/50/100/200G。乙太网路控制器架构旨在为企业和云端规模网路和储存应用(例如高效能运算、通讯、机器学习、储存分解和资料分析)在伺服器内创建可扩充性功能丰富的网路解决方案。 。

北美占最大市场占有率

- 为了充分发挥 5G 的潜力,需要灵活的网路和交通基础设施。随着乙太网路成为最高效的传输技术,营运商路由器和交换器负责支援共用基础架构上的各种用例,从而导致乙太网路设备安装量的增加。

- 随着5G网路的发展及其应用的扩展,5G基础设施对乙太网路控制器的需求也将增加。与美国类似,只有部分公司开始提供5G网路服务。例如,在推出新无线技术出现严重延误后,通讯巨头 AT&T 和 Verizon 于 2022 年 1 月在美国推出了 5G 服务,航班并未出现严重延误。

- 乙太网路控制器允许有线连接到电脑网络,因此任何需要高速互联网连接的设备都应使用乙太网路控制器来实现高速互联网连接。云端基础设施网路也是如此。随着云端能力的发展以及企业将业务转移到云端,美国对云端应用程式的需求正在迅速增长。未来几年,越来越多的企业将选择云端储存解决方案,因为其成本低、维护量少、资料安全以及近乎无限的扩充性。因此,云端运算和储存的成长也将带动乙太网路控制器市场的激增。

- 据爱立信消费者实验室称,5G 无线技术已经正在改变加拿大人使用智慧型手机的方式。与 4G 用户相比,5G采用者每週花在云端游戏上的时间为 2 小时,在扩增实境(AR) 应用程式上的时间超过 90 分钟。升级后,15% 的人表示家中的 Wi-Fi 使用量减少了。这意味着 5G 最终将提供消费者一直在等待的高频宽应用体验。此外,用户期望 5G 覆盖汽车内部,这被认为比速度或电池寿命更重要。

- 电信业者在 3500 MHz频谱上的巨额支出(比预期多三倍)进一步证明了他们对 5G 的承诺。罗杰斯斥资 33 亿加元(24.3 亿美元)购买 5G 频谱,覆盖加拿大 99.4% 的人口,使其成为该国该技术最大的单一投资者。

乙太网路控制器产业概况

由于竞争激烈,乙太网路控制器市场本质上是分散的。儘管分散,但市场主要与建立和营运方面的监管要求相关。此外,由于创新、收购和合作伙伴关係的增加,未来市场的竞争可能会变得更加激烈。该市场的主要企业包括英特尔公司、博通公司、Microchip Technology Inc.、Cirrus Logic Inc.、德州仪器公司等。

- 2022 年 12 月 -资料基础设施半导体解决方案的领导者之一Marvell Technology, Inc. 推出全新5nm 1.6T 乙太网路PHY,具有100G I/O 功能、内建媒体存取控制安全(MACsec) 和整体功能。我们推出了Alaska CX9340P 。精确时间协定(PTP)支援通讯网路应用和云端资料中心。 PTP 使乙太网路能够以高可靠性处理时序关键型服务。另一方面,MACsec 允许资料中心营运商启用基于硬体的链路层安全性。 X9340P 与先前发布的 Alaska C X93160 PHY 相结合,为重定时、齿轮箱、加密和定时应用提供了一个多功能、引脚相容的平台,速度高达 800 GbE。

- 2022 年 4 月 - Cadence Design Systems Inc. 推出 Cadence 高速乙太网路控制器 IP 系列,支援高达 800G 的完整乙太网路子系统解决方案。该公司还推出了采用 7 nm、5 nm 和 3 nm 製程节点的 Cadence SerDes PHY IP,这些节点针对功耗、效能和麵积 (PPA) 进行了最佳化。低延迟、高速控制器 IP 扩展了 Cadence 的乙太网路控制器 IP 产品组合,非常适合新时代人工智慧和机器学习 (AI/ML)、云端和 5G 基础设施中的各种乙太网路应用。新的控制器系列支援 100G、200G、400G 和 800G 乙太网路的各种集中频宽。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 采用 EtherCat 进行机器控制的即时网络

- 采用USB乙太网路控制器

- 市场限制因素

- 受新冠肺炎 (COVID-19) 影响,需求低迷

- 价格竞争导致报酬率较低

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19 对市场的影响

第五章市场区隔

- 频宽类型

- 快速以太网

- Gigabit以太网

- 交换器以太网

- 功能

- PHY(物理层)

- 融合的

- 最终用户

- 伺服器

- 路由器交换机

- 消费性应用

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争形势

- 公司简介

- Intel Corporation

- Broadcom Inc.

- Microchip Technology Inc.

- Cirrus Logic Inc.

- Texas Instruments Incorporated

- Silicon Laboratories, Inc.

- Marvell Technology Group

- Realtek Semiconductor Corp.

- Cadence Design Systems, Inc.

- Futurlec Inc.

第七章 投资分析

第八章市场机会与未来趋势

The Ethernet Controller Market size is estimated at USD 11.62 billion in 2024, and is expected to reach USD 16.63 billion by 2029, growing at a CAGR of 7.42% during the forecast period (2024-2029).

The market studied is driven by the increasing adoption of data centers and cloud computing in the modern digital economy. From scientific discoveries to Artificial Intelligence (AI), modern data centers are crucial to solving some of the critical global challenges. These current data centers, like Artificial Intelligence, are transforming to increase networking bandwidth and optimize workloads.

Key Highlights

- The growing volume of Big Data across the business ecosystem is gaining maturity. A study by Accenture indicates that about 79% of enterprise executives agreed that companies that do not embrace Big Data would lose their competitive position and are expected to face extinction. With enterprises transitioning to Big Data, the data traffic is expected to increase, fueling the demand for Ethernet controllers.

- Ethernet for Control Automation Technology (EtherCAT) is based on the CANopen protocol and Ethernet. Still, it differs from the internet or network communications in optimized explicitly for industrial automation control. Utilizing the OSI network model, Ethernet and EtherCAT rely on the same physical and data link layers. Beyond that, the two networks diverge by design as they are optimized for different tasks.

- A USB-to-Ethernet converter is helpful in a variety of circumstances. For example, a user's laptop's Wi-Fi option may be experiencing technical difficulties, or the user may discover that the Wi-Fi is disabled for security reasons in specific locations, even though users require internet access. In the circumstances like these, an Ethernet port and a simple adapter should suffice. Using a cable will provide a faster and more consistent connection.

- The market is expected to create a roadblock for itself to update faster on technology, as long-duration contracts with extensions saturate the market, thus impacting its growth. When the industry trends indicate to the solution and services providers to use new and emerging technology Ethernet controllers, long-term contracts can be counterproductive in the market. Moreover, the growing competition in the market impacts the profit margins and existing vendors' growth. The competition level between suppliers is so high that Ethernet controller products are transitioning to commoditized worldwide.

- The Work-From-Home (WFH) policies shifted information security's focus from enterprise infrastructure to cloud and virtualized infrastructure. As per IBM Security Report from the previous year, about 54% of the organizations responded positively to remote working amid the COVID-19 outbreak. Such developments in the market have contributed to the rising demand for cloud-based solutions, which will increase the need for ethernet controllers.

Ethernet Controller Market Trends

Servers to Hold the Largest Market Share

- Most businesses require data storage, whether for their email, website, or online transactions, and this may be done on a server. Servers are specialized computers linked to a company's local network and, in most cases, the Internet. If a company is small enough, it may decide to keep its servers in-house and run them own. However, as organizations and their demands expand, more servers and storage space are required as more data is generated. A typical data center infrastructure includes many servers, which are powerful computers. According to Ericsson, by the next four years, global monthly traffic per mobile PC is projected to amount to 25.88 GB per active device.

- As servers power data centers and support cloud environments, the server industry is the backbone of innumerable mission-critical and client-side corporate computing operations. As businesses seek to power big data and advanced workload requirements, demand for higher-performing servers continues to climb. With the increasing cloud computation, AI, Big Data, and Data Centers, the need for servers will also grow significantly. With this growing demand for servers, Ethernet Controller demand will also increase.

- A Baseboard Management Controller (BMC) monitors most modern servers' temperature, voltages, and fans. When something in the system requires an administrator's attention (such as the CPU overheating), the BMC may generally be set to send out notifications (in the form of emails and SNMP alerts).

- Application Device Queues (ADQ), Dynamic Device Personalization (DDP), and support for both iWARP and RoCEv2 Remote Direct Memory Access (RDMA) are included in Intel Ethernet 800 Series controllers. It provides workload-optimized performance and the flexibility to meet changing network requirements. For high-performance server applications, including NFV, storage, HPC-AI, and hybrid cloud, the 800 Series controllers provide speeds up to 100GbE.

- The NetXtreme-E Series BCM57414 50G PCIe 3.0 Ethernet controller is based on Broadcom's scalable 10/25/50/100/200G. Ethernet controller architecture is designed to build highly scalable, feature-rich networking solutions in servers for enterprise and cloud-scale networking and storage applications, such as high-performance computing, telco, machine learning, storage disaggregation, and data analytics.

North America Holds Largest Market Share

- 5G requires a flexible networking and transportation infrastructure to reach its full potential. As Ethernet becomes the most efficient transport technology, carrier routers and switches are charged with supporting a range of use cases over shared infrastructure, increasing Ethernet gear installations.

- With the 5G network growth and their growing applications, the need for ethernet controllers for 5G infrastructure will also be in demand. As in the United States, only some companies have started to provide 5G network services. For instance, after the deployment of the new wireless technology was scale delayed, telecom giants AT&T and Verizon debuted 5G service in the United States in January 2022 without significant flight delays.

- As Ethernet Controller allows wired connection to the computer network, any device requiring a high-speed internet connection will have to use Ethernet Controllers for fast internet connections. Such is the case with Cloud Infrastructure networks. With developing cloud capabilities and enterprises shifting their work to the cloud, the demand for cloud applications is increasing rapidly in the United States. In the coming years, more and more businesses will opt for Cloud storage solutions due to their low costs, less maintenance, data security, and almost unlimited scalability. Therefore this rise in cloud computing and storage will also surge in the Ethernet Controller Market.

- According to Ericsson ConsumerLab, 5G wireless technology is already transforming how Canadians use their smartphones. Compared to 4G users, early 5G adopters spend two hours per week on cloud gaming and 90 minutes more on augmented reality (AR) apps. After upgrading, 15% said they had reduced their Wi-Fi usage, even at home. It means that 5G will finally deliver the experience consumers have been waiting for in high-bandwidth apps. Furthermore, users expect 5G to provide interior coverage, which is considered more significant than speed or battery life.

- Telecommunications companies' enormous spending in the 3500 MHz spectrum (three times more than projected) further proves their commitment to 5G. Rogers spent CAD 3.3 billion (USD 2.43 billion) on the 5G spectrum, which covers 99.4% of the Canadian population, making it the country's largest single investor in the technology.

Ethernet Controller Industry Overview

The Ethernet Controller Market is fragmented in nature due to high competition. Despite the fragmentation, the market is primarily tied to the regulatory requirements for establishment and operation. Further, with increasing innovation, acquisitions, and partnerships, market rivalry tends to rise in the future. The major players in the market are Intel Corporation, Broadcom Inc., Microchip Technology Inc, Cirrus Logic Inc., and Texas Instruments Incorporated, among others.

- December 2022 - Marvell Technology, Inc., one of the leaders in data infrastructure semiconductor solutions, announced the Alaska CX9340P, a new 5nm 1.6T Ethernet PHY with 100G I/O capability, built-in Media Access Control security (MACsec) and total Precision Time Protocol (PTP) support communications network applications and for the cloud data center. PTP enables Ethernet networks to handle ultra-reliable timing-critical services, whereas MACsec allows data center operators to enable hardware-based link-layer security. The combination of the X9340P and the previously announced Alaska C X93160 PHY provides a pin-compatible, versatile platform for retiming, gear boxing, encryption, and timing applications at speeds up to 800 GbE.

- April 2022 - Cadence Design Systems Inc. announced the Cadence High-Speed Ethernet Controller IP family, enabling complete Ethernet subsystem solutions up to 800G. The company also introduced Cadence SerDes PHY IP in 7 nm, 5 nm, and 3 nm process nodes, optimized for power, performance, and area (PPA). The low-latency, high-speed controller IP expands Cadence's Ethernet Controller IP portfolio and is well suited for vast applications of Ethernet in new-age artificial intelligence and machine learning (AI/ML), cloud, and 5G infrastructures. The new controller family supports different aggregated bandwidths for 100G, 200G, 400G, and 800G Ethernet.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of EtherCat for Realtime Network for Machine Control

- 4.2.2 Adoption of USB Ethernet Controllers

- 4.3 Market Restraints

- 4.3.1 Low Demand Due to Impact of COVID-19

- 4.3.2 Competitive Prices Led to Stiff Profit Margins

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Bandwidth Type

- 5.1.1 Fast Ethernet

- 5.1.2 Gigabit Ethernet

- 5.1.3 Switch Ethernet

- 5.2 Function

- 5.2.1 PHY (Physical Layer)

- 5.2.2 Integrated

- 5.3 End User

- 5.3.1 Servers

- 5.3.2 Routers and Switches

- 5.3.3 Consumer Applications

- 5.3.4 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Intel Corporation

- 6.1.2 Broadcom Inc.

- 6.1.3 Microchip Technology Inc.

- 6.1.4 Cirrus Logic Inc.

- 6.1.5 Texas Instruments Incorporated

- 6.1.6 Silicon Laboratories, Inc.

- 6.1.7 Marvell Technology Group

- 6.1.8 Realtek Semiconductor Corp.

- 6.1.9 Cadence Design Systems, Inc.

- 6.1.10 Futurlec Inc.