|

市场调查报告书

商品编码

1445595

过程计量:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Process Instrumentation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

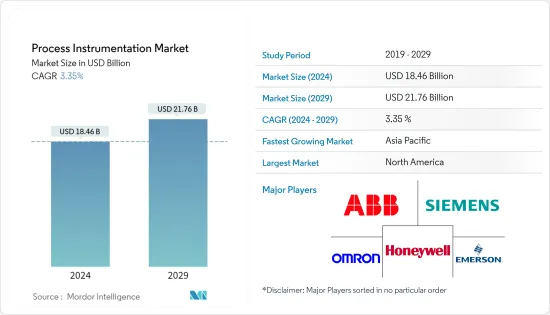

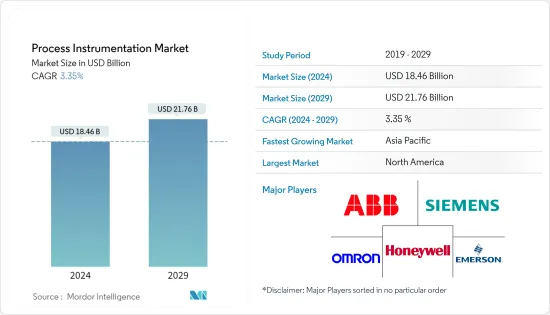

过程仪表市场规模预计到2024年为184.6亿美元,预计到2029年将达到217.6亿美元,在预测期内(2024-2029年)增长3.35%,复合年增长率增长。

市场由技术创新和对过程控制系统不断增长的需求所驱动。此外,成本效率、工程时间的缩短、资产利用率和能源效率是推动製程测量市场成长的一些关键因素。

主要亮点

- 各种最终用途产业都需要製程仪器设备。使用製程仪器设备有许多好处,包括提高产品品质、减少排放、减少人为错误和降低成本。记录、定位、测量和控制等关键参数对于製造单元的顺利运作至关重要,并且是製程设备实现显着水准的绝对可靠性、准确度和精密度的首要任务,从而促进市场成长。

- 长期合约对过程仪器解决方案供应商来说非常有利,因为它们保证了稳定的资金流动。因此,它已成为顶级公司赢得合约(尤其是政府合约)的重要手段。例如,西门子在 2022 年 9 月透露,该公司被选中对亚历山大配电公司 (AEDC) 的配电控製网路和增强计量网路进行现代化改造,该公司隶属于国营埃及电力控股公司。

- 由于连网型设备、感测器的激增以及 M2M通讯的普及,製造业正在创建更多的资料点。根据 Zebra 最新的行业愿景研究,预计到 2022 年,以物联网和 RFID 为中心的智慧资产追踪系统的性能将优于传统的基于电子表格的方法。

- 最近製造业采用自动化的激增推动了市场的成长。这是因为实业家越来越了解自动化在上市速度、投资支出和产出品质方面的一些好处。然而,高昂的初始投资和维护投资成本预计将阻碍预测期内的市场成长。

- 由于劳动力短缺,COVID-19感染疾病增加了对工业自动化的需求。自 COVID-19 以来,公司越来越多地在整个生产过程中部署智慧机器人和技术。机器人技术被视为提高产量的重要手段。机器人的大部分接受度是在工业领域,机器比人类更有效、更可靠地执行许多手动任务。

过程测量市场趋势

水和废水处理预计成长最快

- 製程仪器用于监测製程工厂的各种参数,例如流量、压力、温度、pH、电导率、液位、浊度、速度、力、湿度以及水和污水处理中的其他因素。Masu。

- SCADA 系统广泛用于监测和调节水和废弃物处理流程。这些使操作员能够监控水箱、运河、水库等的消费量、流量和内容。此外,它们还提供有关处理过的水状况的资料。 SCADA 技术经常用于管理雨水排放基础设施和调节污水处理厂。

- 当前水资源供应和永续性方面的挑战主要是由于需求的大幅增加。然而,根据美国环保署2022年5月的数据,美国每年因家庭外洩而浪费约9,000亿加仑的水。这相当于约1100万户家庭一年的用水量。这就需要采用流量控制阀等製程仪器,进而推动市场成长。

- 此外,美国环保署(EPA)正在加快对美国老化的水基础设施的投资。例如,2022年11月,美国环保署核准向德克萨斯州普夫鲁格维尔市提供5,200万美元的水基础设施金融创新法案(WIFIA)拨款,以支持水处理设施现代化计划。透过 WFIIA 的融资,EPA 支持相关设施增加可处理的饮用水量,同时利用现代化的处理和过滤设备使水更健康,方便饮用。预计这将推动过程仪器市场的成长。在行业中。

- 政府加强污水处理措施预计将有助于未来几年该领域的成长。例如,2022 年 10 月,纽约州州长启动了倡议污水5,500 万美元的布法罗鸟岛污水处理设施废水整治计画。

亚太地区成为成长最快的市场

- 由于工业活动的快速扩张、成本压力和生产力的上升以及中国和印度等开发中国家的有利政府政策,预计亚太地区的成长速度将快于预期。

- 该地区工业部门的不断扩张以及石油和天然气使用量的增加正在推动该行业向前发展。例如,中国计划在2025年将其广泛的天然气管网扩展至16.3万公里,需要投资1.9兆美元。

- 该地区最终用途开发的增加预计将为市场参与企业创造有利可图的机会,以改善其足迹。 2022 年1 月,阿达尼集团与TotalEnergies 之间的合作伙伴阿达尼天然气有限公司(ATGL) 将耗资200,000 亿卢比(约2000 亿美元)在另外14 个地理区域开发城市燃气配送(CGD) 基础设施。我已获得我的资金执照。

- 石油和天然气消费量的增加需要建立新的生产设施,并增加对製程仪器的要求。根据IEA预测,到2040年,石油日产量预计将超过1500万桶。此外,根据 IBEF 的数据,到 2040 年,天然气使用量预计将超过 1,4,308 万吨,石油和天然气需求的增加预计将做出贡献。为当地市场的发展做出贡献。

- 政府在教育公众了解技术的好处以及为引入行业尖端机械而分配资金方面发挥积极作用,对于该地区的市场成长至关重要。未来几年,市场将受到金属和采矿、化学品、食品和饮料以及石油和天然气等关键最终用途行业繁荣的推动。

过程测量产业概述

过程测量市场适度分散,包括Honeywell国际公司、西门子公司、OMRON公司、ABB 有限公司和艾默生电气公司等全球和区域参与者。这些主要企业正在采取各种策略,例如新产品发布、扩张、协议、合资、合作和收购,以扩大其在市场上的足迹。

2022 年 11 月,Equiliver推出了专用的一次性技术部门,以满足製药业不断变化的流体管理要求。 SDO 阀是 Equilibar 首款一次性流体控制装置,可精确控制背压和流量。 「SDO 是药品生产领域独特的专用湿阀,」该公司声称。 2022 年 9 月,工业技术和物联网 (IoT) 解决方案的领先开发商 OleumTech 在其快速扩展的 H 系列接线製仪器中添加了智慧差压 (DP) 变送器。创新的 DP 变送器提供石化、上游石油和天然气、电力、化学、污水和其他行业所需的卓越性能、可靠性和精度。 2022 年 7 月,艾默生推出了 TESCOM Anderson Greenwood Instrumentation H2 阀门系列,适用于压力高达 15,000 psi (103.4 MPa) 的氢气操作。这项创新技术能够可靠地隔离高压气体操作(例如氢气加註设施和长管拖车)中的製程压力,从而减少逃逸污染物并提高安全性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 节能生产流程的需求不断增长

- 以最低的成本实现高水准的效率

- 市场限制因素

- 研发成本上升

- 解决方案和设备的实施和维护成本更高

- 价值链分析

- 波特的五力

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间敌对的强度

第五章市场区隔

- 装置

- 发送器

- 控制阀

- 科技

- 可程式逻辑控制器(PLC)

- 集散控制系统(DCS)

- 监控和资料采集 (SCADA)

- 製造执行系统(MES)

- 最终用户

- 水和污水处理

- 化学製造

- 能源和公共

- 石油和天然气开采

- 金属和采矿

- 其他流程工业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争形势

- 公司简介

- Honeywell International Inc.

- Siemens AG

- Omron Corporation

- ABB Ltd.

- Emerson Electric Company

- Rockwell Automation Inc.

- Mitsubishi Electric Corporation

- Danaher Corporation

- Metso Corporation

- Yokogawa Electric Corporation

- Endress+Hauser AG

第七章 投资分析

第八章市场机会与未来趋势

The Process Instrumentation Market size is estimated at USD 18.46 billion in 2024, and is expected to reach USD 21.76 billion by 2029, growing at a CAGR of 3.35% during the forecast period (2024-2029).

The market is driven by technological innovations and increasing demands for process control systems. Moreover, cost efficiency, reduction in engineering time, asset utilization, and energy efficiency are some of the major factors driving the growth of the process instrumentation market.

Key Highlights

- Process instrumentation equipment is needed in a wide range of end-use industries. The use of process instrumentation equipment offers a host of benefits, including improvement in the quality of the product, emission reduction, reduction in human errors, and cost-savings. Significant parameters like recording, positioning, measuring, and controlling fuel the market's growth as they are essential for the smooth functioning of a manufacturing unit and are top priorities for process instruments for achieving significant levels of absolute reliability, accuracy, and precision.

- A long-term contract is a significant gain for process instrumentation solution suppliers because it ensures a steady stream of money. As a result, it is a critical technique for top companies to secure contracts, particularly from governments. Siemens, for example, revealed in September 2022 that it had been selected to modernize the distributing control network and enhanced metering network for Alexandria Electricity Distribution Company (AEDC), a part of the state-owned Egyptian Electrical Holding Company.

- The manufacturing business has seen an increase in data points created due to the widespread use of connected equipment and sensors and the enablement of M2M communication. According to Zebra's newest industrial vision research, intelligent asset tracking systems centered on IoT and RFID are predicted to outperform conventional spreadsheet-based approaches by 2022.

- The recent surge in the adoption of automation in the manufacturing sector has contributed to market growth. This is due to a greater industrialist understanding of the several advantages of automation in respect of speed to market, investment outlay, and output quality. However, high initial and maintenance investment cost is expected to hamper the market growth over the forecast period.

- The COVID-19 pandemic boosted the demand for industrial automation due to labor shortages. Post Covid-19, companies are increasingly adopting intelligent robotics and technology across the production processes. Robotics are seen as critical instruments for increasing production. The majority of robotic acceptance has happened in the industrial sector, wherein machines do numerous manual jobs more effectively and reliably than humans.

Process Instrumentation Market Trends

Water and Wastewater Treatment is Expected to Witness the Highest Growth

- Process instrumentations are used to monitor various parameters in process plants, such as flow, pressure, temperature, pH, conductivity, level, turbidity, speed, force, humidity, and other factors in water & wastewater treatment.

- SCADA systems are widely employed in monitoring and regulating water and waste treatment processes. These enable operators to monitor the consumption, flows, and contents of water tanks, canals, reservoirs, and others. Furthermore, these give data on the condition of the water being handled. SCADA technologies are frequently utilized to manage stormwater draining infrastructure and regulate wastewater purification plants.

- The current challenges of water availability and sustainability are primarily attributed to an enormous increase in demand. However, as per U.S. EPA in May 2022, Household leaks waste around 900 billion gallons of water per year in the United States. That is equivalent to roughly 11 million households' annual water use. This necessitates the adoption of process instrumentation, such as flow control valves, fueling market growth.

- Moreover, the United States Environmental Protection Agency (EPA) has accelerated investment in the nation's aging water infrastructure. For instance, in November 2022, the U.S. The EPA approved a USD 52 million Water Infrastructure Finance and Innovation Act (WIFIA) grant to the City of Pflugerville, Texas, to support the Water Treatment Plant Modernization Project. With the WIFIA loan, the EPA is assisting the facility in increasing the amount of drinking water it can process while also keeping the water healthier to consume with modern treatment and filter equipment, which in turn is expected to propel the growth of the process instrumentation market in the industry.

- Increasing government initiatives in wastewater treatment are expected to contribute to segment growth over the coming years. For instance, in October 2022 New York Governor launched a USD 55 million wastewater upgrade initiative at Buffalo's Bird Island Wastewater Processing Facility.

Asia Pacific to Emerge as the Fastest Growing Market

- Asia Pacific is expected to have the fastest growth over the forecast due to rapidly increasing industrial activities, rising cost pressure and production rate, and favorable government policies in developing nations such as China and India in this region.

- The region's expanding industrial sector and increased oil & gas usage are propelling the industry ahead. For instance, China intends to increase its massive gas pipeline networks to 163,000 kilometers by 2025, requiring a USD 1.9 trillion investment.

- Increasing end-use developments in the region are expected to create lucrative opportunities for market participants to improve their footprints. In January 2022, Adani Total Gas Ltd (ATGL), a collaborative partnership among the Adani Group and TotalEnergies, secured licenses to develop its City Gas Distribution (CGD) infrastructure to 14 additional geographical regions with an INR 20,000-crore (~USD 200 Billion) investment.

- The rising consumption of oil & gas will necessitate the establishment of new production facilities, boosting the requirement for process instrumentation. According to the IEA, daily oil output is expected to exceed 15 million barrels by 2040. Further, according to the IBEF, natural gas usage is expected to surpass 143.08 million tons by 2040. Thus, increasing demand for oil & gas is expected to contribute to regional market growth.

- The active role of governments in educating the masses regarding the benefits of technology and rising funds being diverted towards adopting technologically advanced machinery in industries has been of prime importance for market growth in the region. In the next few years, the market will be driven by the thriving growth of key end-use industries such as metal and mining, chemical, food and beverages, oil & gas, and others.

Process Instrumentation Industry Overview

The process instrumentation market is moderately fragmented, with the presence of both global and regional players such as Honeywell International Inc., Siemens AG, Omron Corporation, ABB Limited, and Emerson Electric Co., among others. These key players are adopting various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in the market.

In November 2022, Equilibar launched a dedicated Single Use Technology Branch to address the pharmaceutical industry's ever-changing fluid management requirements. The SDO valves are Equilibar's first single-usage fluid control device, which precisely regulates back pressures and flow. "The SDO is the unique wetted per-use valve in the pharmaceutical production area," claims the company. In September 2022, OleumTech, a leading developer of industrial technology and Internet of Things (IoT) solutions, added a Smart Differential Pressure (DP) Transmitter to its rapidly expanding H Series range of hardwired processes instrumentation. The innovative DP Transmitter provides the superior performance, dependability, and precision required by industrial industries such as petrochemical, upstream oil and gas, electricity, chemical, and wastewater. In July 2022, Emerson introduced the TESCOM Anderson Greenwood Instrumentation H2 Valve Range for hydrogen operations with pressures up to 15,000 psi (103.4 MPa). The innovative technology reliably separates process pressures in high-pressure gas operations, including hydrogen filling facilities and tube trailers, lowering fugitive pollutants and increasing safety.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for energy-efficient production processes

- 4.2.2 High level of efficiency with minimum cost

- 4.3 Market Restraints

- 4.3.1 Higher cost of research and development

- 4.3.2 Higher cost of implementation and maintenance of solutions and devices

- 4.4 Value Chain Analysis

- 4.5 Porters Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Instrument

- 5.1.1 Transmitter

- 5.1.2 Control Valve

- 5.2 Technology

- 5.2.1 Programmable Logic Controller (PLC)

- 5.2.2 Distributed Control System (DCS)

- 5.2.3 Supervisory Control and Data Acquisition (SCADA)

- 5.2.4 Manufacturing Execution System (MES)

- 5.3 End-User

- 5.3.1 Water and Wastewater Treatment

- 5.3.2 Chemical Manufacturing

- 5.3.3 Energy & Utilities

- 5.3.4 Oil and Gas Extraction

- 5.3.5 Metals and Mining

- 5.3.6 Other Process Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Honeywell International Inc.

- 6.1.2 Siemens AG

- 6.1.3 Omron Corporation

- 6.1.4 ABB Ltd.

- 6.1.5 Emerson Electric Company

- 6.1.6 Rockwell Automation Inc.

- 6.1.7 Mitsubishi Electric Corporation

- 6.1.8 Danaher Corporation

- 6.1.9 Metso Corporation

- 6.1.10 Yokogawa Electric Corporation

- 6.1.11 Endress+ Hauser AG