|

市场调查报告书

商品编码

1690125

协作白板软体-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Collaborative Whiteboard Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

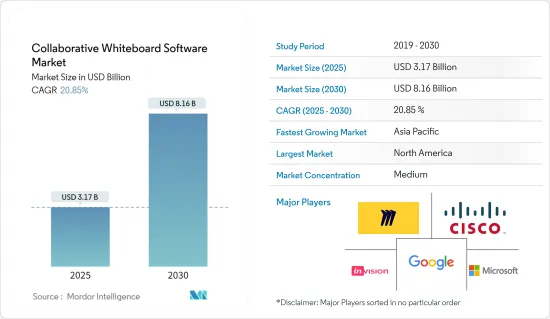

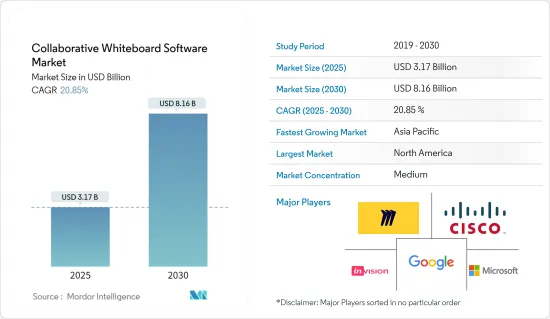

协作白板软体市场规模预计在 2025 年为 31.7 亿美元,预计到 2030 年将达到 81.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 20.85%。

关键亮点

- 协作白板软体描述了一个数位平台,多个使用者可以从自己的装置同时共用和编辑内容。这种实体替代品在设计、储存和共用内容方面用途广泛,可促进无缝的协作沟通。

- 随着数百万人转向远距工作,对协作工具的需求激增。到 2023 年,Microsoft Teams 将拥有 3.2 亿用户,并被 91% 的财富 100 强企业使用。安永、SAP、大陆集团和埃森哲等全球性公司以拥有庞大的员工队伍而闻名,并已采用 Microsoft Teams 来满足其沟通需求。 MS Teams 可以与 Microsoft 的白板软体工具集成,这表明所研究的市场有需求。

- 设计和计划管理团队喜欢使用这些工具。它提供了一个直观、用户友好的内容共用空间,使各个细分领域的管理团队受益。虽然大多数协作白板解决方案都是独立的,但有些解决方案整合到其他设计软体或视觉化协作平台中。随着团队在地理上的分布越来越广,团队成员之间沟通讯息的责任也随之增加,增加了协调工作量。同地和分散式团队之间的有效任务协调正在支援所有最终用户领域的市场成长。

- 然而,培训不足、误用、利用不足和订阅超支等问题阻碍了市场成长。如果团队成员无法有效地使用协作工具,订阅就会失去价值。因此,对于任何协作白板软体开发人员来说,确保使用者友善的介面和组织全面的培训至关重要。

- 自 COVID-19 爆发以来,全球劳动力的远距工作数量迅速增加,对强大的沟通和协作工具的需求也随之增加。作为回应,协作白板软体解决方案已成为确保生产力不会下降的重要参与企业。许多组织正在考虑转向部分或全部远端工作。

协作白板软体市场趋势

大公司占有较大的市场占有率

- 透过即时协作,协作白板软体工具可以使组织在许多方面受益,包括提高生产力、有效的使用者适应、最新资讯、知识共用和即时回馈。随着对远距工作的依赖性不断增加,组织需要合适的协作工具来优化流程。随着全球各个组织越来越多地采用远端办公的趋势,对预先安装 Microsoft 白板功能的 Microsoft Teams 等工具的需求也日益增加。

- 协作白板软体在大型企业中用于改善工作调度的应用正在支持市场的成长。缺乏时间安排会浪费整个组织中大量员工的工作时间。制定计划并安排其目标和活动的企业能够取得更多成就并提高效率。每日、每周和每月的计划使团队能够有效地组织他们的工作流程,这很可能成为未来几年市场探索的驱动力。

- 根据思科 2024 年 1 月的一项调查,政府受访者平均每週远距工作三天,88% 的人表示他们对可用的远距工作安排感到中等或非常满意。此外,97% 的受访者对他们使用的协作工具感到满意。

- 在大公司中,员工有专门用于计划的房间,墙上有大白板,他们可以在白板上看到与计划相关的所有资讯。然而,随着远端和混合工作模式的兴起,越来越多的企业正在利用线上白板,并添加视讯、网站和工具整合等数位元素以实现更好的沟通,预计这将支援大型企业的市场成长。

- 大型企业在多个地区设有办事处,其业务生态系统中涉及多个团队和相关人员。这些因素支持采用协作白板软体来提高生产力、创新、培训和改善沟通。

预计北美将占据较大的市场占有率

- 北美是占据调查市场主要份额的主要地区之一。新冠疫情对该地区产生了重大影响,对 IT 产业造成了严重破坏。然而,IT 公司已经成功实施了在家工作文化,现在愿意采用混合工作文化。脑力激盪、制定策略和有效会议预计将在混合工作文化中继续进行,为市场创造成长机会。

- 此外,采用云端运算已成为该地区企业和政府机构的关键策略倡议。采用云端技术可以帮助优化资源利用率,改善团队成员之间的协作,并提高效率。该软体为团队提供了一个更有效的协作平台,培养解决问题的能力和创造力,支援市场对协作白板软体云端部署的需求。

- 由于学习过程的数位化以及美国K-12 学校为了更好地理解而出现的音讯和视讯教育,智慧教室专案的成长,透过应用协作白板软体来简化课程计划,使用 AI 整合工具,创建动态课程内容,并与其他教育工作者共用课程,推动了市场的成长。这些方面正在帮助北美教育界创造更好的学习环境。

- 供应商还专注于整合人工智慧等新技术,以提供增强的协作白板工具,例如对笔记进行分类、创建图像、编辑图形、即时摘要便籤、将开发人员代码翻译成日常语言、创建模板、创建创意图等。由于北美组织往往是先进技术的早期采用者,因此预计这一市场发展将推动市场发展。

- 该地区的医疗保健领域正在经历数位化,增加了对互动式白板的需求,预计这将推动市场发展。这些白板为医院环境中的医疗专业人员提供了创新的解决方案,提高了患者照护的品质。从增强病人参与到促进医务人员之间的协作讨论,这些先进的工具已经证明了其在临床场景中的整合和成像方面的多功能性和有效性,推动了北美市场的成长。

协作白板软体产业概览

该市场仍处于采用的早期阶段,供应商正在积极寻求扩大其用户群。越来越多的新参与企业透过提供更多功能、有竞争力的价格以及与现有应用程式套件的整合进一步加剧了竞争。整体而言,竞争对手之间的敌意程度适中,预计在预测期内将会加剧。市场领导是思科系统公司、InVisionApp Inc.、Miro、微软公司和Google有限责任公司。

- 2024 年 4 月:Miro 荣获 2024 年度 Google 云端技术合作伙伴「生产力与协作」奖:因与 Google Workspace 的无缝整合而荣获「创新」奖。透过集成,使用者可以将 Miro 板附加到 Google 日历事件,从 Google Meet 开启 Miro 板,以及在 Miro 中工作时编辑 Google 文件、表格和幻灯片。此功能可望推动 Miro 协作白板软体的市场采用。

- 2024 年 3 月:思科系统公司推出新的多功能设备,为混合员工提供现代化的协作体验。该公司宣布推出 Cisco Board Pro G2,这是一款由人工智慧驱动、支援触控的协作设备,旨在为任何办公桌带来现代化、个人化的生产力中心。预计这将支持该公司 Board Pro G2 设备中使用的白板软体的成长。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 价值链分析

- COVID-19 工业影响评估

- 协作白板类型

第五章市场动态

- 市场驱动因素

- 增加组织中的远距工作和即时协作

- 市场限制

- 新兴国家缺乏意识和数位资源

第六章市场区隔

- 按作业系统

- Windows 和 Web

- iOS

- Android

- 依实施类型

- 本地

- 云

- 按组织规模

- 大型企业

- 中小型企业

- 按行业

- BFSI

- 医疗保健

- 教育

- 资讯科技/通讯

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Cisco Systems Inc.

- Invisionapp Inc.

- Miro

- Mural

- Eztalks

- Explain Everything

- Beecanvas

- Bluescape

- Google Jamboard(Alphabet Inc.)

- Microsoft Corporation

- Zoom Video Communications

- Stormboard

- Limnu

- Conceptboard

- Twiddla

- Ziteboard

- Lucidspark

- Collaboard

- Edrawmind(Wondershare)

- Groupmap Technology Pty Ltd

- Vizetto

- Zira Technologies Inc.

- Trello Inc.(Atlassian Corporation PLC)

- Figma Inc.

- Ayoa(Opengenius Limited)

第八章投资分析

第九章:市场的未来

The Collaborative Whiteboard Software Market size is estimated at USD 3.17 billion in 2025, and is expected to reach USD 8.16 billion by 2030, at a CAGR of 20.85% during the forecast period (2025-2030).

Key Highlights

- Collaborative whiteboard software provides a digital platform where multiple users can simultaneously share and edit content from their respective devices. Replacing its physical counterpart, this tool is versatile for designing, saving, and sharing content, fostering seamless collaborative communication.

- The demand for collaboration tools surged as millions shifted to remote work. In 2023, Microsoft Teams, with 320 million subscribers, notably served 91% of Fortune 100 companies. Global Enterprises, including Ernst & Young, SAP, Continental AG, and Accenture, are known for their substantial workforce and have embraced Microsoft Teams for their communication needs. MS Teams can be integrated with the Microsoft Whiteboard software tool, which shows the demand for the market studied.

- Design and project management teams predominantly favor these tools. They offer an intuitive and user-friendly content-sharing space, benefiting management groups in various disciplines. While most collaborative whiteboard solutions stand alone, some are integrated into other design software or visual collaboration platforms. As teams become more geographically dispersed, the onus of disseminating information among team members intensifies, bolstering coordination efforts. Effective task coordination in both collocated and distributed teams supports the market's growth in all the end-user segments.

- However, challenges like inadequate training, misuse, underutilization, and subscription wastage hinder the market's growth. Subscriptions lose value if team members cannot effectively leverage their collaboration tools. Hence, ensuring user-friendly interfaces and comprehensive training from organizations become pivotal for collaborative whiteboard software developers.

- Since the onset of COVID-19, the global workforce has seen a rapid surge in remote work, increasing the need for robust communication and collaboration tools. In response, collaborative whiteboard software solutions have emerged as a pivotal player, ensuring productivity remains intact. Many organizations are eyeing a shift toward either partial or complete remote work setups.

Collaborative Whiteboard Software Market Trends

Large Enterprises Hold Significant Market Share

- In real-time collaboration, collaborative whiteboard software tools benefit the organization in many ways, like increasing productivity, effective user adaptation, up-to-date information, knowledge sharing, and instant feedback. With the growing dependency on remote work, organizations need the proper tools to collaborate with the team to optimize their processes. Increasing remote working trends adopted by different organizations worldwide are fueling the demand for tools such as Microsoft Teams, which has a pre-installed setup of Microsoft whiteboard feature.

- The application of collaboration whiteboard software to improve work scheduling in large enterprises supports the market's growth. Lack of scheduling can waste large percentages of employees' work time across organizations. Businesses that plan and schedule their goals and activities get more done and are more effective. Daily, weekly, and monthly scheduling allows teams to organize their workflows efficiently, which can be a driving factor for the market studied in the years ahead.

- According to a survey by Cisco in January 2024, government respondents work remotely on average three days per week, with 88% reporting they are moderately or very satisfied with the remote work arrangement that is available to them. Furthermore, 97% of respondents are satisfied with the collaboration tools they are using.

- In larger companies, employees use a dedicated room for their projects, equipped with large whiteboard walls to visualize all relevant information about the project. However, in line with the growth of remote working conditions and hybrid working models, companies are increasingly using an online whiteboard to add digital elements, including videos, websites, or integrations of tools for better communications, which is expected to support the growth of the market in large enterprises.

- Large companies have a presence in various geographical locations and have multiple teams and stakeholders involved in their business ecosystem. This factor supports the adoption of collaborative whiteboard software for increased productivity, innovation, training, and better communications.

North America Expected to Hold Significant Market Share

- North America is one of the prominent regions with a significant share of the market studied. The COVID-19 pandemic had a major impact on the region, and significant disruptions occurred in the IT sector. However, the IT companies successfully implemented a work-from-home culture and are now looking forward to introducing a hybrid work culture. Significant brainstorming sessions, strategy planning, and effective meetings are expected to continue in a hybrid work culture, creating growth opportunities for the market studied.

- Moreover, cloud adoption has become a significant strategic move for businesses and government entities in the region. Adopting cloud technologies allows them to optimize resource usage, improve collaboration of team members from anywhere, and enhance efficiency. This software provides a platform for teams to work together more effectively, fostering problem-solving and creativity and supporting the demand for cloud deployment of collaborative whiteboard software in the market.

- The growth of smart-classroom programs by digitalizing the learning process and the emergence of audio and video-based teaching for better understanding in the USA K-12 schools are fueling the growth of the market, supported by the application of collaborative whiteboard software in streamlining lesson planning with AI-integrated tools, creating dynamic lesson content, and sharing lessons with other educators. These aspects help to create a better learning environment in the education sector of North America.

- Vendors are also focusing on integrating emerging technologies such as AI to offer enhanced collaborative whiteboard tools to categorize notes, create images, edit graphics, instantly summarize sticky notes, translate developer code into daily terms, create templates, and create idea maps. In line with the trend of early adoption of advanced technologies by North American organizations, these developments are expected to boost the market.

- The digitalization of the healthcare sector in the region is expected to drive the market due to the increasing need for interactive whiteboards. These whiteboards offer innovative solutions for medical professionals in hospital settings, improving patient care quality. From enhancing patient engagement to facilitating collaborative discussions among medical staff, these advanced tools have proven their versatility and effectiveness with integration and imaging in the clinical scenario, fueling the market's growth in North America.

Collaborative Whiteboard Software Industry Overview

The market is still in the early stages of adoption, and vendors are actively looking to expand their user base. The growing number of new players further intensifies the competition by offering more features, competitive pricing, and integration into the existing suite of applications. Overall, the intensity of the competitive rivalry is moderate and is expected to increase during the forecast period. The market leaders are Cisco Systems Inc., InVisionApp Inc., Miro, Microsoft Corporation, and Google LLC.

- April 2024: Miro won the Google Cloud Technology Partner of the Year Award 2024 for "Productivity & Collaboration: Innovation" due to its seamless integration with Google Workspace. This integration allows users to attach Miro boards to Google Calendar events, open Miro boards from Google Meet, and edit Google Docs, Sheets, and Slides while working in Miro. This functionality is expected to drive the adoption of Miro's collaborative whiteboard software in the market.

- March 2024: Cisco Systems Inc. launched new purpose-built, multifunctional devices that deliver modernized collaboration experiences to the hybrid workforce. The company announced the launch of the Cisco Board Pro G2, an AI-fueled and touch-enabled collaboration device designed to bring a modern and personalized productivity hub to any desk, which is projected to support the growth of whiteboard software developed by the company to be used in its Board Pro G2 device.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

- 4.5 Types of Collaborative Whiteboards

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Remote Working and Real-time Collaboration in Organizations

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness and Digital Resources in Developing Countries

6 MARKET SEGMENTATION

- 6.1 By Operating System

- 6.1.1 Windows and Web

- 6.1.2 iOS

- 6.1.3 Android

- 6.2 By Deployment Mode

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Organization Size

- 6.3.1 Large Enterprises

- 6.3.2 Small and Medium Enterprises

- 6.4 By End-user Vertical

- 6.4.1 BFSI

- 6.4.2 Healthcare

- 6.4.3 Education

- 6.4.4 IT and Telecommunications

- 6.4.5 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Invisionapp Inc.

- 7.1.3 Miro

- 7.1.4 Mural

- 7.1.5 Eztalks

- 7.1.6 Explain Everything

- 7.1.7 Beecanvas

- 7.1.8 Bluescape

- 7.1.9 Google Jamboard (Alphabet Inc.)

- 7.1.10 Microsoft Corporation

- 7.1.11 Zoom Video Communications

- 7.1.12 Stormboard

- 7.1.13 Limnu

- 7.1.14 Conceptboard

- 7.1.15 Twiddla

- 7.1.16 Ziteboard

- 7.1.17 Lucidspark

- 7.1.18 Collaboard

- 7.1.19 Edrawmind (Wondershare)

- 7.1.20 Groupmap Technology Pty Ltd

- 7.1.21 Vizetto

- 7.1.22 Zira Technologies Inc.

- 7.1.23 Trello Inc. (Atlassian Corporation PLC)

- 7.1.24 Figma Inc.

- 7.1.25 Ayoa (Opengenius Limited)