|

市场调查报告书

商品编码

1445648

加密资产管理:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Crypto Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

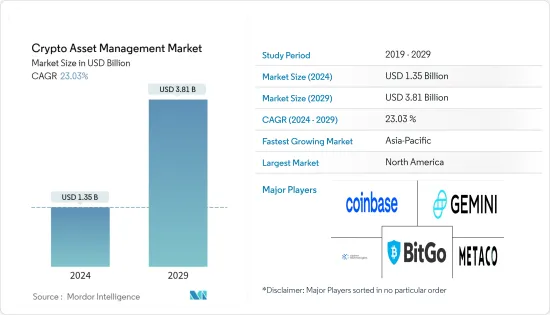

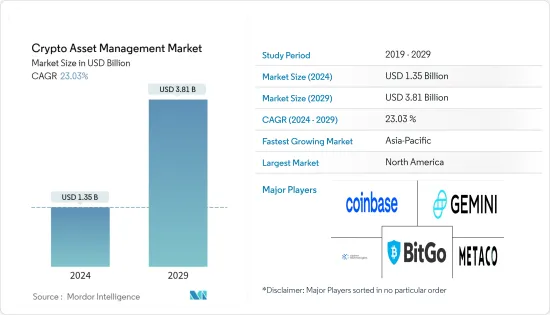

加密资产管理市场规模预计到 2024 年为 13.5 亿美元,预计到 2029 年将达到 38.1 亿美元,预测期内(2024-2029 年)复合年增长率为 23.03%。

分析认为,资产管理产业的发展以及加密基金投资的增加将影响未来几年加密资产管理市场的成长。

主要亮点

- 近年来,由于区块链技术的进步,人们对加密货币产生了巨大的兴趣。随着加密货币的发展势头强劲,加密货币市场对可靠投资选择的需求不断增长。此外,新兴的区块链技术有潜力为多个最终用户产业提供多功能的商业应用,并将其服务扩展到数位资产的巨大成长。因此,预测期内加密资产管理的需求将会显着提升。

- 此外,随着消费者和 BFSI 和零售等各种最终用户机构越来越多地采用加密货币,越来越多的机构投资者和财富管理师开始投资加密货币。在预测期内,加密货币、数位资产和区块链技术的现有和未来发展将进一步推动加密资产管理平台的采用。

- 此外,许多财富管理平台利用人工智慧/机器学习程式根据用户的投资目标创建投资组合。它还可以帮助您追踪和管理大量资产。随着加密产业和新数位资产的普及,这些因素将进一步增加对加密资产管理平台的需求。

- 然而,缺乏对加密货币的认识和技术理解,加上各国的安全问题和严格的监管情况,可能会限制预测期内加密资产管理市场的成长。

- COVID-19感染疾病极大地扰乱了传统的投资场景。这使得数位加密货币领域变得更具吸引力。这场大流行引发了全球经济危机,其硬性通货紧缩性质使虚拟成为对抗经济动盪的有吸引力的选择。此外,当前的疫情促进了云端基础的加密资产管理的需求,推动了更深层的数位化,对市场成长产生了积极影响。

加密资产管理市场趋势

BFSI 产业预计将占据重要的市场占有率

- 由于该行业越来越多地采用区块链或分散式帐本技术,预计 BFSI 行业对加密货币的投资将会增加。例如,透过建立分散式支付帐本(例如比特币),银行解决方案可以比传统系统以更低的费用促进更快的支付。

- 近年来,由于向行动银行银行等数位化主导的经营模式的转变,世界各地的银行和机构对区块链技术的采用迅速获得了显着的势头。此外,加密货币交易的成长也增加了银行业对资产管理平台的需求。例如,根据 BitInfoCharts 的资料,2022 年 9 月区块链上的每日比特币交易数量达到 286,500 笔,而 2021 年 12 月为 269,390 笔。

- 全球越来越多的金融机构涉足加密资产和区块链。例如,2022 年 9 月,法国虚拟第三大银行法国兴业银行 (GLE) 宣布推出一项针对资产管理客户的新服务,旨在满足投资者对加密货币日益增长的需求。新推出的服务将使资产管理公司能够在符合欧洲法规的框架内以简单且适应性强的方式提供加密资产。预计此类倡议和案例将加速 BFSI 行业中加密资产管理解决方案的采用。

- 此外,加密货币的日益普及导致银行业广泛采用加密资产管理平台,以有效服务机构投资者。例如,德国资产第二大银行DZ Bank于2023年2月宣布将与数位资产公司Metaco合作,将数位货币全面整合到其财富管理服务中。该银行已选择数位资产公司 Metaco 的託管平台 Harmonize 为其机构客户提供数位货币。

预计北美将主导市场

- 预计北美将主导美国加密资产管理市场。此外,美国是加密虚拟交易和交易的主要市场之一,因此资产管理解决方案的采用正在迅速进展。

- 北美也是该技术的早期采用者,在最终用户产业中大量采用了区块链。此外,知名市场供应商的存在也正在快速推动市场发展。先进技术和数数位化的早期采用预计将推动该地区加密资产管理市场的成长。

- 此外,预计在预测期内,美国各个最终用户群的采用率不断提高将推动国内资产管理平台市场的发展。例如,2022年10月,美国银行纽约梅隆银行宣布其数位资产託管平台在美国运作,允许部分客户传输和持有比特币和以太币。这项服务强化了纽约梅隆银行支持客户对值得信赖的传统数位资产服务供应商的需求的承诺。

- 此外,越来越多的美国公司正在将虚拟和其他数位资产用于各种营运、投资和交易目的,这为未来几年资产管理市场的供应商创造了巨大的机会。

加密资产管理行业概况

随着加密货币在全球的普及,加密资产管理市场的竞争形势预计将逐渐走向分散化。此外,几家中小型全球公司的出现预计将有助于市场成长。现有市场公司越来越多地推出新产品并进行一些创新,以提高其在市场上的影响力。

2022 年 10 月,专门从事加密货币的资产管理公司 BlockTower推出。

2022 年 5 月,个人和机构的加密货币平台 Blockchain.com 宣布与泽西岛投资管理公司 Altis Partners推出新的加密资产管理平台。新平台称为 Blockchain.com 资产管理(BCAM),将为家族办公室、机构投资者和高净值人士提供受监管的投资产品。 Altis Partners 将管理投资,Blockchain.com 将提供加密货币交易基础设施、安全性、研究和软体服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19感染疾病对市场的影响

第五章市场动态

- 市场驱动因素

- 最终用户产业的区块链技术采用率增加

- 加密货币资产的安全性日益受到关注

- 越来越多地采用加密货币进行汇款和交易

- 市场限制因素

- 缺乏集中的法规结构

- 缺乏技术知识和技术意识

第六章市场区隔

- 按类型

- 解决方案

- 储存解决方案

- 代币化解决方案

- 汇款及汇款解决方案

- 交易解决方案

- 服务

- 解决方案

- 依部署方式

- 云

- 本地

- 按最终用户产业

- BFSI

- 零售与电子商务

- 媒体与娱乐

- 其他最终用户产业(医疗保健、旅游、饭店)

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争形势

- 公司简介

- BitGo, Inc.

- Coinbase, Inc.

- Gemini Trust Company, LLC

- Cipher Technologies Management LP

- Metaco SA

- Amberdata Inc.

- Paxos Trust Company, LLC

- Crypto Finance Group

- Bakkt

- ICONOMI Limited

第八章投资分析

第九章市场机会与未来趋势

The Crypto Asset Management Market size is estimated at USD 1.35 billion in 2024, and is expected to reach USD 3.81 billion by 2029, growing at a CAGR of 23.03% during the forecast period (2024-2029).

The evolution of the asset management industry, coupled with increasing investments in crypto funds, is analyzed to influence the crypto asset management market growth in the coming years.

Key Highlights

- Blockchain technology advances have generated significant interest in cryptocurrencies over the past few years. As crypto gains momentum, there is a growing demand for reliable investment options in the crypto market. In addition, emerging blockchain technology has the potential to offer multipurpose business applications across several end-user industries, extending its services across the enormous growth of digital assets. Thus significantly driving the demand for crypto asset management over the forecast period.

- Further, an increasing number of institutional investors and wealth managers started investing in cryptocurrencies, coupled with growth in cryptocurrency adoption by consumers and various end-user institutions such as BFSI and retail. The adoption of a crypto asset management platform will be further fostered during the forecast period by the existing and future developments in cryptocurrencies, digital assets, and blockchain technology.

- Moreover, many asset management platforms utilize AI/ML programs that create portfolios according to the investment goals of the users. They also help to track and manage a large number of assets. Such factors further boost the demand for crypto asset management platforms with the increasing popularity of the crypto industry and new digital assets.

- However, a lack of awareness and technical understanding regarding cryptocurrency coupled with security issues and a stringent regulatory landscape in various countries may limit the growth of the crypto asset management market over the forecast period.

- The COVID-19 pandemic largely disrupted the traditional investment scenario. This further made the digital cryptocurrency space increasingly attractive. The pandemic led to a global economic crisis, which made crypto an attractive option to combat economic disruption due to its hard, deflationary nature. Additionally, the outbreak fostered the demand for cloud-based crypto asset management and pushed the drive toward deeper digitalization, thus positively impacting the market growth.

Crypto Asset Management Market Trends

BFSI Industry Expected to Hold Significant Market Share

- The growing adoption of blockchain or distributed ledger technologies in the sector is expected to increase investment by the BFSI sector in cryptocurrency. For instance, by establishing a decentralized payment ledger (e.g., Bitcoin), banking solutions could facilitate faster payments at lower fees than traditional systems.

- In recent years, the adoption of blockchain technology is rapidly gaining significant traction in banking and institutions across the globe owing to the move towards digitalization-driven business models like mobile banking. Further, the growth in crypto transactions is also enhancing the demand for asset management platforms in the banking sector. For instance, according to the data from BitInfoCharts, the number of Bitcoin transactions per day on blockchain reached 286.5 thousand in September 2022 compared to 269.39 thousand in December 2021.

- More and more financial institutions worldwide are getting involved in crypto assets and blockchain. For instance, in September 2022, Societe Generale (GLE), the third-largest French bank by market cap, introduced new services for asset manager clients looking to respond to the increased demand from investors for cryptocurrencies. The newly launched services will enable asset managers to offer crypto funds in a simple and adapted way within a framework compliant with European regulations. Such initiatives and instances are expected to boost crypto asset management solutions adoption in the BFSI industry.

- Further, the rising popularity of cryptocurrency led to the high adoption of crypto asset management platforms in the banking sector to effectively serve institutional investors. For instance, in February 2023, DZ Bank, Germany's second-largest bank regarding asset size, announced to fully integrate of digital currencies into its asset management services in partnership with the digital asset firm Metaco. The bank selected the digital asset firm Metaco's custody platform Harmonize to provide digital currencies to its institutional clients.

North America Expected to Dominate the Market

- North America is expected to dominate the crypto asset management market globally, owing to the dominance of the United States and Canada in adopting Bitcoin or Cryptocurrencies. In addition, the US is one of the prominent markets for crypto trading and transactions, thus driving the adoption of asset management solutions rapidly.

- Also, North America is an early technological adaptor with significant blockchain adoption in end-user industries. In addition, the presence of prominent market vendors also drives the market at a significant pace. The early adoption of advanced technologies and digitization is expected to fuel the growth of the crypto asset management market in the region.

- Moreover, the growing adoption in various end-user segments across the United States is expected to drive the asset management platform market in the country over the forecast period. For instance, in October 2022, American Bank, BNY Mellon, announced that its Digital Asset Custody Platform is live in the United States, With select clients now able to transfer and hold bitcoin and ether. This offering reinforces BNY Mellon's commitment to supporting its client demand for a trusted traditional and digital asset servicing provider.

- Moreover, an increasing number of businesses in the United States are using cryptocurrencies and other digital assets for a host of operational, investment, and transactional purposes, thus creating significant opportunities for asset management market vendors in the coming years.

Crypto Asset Management Industry Overview

The competitive landscape of the Crypto Asset Management Market is expected to gradually move towards fragmentation, owing to the increasing adoption of cryptocurrency across the globe. Also, the emergence of several small and medium-sized global players is expected to help the market grow. The existing market players are increasingly making new product launches or several innovations to boost their market presence.

In October 2022, Crypto-focused asset-management company BlockTower launched a venture capital arm with a new USD 150 million fund to back decentralized finance (DeFi) and blockchain-infrastructure projects.

In May 2022, Blockchain.com, a cryptocurrency platform for individuals and institutions, announced the launch of a new crypto asset management platform with Altis Partners, a Jersey-based investment Manager. The new platform is called Blockchain.com Asset Management (BCAM) and offers regulated investment products for family offices, institutional investors, and high-net-worth individuals. Altis Partners will manage the investments, and Blockchain.com will provide the crypto trading infrastructure, security, research, and software services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Blockchain Technology Across End-user Industries

- 5.1.2 Increasing Focus on the Security of Cryptocurrency Assets

- 5.1.3 Growing Adoption of Cryptocurrency for Remittances and Trading Purposes

- 5.2 Market Restraints

- 5.2.1 Lack of a Centralized Regulatory Framework

- 5.2.2 Lack of Technical Knowledge and Awareness of the Technology

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solutions**

- 6.1.1.1 Custody Solutions

- 6.1.1.2 Tokenization Solutions

- 6.1.1.3 Transfer & Remittance Solutions

- 6.1.1.4 Trading Solutions

- 6.1.2 Services

- 6.1.1 Solutions**

- 6.2 By Deployment Mode

- 6.2.1 Cloud

- 6.2.2 On-Premise

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Retail & E-commerce

- 6.3.3 Media & Entertainment

- 6.3.4 Other End-user Industries (Healthcare, Travel & Hospitality)

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 BitGo, Inc.

- 7.1.2 Coinbase, Inc.

- 7.1.3 Gemini Trust Company, LLC

- 7.1.4 Cipher Technologies Management LP

- 7.1.5 Metaco SA

- 7.1.6 Amberdata Inc.

- 7.1.7 Paxos Trust Company, LLC

- 7.1.8 Crypto Finance Group

- 7.1.9 Bakkt

- 7.1.10 ICONOMI Limited