|

市场调查报告书

商品编码

1445649

认证机构:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Certificate Authority - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

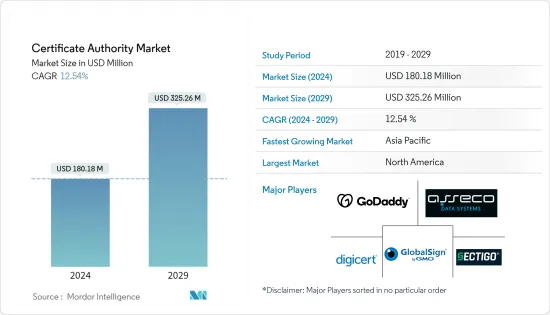

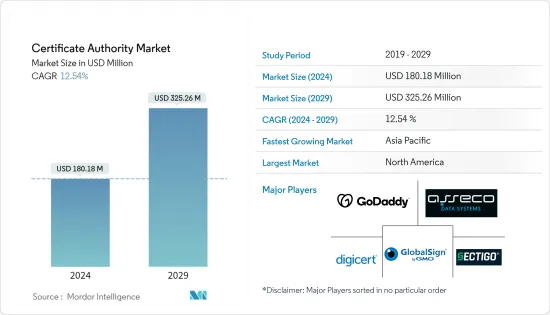

证书颁发机构市场规模预计到 2024 年为 1.8018 亿美元,预计到 2029 年将达到 3.2526 亿美元,在预测期内(2024-2029 年)增长 12.54%,复合年增长率增长。

网路用户对安全网路存取的意识不断提高,在不断扩大的线上客户群中建立信任的需求日益增加,以及严格的合规性和监管遵守将推动证书颁发机构市场在此期间的增长。这些是预计的一些驱动力来驱动这个。预测期。

主要亮点

- 凭证授权单位 (CA) 虽然很少被称为凭证授权机构,但其作用是验证实体(电子邮件地址、公司、网站、个人等)的身份并将其与加密金钥绑定。公司或公司。颁发被认可为数位证书的电子文件。

- 网路用户对安全网路存取的意识不断提高,在不断扩大的线上客户群中建立信任的需求日益增长,以及严格的合规性和监管合规性将推动预测期内受调查市场的成长,这是预期的主要因素。

- 基于凭证的身份验证使用数位凭证来识别使用者、机器或设备,然后再授予对资源、网路或应用程式的存取权限。随着物联网和 BYOD 趋势的不断发展,身分验证凭证的采用预计也会增加。

- 凭证授权单位 (CA) 是颁发 SSL 凭证的受信任组织。这些数位凭证是以加密方式将实体连结到公钥的资料檔案。 Web 浏览器使用这些来检验Web 伺服器提供的内容,确保您在线上看到的内容是可信任的。

- SSL 凭证因其完整性、不可否认性、加密和身分验证功能而被认为占据了凭证授权单位市场的主要份额。它是一种经过网域检验的全自动检验类型,可让使用者在几分钟内开始保护电子商务、网路邮件、部落格访客、登入等。这是为您的网站启动 SSL 保护的最快且最经济的方法之一。

- 由于保护客户资料和满足合规性要求的需求不断扩大,医疗保健产业预计在预测期内将大幅成长。针对个人识别资讯 (PII)、电子健康记录 (EHR) 和受保护的健康资讯 (PHI) 的网路攻击的增加是医疗机构关注的主要问题。

- COVID-19 大流行并未对市场造成负面影响。大多数公司被迫在几週甚至几天内将员工转移到远距工作。该开关引入了许多新的安全隐患。在当今的环境中,多重身份验证(例如 PKI 凭证和密码)是为网路及其使用者应用灵活且可扩展的安全性的最有效方法。

认证机构市场趋势

医疗保健终端用户垂直领域预计将占据重要的市场占有率

- 所有医疗网站所有者都应确保其网站采用 HTTPS。选择合适的SSL凭证也是医疗网站SSL网站安全的重要考量。我们建议取得 EV SSL 证书,该证书提供与医疗网站相关的必要加密等级和最高检验。

- 医疗保健产业预计将在未来见证最大的成长机会。诊所和医院等医疗机构储存了大量敏感资料,因此医疗网站有必要实施数位凭证。医疗保健领域数位化投资不断增加,这将为未来证书颁发机构市场创造新的成长机会。

- 医疗保健企业正在迅速采用先进技术,为患者提供直觉和客製化的体验。医疗保健领域扩大策略使得保护使用者密码和其他敏感资讯变得越来越困难。

- 数位证书帮助医护人员保护电脑和智慧型手机等行动装置上的个人健康资讯。此外,针对个人识别资讯 (PII) 的网路攻击的增加也是医疗保健组织面临的重大问题。据身分盗窃资源中心称,今年美国医疗保健行业已发生超过 340 起资料外洩事件。

- 数位证书对于确保医疗保健解决方案符合 HIPAA 以及其他联邦和州法规至关重要。一些行业组织已经建立了标准和最佳实践,以帮助医疗保健公司购买许可的解决方案,他们确信这些解决方案可以满足这些需求。无论是在传统医疗保健应用还是连结的医疗设备联网用例中,数位凭证在确保这种保证方面发挥关键作用。

预计北美将占据重要市场占有率

- 预计在预测期内,北美将在按地区分類的证书颁发机构市场中拥有最大的市场规模。北美市场的主要成长动力是主要证书颁发机构的大量存在以及严格的资料安全法规和合规性。

- 由于线上业务、数位转型和物联网趋势的成长,预计北美将推动证书颁发机构市场的发展。此外,该地区的国家,即美国和加拿大,已经更新或引入了新的国家网路安全政策,以推动证书颁发机构市场的发展。

- 物联网 (IoT) 趋势的成长预计将为该地区的证书颁发机构市场创造重大成长机会。此外,医疗保健和医疗领域资料外洩和资料窃取的增加预计也将推动该地区证书颁发机构市场的成长。

- 在美国,医疗保健网路安全犯罪呈上升趋势,并且仍然是美国主要关注的问题之一,促使公司在市场上推出解决方案。

- 随着需求的成长,思科共用了有关云端软体国际安全合规性和认证要求的内部指南。 2022 年 5 月,思科公开了思科云端控制框架 (CCF)。 CCF 旨在协助团队确保云端产品和服务符合安全和隐私要求,并透过简化的合规性和风险管理策略「节省大量资源」。

认证机构产业概况

证书颁发机构市场竞争激烈,由多家主要企业组成。全球市场竞争日益激烈。儘管如此,主要的国际公司在这个市场上占有重要地位。这些公司正在利用策略合作倡议来扩大市场占有率并提高盈利。由于全球化,大多数公司都在积极进行併购。

2022年5月,SSL.com发布了eSignerCKA(云端密钥适配器)。此基于 Windows 的应用程式使用 CNG 介面(KSP 金钥服务供应商)来允许 certutil.exe 和 Signtool.exe 等工具使用 eSignerCSC 进行程式码签章操作。

同月,WISeKey 开发了新的 INeS 物联网设备管理平台,使客户和开发人员能够自动化设备和凭证管理并与製造链整合。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19 对市场的影响

- 监管状况

第五章市场动态

- 市场驱动因素

- 网路用户对安全网路存取的意识不断增强

- 严格的监管和合规控制

- 市场限制因素

- 使用自签名证书

- 对安全证书的重要性缺乏认识

第六章市场区隔

- 按成分

- 证书类别

- SSL凭证

- 代码签署证书

- 安全电子邮件证书

- 认证证书

- 服务

- 证书类别

- 按组织规模

- 大公司

- 中小企业

- 按行业 按最终用户

- BFSI

- 零售

- 卫生保健

- 资讯科技和电信

- 其他最终用户领域

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争形势

- 公司简介

- DigiCert Inc.

- Sectigo Limited

- GoDaddy Inc.

- Asseco Data Systems SA(Asseco Poland SA)

- GlobalSign

- Entrust Corporation

- Actalis SpA

- SSL.Com

- Trustwave Holdings

- Network Solutions LLC

- WISeKey International Holdings

- Swisssign AG

- OneSpan Inc.

- Camerfirma SA

- Buypass AS

- Zerossl

第八章 主要文件签名/电子签章库及邮件认证公司名单

第九章投资分析

第十章市场机会与未来趋势

The Certificate Authority Market size is estimated at USD 180.18 million in 2024, and is expected to reach USD 325.26 million by 2029, growing at a CAGR of 12.54% during the forecast period (2024-2029).

The rise in awareness among internet users about secure web access, the increasing need to build trust among the expanding online customer base, and adhering to rigorous compliances and regulations are some of the driving factors anticipated to drive the growth of the certificate authority market during the forecast period.

Key Highlights

- A certificate authority (CA), also seldom mentioned as a certification authority, is a firm or company that works to authenticate the identities of entities (such as email addresses, companies, websites, or individual persons) and bind them to cryptographic keys through the issuance of electronic documents recognized as digital certificates.

- The rise in awareness among internet users about secure web access, the increasing need to build trust among the expanding online customer base, and adhering to rigorous compliances and regulations are the major factors anticipated to drive the market growth studied during the forecast period.

- The certificate-based authentication uses a digital certificate to identify a user, machine, or device before granting access to a resource, network, and application. The growing IoT and BYOD trends are also expected to increase the adoption of authentication certificates.

- A certificate authority (CA) is a reputable organization that issues SSL certificates. These digital certificates are data files that link an entity to a public key cryptographically. Web browsers use them to verify content provided from web servers, guaranteeing that content presented online is trustworthy.

- The SSL certificates segment deems for a principal share of the certification authority market due to its integrity, non-repudiation, encryption, and authentication features. It is a domain validated and completely automated validation type that allows users to start defending their eCommerce, webmail, blog visitors, logins, and more within a few minutes. It is one of the swiftest and most affordable means to activate SSL protection for the website.

- The healthcare industry vertical is anticipated to grow tremendously during the forecast period, owing to an expanding need to secure customers' data and satisfy compliance requirements. The growing incidents of cyber-attacks on Personally Identifiable Information (PII), Electronic Health Records (EHR), and Protected Health Information (PHI) are major concerns for healthcare organizations.

- Owing to the COVID-19 pandemic, the market did not witness any negative impact. Most businesses were compelled to move staff to remote work in weeks, if not days. The changeover has ushered in a slew of new security dangers. In today's environment, multifactor authentication, such as PKI certificates and passwords, is the most effective way to apply flexible, scalable security to networks and their users.

Certificate Authority Market Trends

Healthcare End User Vertical Segment is Expected to Hold Significant Market Share

- Every medical website owner must ensure that the website has HTTPS. Choosing the right SSL certificate should also be a key consideration for the SSL website security of a medical website. It is recommended to have an EV SSL certificate, which offers the required encryption level relevant to medical websites along with the highest validation.

- The Healthcare category is expected to demonstrate the highest growth opportunities in the future. In healthcare facilities such as clinics and hospitals, vast amounts of sensitive and confidential data are stored, making adopting digital certificates necessary for a healthcare website. Investments in digitalization have increased in the healthcare sector, which will create new growth opportunities for the certificate authority market moving forward.

- The healthcare business is rapidly adopting advanced technologies to provide patients with an intuitive, tailored experience. The expansion strategy of partnerships, mergers, and acquisitions in the healthcare sector vertical has increased the difficulty of protecting user passwords and other sensitive information.

- The digital certificates assist healthcare practitioners in securing personal health information on mobile devices such as computers and smartphones. Furthermore, the increasing number of cyber-attacks on Personally Identifiable Information (PII) is a significant concern for healthcare organizations. According to Identity Theft Resource Center, there have been more than 340 incidents of data compromises in the United States in the healthcare sector this year.

- Digital certificates will become vital in ensuring that healthcare solutions comply with HIPAA and other federal and state regulations. Several industry organizations are establishing standards and best practices that will allow healthcare companies to buy licensed solutions that they can be confident will meet these needs. In both traditional healthcare applications and IoT use cases for linked medical equipment, digital certificates play a critical role in ensuring this assurance.

North America is Expected to Hold Significant Market Share

- North America is expected to hold the largest market size in the certificate authority market by region during the forecast period. Primary growth drivers for the North American market constitute the significant presence of primary certificate authorities and stringent data security regulations and compliance.

- Due to growing online businesses, digital transformation, and IoT trends, North America is anticipated to drive the certificate authority market. Additionally, the countries in the region, namely the United States and Canada, have updated or introduced new national cybersecurity policies that would drive the certificate authority market.

- Growing Internet of Things (IoT) trends are expected to create vital growth opportunities for the certification authority market in the region. Moreover, the growing number of data breaches and data thefts in the healthcare and medical sector is also anticipated to boost the Certificate Authority Market growth in the region.

- Healthcare cybersecurity crimes are on the rise in the US and continue to be one of the major concerns in the country, fueling firms to drive solutions in the market.

- Amid the growing demand, Cisco shared an internal guide on international security compliance and certification requirements for cloud software. In May 2022, Cisco released the 'Cisco Cloud Controls Framework' (CCF) to the public. The CCF aims to help teams ensure cloud products and services meet security and privacy requirements with a simplified compliance and risk management strategy, 'saving significant resources.'

Certificate Authority Industry Overview

The Certificate Authority Market is highly competitive and consists of several major players. The market is gaining competition globally. Nonetheless, the market exhibits a strong presence of key international players. These companies leverage strategic collaborative initiatives to expand their market share and enhance profitability. Most companies are actively involved in mergers and acquisitions, owing to globalization.

In May 2022, SSL.com released eSignerCKA (Cloud Key Adapter). This Windows-based application uses the CNG interface (KSP Key Service Provider) to allow tools such as certutil.exe and signtool.exe to use the eSignerCSC for code signing operations.

In the same month, WISeKey developed a new INeS IoT device management platform to enable customers and developers to automate the device and certificate management, integrating it with the manufacturing chain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Regulatory Landscape

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Awareness Among Internet Users About Secure Web Access

- 5.1.2 Managing Strict Regulations and Compliance

- 5.2 Market Restraints

- 5.2.1 Using of Self-Signed Certificates

- 5.2.2 Lack of Awareness About the Importance of Security Certificates

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Certificate Types

- 6.1.1.1 SSL Certificates

- 6.1.1.2 Code Signing Certificates

- 6.1.1.3 Secure Email Certificates

- 6.1.1.4 Authentication Certificates

- 6.1.2 Services

- 6.1.1 Certificate Types

- 6.2 By Organization Size

- 6.2.1 Large Enterprises

- 6.2.2 Small and Medium-Sized Enterprises

- 6.3 By End-user Vertical

- 6.3.1 BFSI

- 6.3.2 Retail

- 6.3.3 Healthcare

- 6.3.4 IT and Telecom

- 6.3.5 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DigiCert Inc.

- 7.1.2 Sectigo Limited

- 7.1.3 GoDaddy Inc.

- 7.1.4 Asseco Data Systems SA (Asseco Poland SA)

- 7.1.5 GlobalSign

- 7.1.6 Entrust Corporation

- 7.1.7 Actalis SpA

- 7.1.8 SSL.Com

- 7.1.9 Trustwave Holdings

- 7.1.10 Network Solutions LLC

- 7.1.11 WISeKey International Holdings

- 7.1.12 Swisssign AG

- 7.1.13 OneSpan Inc.

- 7.1.14 Camerfirma SA

- 7.1.15 Buypass AS

- 7.1.16 Zerossl