|

市场调查报告书

商品编码

1445652

组合式基础架构基础设施:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Composable Infrastructure - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

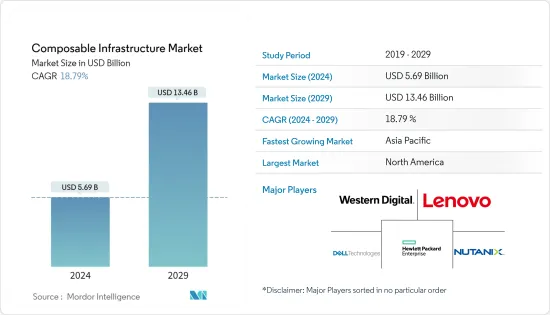

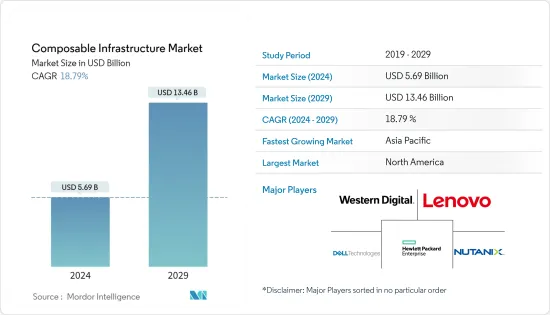

组合式基础架构市场规模预计 2024 年为 56.9 亿美元,预计到 2029 年将达到 134.6 亿美元,在预测期内(2024-2029 年)增长 18.79%,复合年增长率为

组合式基础架构是指透过分解资料中心基础架构的各个元件(例如运算、网路和储存),并根据特定工作负载的需求以不同方式整合它们而形成的IT基础设施基础架构。预计推动组合式基础架构基础设施市场成长的主要因素是业务分析工作负载的增加、客户期望的提高、DevOps 等方法的实施、自动化和标准化工具的兴起以及混合云端的采用。这是一种成长。

主要亮点

- 传统的、孤立的IT基础设施基础设施无法提供现代世界的企业关键型应用程式所需的弹性。此外,越来越多的 IT 公司正在转向 DevOps调查方法来进行应用开发。这需要敏捷框架来适应快速发展的应用程式需求,通常使用「基础设施即程式码」调查方法来优化资源分配。

- 组合式基础架构利用易于使用的 API 将基础架构转换为程式码。对于大型企业来说,基础架构即程式码解决方案提高了IT基础设施团队的效率,并且部署起来简单、敏捷。 FireFly 云端管理解决方案推出了AIaC,这是一个开放原始码计划,可产生人工智慧驱动的基础设施即程式码。 AIaC会自动产生对应的IaC程式码范本、程式码註解和执行指令,无需手动编码。

- 美光先进的 OCP 储存支援云端规模和企业资料中心。智慧管理、效能优化、无缝整合和错误处理等功能可协助客户加快上市时间并降低营运成本。该解决方案扩展了跨企业和超大规模资料中心业者企业利用核心韧体等优势,从而带来更多功能、更好的质量,并可存取 HPE 和 Micron 等公司推向市场的尖端功能,并允许快速存取。

- 自 COVID-19 以来,无论是 IT 服务还是金融服务领域的领先基础设施公司都在将其能力重新调整到混合云端、物联网和边缘运算等数位化解决方案中。总部位于阿联酋的投资银行与 Temenos 合作,Temenos 专门开发银行和金融服务企业软体。它是阿联酋第一家为其数位和核心银行业务平台采用完整 SaaS 模式的银行。

组合式基础架构趋势 市场趋势

IT和通讯业预计在预测期内将显着成长

- IT 和通讯公司希望在当前情况下加速应用、资料和创新。您需要更有效率地管理传统裸机和虚拟应用程序,同时透过软体主导的自动化和可根据您的特定要求灵活客製化的流动资源池支援容器化应用程式。

- 大多数企业正在采用可组合的 IT 平台来加速转型并缩短实施时间。调查显示,50%的公司在过去两年中已经转变为在这种环境下运作。

- 2023 年 1 月 Microsoft 收购可组合组合式基础架构供应商 Fungible,透过高效能、低功耗的资料处理单元 (DPU) 加速资料中心网路和储存效能。

- 2023 年 2 月 亚马逊运算平台 AWS Lambda 推出企业数位体验测试云端。此云端服务可让企业在跨浏览器测试、准确的装置测试、视觉回归测试和 OTT 应用程式测试之间进行选择。

预计北美将在整个预测期内占据很大份额

- 北美地区在组合式基础架构市场占据主导地位,其中美国占据主要市场占有率。该地区的优势在于拥有主要的组合式基础架构解决方案供应商,例如思科、Juniper Networks、Liqid Inc.、Nutanix Inc. 和 Hewlett Packard Enterprise。这些公司专注于合作伙伴关係、併购以及创新解决方案,以保持在区域和全球竞争环境中的地位。

- 中小企业数量的增加以及对提高运算、储存和网路结构资源基础设施效率的关注是市场的一些主要驱动因素。根据 CBRE、纽约和新泽西州发布的联合报告,金融服务业是 2022 年上半年资料中心租赁活动的主要市场。为了满足不断增长的需求,在建资料中心活动在 2022 年上半年达到 67 兆瓦,创 10 年来新高。

- 事件驱动架构(EDA)是领先公司采用的新现象,可以补充市场的成长。遵循事件驱动的微服务,使用即时资料和非同步互动来转变业务流程和客户体验。根据 O'Reilly 最近的一项研究,近 61% 的软体工程师和技术专业人员使用微服务已超过一年。金融和银行业在微服务使用方面名列前茅,其次是电子商务、通讯、製造、运输和物流等其他行业。

- 2022年10月-美国Fiserve公司Finxact与普华永道合作,为金融机构提供业界领先的云端解决方案。该协议将允许金融机构向其客户推出商业云端产品。

组合式基础架构产业概述

可组合式基础架构的竞争非常激烈,其中包括许多主要的国际和国内竞争对手。这些公司控制着很大一部分市场,并致力于扩大全球客户群。在整个预测期内,这些企业将专注于研发倡议、策略联盟以及其他无机和内部成长策略。

2022年10月,华为技术有限公司在华为全联接大会上推出了适用于油田技术的全新网路架构,使用户能够控制和保护其网路。客户可以使用单一实体网路存取多种服务,从而减少企业投资。由于采用这种提供全面分析和简报平台的新解决方案,石油零售公司现在可以远端管理站资料。

2022 年 10 月,瑞士跨国投资银行和金融服务公司瑞银集团与微软合作,交付其一半以上的应用程式在 Microsoft Azure 云端上运作。 Azure 有助于推动 UBS 的永续性工作、提高营运效率并维护合规性和安全标准。总体而言,这有助于公司提高交付速度并改善客户和员工的数位体验。

2022 年 11 月,德勤和 Amazon Web Services 合作提供云端基础的银行即服务 (BaaS) 平台,使组织能够提供客製化的数位银行业务服务。这项服务使小型银行能够在快速变化的银行环境中竞争并进一步加强其业务。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 组合式基础架构的可扩展性显着提高

- 市场挑战

- 缺乏实施组合式基础架构的意识和技能

第六章 COVID-19 疾病对组合式基础架构市场的影响

第七章市场区隔

- 类型

- 软体

- 硬体

- 最终用户产业

- 资讯科技和电信

- BFSI

- 卫生保健

- 工业製造

- 其他最终用户产业(零售、媒体和娱乐、能源和电力)

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第八章 竞争形势

- 公司简介

- Nutanix Inc.

- Juniper Networks Inc.

- Lenovo Group Limited

- Dell EMC(Dell Technologies Inc.)

- Western Digital Corp.

- Hewlett Packard Enterprise Co.

- NetApp Inc.

- DriveScale Inc.

- Fungible Inc.

- TidalScale Inc.

- Liqid Inc.

第九章投资分析

第10章市场的未来

The Composable Infrastructure Market size is estimated at USD 5.69 billion in 2024, and is expected to reach USD 13.46 billion by 2029, growing at a CAGR of 18.79% during the forecast period (2024-2029).

Composable infrastructure refers to the IT infrastructure formed by disintegrating various components such as computing, networking, and storage of the data center infrastructure and integrating them in different ways per the needs of specific workloads. Major factors expected to drive the growth of the composable infrastructure market are rising business analytics workload, increased customer expectations, implementation of methodologies such as DevOps, the rise of automation and standardization tools, and the increasing adoption of hybrid cloud.

Key Highlights

- The conventional siloed IT infrastructure cannot provide the flexibility required by the modern world's enterprise-critical applications. Additionally, an increasing number of IT firms are shifting to the DevOps methodology for application development, which needs an agile framework to keep up with the rapidly evolving application requirements and often uses an "infrastructure as code" methodology to optimize resource allocation.

- A composable infrastructure turns "infrastructure into code" with the help of an easy-to-use API. For a large enterprise, the infrastructure as a code solution delivered efficiency to the IT infrastructure team with ease and agility to deploy. FireFly Cloud Management Solution launched Open Source Project 'AIaC' to Generate AI-powered Infrastructure-as-Code. AIaC will eliminate the need for manual coding as it will automatically generate the corresponding IaC code templates, code comments, and execution instructions.

- Micron advanced OCP storage support for cloud-scale and enterprise data centers. With features like intelligent management, performance optimization, seamless integration, and error handling, the clients can accelerate time to market and lower operating costs. The solution extends benefits like core firmware leveraged across the enterprise and hyper scalers, resulting in more features, better quality, and rapid access to those leading-edge features brought to market by companies like HPE and Micron.

- Post-COVID-19, major infrastructure players, be it in IT or financial services, are diverting their functionalities to digitized solutions such as hybrid cloud, IoT, and edge computing. UAE-based Invest Bank partnered with Temenos, which specializes in enterprise software for banks and financial services. This was the first bank in UAE to adopt a full SaaS model for its digital and core banking platform.

Composable Infrastructure Market Trends

IT and Telecom Vertical is Expected to Grow at a Significant Rate Over the Forecast Period

- IT and telecom enterprises are willing to accelerate their apps, data, and innovation in the current scenario. It needs to manage conventional bare-metal and virtualization applications more efficiently while supporting containerized applications with software-driven automation and a fluid pool of resources that may flexibly custom fit the specific requirements.

- Composable IT platforms are being adopted by the majority of businesses to speed up transformation and cut down on implementation time. A poll indicates that 50% of companies have changed to operate in this environment in the last two years.

- January 2023 - Microsoft acquired Fungible, a provider of composable infrastructure, to accelerate networking and storage performance in data centers with high-efficiency, low-power data processing units (DPUs).

- February 2023 - AWS Lambda, a computing platform by Amazon, launched a digital experience testing cloud for enterprises. This cloud service will enable enterprises to pick and choose across cross-browser testing, accurate devices testing, visual regression testing, and OTT app testing.

North America is Expected to Hold a Significant Share Throughout the Forecast Period

- The North American region dominates the composable infrastructure market, with the United States occupying a significant market share. The region's dominance is the presence of leading composable infrastructure solution providers, such as Cisco, Juniper Networks, Liqid Inc., Nutanix Inc, and Hewlett Packard Enterprise. These players focus on partnerships, mergers and acquisitions, and innovative solutions to stay in the regional and global competitive landscapes.

- The growing number of SMEs and concerns over increasing the infrastructure's efficiency in computing, storage, and network fabric resources are some of the primary drivers of the market. According to a report published by CBRE, New York and New Jersey together, they were flagged as the top markets for data center leasing activity during the first half of 2022, driven by the financial services sector. To meet the rising demand, the under-construction activity of data centers hit a 10-year high of 67 MW in H1 2022.

- Event-Driven Architecture, or EDA, is a new phenomenon adopted by leading enterprises, which complements market growth. Event-driven microservices are followed to transform business processes and customer experience using real-time data and asynchronous interactions. A recent study by O'Reilly depicted that almost 61% of software engineers and technical professionals have been using microservices for a year or more. The finance and banking sector topped the chart for using microservices, followed by other industries like e-commerce, telecom, manufacturing, transportation, and logistics.

- Oct 2022 - Finxact, a Fiserve company in the US, teamed up with PwC to offer financial institutions cutting-edge cloud solutions for the industry. By this agreement, financial institutions will be able to introduce their clients to commercial cloud products.

Composable Infrastructure Industry Overview

There are many major international and local competitors in the fiercely competitive market for composable infrastructure. These companies control a sizeable portion of the market and concentrate on growing their customer bases across the world. Throughout the projected period, these businesses will focus on R&D initiatives, strategic alliances, and other inorganic and organic growth strategies.

In October 2022, Huawei Technologies unveiled new network architecture for oil field technologies at Huawei Connect that lets users control and secure networks. Customers can access numerous services using a single physical network, lowering enterprise investment. Retail oil firms may now manage station data remotely thanks to this new solution, which offers a thorough analysis and presentation platform.

In October 2022, UBS group (a multinational investment bank and financial services company in Switzerland) collaborated with Microsoft to offer more than half of its applications running with the Microsoft Azure Cloud. Azure will help advance UBS's sustainability initiatives, drive operational efficiencies, and maintain its standards for compliance and security. Overall, it will help the firm to increase the speed at which it can deliver and improve upon its digital experiences for clients and employees.

In November 2022, Deloitte and Amazon Web Services partnered to provide Cloud-based BaaS (Banking as a Service) platform to help organizations offer customized digital banking services. The service will allow smaller banks to compete in a rapidly changing banking environment and further boost their business.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Significantly High Scalability of Composable Infrastructure

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness and Skill Set to Implement a Composable Infrastructure

6 IMPACT OF COVID-19 ON THE COMPOSABLE INFRASTRUCTURE MARKET

7 MARKET SEGMENTATION

- 7.1 Type

- 7.1.1 Software

- 7.1.2 Hardware

- 7.2 End-user Verticals

- 7.2.1 IT and Telecom

- 7.2.2 BFSI

- 7.2.3 Healthcare

- 7.2.4 Industrial Manufacturing

- 7.2.5 Other End-user Verticals (Retail, Media and Entertainment, Energy and Power)

- 7.3 Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia-Pacific

- 7.3.4 Latin America

- 7.3.5 Middle-East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Nutanix Inc.

- 8.1.2 Juniper Networks Inc.

- 8.1.3 Lenovo Group Limited

- 8.1.4 Dell EMC (Dell Technologies Inc.)

- 8.1.5 Western Digital Corp.

- 8.1.6 Hewlett Packard Enterprise Co.

- 8.1.7 NetApp Inc.

- 8.1.8 DriveScale Inc.

- 8.1.9 Fungible Inc.

- 8.1.10 TidalScale Inc.

- 8.1.11 Liqid Inc.