|

市场调查报告书

商品编码

1645149

开放原始码服务:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Open Source Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

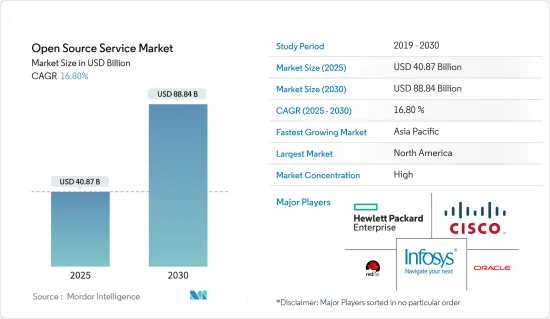

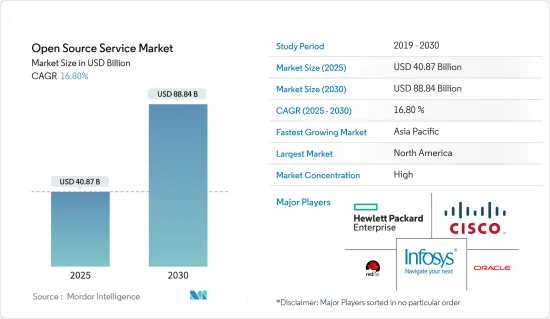

开放原始码服务市场规模在 2025 年估计为 408.7 亿美元,预计到 2030 年将达到 888.4 亿美元,在市场估计和预测期(2025-2030 年)内以 16.80% 的复合年增长率增长。

企业可以受益于开放原始码服务(OSS)工具的速度和灵活性来执行数位转型和资料迁移等大型计划,而开发人员可以更快地开始计划,并且减少前期成本。有了这样的OSS,您可以与使用相同工具、遇到类似问题并已共用解决方案的一大群开发人员合作。

主要亮点

- 从医疗保健人力管理到医疗穿戴设备,一切都由开放原始码提供支援。开放原始码技术非常适合用于医疗保健领域,使用者、临床社群和 IT 供应商之间的积极合作使得开发出为医疗和社会照护带来最大利益的解决方案成为可能。根据2022年6月开源状况发布的报告,77%的公司同意他们在去年采用了开放原始码软体。

- 自新冠肺炎疫情爆发以来,随着远距工作模式的转变,数位转型和虚拟连结已成为企业生存的必需品。企业已经采用这些免费工具来完成各种各样的任务。根据红帽公司2022年企业开放原始码状况报告,92%的IT领导者承认开放原始码服务在疫情挑战期间的共用解决方案和危机管理中发挥了关键作用。

- 企业从多个来源使用各种软体资产:内部部署、云端、SaaS 和开放原始码。它们可以在任何地方运行,并可以透过 API 或服务呼叫从任何地方存取。 API、无伺服器介面、易受攻击的服务和不透明的软体资产导致这种分散式环境中应用程式的攻击面不断扩大。根据平均每个企业报告的 API 安全事件百分比为 95%,API 和服务端点已成为最受青睐的攻击手法。 2015 年至 2021 年间,OVE资料库中发现的涉及 API 的安全漏洞数量增加了 540%。这些因素可能会减缓开放原始码服务市场的适应。

- 在持续的 COVID-19 疫情期间,开放原始码服务公司的需求正在增加。市场上的供应商正在透过利用、扩展和提高开放原始码储存库(包括资料、模型、视觉化、Web 和行动应用程式等)的认识来创新和建立新的解决方案,以对抗病毒的传播。例如,Locale.ai 创建了开放原始码的、互动式视觉化工具,展示所有已知的 COVID-19 病例。随着新资料的出现,此地图会即时更新。

开放原始码服务市场趋势

专注于降低拥有成本和加快上市时间预计将推动市场成长

世界正在发生变化,开放原始码在商业领域占据的重大份额就是明证。此外,开放原始码处于巨量资料、行动应用和云端等新市场趋势的前沿。 OSS交易量增加了四倍。公司采用开放原始码是因为它允许他们使用任何公司的软体和产品,从而降低总体拥有成本 (TCO)。

- 2022 年 10 月-思科宣布推出 Function Clarity,这是一款新的开放原始码解决方案,可协助保护无伺服器功能并大幅减少建置和部署云端原生应用程式所需的程式码量。使用无密钥或密钥对方法,您的程式码在运行时就不会被暴露。 AWS(亚马逊网路服务)上的 Lambda 函数等无伺服器技术的快速扩张,导致了对 FunctionClarity 等平台的需求日益增长。我们发现这些解决方案的需求与两年前相比增加了 3.5 倍。

- 2023 年 2 月-Red 红帽公司推出了免费订阅结构,让合作伙伴可以存取红帽公司的开放混合云产品组合。它可用于创建软体程式和概念验证、评估产品创意、磨练技术力等。 红帽公司的可用混合云产品组合提供了数百个自助订阅,使合作伙伴可以灵活地客製化产品订阅。

预计北美将占很大份额

- 海量资料的可用性推动了对更多异质运算的需求,从而加速了云端原生、人工智慧和机器学习技术的发展。北美对此进展表示欢迎。该地区是 IBM 公司、Redhat 和 Oracle 公司等技术领导者的所在地,开放原始码服务的采用率很高。

- GitHub 将其开放原始码平台描述为一种服务,它创造了一种参与和协作的文化,每个人都可以为让世界变得更美好做出贡献。透过这种方式,GitHub 宣布其开发人员数量已突破 1 亿。使用 GitHub Sponsors 之类的工具,有些计划可以透过捐赠来支持自己。其中一个计划Caliber 已获得资助,并全职致力于开放原始码。

- 波士顿大学采用 Red Hat OpenShift Data Science 来以简洁的方式向学生传授重要的计算系统概念。该工具为波士顿大学的电脑科学和电子工程系提供了一个可扩展的学生环境、一个只需透过网路浏览器即可启动的客製化 Linux 游乐场以及一个用于託管开放原始码教科书和互动讲座的平台。透过采用该解决方案,波士顿大学在不到一个月的时间内将用户群扩大到约 100 人。在尖峰时段,并发会话超过 100 个,目前环境中有近 300 个活跃用户。

- 2022 年 10 月-开放式运算计划(OCP) 在北美开设首个 OCP 体验中心。 OCP体验中心旨在透过将开放原始码和开放协作的优势引入硬件,推动整个产业资料中心和伺服器技术的最佳实践。此模式将推动电讯和边缘基础设施的发展,OCP 将加速资料中心网路设备、GPU 伺服器、储存设备和设备以及可扩展机架设计的创新。

开放原始码服务产业概况

开放原始码服务市场竞争激烈。然而,市场主要由全球参与者主导,例如:埃森哲、甲骨文、思科和印孚瑟斯等公司就是其中的几家。

2023 年 2 月Oracle和红帽公司签署协议,将 Red Hat Enterprise Linux (RHEL) 作业系统整合到Oracle云端基础架构 (OCI) 中。这种新的整合使企业能够标准化其云端操作。这提供了从资料库到Oracle Cloud 的完整平台,为用户提供了选择,并改善了使用 RHEL 和 OCI 进行云端迁移和数位转型的企业的体验。

2023 年 1 月-Infosys 加入 Linux 基金会网路 (LFN),成为该开放原始码网路计划的白金会员。 LFN 已经为其他 18 个全球领先组织提供服务。透过将更多来自开放原始码社群的前沿创新引入企业市场,印孚瑟斯将能够扩大其开放生态系统。

2022 年 10 月-GE Digital 和 Infosys 合作为使用者提供与电网相关的产品和服务解决方案。该解决方案专为公共产业部门设计,旨在帮助营运商提供更可靠、更有弹性、永续的电网。该计划将由一个软体平台和一系列结合能源资料、网路建模和人工智慧的智慧应用程式提供支援。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 对开放原始码服务市场的影响

- 市场驱动因素

- 降低拥有成本并缩短上市时间

- 互通性和客製化灵活性

- 市场限制

- 安全问题

第五章 市场区隔

- 按服务类型

- 咨询及实施服务

- 支援、维护和管理服务

- 培训服务

- 按最终用户产业

- 银行、金融服务和保险

- 电讯、IT

- 製造业

- 政府

- 卫生保健

- 零售

- 其他(运输及物流、能源及公共产业)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 公司简介

- Accenture PLC

- Oracle Corporation

- Cisco Systems, Inc.

- Open Source Services

- HCL Technologies

- Hewlett Packard Enterprise Company

- IBM Corporation

- Infosys Limited

- Wipro Limited

- ATOS SE

- Red Hat Inc.

第七章投资分析

第 8 章:市场的未来

The Open Source Service Market size is estimated at USD 40.87 billion in 2025, and is expected to reach USD 88.84 billion by 2030, at a CAGR of 16.80% during the forecast period (2025-2030).

While enterprise companies can benefit from the speed and flexibility of Open Source Service (OSS) tools to execute large-scale projects like digital transformation and data migrations, developers can start projects faster and with no initial cost outlay. These OSS allows working with a large group of developers who may be using the same tools or might have encountered similar problems and already have solutions to share.

Key Highlights

- Everything from healthcare human resource management to medical wearables is powered by open source. Open source technology is ideal for use in the healthcare sector, where active collaboration between user and clinical communities and IT vendors allows for the development of solutions that maximize benefits to the provision of health and social care-according to a report released by the State of Open Source in June 2022, 77% of the businesses agreed that they adopted open-source software in the last year.

- Digital transformation and virtual connections became essential for organizations to survive as there was a shift for remote working post-Covid-19. Businesses adopted these free tools for a variety of tasks. According to Red Hat's State of Enterprise Open Source Report in 2022, 92% of IT leaders accepted that Open Source Services played an important role in shared solutions and crisis management during the challenging phase of the pandemic.

- Enterprises use various software assets from multiple sources, including internal, cloud, SaaS, and open source. They run anywhere and can be accessed via APIs and service calls from any location. APIs, serverless interfaces, vulnerable services, and opaque software assets contribute to the growing attack surface for these applications in this distributed environment. With the average company reporting 95% of API security incidents, APIs and service endpoints have emerged as preferred threat vectors. The number of security flaws involving APIs discovered in the OVE database between 2015 and 2021 increased by 540%. These factors may slow down the adaptation of the Open Source Service Market.

- During the ongoing COVID-19 pandemic, the demand for open-source service companies has seen an upward trend. Vendors in the market are using and expanding open source repositories containing datasets, models, visualizations, web and mobile applications, and more to innovate and build new solutions to combat the spread of the virus through generating awareness. For instance, Locale.ai created an open-source, interactive visualization of all known cases of COVID-19. The map provides live updates with new data as it becomes available.

Open Source Service Market Trends

Emphasis on Reduced Cost of Ownership and Time to Market is Expected to Drive the Market Growth

There is a change in the world, as evidenced by the fact that Open Source has a sizable market share in the commercial sector. In addition, Open Source is setting the pace for emerging market trends like Big Data, Mobile applications, and Cloud. The size of OSS deals has quadrupled. Companies are adopting open source because it allows them to use any company's software and products and reduces the total cost of ownership (TCO).

- October 2022 - Cisco introduced FunctionClarity, a new open-source solution that aids in the security of serverless functions, significantly reducing the amount of code required to build and deploy cloud-native applications. The code can no longer be exposed at runtime using keyless or key pair methods. With the rapid expansion of serverless technologies such as AWS (Amazon Web Services) Lambda functions, the need for FunctionClarity-like platforms is growing. It is observed the demand for these solutions grew 3.5 times compared to what it was two years ago.

- February 2023 - Red Hat launched a cost-free subscription structure that grants partners access to Red Hat's open hybrid cloud portfolio. It can be used to create software programs and proofs-of-concept, evaluate product ideas, sharpen technical abilities, and more. Red Hat's available hybrid cloud portfolio will allow access to hundreds of self-support subscriptions, and partners will have the flexibility to customize product subscriptions.

North America is Expected to Hold Major Share

- The availability of enormous amounts of data is causing a demand for more heterogeneous computing, which has sped up the development of cloud-native, artificial intelligence, and machine learning technologies. North America welcomes such advancements with open arms. Being the base of technology leaders such as IBM Corporation, Redhat, and Oracle Corporation, the adoption of Open Source Services is high in the region.

- GitHub describes Open Source Platform as a service that creates a culture of participation and collaboration where anyone can contribute to improving the world. Following this approach, GitHub announced crossing 100 million developers. Using tools like GitHub Sponsors, some projects can support themselves through donations. One of the projects, Caliber, was sponsored to work on open source full-time.

- Boston University sought a concise approach to teach students about important computing system concepts, for which they turned to Red Hat OpenShift Data Science. The tool gave the CS and ECE departments at Boston University a scalable setting for students, ensuring a customized Linux playground that only needs a web browser to get started, and offers a platform for hosting open-source textbooks and interactive lectures. By adopting this solution, Boston University scaled its user base to about 100 in less than a month. With peaks of more than 100 concurrent sessions, the environment currently has close to 300 active users.

- October 2022 - The Open Compute Project (OCP) launched its first OCP experience center in North America. The OCP Experience Center seeks to disseminate best practices for data center and server technology across industries by bringing the advantages of open source and open collaboration to hardware. The model advances the telecom sector and edge infrastructure, and OCP accelerates innovation around the data center's networking equipment, GPU servers, storage devices and appliances, and scalable rack designs.

Open Source Service Industry Overview

The Open Source Service Market is highly competitive. However, the market is dominated by global players such as Accenture, Oracle, Cisco, and Infosys, to name a few. These businesses' primary growth tactics to survive the fierce competition include product releases, substantial investment in research and development, collaborations, and acquisitions.

February 2023 - Oracle and Red Hat signed a contract to integrate the Red Hat Enterprise Linux (RHEL) operating system into the Oracle Cloud Infrastructure (OCI). This new integration enables businesses to standardize their cloud operations. It offers them a complete platform from their databases to the Oracle cloud, allowing user choice and improving the experience for companies using RHEL and OCI for cloud migration and digital transformation.

January 2023 - Infosys joined Linux Foundation Networking (LFN) as a platinum member for open-source networking projects. The LFN already serves 18 other leading global organizations. Infosys will be able to expand the open ecosystem by introducing more cutting-edge innovations from the open-source community to the enterprise market.

October 2022 - GE digital and Infosys partnered to assist their users with solutions for grid-related goods and services. The solution is designed exclusively for the utility sector, assisting operators in realizing a more dependable, resilient, and sustainable grid. A software platform and a collection of intelligent applications that combine energy data, network modeling, and artificial intelligence will power the project.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on Open Source Services Market

- 4.4 Market Drivers

- 4.4.1 Reduced Cost of Ownership and Time to Market

- 4.4.2 Interoperability and Flexibility in Terms of Customization

- 4.5 Market Restraints

- 4.5.1 Security Issues

5 MARKET SEGMENTATION

- 5.1 By Service Type

- 5.1.1 Consulting and Implementation Services

- 5.1.2 Support, Maintenance, and Management Services

- 5.1.3 Training Services

- 5.2 By End-user Industry

- 5.2.1 Banking, Financial Services, and Insurance

- 5.2.2 Telecom and IT

- 5.2.3 Manufacturing

- 5.2.4 Government

- 5.2.5 Healthcare

- 5.2.6 Retail

- 5.2.7 Others (Transportation and Logistics, Energy and Utilities)

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.3 Asia

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.4 Australia and New Zealand

- 5.3.5 Latin America

- 5.3.6 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Accenture PLC

- 6.1.2 Oracle Corporation

- 6.1.3 Cisco Systems, Inc.

- 6.1.4 Open Source Services

- 6.1.5 HCL Technologies

- 6.1.6 Hewlett Packard Enterprise Company

- 6.1.7 IBM Corporation

- 6.1.8 Infosys Limited

- 6.1.9 Wipro Limited

- 6.1.10 ATOS SE

- 6.1.11 Red Hat Inc.