|

市场调查报告书

商品编码

1445710

卫星通讯 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Satellite Communications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

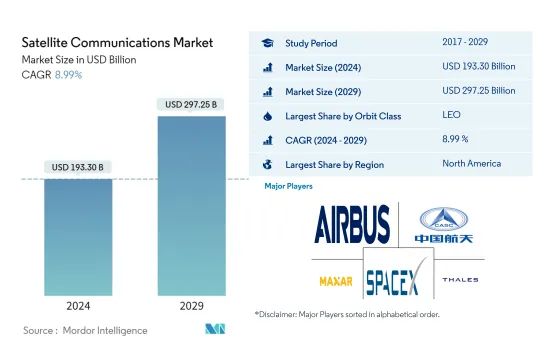

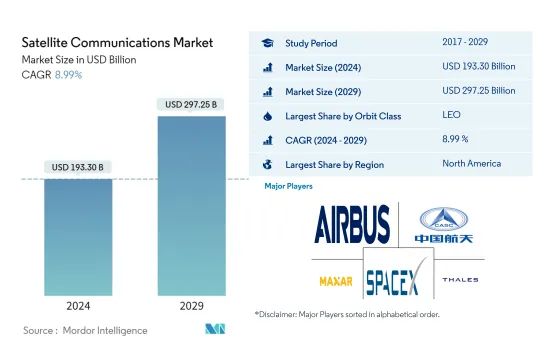

卫星通讯市场规模预计到2024年为1,933亿美元,预计2029年将达到2,972.5亿美元,在预测期内(2024-2029年)CAGR为8.99%。

低轨卫星预计将构成领先部分

- 卫星或太空船通常被放置在围绕地球的许多特殊轨道之一,或者可以发射进入星际旅行。地球轨道分为三种:地球静止轨道(GEO)、中地球轨道(MEO)和低地球轨道(LEO)。许多气象和通讯卫星往往具有高地球轨道,离地表最远。中地球轨道卫星包括旨在监测特定区域的导航卫星和专用卫星。大多数科学卫星,包括美国太空总署的地球观测系统,都位于低地球轨道上。

- 小型卫星的快速发展及其在近地轨道的部署因其附加优势正在推动低地球轨道领域的成长。 2017-2019年,GEO卫星占据了大部分市场份额。 2020 年,LEO 卫星势头强劲,预计在预测期内也将持续保持成长轨迹。预计到 2029 年,LEO 细分市场将占据 79.5% 的市场份额,其次是 GEO,份额为 18%。

- 製造和发射的不同卫星有不同的应用。 2017 年至 2022 年期间,在 MEO 发射的 57 颗卫星中,有 8 颗是用于通讯目的的。同样,GEO 的 147 颗卫星中,有 105 颗用于通讯目的。世界各地的不同组织拥有约 4,131 颗製造和发射的低地球轨道卫星。其中,近 2,976 颗卫星是为通讯目的而设计的。

通讯应用需求的不断增长正在推动全球市场的需求

- 卫星通讯市场是一个全球性产业,为电信、军事和国防以及广播等各个部门提供关键基础设施。在卫星发射方面,2017-2022年期间,约80%的通讯卫星由北美製造和发射,其次是欧洲,占15%,中国占3%,其余各占2%。

- 北美拥有强大的军事和国防部门,对卫星技术进行了大量投资,商业部门也很重要,SpaceX、MDA、HughesNet 和 Telesat 等公司经营大量卫星,用于宽频网路、电视广播和其他服务。

- 欧洲是全球卫星通讯市场的另一个重要参与者,也是泰雷兹阿莱尼亚航太公司和空中巴士防务航太公司等多家领先卫星製造商的所在地。欧洲太空总署 (ESA) 在太空技术方面投入巨资,以支持国家安全和国防计画。商业卫星通讯市场也很重要,Eutelsat 和 SES 等公司经营大量用于通讯、广播和其他服务的卫星。

- 在高速资料传输需求不断增长和卫星技术投资不断增加的推动下,亚太地区预计将成为卫星通讯成长最快的市场。中国和印度是该地区最大的两个市场,两国都大力投资太空技术,以支持国家安全和国防措施并推动经济成长。

全球卫星通讯市场趋势

全球对卫星小型化的需求不断上升

- 小型卫星能够以传统卫星的一小部分成本执行几乎所有功能,这提高了建造、发射和运行小型卫星星座的可行性。北美的需求主要由每年製造最多小型卫星的美国所推动。在北美,2017年至2022年期间,该地区各参与者总共将596颗奈米卫星送入轨道。美国宇航局目前正在参与多个旨在开发这些卫星的项目。

- 由于萨里卫星技术有限公司和 GomSpace Group AB 等几个着名的卫星製造实体在该地区的存在,欧洲已成为奈米和微型卫星製造的中心。 2018 年 11 月,欧空局宣布参与设计名为 DoT-4 的低成本 35 公斤月球通讯卫星任务,计画于 2021 年发射。 DoT-4 旨在使用 Goonhilly 深空网路向地球提供通讯中继,并与月球表面的漫游车连接。

- 亚太地区的需求主要由中国、日本和印度推动,这些国家每年製造的小型卫星数量最多。 2017 年至 2022 年期间,该地区的不同参与者将超过 190 颗奈米和微型卫星送入轨道。中国正投入大量资源来增强其天基能力。该国迄今为止在亚太地区发射了数量最多的奈米和微型卫星。

市场投资机会不断增多

- 2021 年,北美用于太空计画的政府支出约为 370 亿美元。该地区是太空创新和研究的中心,拥有世界上最大的航太机构 NASA。 2022年,美国政府在太空计画上花费了近620亿美元,成为全球太空计画支出最高的国家。在美国,联邦机构每年从国会获得 323.3 亿美元的资金,称为预算资源,用于其下属机构。

- 英国政府计画耗资 75 亿美元升级武装部队的卫星通讯能力。 2020 年 7 月,英国国防部 (MoD) 向空中巴士防务与航太公司授予了一份价值 6.3 亿美元的合同,用于建造一颗新的电信卫星,作为增强军事能力的权宜之计。 2022 年 11 月,欧空局宣布,提议在未来三年内增加 25% 的太空资金,以保持欧洲在地球观测领域的领先地位,扩大导航服务,并继续与美国在勘探领域保持合作伙伴关係。 ESA 要求其 22 个国家支持 2023-2025 年约 185 亿欧元的预算。

- 考虑到亚太地区太空相关活动的增加,根据日本预算草案,2022年太空预算将超过14亿美元,其中包括H3火箭、工程测试卫星9号的研製,以及国家的资讯收集卫星(IGS)计画。印度22财年太空计画提案预算为18.3亿美元。 2022年,韩国科学与资讯通讯部宣布太空预算为6.19亿美元,用于製造卫星、火箭和其他关键太空设备。

卫星通讯产业概况

卫星通讯市场较为集中,前五名企业占98.46%。该市场的主要参与者包括空中巴士公司、中国航太科技集团公司 (CASC)、Maxar Technologies Inc.、Space Exploration Technologies Corp. 和 Thales(按字母顺序排列)。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:执行摘要和主要发现

第 2 章:报告报价

第 3 章:简介

- 研究假设和市场定义

- 研究范围

- 研究方法论

第 4 章:主要产业趋势

- 卫星小型化

- 卫星质量

- 太空计画支出

- 规范架构

- 全球的

- 澳洲

- 巴西

- 加拿大

- 中国

- 法国

- 德国

- 印度

- 伊朗

- 日本

- 纽西兰

- 俄罗斯

- 新加坡

- 韩国

- 阿拉伯聯合大公国

- 英国

- 美国

- 价值炼和配销通路分析

第 5 章:市场区隔(包括以美元计价的市场规模、截至 2029 年的预测以及成长前景分析)

- 卫星质量

- 10-100公斤

- 100-500公斤

- 500-1000公斤

- 10公斤以下

- 1000公斤以上

- 轨道级

- 地球轨道

- 低地轨道

- 中欧

- 通讯类型

- 广播

- 行动通讯

- 卫星电话

- 其他的

- 最终用户

- 商业的

- 军事与政府

- 其他

- 地区

- 亚太

- 欧洲

- 北美洲

- 世界其他地区

第 6 章:竞争格局

- 关键策略倡议

- 市占率分析

- 公司概况

- 公司简介(包括全球概况、市场概况、核心业务部门、财务状况、员工人数、关键资讯、市场排名、市场份额、产品和服务以及近期发展分析)。

- Airbus SE

- China Aerospace Science and Technology Corporation (CASC)

- Cobham Limited

- EchoStar Corporation

- Intelsat

- L3Harris Technologies Inc.

- Maxar Technologies Inc.

- SES SA

- SKY Perfect JSAT Corporation

- Space Exploration Technologies Corp.

- Swarm Technologies, Inc.

- Thales

- Thuraya Telecommunications Company

- Viasat, Inc.

CHAPTER 7 : CEOへの主な戦略的质问

第 8 章:附录

- 全球概况

- 概述

- 波特的五力框架

- 全球价值链分析

- 市场动态 (DRO)

- 来源和参考文献

- 表格和图表清单

- 主要见解

- 数据包

- 专业术语

The Satellite Communications Market size is estimated at USD 193.30 billion in 2024, and is expected to reach USD 297.25 billion by 2029, growing at a CAGR of 8.99% during the forecast period (2024-2029).

LEO satellites are expected to comprise the leading segment

- A satellite or spacecraft is usually placed into one of many special orbits around the Earth, or it can be launched into an interplanetary journey. There are three types of Earth orbits: geostationary orbit (GEO), medium Earth orbit (MEO), and low Earth orbit (LEO). Many weather and communications satellites tend to have high Earth orbits, which are farthest from the surface. Satellites in medium Earth orbit include navigational and specialized satellites designed to monitor a specific area. Most science satellites, including NASA's Earth Observation System, are in low Earth orbit.

- The rapid development of small satellites and their deployment in low Earth orbit because of their added advantages are driving the growth of the LEO segment. During 2017-2019, the majority share of the market was occupied by GEO satellites. In 2020, LEO satellites gained momentum, and they are expected to continue their growth trajectory during the forecast period as well. The LEO segment is expected to occupy a market share of 79.5% in 2029, followed by GEO, with a share of 18%.

- The different satellites manufactured and launched have different applications. During 2017-2022, of the 57 satellites launched in MEO, eight were built for communication purposes. Similarly, of the 147 satellites in GEO, 105 were deployed for communication purposes. Around 4,131 LEO satellites manufactured and launched were owned by various organizations across the world. Of that, nearly 2,976 satellites were designed for communication purposes.

Rising demand for communication application is driving the demand in the market globally

- The satellite communications market is a global industry that provides critical infrastructure for various sectors, including telecommunications, military and defence, and broadcasting. Regarding satellite launches, during 2017-2022, approximately 80% of the communication satellites were manufactured and launched by North America, followed by Europe with 15%, China with 3%, and the rest with 2%, respectively.

- North America has a strong military and defence sector that invests heavily in satellite technology, and the commercial sector is also significant, with companies like SpaceX, MDA, HughesNet, and Telesat operating large fleets of satellites for broadband internet, TV broadcasting, and other services.

- Europe is another significant player in the global satellite communications market, and it is home to several leading satellite manufacturers, including Thales Alenia Space and Airbus Defence and Space. The European Space Agency (ESA) invests heavily in space technology to support national security and defence initiatives. The commercial satellite communications market is also significant, with companies like Eutelsat and SES operating large fleets of satellites for communication, broadcasting, and other services.

- The Asia-Pacific region is expected to be the fastest-growing market for satellite communications, driven by increasing demand for high-speed data transmission and rising investments in satellite technology. China and India are two of the largest markets in the region, with both countries investing heavily in space technology to support national security and defence initiatives and drive economic growth.

Global Satellite Communications Market Trends

The global demand for satellite miniaturization is rising

- The ability of small satellites to perform nearly all of the functions of a traditional satellite at a fraction of its cost has increased the viability of building, launching, and operating small satellite constellations. The demand from North America is primarily driven by the United States, which manufactures the most small satellites each year. In North America, during 2017-2022, a total of 596 nanosatellites were placed in orbit by various players in the region. NASA is currently involved in several projects aimed at developing these satellites.

- Europe has become the hub for nano and microsatellite manufacturing due to the presence of several prominent satellite manufacturing entities in the region, including Surrey Satellite Technology Ltd and GomSpace Group AB. In November 2018, ESA announced its participation in designing a low-cost 35 kg lunar communications satellite mission called DoT-4, which was targeted for a 2021 launch. DoT-4 was designed to provide the communications relay back to Earth using the Goonhilly Deep Space Network and link up with a rover on the surface of the Moon.

- The demand from Asia-Pacific is primarily driven by China, Japan, and India, which manufacture the largest number of small satellites annually. During 2017-2022, more than 190 nano and microsatellites were placed into orbit by various players in the region. China is investing significant resources in augmenting its space-based capabilities. The country has launched the most significant number of nano and microsatellites in Asia-Pacific to date.

Investment opportunities are increasing in the market

- Government expenditure for space programs in North America reached approximately 37 billion in 2021. The region is the epicenter of space innovation and research, with the presence of the world's biggest space agency, NASA. In 2022, the US government spent nearly USD 62 billion on its space programs, making it the highest spender on space programs in the world. In the United States, federal agencies receive funding of USD 32.33 billion from Congress every year, known as budgetary resources, for their subsidiaries.

- The UK government has planned an upgradation, worth USD 7.5 billion, of the satellite telecommunication capabilities of the armed forces. In July 2020, the UK Ministry of Defence (MoD) awarded a contract worth USD 630 million to Airbus Defence and Space for constructing a new telecommunications satellite as a stopgap to bolster military capabilities. In November 2022, ESA announced that it proposed a 25% boost in space funding over the next three years to maintain Europe's lead in Earth observation, expand navigation services, and remain a partner in exploration with the United States. ESA asked its 22 nations to back a budget of around EUR 18.5 billion for 2023-2025.

- Considering the increase in space-related activities in the Asia-Pacific region, in 2022, according to the draft budget of Japan, the space budget amounted to over USD 1.4 billion, which included the development of the H3 rocket, Engineering Test Satellite-9, and the nation's Information Gathering Satellite (IGS) program. The proposed budget for India's space programs for FY22 was USD 1.83 billion. In 2022, South Korea's Ministry of Science and ICT announced a space budget of USD 619 million for manufacturing satellites, rockets, and other key space equipment.

Satellite Communications Industry Overview

The Satellite Communications Market is fairly consolidated, with the top five companies occupying 98.46%. The major players in this market are Airbus SE, China Aerospace Science and Technology Corporation (CASC), Maxar Technologies Inc., Space Exploration Technologies Corp. and Thales (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Miniaturization

- 4.2 Satellite Mass

- 4.3 Spending On Space Programs

- 4.4 Regulatory Framework

- 4.4.1 Global

- 4.4.2 Australia

- 4.4.3 Brazil

- 4.4.4 Canada

- 4.4.5 China

- 4.4.6 France

- 4.4.7 Germany

- 4.4.8 India

- 4.4.9 Iran

- 4.4.10 Japan

- 4.4.11 New Zealand

- 4.4.12 Russia

- 4.4.13 Singapore

- 4.4.14 South Korea

- 4.4.15 United Arab Emirates

- 4.4.16 United Kingdom

- 4.4.17 United States

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Satellite Mass

- 5.1.1 10-100kg

- 5.1.2 100-500kg

- 5.1.3 500-1000kg

- 5.1.4 Below 10 Kg

- 5.1.5 above 1000kg

- 5.2 Orbit Class

- 5.2.1 GEO

- 5.2.2 LEO

- 5.2.3 MEO

- 5.3 Communication Type

- 5.3.1 Broadcasting

- 5.3.2 Mobile Communication

- 5.3.3 Satellite Phone

- 5.3.4 Others

- 5.4 End User

- 5.4.1 Commercial

- 5.4.2 Military & Government

- 5.4.3 Other

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.2 Europe

- 5.5.3 North America

- 5.5.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Airbus SE

- 6.4.2 China Aerospace Science and Technology Corporation (CASC)

- 6.4.3 Cobham Limited

- 6.4.4 EchoStar Corporation

- 6.4.5 Intelsat

- 6.4.6 L3Harris Technologies Inc.

- 6.4.7 Maxar Technologies Inc.

- 6.4.8 SES S.A.

- 6.4.9 SKY Perfect JSAT Corporation

- 6.4.10 Space Exploration Technologies Corp.

- 6.4.11 Swarm Technologies, Inc.

- 6.4.12 Thales

- 6.4.13 Thuraya Telecommunications Company

- 6.4.14 Viasat, Inc.

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms