|

市场调查报告书

商品编码

1937368

Wi-Fi:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Wi-Fi - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

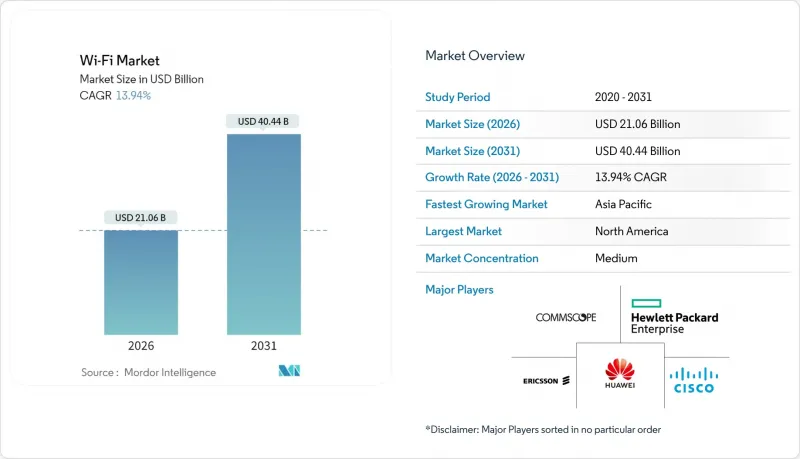

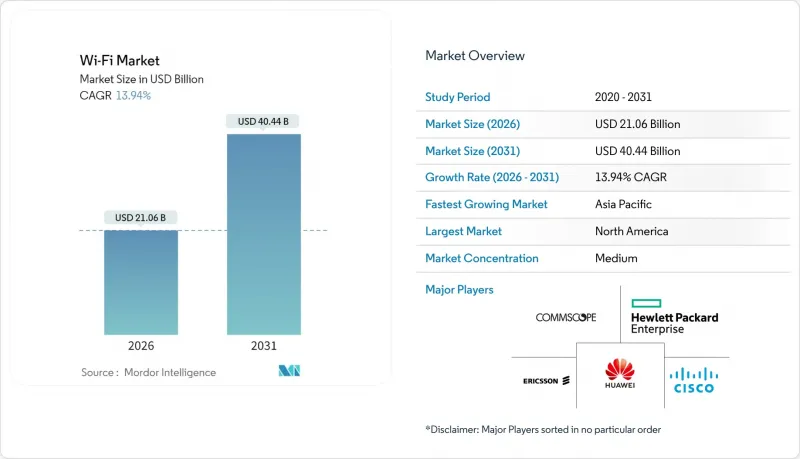

预计到 2025 年,Wi-Fi 市场价值将达到 184.8 亿美元,从 2026 年的 210.6 亿美元成长到 2031 年的 404.4 亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 13.94%。

推动这项加速发展的关键因素包括企业对无线优先架构日益增长的偏好、Wi-Fi 7 的商业化以及 OpenRoaming 标准的采用。企业意识到高容量 WLAN 对于实现混合办公、边缘人工智慧和即时工业自动化至关重要,从而将更新周期从八年缩短至五年。网状网路在住宅和小规模办公环境中的快速普及进一步扩大了潜在市场。同时,北美联邦宽频计画正在为公共部门创造商机。虽然 6 GHz 频谱分配可以暂时缓解网路拥堵,但也推动了对具有确定性延迟的三频网路基地台可用于机器人、远端医疗和身临其境型现实服务。由于互通性要求避免了供应商锁定,并使以服务为中心的新进业者能够挑战现有硬体供应商,因此竞争格局依然开放。

全球Wi-Fi市场趋势与洞察

物联网和智慧设备的兴起

企业正在部署高密度感测器网络,每个网路基地台连接超过 100 个终端已成为常态。只有 Wi-Fi 6E 的 OFDMA 调度和多用户 MIMO 功能才能经济高效地满足这种需求。智慧楼宇营运商正在透过 Wi-Fi 网状网路整合暖通空调、照明和监控系统,从而降低 40% 的结构化布线成本,并实现预测性维护分析。边缘推理工作流程对 10 毫秒以下回应时间的需求,使得 Wi-Fi 7 的多连结运作极具吸引力,即使在高负载下也能保持无抖动流量。一项工业自动化试点计画表明,专用 6 GHz 频道的运转率高达 99.9%,而拥塞的 5 GHz 连结的正常运作时间仅为 97.8%,这验证了新频谱转换在关键任务机器人应用中的有效性。这些成果鼓励企业承担更高的初始投资,以换取长期的生产力提升。

智慧城市计画与公共Wi-Fi部署

由于Wi-Fi部署速度更快,且在广大的农村地区比光纤建设成本更低,地方政府的宽频计画越来越重视将其作为实现数位包容的主要媒介。菲律宾正投资12亿美元,计画到2028年在17,000个描笼涯(政府辖区)部署超过10万个公共热点,此模式已被多个新兴经济体采用。欧洲的「数位十年」计画在2030年实现Gigabit部署,并将Wi-Fi 7网状网路定位为山区和岛屿地区低成本的「最后一公里」替代方案。都市区正透过迭加感测器回程传输来为交通、空气品质和紧急应变系统提供资金,并透过效率提升实现基础设施的资金筹措。中立主机部署,即在开放漫游协议下结合Wi-Fi和5G无线网络,既能实现市民无缝连接,又能透过漫游费创造新的收入来源。

免执照频段的频谱拥塞和干扰

在曼哈顿等人口密集的都市区,即使部署了支援 Wi-Fi 6E 的设备,尖峰时段的吞吐量也会下降近 60%。这是因为老旧设备占据了 2.4 GHz频宽。微波炉、蓝牙设备和老旧路由器产生的重迭噪声,即使是自适应演算法也无法完全避免。企业越来越多地在其庞大的园区内聘请频谱顾问,费用在 5 万至 20 万美元之间,以设计满足服务等级目标的频道规划。监管机构正在考虑采用类似 CBRS 的半授权系统,以允许关键的物联网流量在不受消费者干扰的情况下运作。虽然 6 GHz 频谱的分配暂时缓解了压力,但预计由于物联网终端数量的指数级增长,频谱将在五年内饱和。

细分市场分析

截至2025年,网路基地台将占Wi-Fi市场份额的35.92%,显示在收入结构转变的背景下,硬体的重要性依然不减。同时,预计到2031年,服务领域将以15.98%的复合年增长率成长,反映出市场正向「网路即服务」(Network-as-a-Service)模式转变,将初始投资转化为持续的营运成本。成本压力正推动独立路由器和增程器走向商品化,而云端原生编排平台则接管了传统上由本地控制器执行的策略配置和编配功能。託管服务供应商正在利用人工智慧技术实现通道分配、负载平衡和异常检测的自动化,与客户自建网路相比,可将计划外停机时间减少75%。到2031年,在成熟经济体中,软体和服务所占的Wi-Fi市场规模预计将超过硬件,因为企业将生命週期柔软性置于资产所有权之上。

这种转变反映了更广泛的IT采购趋势,即优先考虑结果而非所有权。付费使用制将WLAN成本与运转率挂钩,既减少了预算波动,也提高了财务长的透明度。供应商不再仅仅依靠硬件,而是透过提供预防性保养、安全合规性和即时体验评估等服务来实现差异化。边缘网关和加固型物联网桥接器虽然市场规模小规模,但成长迅速,它们能够在恶劣的工业环境中提供可靠的连接,而这些环境的振动、灰尘和极端温度都可能导致消费性设备损坏。嵌入网路基地台的AI晶片为通用硬体增添了价值,这些硬体以託管服务的形式交付,能够简化复杂性并加快生产力提升速度。

区域分析

到2025年,北美将占据全球Wi-Fi市场40.55%的份额,这主要得益于650亿美元的宽频奖励计画和企业快速的网路更新週期。北美地区率先获得频宽的使用权,使其成为三频部署的先驱,这使其在性能上领先于其他仍在等待监管部门等待核可的地区。财富500强企业平均每五年更新一次其无线区域网路(WLAN),以建构支援混合办公的智慧办公环境,速度比全球平均快两年。医疗保健和教育是强劲的成长领域,需要企业级可靠性的网路来支援远端医疗和远端教育。

亚太地区预计将成为成长最快的地区,到2031年复合年增长率将达到15.12%,这主要得益于各国将无线网路定位为关键基础设施而非补充手段的数位化策略。中国工厂自动化蓬勃发展,这得益于旨在提升国内晶片组能力的政策,也带动了工业级Wi-Fi 6E设备的大量订单。印度的「数位印度」计画旨在透过Wi-Fi Mesh网路连接60万个村庄,将无线技术定位为促进农村地区发展的关键推动因素。东南亚各国正在将WLAN整合到旅游中心和出口导向产业园区,政府补贴透过缩短投资回收期加速了无线技术的普及。雅加达、曼谷和胡志明市的智慧城市资金筹措计画进一步刺激了区域需求。

欧洲的成长稳步推进,工业4.0的实施以及《数位十年指令》强制要求在2030年实现Gigabit家庭网路连接。在阿尔卑斯山和希腊岛屿等地形崎岖的地区,Wi-Fi提供了一种经济高效的最后一公里解决方案。欧盟数位单一市场主导的开放漫游协议实现了跨境无缝连接,促进了偏远地区的旅游业和商务旅行。德国在工业领域主导Wi-Fi应用,而北欧国家则专注于智慧电网和永续性应用,这些应用依赖节能型行波管(TWT)调度。中东和非洲地区正在投资Wi-Fi,以实现经济多元化,摆脱对油气资源的依赖,并弥合沙漠和山区农村地区的数位落差。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 物联网和智慧设备的兴起

- 智慧城市计画与公共Wi-Fi部署

- WiFi 6/6E 的快速普及以及 WiFi 7 的即将推出

- 由于混合/远端办公模式的兴起,对高容量无线区域网路 (WLAN) 的需求不断增长。

- WiFi 和 5G 与 OpenRoaming/Passpoint 的融合

- 适用于电池供电物联网节点的节能型TWT功能

- 市场限制

- 免执照频段的频谱拥塞和干扰

- 资料隐私和安全合规成本不断增加

- 在60 GHz频段,Li-Fi和替代技术将取代高密度WiFi应用场景。

- 晶片组供应限制导致 WiFi 7 设备发布延迟

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按组件

- 硬体

- 网路基地台

- 路由器和扩展器

- 无线控制器

- 其他设备类型

- 解决方案

- 服务

- 硬体

- 终端用户产业

- 消费者

- 企业/企业园区

- 教育

- 卫生保健

- 饭店和零售业

- 工业与物流

- 按地区

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲和纽西兰

- 亚太其他地区

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Cisco Systems, Inc.

- Hewlett Packard Enterprise(Aruba)

- Huawei Technologies Co., Ltd.

- CommScope Holding Company Inc.(Ruckus Networks)

- Juniper Networks Inc.

- Telefonaktiebolaget LM Ericsson

- Extreme Networks, Inc.

- Ubiquiti Inc.

- Fortinet Inc.

- TP-Link Technologies Co., Ltd.

- Netgear Inc.

- D-Link Corporation

- Zyxel Communications Corp.

- Qualcomm Technologies, Inc.

- Broadcom Inc.

- Intel Corporation

- MediaTek Inc.

- Cambium Networks Ltd.

- EnGenius Networks, Inc.(Elitegroup)

- Purple WiFi Ltd.

- Cloud4Wi Inc.

- MetTel Inc.

- Singtel Group

第七章 市场机会与未来展望

The Wi-Fi Market was valued at USD 18.48 billion in 2025 and estimated to grow from USD 21.06 billion in 2026 to reach USD 40.44 billion by 2031, at a CAGR of 13.94% during the forecast period (2026-2031).

Growing enterprise preference for wireless-first architecture, the commercial debut of Wi-Fi 7, and the adoption of OpenRoaming standards are the primary forces propelling this acceleration . Enterprises view high-capacity WLAN as pivotal for hybrid work enablement, edge-hosted artificial intelligence, and real-time industrial automation, prompting refresh cycles that shorten from eight years to five. Rapid mesh penetration in residential and small-office environments further broadens the addressable base, while federal broadband programs in North America stimulate public-sector opportunities. Spectrum allocations in the 6 GHz band supply temporary congestion relief, yet also spark demand for tri-band access points that can assure deterministic latency for robotics, telemedicine, and immersive reality services. The competitive landscape remains open because interoperability requirements prevent lock-in, allowing new service-centric entrants to challenge incumbent hardware vendors.

Global Wi-Fi Market Trends and Insights

Proliferation of IoT and smart devices

Enterprises deploy dense sensor networks that often exceed 100 connected endpoints per access point, a profile economically serviced only by Wi-Fi 6E's OFDMA scheduling and multi-user MIMO capabilities. Smart-building operators integrate HVAC, lighting, and surveillance over Wi-Fi mesh to cut structured-cabling costs by 40% and enable predictive maintenance analytics. Demand for sub-10 ms response in edge inference workflows makes Wi-Fi 7's multi-link operation attractive because it sustains jitter-free traffic under load. Industrial automation pilots report 99.9% uptime on dedicated 6 GHz channels versus 97.8% on congested 5 GHz links, validating the migration to new spectrum for mission-critical robotics. These gains encourage organizations to absorb higher capital outlays in return for long-run productivity .

Smart-city initiatives and public Wi-Fi roll-outs

Municipal broadband programs increasingly favor Wi-Fi as the primary medium for digital inclusion because installation is quicker and less capital-intensive than fiber in sprawling rural territories. The Philippines commits USD 1.2 billion to deploy more than 100,000 public hotspots across 17,000 barangays by 2028, a template mirrored by several emerging economies. Europe's Digital Decade targets gigabit coverage by 2030 and positions Wi-Fi 7 mesh as an affordable last-mile alternative in mountainous and island regions. Cities monetize infrastructure by layering sensor backhaul for traffic, air-quality, and emergency-response schemes that self-fund through efficiency gains. Neutral-host deployments that blend Wi-Fi and 5G radios under OpenRoaming agreements generate fresh revenue as roaming fees while delivering seamless citizen connectivity.

Spectrum congestion and interference in unlicensed bands

Dense urban precincts such as Manhattan experience throughput drops near 60% during peak usage, even when Wi-Fi 6E hardware is present, because legacy devices crowd the 2.4 GHz spectrum. Microwave ovens, Bluetooth handsets, and older routers create overlapping noise that adaptive algorithms cannot fully evade. Enterprises increasingly hire spectrum consultants, a service costing USD 50,000-200,000 on expansive campuses, to engineer channel plans that meet service-level objectives. Regulators consider quasi-licensed regimes akin to CBRS so that critical IoT traffic can operate free of consumer interference. Although the 6 GHz allocation temporarily alleviates pressure, forecasts show saturation within five years as IoT endpoints grow exponentially.

Other drivers and restraints analyzed in the detailed report include:

- Rapid adoption of Wi-Fi 6/6E and upcoming Wi-Fi 7

- Hybrid/remote work models demanding high-capacity WLAN

- Heightened data-privacy and security compliance costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, access points contributed 35.92% to the Wi-Fi market share, underlining hardware's continuing relevance even as revenue mix shifts. The services segment, however, is projected to compound at 15.98% through 2031, reflecting the pivot to Network-as-a-Service frameworks that convert upfront capital into recurring operating expense. Cost pressures commoditize standalone routers and range extenders, while cloud-native orchestration platforms take over the policy and analytics roles previously executed by on-premises controllers. Managed service providers leverage artificial intelligence to automate channel allocation, load balancing, and anomaly detection, ultimately delivering 75% fewer unplanned-outage minutes than customer-operated networks. By 2031, the Wi-Fi market size attributed to software and services is expected to eclipse hardware contribution in mature economies as organizations prioritize life-cycle flexibility over asset ownership.

The shift mirrors broader IT procurement trends that favor outcomes over ownership. Consumption-based pricing aligns WLAN costs with occupancy levels, flattening budget spikes and improving CFO visibility. Vendors bundle proactive maintenance, security compliance, and real-time experience scoring to differentiate beyond hardware. Edge gateways and ruggedized IoT bridges constitute a small but fast-rising category, supplying deterministic connectivity in harsh industrial zones where vibration, dust, and temperature extremes invalidate consumer-grade gear. As AI chips embed inside access points, even commodity hardware gains value when offered as a managed experience that abstracts complexity and accelerates time to productivity.

The Wi-Fi Market Report is Segmented by Component (Hardware, Solutions, Services), End-User Vertical (Consumer, Enterprise/Corporate Campuses, Education, Healthcare, Hospitality and Retail, Industrial and Logistics), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounts for 40.55% of the Wi-Fi market in 2025, owing to USD 65 billion in broadband incentives and rapid enterprise refresh cycles. Early access to 6 GHz spectrum allows institutions to pioneer tri-band deployments, creating a performance gap over regions still seeking regulatory clearance. Fortune 500 companies refresh their WLAN every five years, two years faster than the global average, to equip smart offices tailored for hybrid work. Healthcare and education pillars represent robust growth nodes as telehealth and distance learning require enterprise-grade reliability.

Asia Pacific records the fastest trajectory with a 15.12% CAGR through 2031, enabled by national digital strategies that treat wireless as primary rather than complementary infrastructure. China's factory-automation boom, amplified by policy to cultivate domestic chipset capability, translates to bulk orders for industrial-grade Wi-Fi 6E equipment. India's Digital India mission envisions connecting 600,000 villages via Wi-Fi mesh, making wireless the linchpin of rural inclusion. Southeast Asian economies integrate WLAN across tourism hubs and export-oriented manufacturing parks, while government subsidies shrink payback periods and accelerate deployments. Smart-city funding rounds across Jakarta, Bangkok, and Ho Chi Minh City further elevate regional demand.

Europe's growth remains orderly as Industry 4.0 uptake and Digital Decade mandates require gigabit household coverage by 2030. Wi-Fi serves as the cost-effective last-mile solution in rugged topographies like the Alps and the Greek islands. OpenRoaming agreements spearheaded by the EU Digital Single Market create frictionless cross-border connectivity, bolstering tourism and remote business travel. Germany leads industrial adoption, whereas Nordic nations focus on smart-grid and sustainability use cases that rely on energy-efficient TWT scheduling. The Middle East and Africa invest in Wi-Fi to diversify economies beyond hydrocarbons and to bridge digital divides in rural deserts and mountainous terrain.

- Cisco Systems, Inc.

- Hewlett Packard Enterprise (Aruba)

- Huawei Technologies Co., Ltd.

- CommScope Holding Company Inc.(Ruckus Networks)

- Juniper Networks Inc.

- Telefonaktiebolaget LM Ericsson

- Extreme Networks, Inc.

- Ubiquiti Inc.

- Fortinet Inc.

- TP-Link Technologies Co., Ltd.

- Netgear Inc.

- D-Link Corporation

- Zyxel Communications Corp.

- Qualcomm Technologies, Inc.

- Broadcom Inc.

- Intel Corporation

- MediaTek Inc.

- Cambium Networks Ltd.

- EnGenius Networks, Inc. (Elitegroup)

- Purple WiFi Ltd.

- Cloud4Wi Inc.

- MetTel Inc.

- Singtel Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of IoT and smart devices

- 4.2.2 Smart-city initiatives and public WiFi roll-outs

- 4.2.3 Rapid adoption of WiFi 6/6E and upcoming WiFi 7

- 4.2.4 Hybrid/remote work models demanding high-capacity WLAN

- 4.2.5 Convergence of WiFi and 5G via OpenRoaming/Passpoint

- 4.2.6 Energy-efficient TWT features for battery-powered IoT nodes

- 4.3 Market Restraints

- 4.3.1 Spectrum congestion and interference in unlicensed bands

- 4.3.2 Heightened data-privacy/security compliance costs

- 4.3.3 Li-Fi and 60 GHz alternatives cannibalizing dense-WiFi use cases

- 4.3.4 Chipset supply constraints delaying WiFi 7 device launches

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Access Points

- 5.1.1.2 Routers and Extenders

- 5.1.1.3 Wireless Controllers

- 5.1.1.4 Other Device Types

- 5.1.2 Solutions

- 5.1.3 Services

- 5.1.1 Hardware

- 5.2 By End-user Vertical

- 5.2.1 Consumer

- 5.2.2 Enterprise/Corporate Campuses

- 5.2.3 Education

- 5.2.4 Healthcare

- 5.2.5 Hospitality and Retail

- 5.2.6 Industrial and Logistics

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Argentina

- 5.3.2.3 Rest of South America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 Asia Pacific

- 5.3.4.1 China

- 5.3.4.2 Japan

- 5.3.4.3 South Korea

- 5.3.4.4 India

- 5.3.4.5 Australia and New Zealand

- 5.3.4.6 Rest of Asia Pacific

- 5.3.5 Middle East

- 5.3.5.1 GCC

- 5.3.5.2 Turkey

- 5.3.5.3 Rest of Middle East

- 5.3.6 Africa

- 5.3.6.1 South Africa

- 5.3.6.2 Nigeria

- 5.3.6.3 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Cisco Systems, Inc.

- 6.4.2 Hewlett Packard Enterprise (Aruba)

- 6.4.3 Huawei Technologies Co., Ltd.

- 6.4.4 CommScope Holding Company Inc.(Ruckus Networks)

- 6.4.5 Juniper Networks Inc.

- 6.4.6 Telefonaktiebolaget LM Ericsson

- 6.4.7 Extreme Networks, Inc.

- 6.4.8 Ubiquiti Inc.

- 6.4.9 Fortinet Inc.

- 6.4.10 TP-Link Technologies Co., Ltd.

- 6.4.11 Netgear Inc.

- 6.4.12 D-Link Corporation

- 6.4.13 Zyxel Communications Corp.

- 6.4.14 Qualcomm Technologies, Inc.

- 6.4.15 Broadcom Inc.

- 6.4.16 Intel Corporation

- 6.4.17 MediaTek Inc.

- 6.4.18 Cambium Networks Ltd.

- 6.4.19 EnGenius Networks, Inc. (Elitegroup)

- 6.4.20 Purple WiFi Ltd.

- 6.4.21 Cloud4Wi Inc.

- 6.4.22 MetTel Inc.

- 6.4.23 Singtel Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment