|

市场调查报告书

商品编码

1690923

固体级热塑性丙烯酸(珠)树脂:市场占有率分析、产业趋势和成长预测(2025-2030)Solid-grade Thermoplastic Acrylic (Beads) Resin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

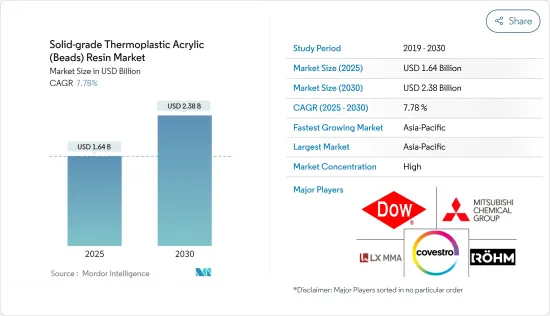

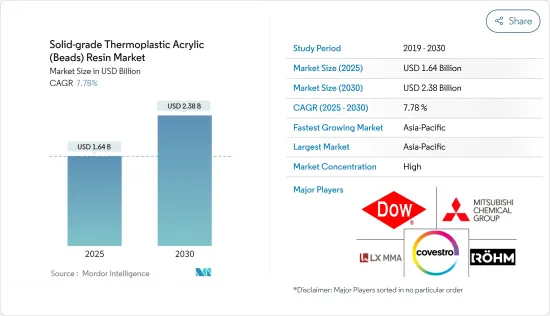

固体级热塑性丙烯酸树脂市场规模预计在 2025 年为 16.4 亿美元,预计到 2030 年将达到 23.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.78%。

由于全国范围内的封锁和保持社交距离的规定,导致供应链中断以及各种製造和建设活动关闭,COVID-19 疫情对 2020 年的市场产生了负面影响。然而,自从限制解除以来,情况正在逐渐改善。各行业对室内外油漆和涂料的需求不断增加,预计将对研究市场产生正面影响。

关键亮点

- 短期内,油漆和涂料行业的扩张以及固体级热塑性丙烯酸(珠)树脂提供的各种好处是推动市场需求的因素之一。

- 相反,政府对原材料的严格监管阻碍了市场的成长。

- 电动车产业的扩张可能会在未来几年为市场创造机会。

- 预计亚太地区将主导市场,并在预测期内实现最高的复合年增长率。

固体热塑性丙烯酸(珠状)树脂的市场趋势

在油漆和涂料行业的使用日益增多

- 固体级热塑性丙烯酸(珠状)树脂广泛用于油漆和被覆剂配方。此外,这些树脂主要用于工业涂料、建筑涂料、交通涂料和捲材涂料等油漆和涂料领域。

- 固体级热塑性丙烯酸(珠)树脂是油漆和涂料的强力黏合剂。这些树脂易溶于有机溶剂和紫外线单体。它也可溶于二甲苯、酯和酮。

- 这些树脂可与多种基材黏合,包括金属、塑胶和水泥材料。此外,它还耐用、有光泽、耐碱、干燥速度快,并且易于黏附在各种基材上。固体级热塑性丙烯酸树脂也用于木材涂料和电子涂料。

- 根据《涂料世界》报告,2021年各国各类涂料出口总合将达249亿美元,而2020年为216亿美元,且逐年呈现显着成长。此外,预计到 2022 年全球油漆和涂料市场价值将达到约 1,980 亿美元。

- 根据《涂料世界》的报告,亚洲是油漆和涂料行业最大的地区,占全球市场占有率的近45%,其次是北美,占23%,拉丁美洲占7%,中东和非洲占6%。

- 亚太地区持续的经济实力以及对基础设施、机械、製造设备等需求的相应增长预计将推动该地区对油漆和被覆剂的需求。此外,在钢铁、化工、石油和天然气、製造和建筑等终端用户产业,生产设施的扩建和投资的增加可能会带来新的机会。

- 根据美国涂料协会的报告,2022年美国建筑涂料市场规模约159亿美元。预计到2023年底将达到170亿美元以上。

- 加拿大约有 260 家油漆和涂料製造商。加拿大的油漆和涂料製造业规模比美国小,占年GDP的比重不到0.5%。

- 欧洲拥有许多大型涂料产业,其中主要经济体有德国、法国、义大利、西班牙。由于该地区有几家老字型大小企业,预计预测期内油漆和涂料行业将会扩大。德国是欧洲领先的油漆和涂料生产国之一。根据 Haltermann Carless 介绍,该国每年生产约 260 万吨油漆和被覆剂,用于汽车、建筑、一般工业和防腐等各种用途。

- 随着结构性改革的进行,中东和非洲对工业涂料的需求预计将强劲。此外,沙乌地阿拉伯宣布了「2030愿景」及其伴随的国家转型计画(NTP),带动了医疗保健和教育等各个领域的投资增加。

- 由于所有这些因素,预计固体级热塑性丙烯酸(珠)树脂市场在预测期内将稳定成长。

亚太地区占市场主导地位

- 预计亚太地区将主导市场。以国内生产毛额计算,中国是该地区最大的经济体。中国和印度是世界上成长最快的新兴经济体之一。

- 根据《涂料世界》的报告,到2022年,亚太地区仍将是全球油漆和涂料产业最具活力的地区。这是因为强劲的经济成长和有利的人口趋势使该地区多年来成为全球成长最快的油漆和涂料市场。

- 预计亚太地区的中产阶级人口将会增加,同时可支配所得也会增加。这促进了该地区住宅领域的扩张。因此,随着建筑业的发展,已成为建筑涂料最重要的市场之一。

- 此外,亚太地区是世界上成长最快的地区,新兴工业化国家数量不断成长。工业成长刺激了对能源基础设施的需求,进而推动了对油漆和涂料的需求。然而,由于新冠疫情导致的工厂关闭,亚太地区油漆和涂料市场的成长并不均衡,导致需求大幅波动。

- 此外,由于运输、建筑、建筑施工、电子、石油和天然气、太阳能和其他工业领域对丙烯酸复合材料、油漆和涂料的需求增加,预计未来几年亚太地区固体级热塑性丙烯酸(珠状)树脂的消费水准将大幅上升。

- 亚洲将成为最大的地区,占全球市场占有率的近45%,到2022年将达到900亿美元。亚洲最大的子区域是大中华区,占亚洲油漆和涂料市场的近58%。

- 根据欧洲涂料协会统计,中国有近1万家涂料製造商。全球大多数主要涂料製造商都在中国设有製造地,包括立邦涂料、阿克苏诺贝尔、中国船舶涂料、PPG工业、BASF和艾仕得涂料。油漆和涂料公司正在加大对该国的投资。

- 2022 年,印度涂料产业价值超过 6,200 亿印度卢比(80 亿美元)。过去二十年来,它一直保持着两位数的稳定成长,是全球成长最快的涂料经济体。该国有 3,000 多家涂料製造商,几乎所有全球公司都在那里运作。建筑涂料约占整个市场的75%,而工业涂料占25%。

- 根据《涂料世界》报道,泰国是最具活力的油漆和涂料市场之一。泰国的油漆和涂料市场高度集中,前四大公司(TOA Paint (Thailand) Public Company Limited、Akzo Nobel Paints (Thailand) Company Limited、Jotun Thailand Limited 和 Berger)占据了 75% 以上的市场占有率。

- 根据经济产业省统计,2021年日本合成树脂涂料产量约101万吨,涂料产量庞大。 2021 年涂料总产量从 2020 年的 150 万吨增加至约 153 万吨。

- 韩国的油漆和涂料市场是亚太地区第四大市场。 KCC、Samhwa Paints、Kangnam Jevisco(前身为 Kunsul Chemical Industrial Company,俗称 KCI)、Noroo Paints 和 Chokwang Paints 是主要的油漆和涂料製造商。它们在韩国油漆和涂料市场占据主导地位,累积市场占有率约为 75%,推动了丙烯酸在该行业的使用率提高。

- 此外,马来西亚的油漆涂料产业是东南亚地区最先进的产业之一,拥有约80家大、中、小型油漆涂料製造商。

- 澳洲油漆工业联合会(APMF)是监督该国油漆和涂料行业运作的官方机构。日本有220多家涂料製造商。主要企业包括多乐士集团、PPG工业公司、宣伟、阿克苏诺贝尔、艾仕得和Haymes Paints。

- 因此,预计上述因素将在预测期内推动亚太地区对固体级热塑性树脂(珠粒)的需求。

固体级热塑性丙烯酸(珠状)树脂产业概况

固体级热塑性丙烯酸(珠状)树脂市场本质上是整合的。市场的主要企业包括(不分先后顺序)科思创股份公司、陶氏化学公司、三菱化学公司、LX MMA 和罗姆有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 油漆和涂料行业的扩张

- 固体级热塑性丙烯酸(珠状)树脂的优势

- 限制因素

- 政府对原物料的严格监管

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 应用

- 丙烯酸复合树脂

- 油漆和涂料

- 线圈涂布

- 工业涂料

- 建筑涂料

- 交通运输涂料

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 其他的

- 南美洲

- 中东和非洲

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Chansieh Enterprises Co. Ltd.

- Covestro AG

- Dow

- Heyo Enterprises Co. Ltd.

- LX MMA

- Makevale Group

- Mitsubishi Chemical Corporation

- Pioneer Chemicals Co. Ltd.

- Polyols & Polymers Pvt. Ltd.

- Rohm Gmbh

- Suzhou Direction Chemical Co. Ltd.

- Trinseo

第七章 市场机会与未来趋势

- 电动汽车产业的扩张

The Solid-grade Thermoplastic Acrylic Resin Market size is estimated at USD 1.64 billion in 2025, and is expected to reach USD 2.38 billion by 2030, at a CAGR of 7.78% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market in 2020 due to nationwide lockdowns and social distancing mandates which led to supply chain disruption and the closure of various manufacturing industries and construction activities. However, the sector is recovering well since restrictions were lifted. Increasing demand for paints and coatings from different sectors in interior and exterior applications is expected to impact the studied market positively.

Key Highlights

- Over the short term, the expansion of the paint and coatings industry and the various benefits offered by solid-grade thermoplastic acrylic (beads) resins are some of the factors driving the market demand.

- Conversely, stringent government regulations regarding raw materials hinder the market's growth.

- Expansion of the electric vehicle industry is likely to create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Solid-grade Thermoplastic Acrylic (Beads) Resin Market Trends

Increasing Usage in the Paints and Coatings Industry

- Solid-grade thermoplastic acrylic (beads) resins are widely used in the formulation of paints and coatings. Furthermore, these resins are used primarily in industrial, architectural, transportation, and coil coatings in the paints and coatings segment.

- Solid-grade thermoplastic acrylic (beads) resins are a strong binder for paints and coatings. These resins can be easily dissolved in organic solvents or UV monomers. They are also soluble in xylene, esters, and ketones.

- These resins offer adhesion to multiple substrates such as metal, plastics, and cementitious. Furthermore, they are durable, have a high gloss, offer good alkali resistance, are fast drying, and easily adhere to a broad substrate range. Solid-grade thermoplastic acrylic resins are also used in wood coatings, electronic coatings, and others.

- According to the Coating World report, the combined exports of various types of paint from all countries amounted to around USD 24.9 billion in 2021, compared to USD 21.6 billion in 2020. It also indicates a notable increase in years. Furthermore, the global paints and coatings market stood at around USD 198 billion in 2022.

- For the paints and coatings industry, Asia is the largest region, with nearly 45% of the global market share, followed by Europe with a 23% share, North America with a 19% share, Latin America with a 7% share, and the Middle East and Africa with a 6% share, as per the Coating World report.

- Asia-Pacific region's continuing economic strength and corresponding increasing need for infrastructure, machinery, manufacturing units, and others are likely to propel the demand for paints and coatings in the region. In addition, expanding production units and increasing investments in the area will likely offer newer opportunities in the end-user industries such as iron and steel, chemical, oil and gas, manufacturing, construction, and others.

- According to the report of the American Coatings Association, in 2022, the market value of architectural coatings in the United States was around USD 15.9 billion. It will likely reach more than USD 17 billion by the end of 2023.

- Canada includes around 260 paint and coating manufacturers. Canada's domestic paint and coating manufacturing industries are fewer than the United States and contribute less than 0.5% to its annual GDP.

- Europe is home to many large paint industries, with the four largest mainland economies, including Germany, France, Italy, and Spain. The presence of several well-established players in the region is projected to expand the paints and coatings segment over the forecast period. Germany is among the leading producers of paints and coatings in Europe. According to Haltermann Carless, the country produces approximately 2.6 million tons of paints and coatings annually, used in various applications such as automotive, architectural, general industry, corrosion protection, and others.

- Due to the region's increasing structural reforms, the Middle East and African regions are anticipated to witness strong demand for industrial coatings. In addition, the announcement of Vision 2030, coupled with the associated National Transformation Plan (NTP), increased investments in various sectors, including healthcare and education in Saudi Arabia.

- Due to all such factors, the market for solid-grade thermoplastic acrylic (beads) resins is expected to grow steadily during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market. In the area, China is the largest economy in terms of GDP. China and India are among the fastest emerging economies in the world.

- As per the report by Coatings World, the Asia-Pacific region continued to be the most dynamic in the paint and coatings industry worldwide in 2022. It happened to owe to strong economic growth coupled with favorable demographic trends that have made this region the fastest-growing paint and coatings market across the globe for many years.

- The Asia-Pacific region is anticipated to witness an increasing middle-class population coupled with rising disposable income. It facilitated the expansion of the residential sector in the area. Hence, it is the most significant architectural coatings market due to the construction industry's development.

- In addition, Asia-Pacific is the fastest-growing region in the world, with more and more countries becoming newly industrialized. This industrial growth is fuelling the demand for energy infrastructure, which is also multiplying, driving the need for paints and coatings. However, due to COVID-19 pandemic-induced lockdowns, the paints and coatings market growth in the Asia-Pacific region was uneven, resulting in large swings in demand.

- Moreover, the consumption levels of solid-grade thermoplastic acrylic (beads) resins in the Asia-Pacific region are expected to rise at a significant rate in the coming years, owing to the increasing demand for acrylic composites, paints, and coatings from the transportation, architectural, building, and construction, electronics, oil and gas, solar power, and other industrial sectors.

- Asia is the largest region, with nearly 45% of the global market share, amounting to USD 90 billion in 2022. Within Asia, the largest sub-region is Greater China which accounts for almost 58% of the Asian paint and coatings market.

- According to European Coatings, nearly 10,000 coatings manufacturers are located in China. Most leading global coating manufacturers, such as Nippon Paint, AkzoNobel, Chugoku Marine Paints, PPG Industries, BASF SE, and Axalta Coatings, have manufacturing bases in China. Paints and coatings companies have been increasingly growing investments in the country.

- In 2022, the Indian Paint Industry was valued at over INR 62,000 crores (USD 8 billion). It is the fastest-growing paint economy globally, with stable double-digit growth over the last two decades. The country includes over 3,000 paint manufacturers, with nearly all global companies present. Architectural paints constitute around 75% of the overall market, and industrial paints take a 25% share.

- As per the Coatings World, Thailand is one of the most vibrant paints and coatings markets. Thailand's paints and coatings market is highly consolidated in nature, with the top four players [TOA Paint (Thailand) Public Company Limited, Akzo Nobel Paints (Thailand) Company Limited, Jotun Thailand Limited, and Berger Co. Ltd] accounting for more than 75% of market share.

- According to the Ministry of Economy, Trade, and Industry (Japan), the production volume of synthetic resin paints in Japan amounted to approximately 1.01 million metric tons in 2021, making up an enormous production volume of paints. Overall, paints' production volume increased to nearly 1.53 million metric tons in 2021, compared to 1.50 million metric tons in 2020.

- The South Korean paint and coating market is the fourth-largest in the Asia-Pacific region. KCC, Samhwa Paints, Kangnam Jevisco (formerly Kunsul Chemical Industrial Company, popularly called KCI), Noroo Paints, and Chokwang Paints are the primary paint and coating producers. They dominate the South Korean paints and coating market with a cumulative market share of approximately 75%, enhancing acrylic acid usage in the industry.

- Furthermore, catered by about 80 large, mid-sized, and small-scale paint and coatings producers, the Malaysian paints and coatings industry is one of the most advanced product offerings in the Southeast Asian region.

- The Australian Paint Manufacturers' Federation Inc. (APMF) is the official association that monitors the functioning of the paints and coatings industry in the country. There were more than 220 manufacturers of paints and coatings in the country. The major companies include Dulux Group, PPG Industries, Sherwin-Williams, Akzo Nobel, Axalta, and Haymes Paints.

- Thus, the above factors are expected to propel the demand for solid-grade thermoplastic resins (beads) in the Asia-Pacific region during the forecasted period.

Solid-grade Thermoplastic Acrylic (Beads) Resin Industry Overview

The solid-grade thermoplastic acrylic (beads) resin market is consolidated in nature. Some of the major players in the market include Covestro AG, Dow, Mitsubishi Chemical Corporation, LX MMA, and Rohm GmbH, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Expansion of the Paints and Coatings Industry

- 4.1.2 Benefits of Solid-grade Thermoplastic Acrylic (beads) Resins

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations Related to Raw Materials

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Acrylic Composite Resins

- 5.1.2 Paints and Coatings

- 5.1.2.1 Coil Coatings

- 5.1.2.2 Industrial Coatings

- 5.1.2.3 Architectural Coatings

- 5.1.2.4 Transportation Coatings

- 5.1.3 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 Rest of the World

- 5.2.4.1 South America

- 5.2.4.2 Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chansieh Enterprises Co. Ltd.

- 6.4.2 Covestro AG

- 6.4.3 Dow

- 6.4.4 Heyo Enterprises Co. Ltd.

- 6.4.5 LX MMA

- 6.4.6 Makevale Group

- 6.4.7 Mitsubishi Chemical Corporation

- 6.4.8 Pioneer Chemicals Co. Ltd.

- 6.4.9 Polyols & Polymers Pvt. Ltd.

- 6.4.10 Rohm Gmbh

- 6.4.11 Suzhou Direction Chemical Co. Ltd.

- 6.4.12 Trinseo

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion of the Electric Vehicle Industry