|

市场调查报告书

商品编码

1445737

自动化机器学习 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Automated Machine Learning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

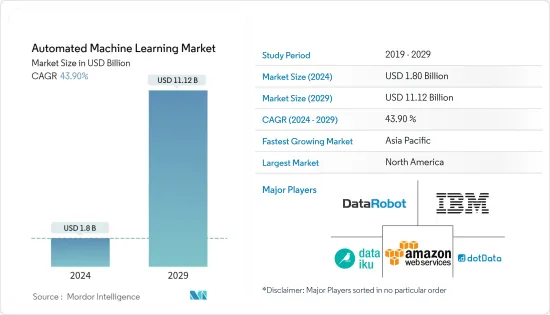

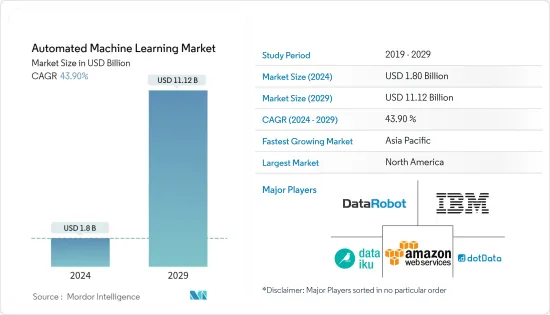

自动化机器学习市场规模预计到 2024 年将达到 18 亿美元,预计到 2029 年将达到 111.2 亿美元,在预测期内(2024-2029 年)CAGR为 43.90%。

主要亮点

- 机器学习 (ML) 是人工智慧 (AI) 的一个子领域,它使训练演算法能够透过统计方法进行分类或预测,从而揭示资料探勘项目中的关键见解。这些见解推动应用程式和业务内的决策,理想情况下会影响关键成长指标。由于它围绕着演算法、模型和计算复杂性,因此必须由熟练的专业人员开发这些解决方案。

- 机器学习 (ML) 已成为业务许多部分的重要组成部分。另一方面,建立高效能机器学习应用程式需要高度专业化的资料科学家和领域专家。自动化机器学习 (AutoML) 旨在透过允许领域专家在没有大量统计和机器学习知识的情况下自动建立机器学习应用程式来减少资料科学家的需求。

- 由于资料科学和人工智慧的改进,自动化机器学习的性能得到了提高。公司认识到这项技术的潜力,因此其采用率在预测期内可能会上升。公司正在以订阅方式销售自动化机器学习解决方案,使客户更容易使用该技术。此外,它还提供按需付费的灵活性。

- 机器学习 (ML) 越来越多地应用于许多应用中,但机器学习专家不足,无法充分支援这种增长。自动化机器学习 (AutoML) 的目标是让机器学习更容易使用。因此,专家应该能够部署更多的机器学习系统,并且与直接使用 ML 相比,使用 AutoML 所需的专业知识更少。然而,技术采用仍然肤浅,限制了市场的成长。

- 在 COVID-19 大流行之后,随着公司转向利用智慧解决方案来实现业务流程自动化,人工智慧的采用正在增加。预计这一趋势将在未来几年持续下去,进一步推动人工智慧在组织流程中的采用。

自动机器学习 (AutoML) 市场趋势

BFSI 将成为最大的最终用户产业

- 近年来,人工智慧(AI)和机器技术越来越多地应用于银行、金融服务和保险(BFSI)行业,以提高营运效率并改善消费者体验。随着资料获得更多关注,对机器学习 BFSI 应用程式的需求不断增长。自动化机器学习可以利用大量资料、经济的处理能力和经济的储存来产生准确、快速的结果。

- 机器学习 (ML) 支援的解决方案还使金融公司能够透过智慧流程自动化实现重复操作的自动化,从而取代体力劳动,从而提高企业生产力。在预测期内,范例包括聊天机器人、文书工作自动化和员工培训游戏化。机器学习预计将用于自动化财务流程。

- COVID-19 大流行后,金融机构对透过数位管道接触并帮助客户表现出越来越大的兴趣。各种数位解决方案,包括聊天机器人、开户和管理支援以及技术援助,在金融领域的采用激增。值得注意的是,Posh.Tech、Spixii 等金融科技公司现在提供智慧聊天机器人,旨在促进银行面向客户的基本功能

- 随着风险管理压力的增加以及治理和监管要求的提高,银行必须加强服务,以提供更好的客户服务。银行诈欺案件数量的增加预计将增加人工智慧和机器学习的采用。一些金融科技品牌越来越多地在多个管道的各种应用程式中使用人工智慧和机器学习,以利用可用的客户资料并预测客户的需求如何变化,哪些诈骗活动最有可能攻击系统,以及哪些服务将证明是有益的,其中其他的。

北美将占据重要市场份额

- 由于强大的创新生态系统、联邦对先进技术的战略投资的推动,再加上来自世界各地的有远见的科学家和企业家以及公认的研究机构的存在,美国预计将在市场上占有相当大的份额.推动了自动化机器学习(AutoML)的发展。

- 包括州和地方政府在内的各个政府处理大量的公民资料,这些数据以前储存在纸本文件上并进行手动处理。然而,随着人工智慧(AI)和机器学习技术提供更快、更准确的资料收集和处理方法,政府可以专注于更复杂和长期的社会和文化问题。此外,federatedML 商业应用的增加预计将进一步推动对 AutoML 的需求。

- 加拿大政府表示,人工智慧 (AI) 技术对于改善加拿大政府为其公民提供服务的方式具有巨大前景。当政府调查人工智慧在政府计画和服务中的使用时,它确保明确的价值观、道德和规则来指导它。

- 在美国试图建立 AutoML 霸主地位的同时,加拿大也正在为此类发展做准备。例如,2023 年 4 月,ePayPolicy 推出了 Payables Connect,这是其保险支付和对帐产品套件的新成员。它利用 ePay 现有的整合和机器学习技术来完全自动化到期应付帐款的对帐、创建和支付。

- 儘管加拿大仍处于在各个行业部署自动化机器学习的初始阶段,但一些因素,包括金融部门自动化需求的不断增长以及学生对教育兴趣的兴起,预计将推动市场成长。

- 该地区的 AutoML 市场正在因云端而发生变化,无伺服器运算使创建者能够快速启动并运行 ML 应用程式。

自动机器学习 (AutoML) 产业概述

全球自动化机器学习市场表现出适度的分散性,众多参与者满足市场需求。新进入者的涌入推动了竞争的加剧,促使现有参与者制定扩大客户群的策略。随着现有市场参与者努力开发尖端产品,这种动态格局也刺激了创新。着名的行业领导者包括 Datarobot Inc.、Amazon Web Services Inc.、dotData Inc.、IBM Corporation 和 Dataiku。

2023 年 8 月,DataRobot 推出了新的生成人工智慧 (AI) 产品,其中包括平台功能和应用人工智慧服务,旨在透过产生人工智慧来加快从概念到价值的旅程。

2023 年 8 月,dotData Inc. 推出了新一代无程式码 MLOps 平台 dotData Ops。该平台透过提供直觉的自助服务环境来帮助机器学习工程师高效部署和操作资料、功能和预测管道。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场驱动因素

- 对高效诈欺检测解决方案的需求不断增长

- 对智慧业务流程的需求不断增长

- 市场限制

- 自动化机器学习工具的采用缓慢

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

- 评估 COVID-19 对市场的影响

第 5 章:市场细分

- 按解决方案

- 独立或本地部署

- 云

- 按自动化类型

- 资料处理

- 特征工程

- 造型

- 视觉化

- 由最终用户

- BFSI

- 零售与电子商务

- 卫生保健

- 製造业

- 其他最终用户

- 按地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太

- 中国

- 日本

- 韩国

- 亚太其他地区

- 世界其他地区

- 北美洲

第 6 章:竞争格局

- 公司简介

- DataRobot Inc.

- Amazon web services Inc.

- dotData Inc.

- IBM Corporation

- Dataiku

- SAS Institute Inc.

- Microsoft Corporation

- Google LLC (Alphabet Inc.)

- H2O.ai

- Aible Inc.

第 7 章:投资分析

第 8 章:市场的未来

The Automated Machine Learning Market size is estimated at USD 1.8 billion in 2024, and is expected to reach USD 11.12 billion by 2029, growing at a CAGR of 43.90% during the forecast period (2024-2029).

Key Highlights

- Machine learning (ML) is a subfield of artificial intelligence (AI) that enables training algorithms to make classifications or predictions through statistical methods, uncovering key insights within data mining projects. These insights drive decision-making within applications and businesses, ideally impacting key growth metrics. Since it revolves around algorithms, models, and computational complexity, skilled professionals must develop these solutions.

- Machine learning (ML) has become an essential component of many parts of the business. On the other hand, building high-performance machine learning applications necessitates highly specialized data scientists and domain experts. Automated machine learning (AutoML) aims to decrease data scientists' needs by allowing domain experts to automatically construct machine learning applications without considerable knowledge of statistics and machine learning.

- The performance of automated machine learning has advanced due to data science and artificial intelligence improvements. Companies recognize the potential of this technology, and hence its adoption rate is likely to rise over the forecast period. Companies are selling automated machine learning solutions on a subscription basis, making it easier for customers to use this technology. Furthermore, it offers flexibility on a pay-as-you-go basis.

- Machine learning (ML) is increasingly used in many applications, but there are insufficient machine learning experts to support this growth adequately. With automated machine learning (AutoML), the aim is to make machine learning easier to use. Therefore, experts should be able to deploy more machine learning systems, and less expertise would be needed to work with AutoML than when working with ML directly. However, the technology adoption is still shallow, restraining the market's growth.

- The adoption of AI is witnessing an increase after the COVID-19 pandemic as companies move towards leveraging intelligent solutions for automating their business processes. This trend is expected to continue over the coming years, further driving the adoption of AI in organizational processes.

Automated Machine Learning (AutoML) Market Trends

BFSI to be the Largest End-user Industry

- In recent years, artificial intelligence (AI) and machine technologies have been increasingly adopted in the banking, financial services, and insurance (BFSI) industry to enhance operational efficiency and improve the consumer experience. As data gain more attention, the demand for machine learning BFSI applications grows. Automated machine learning can produce accurate and rapid results with enormous data, affordable processing power, and economical storage.

- Machine learning (ML)-powered solutions also enable finance firms to replace manual labor by automating repetitive operations through intelligent process automation, increasing corporate productivity. Over the predicted period, examples include chatbots, paperwork automation, and employee training gamification. Machine learning is expected to be used to automate financial processes.

- Post-COVID-19 pandemic, financial institutions are showing a growing interest in reaching and assisting customers through digital channels. Various digital solutions, including chatbots, support for account opening and management, and technical assistance, have seen a surge in adoption within the financial sector. Notably, fintech companies like Posh.Tech, Spixii, and numerous others now provide intelligent chatbots designed to facilitate essential customer-facing functions for banks

- Banks must enhance their services to offer better customer service with the rising pressure in managing risk and increasing governance and regulatory requirements. The rising number of bank fraud cases is expected to increase the adoption of AI and ML. Some fintech brands have been increasingly using AI and ML in various applications across multiple channels to leverage available client data and predict how customers' needs are evolving, which fraudulent activities have the highest possibility to attack a system, and what services will prove beneficial, among others.

North America to Hold Significant Market Share

- The United States is expected to hold a substantial share in the market owing to the strong innovation ecosystem, fueled by strategic federal investments into advanced technology, complemented by the existence of visionary scientists and entrepreneurs coming together from across the world and recognized research institutions, which has driven the development of automated machine learning (AutoML).

- Various governments, including state and local governments, handle enormous quantities of citizen data, which had earlier been stored on paper and processed manually. However, as artificial intelligence (AI) and machine learning technologies provide faster and more accurate data-gathering and processing methods, governments can focus on more complex and long-term social and cultural issues. Further, an increase in commercial applications for federatedML is further expected to drive demand for AutoML.

- According to the Government of Canada, artificial intelligence (AI) technologies hold great promise for enhancing how the Canadian government serves its citizens. As the government investigates the use of artificial intelligence in government programs and services, it ensures that clear values, ethics, and rules guide it.

- While the US is trying to establish AutoML supremacy, Canada is also gearing up for such developments. For instance, in April 2023, ePayPolicy launched Payables Connect, the new addition to its suite of insurance payment and reconciliation products. It leverages ePay's existing integration and machine learning technology to completely automate the reconciliation, creation, and payment of due payables.

- Though Canada is still in the initial phase of deploying automated machine learning across various industries, some factors, including the rising need to automate the financial sector and the emerging educational interest among students, are expected to drive market growth.

- The region's AutoML marketplace is changing due to the cloud, and serverless computing allows creators to get ML applications up and running quickly.

Automated Machine Learning (AutoML) Industry Overview

The global automated machine learning market exhibits moderate fragmentation, with numerous players meeting market demands. Intensifying competition is driven by the influx of new entrants, prompting existing participants to devise strategies for expanding their customer base. This dynamic landscape also spurs innovation as existing market players strive to develop cutting-edge products. Notable industry leaders include Datarobot Inc., Amazon Web Services Inc., dotData Inc., IBM Corporation, and Dataiku.

In August 2023, DataRobot introduced a new generative artificial intelligence (AI) offering comprising platform capabilities and applied AI services designed to expedite the journey from concept to value with generative AI.

In August 2023, dotData Inc. launched dotData Ops, a next-generation no-code MLOps platform. This platform empowers ML engineers by delivering an intuitive, self-service environment for the efficient deployment and operationalization of data, feature, and prediction pipelines.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Efficient Fraud Detection Solutions

- 4.1.2 Growing Demand for Intelligent Business Processes

- 4.2 Market Restraints

- 4.2.1 Slow Adoption of Automated Machine Learning Tools

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Solution

- 5.1.1 Standalone or On-Premise

- 5.1.2 Cloud

- 5.2 By Automation Type

- 5.2.1 Data Processing

- 5.2.2 Feature Engineering

- 5.2.3 Modeling

- 5.2.4 Visualization

- 5.3 By End Users

- 5.3.1 BFSI

- 5.3.2 Retail and E-Commerce

- 5.3.3 Healthcare

- 5.3.4 Manufacturing

- 5.3.5 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 South Korea

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 DataRobot Inc.

- 6.1.2 Amazon web services Inc.

- 6.1.3 dotData Inc.

- 6.1.4 IBM Corporation

- 6.1.5 Dataiku

- 6.1.6 SAS Institute Inc.

- 6.1.7 Microsoft Corporation

- 6.1.8 Google LLC (Alphabet Inc.)

- 6.1.9 H2O.ai

- 6.1.10 Aible Inc.