|

市场调查报告书

商品编码

1445760

主动式与被动电子元件- 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Active and Passive Electronic Components - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

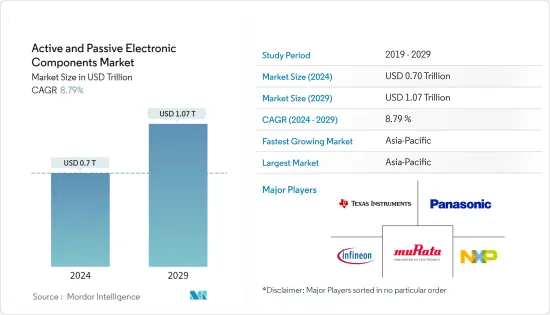

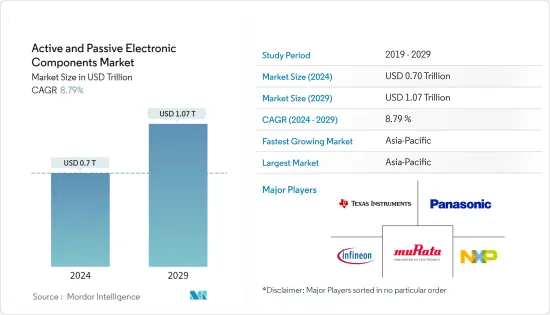

主动和被动电子元件市场规模预计到 2024 年将达到 0.7 兆美元,预计到 2029 年将达到 1.07 兆美元,在预测期内(2024-2029 年)CAGR为 8.79%。

主动式和被动电子元件是任何半导体/电子设备的建构模组。这些组件功能简单,在为电子系统供电方面发挥着至关重要的作用。主动元件是依赖外部电源来修改/控制电讯号的电子电路的一部分,被动电子元件则不需要外部电源来发挥作用。他们使用其他属性来控制电讯号。

主要亮点

- 有源和无源电子市场在过去几年中出现了显着增长,这主要是由于各个行业的数位化程度不断提高。这导致消费性电子产品在各个领域的采用不断增加,以及对连接性和移动性的需求不断增长。随着这些发展,电子产品的复杂性也增加了。这加速了对零件的需求,特别是在汽车和消费性电子产业。

- 消费性电子产业当前的趋势之一是对更小、更轻和更高性能的电子产品日益增长的需求和需求,即电子产品和组件的小型化。快速的技术进步导致了在单一平台上整合多种功能的产品的出现。

- 消费性电子产业是有源和被动电子元件的主要消费者之一。这些组件是电脑、手机和其他几种电子设备等设备中电路的基本建构模组。例如,电晶体执行各种功能,例如放大、电压调节、开关、讯号调製和振盪器。

- 硅、铁、镍、钼等原物料价格近期出现明显变动。受疫情影响,全球贵金属市场进一步受到供应链问题的不利影响,也对市场价格产生影响。钯、镍和钌价格的上涨影响了特定大批量零件的整体生产成本,对市场的成长构成了挑战。

- 在COVID-19大流行期间,医疗保健领域对有源和无源元件的需求大幅增加,以加快检测和治疗过程并增强远端患者监控能力;医疗机构对先进电子设备进行了大量投资,进而推动了对电晶体、电容器、扩大机等组件的需求。

- 例如,对具有模组化架构的电化学电晶体的需求见证了用于快速定量复杂体液中特定抗原的单分子至纳摩尔水平的感测设备的显着增加。此外,在新冠肺炎疫情期间,还观察到了雷射诱导石墨烯场效电晶体 (LIG-FET) 用于检测 SARS-CoV-2 的各种用例。随着这些组件被证明是有益的,进一步的技术创新预计将在后 COVID-19 时期带来新的成长机会。

主动式和被动电子元件市场趋势

5G 技术的日益采用正在推动市场发展

- 5G 不仅对于通讯产业而言是一项突破性创新,预计还将对消费性电子、汽车、工业等各个产业的成长产生重大影响,因为 5G 提供的快速、低延迟连接将显着扩大用例跨越这些产业。

- 爱立信预计,全球5G用户数量预计将快速增长,从2019年的区区1269万增长到2027年的43.7273亿。此外,东北亚预计将拥有最多的5G用户,到2027年将达到17.056亿。2027 年。

- 这些趋势预计将为每个科技产业开启一个充满可能性的新世界,因为 5G 提供的低延迟和快速速度是智慧自动化、人工智慧 (AI)、物联网 (IoT) 进一步发展所需要的。 )、自动驾驶汽车、扩展现实、区块链以及其他一些有待探索的技术。

- 根据高通公司的一项研究,到2035 年,5G 将为整个汽车行业带来超过2.4 兆美元的收入。随着数以百万计的车辆利用行动技术进行即时导航、紧急服务、互联资讯娱乐等,5G 的出现将催生一系列新的应用,例如车对车、车对网路 (V2N)、车对基础设施 (V2I) 和车对行人 (V2P) 通讯。

- 此外,5G预计也将对消费性电子产业的成长产生类似的影响。由于低延迟和快速连接网路的可用性,对物联网连接的消费设备的需求将会成长。这些趋势结合起来将支持所研究市场在预测期内的成长。

亚太地区预计将出现显着成长

- 不断发展的电子产业正在吸引多家跨国公司在亚洲国家独立或透过与不同地区公司成立合资企业设立製造工厂。其中包括 Tyco Electronics、FCI OEN、Molex、Vishay 和 EPCOS 等大型全球组织。预计这将进一步促进亚太地区电阻器的本地製造活动。

- 在中国,所研究市场的成长也可归因于电子产业的蓬勃发展。电子产业是中国最大的产业之一,对国家整体经济成长做出了重要贡献。例如,根据中华人民共和国国务院的数据,2022年1月至2月两个月,主要电子产品製造商增加价值年增12.7%,而2022年同期成长7.5%。该国的整体工业部门。中国是电视、智慧型手机、笔记型电脑和个人电脑、冰箱和空调等电子设备的全球领先生产国。

- 日本的电子产品产业是世界上最大的产业之一,也是推动该国半导体销售需求的最重要因素。日本电子资讯科技产业协会(JEITA)的数据显示,2021年日本电子设备产值较上年增长10.6%,2021年产值约3.94兆日圆。可支配收入不断增加人们的消费观念及其对智慧家庭和智慧商业环境的偏好是日本消费性电子产品成长的重要驱动力。

- 韩国在全球半导体记忆体市场中占据了显着地位。韩国的资料中心市场是成长最快的市场之一,吸引了许多外国企业越来越多的投资。例如,2022 年 4 月,Digital Edge (Singapore) Holdings Pte.有限公司计划透过与 SK eco 工厂合作在韩国仁川开发一个资料中心。两家公司将在仁川富平区国家工业园区共同兴建120MW超大规模资料中心开发案。

- 电子製造业对台湾国内生产毛额(GDP)贡献巨大。台湾积体电路製造公司(TSMC)是该地区最重要的半导体製造商。近日,台积电公布了2022年第二季财报,营收年增36.6%。该公司表示,这一显着成长的最重要原因之一是高效能运算(HPC)产业客户的快速扩张。其中包括人工智慧研究人员、亚马逊网路服务等云端供应商的资料中心以及边缘运算网路。第二季 HPC 营收季增 14%,目前占台积电整体营收的 43%。

主动式和被动电子元件产业概览

主动和被动电子元件市场由长期成熟的参与者组成,他们在产品上进行了大量投资。新进入市场的参与者需要大量投资。这些公司可以透过强大的竞争策略来维持自身的发展。产品创新也有利于新参与者,因为他们可以瞄准新兴和较少探索的应用领域,进一步扩大其市场份额。市场竞争程度很高,预计在预测期内将保持不变。

2022 年 12 月,TDK 公司推出了 ModCap HF,这是一款专为直流母线应用而设计的模组化电容器,可在极高的开关频率下运作。 B25647A* 系列中的六个新创建的电力电容器的额定电压在 900 至 1600 伏特之间,电容范围在 640 至 1850 微法拉之间。最高允许热点温度为 90 °C,额定电流范围为 160 A 至 210 A,视类型而定。

2022年10月,全球顶级被动元件供应商国巨集团发表车规级薄膜贴片电阻-RP系列。 RP系列独特的钝化设计创造了防水介面。此盖屏蔽电阻层,防止湿气从外部进入。凭藉这种防御,RP 系列可以在具有挑战性的条件下保持高电阻稳定性,使其成为电力系统、工业/医疗设备、电信、工业/汽车电子和工业/工业设备的理想选择。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力——波特五力

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 竞争激烈程度

- 替代品的威胁

- COVID-19 对产业的影响

第 5 章:市场动态

- 市场驱动因素

- 对小型化设计的偏好日益增加

- 计算、通讯和消费性电子产品数量不断增长

- 5G 技术的采用率不断提高

- 市场限制

- 金属价格上涨影响零件生产成本

第 6 章:市场细分

- 按组件

- 主动元件

- 电晶体

- 二极体

- 积体电路 (IC)

- 扩大机

- 真空管

- 被动元件

- 电容器

- 电感器

- 电阻器

- 主动元件

- 按最终用户产业

- 汽车

- 消费性电子与计算

- 医疗的

- 工业的

- 通讯

- 其他最终用户产业

- 按地理

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第 7 章:竞争格局

- 公司简介

- Infineon Technologies AG

- NXP Semiconductors NV

- Texas Instruments, Inc.

- Panasonic Corporation

- Murata Manufacturing Co. Ltd

- Eaton Corporation

- TE Connectivity Ltd.

- Honeywell International Inc.

- Toshiba Corp.

- Vishay Intertechnology Inc.

- YAGEO Corporation

- TDK Corporation

- KEMET Corporation (Yageo Corporation)

- AVX Corporation (Kyocera Corp)

- Lelon Electronics Corporation

- Taiyo Yuden Co. Ltd

第 8 章:投资分析

第 9 章:市场的未来

The Active and Passive Electronic Components Market size is estimated at USD 0.7 trillion in 2024, and is expected to reach USD 1.07 trillion by 2029, growing at a CAGR of 8.79% during the forecast period (2024-2029).

Active and passive electronic components are any semiconductor/electronic device's building blocks. With their simple functionalities, these components play a crucial role in powering an electronic system. While active components are part of an electronic circuit that relies on an external power source to modify/control electrical signals, passive electronic components do not need an external power source to function. They use other properties to control the electrical signal.

Key Highlights

- The active and passive electronics market witnessed significant growth over the past few years, primarily due to the increasing digitalization of various sectors. This resulted in the growing adoption of consumer electronics across sectors and the rising need for connectivity and mobility. With these developments, the complexity of electronic products also increased. This accelerated the need for components, especially in the automotive and consumer electronics industries.

- One of the current trends in the consumer electronics industry is the growing demand and need for smaller, lighter, and higher-performing electronics, i.e., the miniaturization of electronics and components. Rapid technological advances have led to the availability of products that incorporate multiple features on a single platform.

- The consumer electronics industry is among the major consumer of active and passive electronic components. These components are among the fundamental building blocks of the circuitry in devices such as computers, cell phones, and several other electronic devices. For instance, a transistor performs various functions such as amplification, voltage regulation, switching, signal modulation, and oscillators.

- The raw materials prices, such as silicon, iron, nickel, and molybdenum, have recently seen significant changes. With the pandemic's influence, the global precious metal market is further witnessing adverse effects of supply chain issues, which also impact the market prices. This increase in the price of palladium, nickel, and ruthenium impacts the overall cost of production for specific large-volume components, challenging the market's growth.

- During the COVID-19 pandemic, the demand for active and passive components increased significantly across the medical and healthcare sector to speed up the detection and treatment process as well as to enhance remote patient monitoring capabilities; healthcare institutions significantly invested in advanced electronic devices, which in turn drove the demand for components such as transistors, capacitors, amplifiers, etc.

- For instance, the demand for electrochemical transistors with a modular architecture witnessed a notable increase in use in sensing devices for the rapid quantification of single-molecule-to-nanomolar levels of specific antigens in complex bodily fluids. Furthermore, various use cases of laser-induced graphene field-effect transistors (LIG-FET) for detecting SARS-CoV-2 were also observed during the COVID period. With these components proving beneficial, further technological innovations are expected to open new growth opportunities in the post-COVID-19 period.

Active & Passive Electronic Components Market Trends

Increasing Adoption of 5G Technology is Driving the Market

- 5G has been a groundbreaking innovation not just for the communication industry but is expected to significantly impact the growth of various industries, including consumer electronics, automotive, industrial, etc., as the fast and low latency connectivity offered by 5G will significantly expand use cases across these industries.

- According to Ericsson, the global number 5G subscriptions are expected to expand rapidly, growing up from a mere 12.69 million in 2019 to 4,372.73 million by 2027. Furthermore, Northeast Asia is expected to hold the largest number of 5G subscribers, reaching 1,705.6 million subscribers by 2027.

- Such trends are expected to open up a new world of possibilities for every tech industry as the low-latency and fast speed offered by 5G is what is needed for further advances in intelligent automation, Artificial Intelligence (AI), the Internet of Things (IoT), autonomous cars, extended reality, blockchain, and several other technologies yet to be explored.

- According to a study by Qualcomm, 5G will generate more than USD 2.4 trillion across the automotive industry by 2035. As millions of vehicles leverage mobile technology for real-time navigation, emergency services, connected infotainment, etc., the advent of 5G will spawn a new range of applications such as Vehicle-2-Vehicle, Vehicle-2-Network (V2N), Vehicle-2-Infrastructure (V2I), and Vehicle-2-Pedestrian (V2P) communications.

- Furthermore, 5G is also expected to have a similar impact on the growth of the consumer electronics industry. The demand for IoT-connected consumer devices will grow due to the availability of low latency and fast connectivity networks. Such trends combinedly will support the growth of the studied market during the forecast period.

Asia Pacific is Expected to Witness Significant Growth

- The growing electronics industry is attracting several MNCs to set up manufacturing plants in Asian countries either independently or through a joint venture with different regional companies. This includes large global organizations such as Tyco Electronics, FCI OEN, Molex, Vishay, and EPCOS. This is further anticipated to boost the local manufacturing activity of resistors in the Asia Pacific region.

- In China, the growth of the studied market can also be attributed to the booming electronics industry. Electronics is one of the largest industries in China and is a significant contributor to the country's overall economic growth. For instance, as per the State Council of the People's Republic of China, during the two months from January to February 2022, the added value of major electronics manufacturers rose 12.7% year-on-year, compared with the 7.5% growth seen in the overall industrial sector in the country. China is the world's leading producer of electronic devices such as TVs, smartphones, laptops and PCs, refrigerators, and air conditioners.

- Japan's electronic products industry, which is one of the largest in the world, is the most significant factor driving demand for sales of semiconductors in the country. As per the Japan Electronics and Information Technology Industries Association (JEITA), in 2021, the production value of electronic devices in Japan grew by 10.6% compared to the previous year, reaching a value of about JPY 3.94 trillion in 2021. The rising disposable income of the people and their preferences for smart homes and smart business environments are important drivers for the growth of consumer electronics in Japan.

- Korea acquired a prominent position in the global semiconductor memory market. The data center market in Korea is one of the fastest growing and is attracting increasing investments from many foreign players. For instance, in April 2022, Digital Edge (Singapore) Holdings Pte. Ltd planned to develop a data center in Incheon, South Korea, through a partnership with the SK eco plant. The companies will jointly build and promote a 120MW hyper-scale data center development project in the National Industrial Complex in Bupyeong-gu, Incheon.

- Electronics manufacturing is a significant contributor to Taiwan's total Gross domestic product (GDP). Taiwan Semiconductor Manufacturing Company (TSMC) is the most important semiconductor manufacturer in the region. Recently TSMC reported its Q2 2022 earnings results, presenting a strong revenue growth of 36.6% year over year. As per the company, one of the most important reasons for this remarkable growth was the rapid expansion of its customers in the high-performance computing (HPC) industry. These include artificial intelligence researchers, data centers for cloud providers like Amazon's Amazon Web Services, and edge computing networks. HPC revenue grew 14% quarter over quarter in Q2 and now makes up 43% of TSMC's overall revenue.

Active & Passive Electronic Components Industry Overview

The active and passive electronic components market comprises long-standing established players who have made significant investments in the product. The new players entering the market require high investments. The companies can sustain themselves through powerful competitive strategies. Product innovations can also work in favor of new players as they can target emerging and less explored application areas to expand their market presence further. The degree of competition is high in the market and is expected to remain the same for the forecasted period.

In December 2022, ModCap HF, a modular capacitor designed for DC link applications that can operate at extremely high switching frequencies, was offered by TDK Corporation. The six newly created power capacitors in the B25647A* series are rated for between 900 to 1600 volts and have capacitance ranges between 640 to 1850 microfarads. The highest allowable hot spot temperature is 90 °C, and the rated currents range from 160 A to 210 A depending on the kind.

In October 2022, YAGEO Group, the world's top supplier of passive components, released the automotive grade thin film chip resistor - RP Series. The RP series' unique passivation design creates a waterproofing interface. This cover shields the resistive layer, preventing moisture from entering from the outside. With this defense, the RP Series can maintain high resistance stability in challenging conditions, making it ideal for power systems, industrial/medical equipment, telecommunications, industrial/automotive electronics, and industrial/industrial equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of COVID-19 on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Preference For Miniaturized Designs

- 5.1.2 Growing Number of Computing, Communications, and Consumer Electronics

- 5.1.3 Increasing Adoption of 5G Technology

- 5.2 Market Restraints

- 5.2.1 Rising Metal Prices Impacting Component Production Costs

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Active Components

- 6.1.1.1 Transistors

- 6.1.1.2 Diode

- 6.1.1.3 Integrated Circuits (ICs)

- 6.1.1.4 Amplifiers

- 6.1.1.5 Vacuum Tubes

- 6.1.2 Passive Components

- 6.1.2.1 Capacitors

- 6.1.2.2 Inductors

- 6.1.2.3 Resistors

- 6.1.1 Active Components

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics and Computing

- 6.2.3 Medical

- 6.2.4 Industrial

- 6.2.5 Communications

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon Technologies AG

- 7.1.2 NXP Semiconductors NV

- 7.1.3 Texas Instruments, Inc.

- 7.1.4 Panasonic Corporation

- 7.1.5 Murata Manufacturing Co. Ltd

- 7.1.6 Eaton Corporation

- 7.1.7 TE Connectivity Ltd.

- 7.1.8 Honeywell International Inc.

- 7.1.9 Toshiba Corp.

- 7.1.10 Vishay Intertechnology Inc.

- 7.1.11 YAGEO Corporation

- 7.1.12 TDK Corporation

- 7.1.13 KEMET Corporation (Yageo Corporation)

- 7.1.14 AVX Corporation (Kyocera Corp)

- 7.1.15 Lelon Electronics Corporation

- 7.1.16 Taiyo Yuden Co. Ltd