|

市场调查报告书

商品编码

1445823

纸吸管 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Paper Straw - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

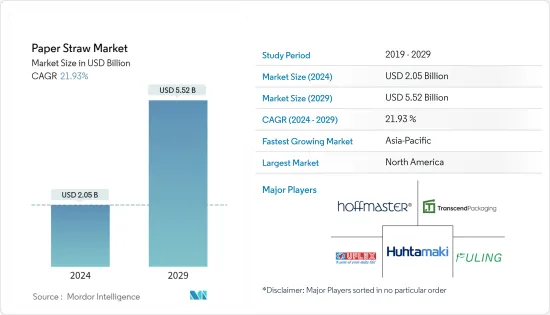

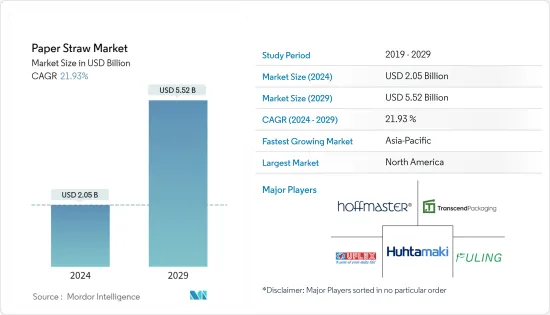

纸吸管市场规模预计到2024年为20.5亿美元,预计到2029年将达到55.2亿美元,在预测期内(2024-2029年)CAGR为21.93%。

各个最终用户产业对纸草纸的需求不断增长,预计将推动市场扩张。

主要亮点

- 对环保产品不断增长的需求是推动市场成长的关键因素。政府采取了各种减少塑胶使用的倡议,并制定了严格的法律限制在器俱生产中使用传统塑胶材料。通常,纸材质具有适应性强、多变、轻质、坚固且可回收等特性。它们可以製成各种颜色、形状和尺寸,以满足客户的需求。快速成长的全球食品和饮料产业是另一个成长诱导因素。

- 然而,纸吸管的高成本和低价替代品的可用性可能会阻碍市场的成长。据 PacknWood 称,纸吸管的成本约为 0.025 美元,明显高于塑胶吸管的 0.005 美元。

- COVID-19 大流行对纸吸管产业产生了复杂的影响。市面上纸吸管的供需受到食品服务机构和餐厅关闭以及供应链管理中断的影响。然而,网路订餐趋势的上升以及医院摄取液体药物对纸吸管的需求不断增长正在推动纸吸管的销售。

纸吸管市场趋势

餐饮服务业推动市场

- 许多咖啡馆和餐厅更注重路边取货或外带。一些商店减少了店内容量,并建立了创造性的送货选项,以确保封锁期间的食品配送。食品和饮料行业预计将大幅增加纸吸管的需求。这主要是因为卫生产品的需求不断增长,这使得纸张成为可行的包装材料。

- 据StatsCan称,预计2022年上半年加拿大的餐饮服务和饮酒场所将呈现成长趋势。2022年1月的销售额为33.2亿美元,2022年7月增至57.9亿美元。成长趋势意味着食品饮料销售量的上升,直接拉动了上述时期全国餐饮场所对纸吸管的需求。

- 值得注意的是,预计到 2023 年 12 月,加拿大将禁止销售一次性塑胶(某些例外情况除外)。对于秸秆市场的参与者来说,食品服务业将继续是他们的主要收入来源。近年来,各国纷纷禁止餐厅发放塑胶吸管。因此,多家公司正在选择其他替代材料来製作餐具和吸管。

- 例如,加拿大麦当劳在 2021 年 10 月表示,将在 2021 年 12 月之前淘汰塑胶餐具、搅拌棒和吸管。这一逐步淘汰发生在加拿大 1,400 多个地点,同时加拿大政府正在采取行动禁止一次性塑料,法规将于2021 年底敲定。截至2021 年11 月,木製餐具和搅拌棒以及纸吸管已在餐厅推出。截至2021 年11 月,麦当劳的目标是使用100% 回收、可再生或可重复使用的材料到2025 年,所有客户的包装中都会采用这种材料。

- 快餐店、全方位服务餐厅、咖啡和小吃店等最终用户的健康成长需要方便的包装,预计将推动生产更高包装形式的需求。食物链持续成长的趋势正在相应地增加市场需求。据麦当劳称,2022年,该公司在全球经营和特许经营了40,275家门店,比2021年的40,031家门店有所增加。在过去17年里,该公司的餐厅数量逐年增长。

亚太地区成长最快

- 推动原生纸包装市场成长的因素是其轻量特性,使产品能够有效率地运输。目前,针对不同品牌的客製化包装符合原纸包装市场客户的关键利益。然而,原料成本的快速上涨正在限制原纸包装市场。

- 推动纸包装市场成长的主要原因是人们越来越意识到采用永续和环保包装材料的好处。一些国家强有力的纸张回收措施正在为市场成长创造机会。来自软塑胶包装的竞争日益激烈是影响该地区纸包装市场的最重要的限制。

- 印度计划从2022年7月起禁止製造、进口、储存、分销、销售和使用包括吸管在内的各种一次性塑胶製品。在此背景下,塑胶吸管禁令将限制深受印度大众欢迎的小包装软性饮料的销售。但该禁令还包括塑胶吸管,这是小包装中的重要配件,因此软性饮料公司预计会受到影响。此类禁令推动了该国纸吸管市场的发展。

- 快餐连锁店专注于在该地区创新新的解决方案。例如,2022 年 10 月,日本麦当劳在所有门市都采用了纸吸管和木製餐具,这家快餐连锁店预计每年将减少 900 吨塑胶垃圾。由于全国约 2,900 个地点的塑胶吸管和叉子供应耗尽,该连锁店将停止提供塑胶吸管和叉子。日本四月颁布了一项减少一次性塑胶的法律后,麦当劳做出了这项改变,扩大了餐饮业在快速、低成本礼貌和永续发展之间平衡的努力。

- 此外,2022年6月,无菌包装产品和解决方案的产业领导者之一Lamipak宣布为印度市场推出U型纸吸管解决方案。 Lamipak 打算为受塑胶吸管禁令影响的饮料公司提供快速可靠的解决方案。该公司在中国拥有一条U型纸吸管生产线,併计划在2023年第三季之前扩大在印尼的产能。全面投产后,两张纸吸管生产线的总产能将达到每月2亿根纸吸管,计划到2023 年每月增加1 亿。

- 塑胶废弃物是一个重大且持久的环境问题,促使政府和企业重新考虑其方法并实施绿色倡议,例如回收和使用替代的可生物降解材料。雀巢(泰国)迎接挑战,使MILO 泰国成为第一个推出首款柔性纸吸管的UHT 品牌,并在2022 年亚洲快速消费品奖中赢得年度绿色倡议奖- 泰国。所有这些倡议均由在该地区运营的公司实施将在预测期内增加该地区纸吸管的市场成长。

纸吸管行业概况

纸吸管市场相当分散。主要公司包括 UFlex Limited、Hoffmaster Group Inc.、Fuling Global Inc.、Canada Brown Eco Products Ltd 和 Huhtamaki OYJ。两家公司不断创新并建立策略合作伙伴关係,以维持其市场份额。

2022年4月,Ulfex推出了U型纸吸管,目标是第一个月生产1亿根吸管,随后几个月生产2亿根。 Ulfex 还打算每年生产 24 亿根吸管。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争激烈程度

- 产业价值链分析

- COVID-19 对市场影响的评估

第 5 章:市场动态

- 市场驱动因素

- 消费者对环保吸管的需求不断增加

- 亚太地区需求不断成长

- 市场限制

- 纸吸管的高成本和替代品的可用性

第 6 章:市场细分

- 材料种类

- 维珍纸

- 再生纸

- 按应用

- 餐饮服务

- 家庭

- 机构

- 其他应用

- 按地理

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第 7 章:竞争格局

- 公司简介

- UFlex Limited

- Hoffmaster Group Inc.

- Transcend Packaging Ltd.

- Huhtamaki OYJ

- Fuling Global Inc.

- Soton Daily Necessities Co. Ltd.

- Tetra Pak International SA

- Canada Brown Eco Products Ltd.

- Karat by Lollicup

- IPI SRL

第 8 章:投资分析

第 9 章:市场机会与未来展望

The Paper Straw Market size is estimated at USD 2.05 billion in 2024, and is expected to reach USD 5.52 billion by 2029, growing at a CAGR of 21.93% during the forecast period (2024-2029).

The increasing demand for paper straw papers across various end-user industries is anticipated to fuel market expansion.

Key Highlights

- The growing demand for environment-friendly products is the key factor driving the market's growth. There are various government initiatives to reduce plastic use and stringent laws that restrict using conventional plastic materials in the production of utensils. Typically, paper materials are adaptable, changeable, light, strong, and recyclable. They can be made in a wide range of colors, forms, and sizes to satisfy the client's needs. The rapidly growing global food and beverage industry is acting as another growth-inducing factor.

- However, the high cost associated with paper straws and the availability of the low price substitute can hinder the market's growth. According to PacknWood, paper straws cost about USD 0.025, which is significantly higher than USD 0.005 for plastic straws.

- The COVID-19 pandemic has had a complex effect on the paper straw industry. The supply and demand of paper straws in the market were affected by the closure of food service establishments and restaurants and a disruption in supply chain management. However, the rising trend in online food ordering and the growing demand for paper straws in hospitals for the intake of liquid medications are driving paper straw sales.

Paper Straw Market Trends

Foodservice sector to Drive the Market

- Numerous cafes and restaurants have focused more on curbside pickup or carryout only. Some stores reduced their in-store capacity and established inventive delivery options to ensure food delivery during the lockdowns. The food and beverage industry is anticipated to increase paper straw demand significantly. This is mainly because of the growing need for hygiene products, which has made paper a viable packaging material.

- According to StatsCan, there was expected to be a growing trend in food service and drinking places in Canada during the first half of 2022. The sale value in January 2022 amounted to USD 3.32 billion, which rose to USD 5.79 billion in July 2022. This growing trend signifies the upward movement in food and beverage sales, which directly pushes the demand for paper straws in the food and drinking places in the period above across the country.

- Notably, single-use plastics are expected to be banned from sale in Canada by December 2023 (barring certain exceptions). For players in the straw market, the food service sector would continue to be their primary source of income. In recent years, various countries have banned restaurants from giving out plastic straws. Due to this, multiple companies are choosing other alternative materials for their cutlery and straws.

- For instance, in October 2021, McDonald's Canada stated it would eliminate plastic cutlery, stir sticks, and straws by December 2021. The phase-out occurred at more than 1,400 Canadian locations and comes as the government of Canada moves to ban single-use plastics, with regulations finalized by the end of 2021. As of November 2021, wooden cutlery and stir sticks were already being rolled out in restaurants, along with paper straws, as of November 2021. McDonald's aims to use 100% recycled, renewable, or reusable materials in all its customers' packaging by 2025.

- The healthy growth of end-users, such as quick-service restaurants, full-service restaurants, and coffee and snack outlets, requiring convenient packaging is expected to drive the need to produce higher packaging formats. The trend of consistent growth of food chains is proportionately increasing the demand for the market. According to McDonald's, in 2022, it operated and franchised 40,275 locations globally, an increase over the 40,031 stores it used in 2021. During the past 17 years, the company has seen growth in restaurants year over year.

Asia-Pacific to Witness Fastest Growth

- The factor driving the growth of the virgin paper packaging market is its lightweight property, which allows the product to be efficiently transported. Customized packaging for different brands is currently in the critical interest of customers in the virgin paper packaging market. However, the rapidly increasing cost of the raw material is restraining the virgin paper packaging market.

- The primary reason driving the growth of the paper packaging market is the growing awareness of the benefits of adopting sustainable and environmentally friendly packaging materials. Strong paper recycling initiatives in several countries are creating opportunities for market growth. Increasing competition from flexible plastic packaging is the most significant constraint impacting the paper packaging market across the region.

- From July 2022, India planned to ban the manufacturing, importing, storing, distributing, selling, and using of various single-use plastic products, including straws. Against this backdrop, the ban on plastic straws will limit the sale of small packs of soft drinks that are popular with the Indian public. But the prohibition extends to plastic straws, an essential accessory in small packages, so soft drink companies were expected to be impacted. Such bans drive the market for paper straws in the country.

- Fast-food chains are focused on innovating new solutions in the region. For instance, in October 2022, McDonald's Japan adopted paper straws and wooden utensils at all locations, which the fast-food chain anticipated would eliminate 900 metric tons of plastic waste annually. The chain will stop offering plastic straws and forks as supplies run out at roughly 2,900 locations nationwide. The change by McDonald's, which comes after Japan enacted a law in April to reduce single-use plastics, widens the restaurant industry's efforts to balance fast, low-cost courtesy, and sustainability.

- Furthermore, in June 2022, Lamipak, one of the industry leaders in aseptic packaging products and solutions, announced the launch of U-shape paper straw solutions for the Indian market. Lamipak intends to deliver beverage companies impacted by the plastic straw ban a swift and reliable solution. The company has a production line for U-shaped paper straws in China and plans to expand production capacity in Indonesia by the third quarter of 2023. When fully launched, both paper straw lines will have a combined capacity of 200 million paper straws per month, with an additional 100 million per month planned for 2023.

- Plastic waste is a significant and persistent environmental problem, prompting governments and businesses to rethink their approaches and implement green initiatives such as recycling and using alternative biodegradable materials. Nestle (Thailand) meets the challenge by making MILO Thailand the first UHT brand to introduce the first flexible paper straws and winning the Green Initiative of the Year-Thailand award at the FMCG Asia Awards 2022. All such initiatives by the companies operating in the region will increase the market growth for paper straws across the region over the forecast period.

Paper Straw Industry Overview

The market for paper straw is quite fragmented. UFlex Limited, Hoffmaster Group Inc., Fuling Global Inc., Canada Brown Eco Products Ltd, and Huhtamaki OYJ are among the major companies. The corporations continue to innovate and form strategic partnerships to maintain their market share.

In April 2022, Ulfex introduced its U-Shape Paper Straw, aimed to produce 100 million straws in the first month and 200 million in the following months. Ulfex also intended to create 2.4 billion straws every year.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumer Demand for Eco-Friendly Straws

- 5.1.2 Growing Demand from Asia-Pacific Region

- 5.2 Market Restraints

- 5.2.1 High Cost of Paper Straws and Availability of Substitutes

6 MARKET SEGMENTATION

- 6.1 Material Type

- 6.1.1 Virgin Paper

- 6.1.2 Recycled Paper

- 6.2 By Application

- 6.2.1 Foodservice

- 6.2.2 Households

- 6.2.3 Institutions

- 6.2.4 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 UFlex Limited

- 7.1.2 Hoffmaster Group Inc.

- 7.1.3 Transcend Packaging Ltd.

- 7.1.4 Huhtamaki OYJ

- 7.1.5 Fuling Global Inc.

- 7.1.6 Soton Daily Necessities Co. Ltd.

- 7.1.7 Tetra Pak International SA

- 7.1.8 Canada Brown Eco Products Ltd.

- 7.1.9 Karat by Lollicup

- 7.1.10 IPI SRL