|

市场调查报告书

商品编码

1445932

农场管理软体 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Farm Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

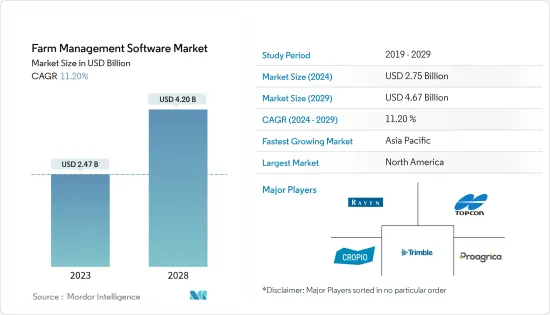

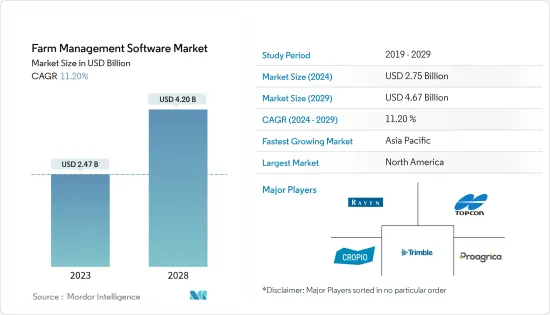

农场管理软体市场规模预计到 2024 年为 27.5 亿美元,预计到 2029 年将达到 46.7 亿美元,在预测期内(2024-2029 年)CAGR为 11.20%。

主要亮点

- 农场管理软体的采用逐年增加,农民的需求转向高生产力和投资回报。用于研究测试的客製化技术系统的开发,包括农民可以轻鬆存取的各种硬体和软体,正在加速农场管理软体市场的成长。

- 农场管理软体市场的成长在很大程度上也是由农业活动的增加和对决策即时资料的需求不断增加所推动的。机器学习和人工智慧正在成为各种农业应用的主流技术,例如精准农业、牲畜监测、养鱼和智慧温室实践。他们管理硬体设备和个人之间交换的资料,以简化农场管理流程。

- 此外,各国政府正采取措施鼓励采用现代农业技术。例如,2021年10月,英国环境、食品和农村事务部(Defra)与英国研究与创新部合作启动了一项资助计划,旨在推动农业部门采用创新技术,以提高农民的获利能力。

- 创新是应对农业部门面临的挑战的重要因素。人工智慧和机器学习的渗透简化了计划、采购、餵食、收穫、行销和库存控制等资料管理活动。新的想法、技术和流程,例如农场管理软体,将在帮助农民、种植者和企业提高生产力方面发挥关键作用,这将导致预测期内研究的市场的成长。

农场管理软体市场趋势

农场劳动力短缺和耕地减少

近年来,由于人们对农业的兴趣下降,加上农民人口老化,农业劳动力减少。根据联合国粮农组织2021年统计报告,农林渔业对就业的贡献从2017年的896,341万人下降至2020年的873,757万人。此外,美国、英国等国家的农业产业依赖劳动力方面,其他已开发国家也出现了类似的趋势。同样,农业、林业和渔业在经济中占据重要地位的亚太地区,劳动力数量也大幅下降,从 2017 年的 618,147 万人减少到 2020 年的 589,103 万人。

由于技术辅助农业需要技术熟练的劳动力,而技术劳动力却严重短缺,考虑到当前的挑战,精准农民钦佩并倾向于使用高效的软体。这种情况是推动市场前进的主要因素之一。耕地减少和全球人口增加是推动市场的主要原因。

此外,根据世界银行的数据,人均耕地面积从 2017 年的 0.19 公顷减少到 2020 年的 0.18 公顷。这促使种植者提高每公顷可用土地的生产力,以满足日益增长的粮食需求。此外,植保化学品使用中的环境安全等问题日益突出,导致各国政府对植保化学品的使用实施了严格的规定。农业领域的所有这些变化正在推动农场管理软体的使用,帮助农民提高生产力和投资回报。因此,随着耕地面积的减少,农业劳动力的短缺预计将推动农民对农场管理软体的采用率,从而在预测期内提振整体市场。

北美主导市场

在北美,由于该地区领先的工业自动化行业和人工智慧解决方案的采用,预计未来几年农场管理软体将呈指数级增长。与发展中国家相比,已开发国家更大的农场和农民的意识导致现代技术的快速采用。这使得北美地区成为最大的农场管理软体技术市场。

多年来,美国一直处于将精密技术应用于农业技术的前沿。根据美国农业部(USDA)的报告,2017年美国农场平均面积为441英亩,2021年将增加至445英亩。大型农场更有可能采用智慧农业技术和软体。随着美国平均农场规模的扩大和农场劳动力的短缺,大农场主完全有能力使用农业软体来获得数据驱动的见解,以优化作物产量。

此外,该地区的参与者和政府正在采取进一步提振市场的措施。例如,2022 年,加拿大政府根据农业科学计划,透过加拿大农业合作伙伴关係向 Mojow Autonomous Solutions Inc. 提供了高达 419,000 美元的资金,投资于农业数位化,以加强加拿大农业部门的可持续性。

同样,加拿大蛋白质工业公司与 Farmers Edge Inc. 和 OPI Systems 合作,投资 2,100 万美元用于农民资料分析项目,收集与植物和储存健康管理相关的农场级资料,这些数据可用于开发预测模型可以使用人工智能(AI)和机器学习来帮助农民提高产量,并做出更好的储存和行销决策。预计这将增加种子选择、设备选择、灌溉和收穫后管理领域的投资回报。

因此,透过数位技术和人工智慧的融合,农民可以更有效和有效率地管理资源。因此,大型农场、农民的高采用率以及政府措施正在推动预测期内该地区研究的市场。

农场管理软体产业概述

农场管理软体市场高度分散。 Raven Industries, Inc.、Trimble Inc.、Topcon Corporation、Cropio Group (Syngenta) 和 Relex Group (Proagrica) 是市场上的一些主要参与者。玩家们正在投资新产品并改进现有产品。他们也参与合作、扩张和收购。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 类型

- 本地/基于网路

- 基于云端

- 软体即服务 (SaaS)

- 平台即服务 (PaaS)

- 应用

- 精耕

- 牲畜监测

- 智慧温室

- 水产养殖

- 其他应用

- 地理

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 欧洲其他地区

- 亚太

- 印度

- 中国

- 澳洲

- 日本

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 非洲其他地区

- 北美洲

第 6 章:竞争格局

- 最常用的策略

- 市占率分析

- 公司简介

- Deere & Company

- Trimble Inc.

- Raven Industries Inc.

- AG Leader Technology

- AGJunction

- AGCO Corporation

- Agrivi

- Topcon Corporation

- Bayer Crop Science (The Climate Corporation)

- Relex Group (Proagrica)

- Cropio Group

- CropIn Technology Solutions Private Limited

第 7 章:市场机会与未来趋势

The Farm Management Software Market size is estimated at USD 2.75 billion in 2024, and is expected to reach USD 4.67 billion by 2029, growing at a CAGR of 11.20% during the forecast period (2024-2029).

Key Highlights

- The adoption of farm management software is increasing every year, with farmer needs shifting toward high productivity and return on investments. The development of customized technological systems for research testing, comprising various hardware and software that are easily accessible by the farmers, is accelerating the growth of the farm management software market.

- The growth of the farm management software market is also largely driven by the increasing agricultural activities and increasing need for real-time data for decision-making. Machine learning and Artificial intelligence are becoming the mainstream technologies for various farming applications, such as precision farming, livestock monitoring, fish farming, and smart greenhouse practices. They manage the data exchanged between hardware equipment and individuals to streamline the farm management process.

- Furthermore, governments are taking initiatives to encourage the adoption of modern agricultural technologies. For instance, in October 2021, the UK Department for Environment, Food and Rural Affairs (Defra) and UK Research and Innovation partnered to launch a funding program aimed at driving the adoption of innovative technology in the agricultural sector to improve the profitability of the farmers.

- Innovation is a vital factor in addressing the challenges faced by the agricultural sector. The penetration of artificial intelligence and machine learning has simplified data management activities such as planning, purchasing, feeding, harvesting, marketing, and inventory control. New ideas, technologies, and processes, such as farm management software, will play a key role in helping farmers, growers, and businesses to become more productive, which will result in the growth of the market studied during the forecast period.

Farm Management Software Market Trends

Farm Labor Shortage and Decreasing Arable Land

The agriculture labor force has decreased in recent years due to the decreased interest in farming, combined with the aging farmer population. According to the FAO statistics 2021 report, the agriculture, forestry, and fishing sector's contribution to employment declined from 896,341 thousand people in 2017 to 873,757 thousand people in 2020. Furthermore, the agricultural industry in the US and the UK, among other countries, depend on laborers, and a similar trend is seen across other developed countries as well. On a similar note, Asia-Pacific, where agriculture, forestry, and fishing occupy a significant part of the economy, is witnessing a massive decline in the workforce, nearly a decline of 618,147 thousand people in 2017 to 589,103 thousand people in 2020.

As technologically assisted agriculture needs skilled laborers that are in acute shortage of availability, precision farmers admire and tend to consume software that can be productive, considering the current challenge. This scenario is one of the major factors that drive the market forward. The decreasing arable land and the increasing global population are among the major reasons driving the market.

Further, according to the World Bank, the area of arable land hectares per person decreased from 0.19 hectares in 2017 to 0.18 hectares in 2020. This pushed growers to increase their productivity per hectare of land available to meet the growing demand for food. Additionally, rising issues, such as environmental safety regarding the usage of crop protection chemicals, led the government of various countries to impose strict regulations on the use of crop protection chemicals. All these changes in the agriculture field are boosting the use of farm management software, which helps farmers increase their productivity and the return on investment. As a result, the shortage of farm labor, with the decreasing area of arable land, is expected to drive the rate of adoption of farm management software among farmers, providing a boost to the overall market during the forecast period.

North America Dominates the Market

In North America, farm management software is anticipated to witness exponential growth in the coming years, owing to the leading industrial automation industry and the adoption of artificial intelligence solutions in the region. The larger farms and awareness among the farmers lead to the quick adoption of modern technologies in developed countries compared to developing nations. This makes the North American region the largest farm management software technologies market.

Over the years, the United States has been at the forefront of deploying precision technology to farming techniques. As per a report by the US Department of Agriculture (USDA), the average farm size in the United States was 441 acres in 2017, which increased and reached 445 acres in 2021. As large-holding farms are more likely to adopt smart agriculture technologies and software. With an increase in the average farm size in the United States and the shortage of farm laborers, large-holding farmers are well-positioned to use farming software to gain data-driven insights for optimizing crop yields.

Furthermore, players and governments in the region are taking initiatives that are further boosting the market. For instance, in 2022, the Government of Canada invested in the digitization of farming to strengthen the sustainability of Canada's agriculture sector by granting up to USD 419,000 to Mojow Autonomous Solutions Inc., through the Canadian Agricultural Partnership, under the AgriScience Program.

Likewise, the protein industries Canada has partnered with Farmers Edge Inc. and OPI systems and invested USD 21 million in the project of data analysis farmers and collecting farm-level data related to plant and storage health management, which can be applied to develop predictive models that may use artificial intelligence (AI) and machine learning that can help farmers improve production, as well as make better storage and marketing decisions. This is anticipated to increase return on investments in the areas of seed selection, equipment selection, irrigation, and post-harvest management.

Hence, with the integration of digital technologies and artificial intelligence, farmers can manage resources more effectively and efficiently. Therefore, the large-sized farms, high adoption rate by farmers, and government initiatives are boosting the market studied in the region during the forecast period.

Farm Management Software Industry Overview

The farm management software market is highly fragmented. Raven Industries, Inc., Trimble Inc., Topcon Corporation, Cropio Group (Syngenta), and Relex Group (Proagrica) are some of the major players operating in the market. The players are investing in new products and improvising their existing ones. They are also involved in partnerships, expansions, and acquisitions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Local/Web-based

- 5.1.2 Cloud-based

- 5.1.2.1 Software as a Service (SaaS)

- 5.1.2.2 Platform as a Service (PaaS)

- 5.2 Application

- 5.2.1 Precision Farming

- 5.2.2 Livestock Monitoring

- 5.2.3 Smart Greenhouse

- 5.2.4 Aquaculture

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Deere & Company

- 6.3.2 Trimble Inc.

- 6.3.3 Raven Industries Inc.

- 6.3.4 AG Leader Technology

- 6.3.5 AGJunction

- 6.3.6 AGCO Corporation

- 6.3.7 Agrivi

- 6.3.8 Topcon Corporation

- 6.3.9 Bayer Crop Science (The Climate Corporation)

- 6.3.10 Relex Group (Proagrica)

- 6.3.11 Cropio Group

- 6.3.12 CropIn Technology Solutions Private Limited