|

市场调查报告书

商品编码

1445934

金属基复合材料 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029 年)Metal Matrix Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

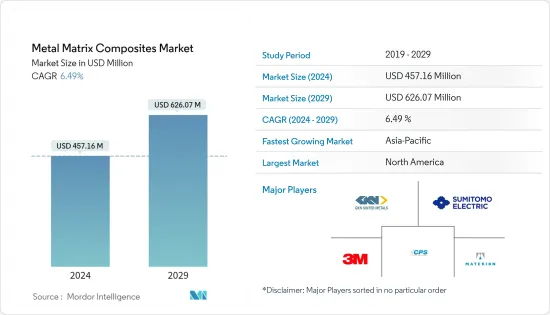

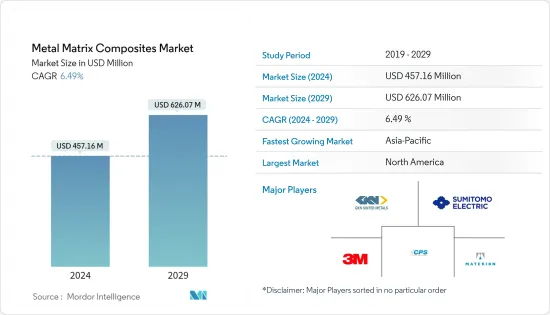

金属基复合材料市场规模预计到2024年为4.5716亿美元,预计到2029年将达到6.2607亿美元,在预测期内(2024-2029年)CAGR为6.49%。

在 2020 年新型冠状病毒 (COVID-19) 大流行期间,全国实施了封锁和社交距离规定,导致供应链中断和各个製造业关闭。这对市场产生了负面影响。然而,在后疫情时期,市场正重回正轨。

主要亮点

- 航空航太和国防工业对轻质材料的需求不断增长,以及金属基复合材料优于金属的性能是市场的主要驱动因素。

- 然而,复杂的製造过程可能会阻碍市场的成长。

- 机车行业的不断增长的使用和电动汽车的日益普及预计将为市场提供新的机会。

- 北美市场占有率最高。然而,预计亚太地区将在预测期内主导市场。

金属基复合材料市场趋势

电气和电子领域成长最快

- 金属基复合材料用于各种电气和电子元件和设备。例如,铝-石墨复合材料因其优异的导热性、可调的热膨胀係数和低密度而被用于电力电子模组。

- SiC 增强的 Al 和 Cu 具有优异的热物理性能,如低热膨胀係数 (CTE)、高导热率和改善的机械性能,例如更高的比强度、更好的耐磨性和特定模数。

- 由于具有高导热性,dymalloy(一种含有 55% 钻石颗粒(以体积计)的铜银合金基体)被用作电子产品中高功率、高密度多晶片模组的基材。

- 此外,PRMMC(颗粒增强金属基复合材料)具有高体积分数,在电子行业中有广泛的应用,包括散热器面板、功率半导体封装、微波模组、电池套、黑盒子外壳、印刷电路等。板散热器等。

- 根据日本电子资讯科技产业协会(JEITA)发布的全球电子统计数据,预计2021年全球电子资讯产业产值将年增11%,达到33,602亿美元,2022年产值也将年增11%。成长5%,达到35,366 亿美元。

- 手机、便携式计算设备、游戏系统和其他个人电子设备的生产将继续激发对电子元件的需求,预计这将推动对金属基复合材料的需求。

- 由于上述所有因素,在预测期内,对电气和电子设备的需求可能会增加所研究市场的需求。

亚太地区将主导市场

- 亚太地区占全球电子产品产量的 70% 以上,韩国、日本和中国等国家为全球各产业製造各种电气元件和用品。

- 亚太地区2021年前9个月的汽车总产量为3,267万辆,较2020年同期成长11%。

- 总体而言,中国、印度、日本和韩国等国家的需求持续成长可能会提振该地区的金属基复合材料市场。

- 2021年12月,中国工业生产年增4.3%。因此,中国工业部门的扩张预计将有利于预测期内金属基复合材料市场的成长。

- 根据中国工信部资料显示,2022年前5个月电子资讯製造业维持稳定成长,年营业收入2,000万元以上(约300万美元),较去年同期成长9.9%。

- 政府启动了 PLI 计划,随着製造商在印度增加产量,该计划可能会在五年内提供 55 亿美元的激励措施。这可能会促进该国电子产品的生产,从而有利于金属基复合材料的需求。

- 在航空航太领域,据印度品牌股权基金会(IBEF)称,未来四年,印度航空业预计将获得 3,500 亿印度卢比(49.9 亿美元)的投资。

- 此外,2022年前四个月,日本电子产业的产量为36,564.4亿日圆(326亿美元),与2021年同期相比成长约0.2%。

- 上述因素可能会增加亚太地区应用产业对金属基复合材料的需求。

金属基复合材料产业概述

全球金属基复合材料市场本质上是部分分散的,该行业存在大量全球和本地参与者。市场的主要参与者包括 GKN Sinter Metals Engineering GmbH、Materion Corporation、3M、Sumitomo Electric Industries Ltd 和 CPS Technologies Corporation 等。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 航太和国防工业对轻质材料的需求不断增加

- 金属基复合材料优于金属的性能

- 限制

- 製造流程复杂

- 其他限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

- 技术简介

第 5 章:市场区隔(市场价值规模)

- 类型

- 镍

- 铝

- 耐火

- 其他类型

- 填料

- 碳化硅

- 氧化铝

- 碳化钛

- 其他填料

- 最终用户产业

- 汽车及机车

- 电气和电子

- 航太和国防

- 工业的

- 其他最终用户产业

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 领先企业采取的策略

- 公司简介

- 3A Composites

- 3M (Ceradyne Inc.)

- ADMA Products Inc.

- CPS Technologies Corp.

- DAT Alloytech

- Denka Company Limited

- GKN Sinter Metals Engineering GmbH

- Hitachi Metals Ltd

- Materion Corporation

- MTC Powder Solutions AB

- Plansee Group

- Sumitomo Electric Industries Ltd

- Thermal Transfer Composites LLC

- TISICS Ltd

第 7 章:市场机会与未来趋势

- 在机车行业中的应用不断增长

- 电动车的普及率不断提高

The Metal Matrix Composites Market size is estimated at USD 457.16 million in 2024, and is expected to reach USD 626.07 million by 2029, growing at a CAGR of 6.49% during the forecast period (2024-2029).

During the pandemic period in 2020 due to COVID-19, there were nationwide lockdowns and social distancing mandates which led to supply chain disruption and the closure of various manufacturing industries. This impacted the market negatively. However, in the post-pandemic period, the market is getting back on track.

Key Highlights

- Increasing demand for lightweight materials in the aerospace and defense industry and superior properties of metal matrix composites over metals are the major driving factors for the market.

- However, the complicated manufacturing process is likely to hinder the market growth.

- Growing use in the locomotive industry and increasing adoption of electric vehicles are expected to provide new opportunities for the market.

- North America accounted for the highest market share. However, Asia-Pacific is projected to dominate the market during the forecast period.

Metal Matrix Composites Market Trends

Electrical and Electronics Segment to Register Fastest Growth

- Metal matrix composites are used in various electrical and electronic components and devices. For instance, aluminum-graphite composites are employed in power electronic modules due to their excellent thermal conductivity, tunable coefficient of thermal expansion, and low density.

- Al and Cu reinforced by SiC are used in various industries due to their excellent thermo-physical properties, such as low coefficient of thermal expansion (CTE), high thermal conductivity, and improved mechanical properties, such as higher specific strength, better wear resistance and specific modulus.

- Because of its high heat conductivity, dymalloy, a copper-silver alloy matrix containing 55% diamond particles (by volume), is utilized as a substrate for high-power, high-density multi-chip modules in electronics.

- In addition, PRMMCs (particulate reinforced metal matrix composites), with a high-volume fraction, have a wide range of applications in the electronics industry, including radiator panels, power semiconductor packages, microwave modules, battery sleeves, black box enclosures, printed circuit board heat sinks, and others.

- According to the global electronics statistics published by the Japan Electronics and Information Technology Industries Association (JEITA), the Production by the global electronics and IT industries is expected to grow 11% year on year in 2021 to reach USD 3,360.2 billion, with 2022 production too lifting 5% to USD 3,536.6 billion.

- The production of cellular phones, portable computing devices, gaming systems, and other personal electronic devices will continue to spark the demand for electronic components, which is expected to boost the demand for metal matrix composites.

- Owing to all the factors mentioned above, the demand for electrical and electronic equipment is likely to increase the demand in the market studied during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific accounts for more than 70% of global electronics production, with countries like South Korea, Japan, and China involved in manufacturing various electrical components and supplies to various industries globally.

- The Asia-Pacific region recorded 32.67 million of total automotive production in the nine months of 2021, an increase of 11% from the same period in 2020.

- Overall, the consistent growth in demand in countries like China, India, Japan, and South Korea is likely to boost the metal matrix composites market in the region.

- Industrial production in China increased by 4.3% year-on-year in December 2021. Thus, the expansion of the industrial sector in the country is anticipated to benefit the growth of the metal matrix composites market during the forecast period.

- According to China's data from the Ministry of Industry and Information Technology, the electronic information manufacturing sector maintained steady growth in the first five months of 2022. The value-added output of electronic information manufacturers with annual operating revenue of at least CNY 20 million (about USD 3 million) expanded 9.9 percent year-on-year during the period.

- The government launched the PLI scheme, which is likely to offer incentives as manufacturers increase production in India with USD 5.5 billion available over five years. This is likely to boost the production of electronics in the country, thus benefiting the demand for metal matrix composites.

- In the aerospace sector, according to the India Brand Equity Foundation (IBEF), the country's aviation industry is expected to witness INR 35,000 crore (USD 4.99 billion) investment in the next four years.

- Moreover, in the first four months of 2022, the production by the Japanese electronics industry accounted for JPY 3,656.44 billion (USD 32.60 billion), registering a growth rate of around 0.2% compared to the same period in 2021.

- The factors mentioned above are likely to ascend the demand for metal matric composites across the application industries in Asia-Pacific.

Metal Matrix Composites Industry Overview

The global metal matrix composites market is partially fragmented in nature, with the presence of a large number of global and local players in the industry. The major players in the market include GKN Sinter Metals Engineering GmbH, Materion Corporation, 3M, Sumitomo Electric Industries Ltd, and CPS Technologies Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Lightweight Materials in Aerospace and Defense Industry

- 4.1.2 Superior Properties of Metal Matrix Composites over Metals

- 4.2 Restraints

- 4.2.1 Compilicated Manufacturing Process

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Nickel

- 5.1.2 Aluminium

- 5.1.3 Refractory

- 5.1.4 Other Types

- 5.2 Fillers

- 5.2.1 Silicon Carbide

- 5.2.2 Aluminum Oxide

- 5.2.3 Titanium Carbide

- 5.2.4 Other Fillers

- 5.3 End-user Industry

- 5.3.1 Automotive and Locomotive

- 5.3.2 Electrical and Electronics

- 5.3.3 Aerospace and Defense

- 5.3.4 Industrial

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3A Composites

- 6.4.2 3M (Ceradyne Inc.)

- 6.4.3 ADMA Products Inc.

- 6.4.4 CPS Technologies Corp.

- 6.4.5 DAT Alloytech

- 6.4.6 Denka Company Limited

- 6.4.7 GKN Sinter Metals Engineering GmbH

- 6.4.8 Hitachi Metals Ltd

- 6.4.9 Materion Corporation

- 6.4.10 MTC Powder Solutions AB

- 6.4.11 Plansee Group

- 6.4.12 Sumitomo Electric Industries Ltd

- 6.4.13 Thermal Transfer Composites LLC

- 6.4.14 TISICS Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Use in Locomotive Industry

- 7.2 Increasing Adoption of Electric Vehicles