|

市场调查报告书

商品编码

1445935

医用弹性体 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Medical Elastomers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

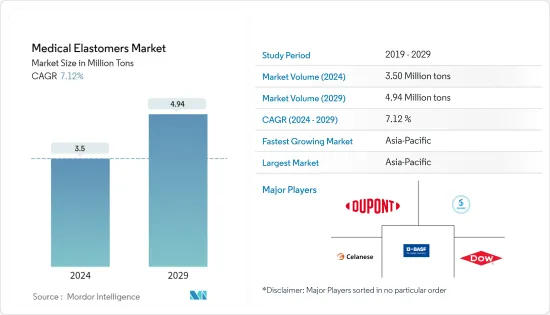

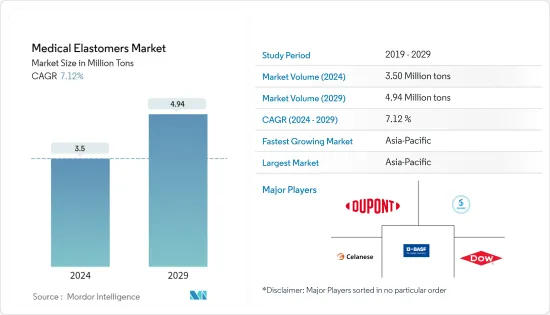

2024年医用弹性体市场规模预估为350万吨,预估至2029年将达494万吨,预测期间内(2024-2029年)CAGR为7.12%。

2020 年,市场受到了 COVID-19 的负面影响。全国范围内的封锁和严格的社交距离规定导致了市场不同领域的供应链中断。然而,由于医疗保健投资的增加,预计市场将稳定成长。

主要亮点

- 对安全、无卤聚合物的需求以及医疗行业向可从外部相互通信的可穿戴健康设备和医疗工具的转变是推动市场的主要因素。

- 一次性设备使用量的减少和硅胶价格的上涨是可能减缓市场成长的因素。随着环保意识的增强,医用弹性体产业正在朝着永续和绿色计画的方向发展。

- 生物基热塑性弹性体的发展是关键的市场机会。

亚太地区在全球市场中占据主导地位,其中中国、印度等国家的消费量最大。

医用弹性体市场趋势

热塑性弹性体 (TPE) 领域成长最快

- 其中,热塑性弹性体(TPE)领域是医用弹性体市场最大的市场份额。

- 在医疗产业,苯乙烯嵌段共聚物(SBC)主要用于医疗管材和薄膜应用。它们也用于製造医疗袋、伤口护理、设备、包装和诊断产品,包括手术巾、针罩、牙科坝、滴注室、运动带、注射器柱塞头、呼吸设备、矫形零件、医疗贴片,和别的。

- 热塑性聚氨酯(TPU)是长链线性聚合物,它允许聚氨酯熔化形成零件,然后零件固化。由于其高性能特性、耐化学品和耐油性、改善的机械性能和增强的耐用性,TPU 在医疗应用中的使用量不断增加。

- 聚氯乙烯 (PVC) 是一种线性热塑性聚合物,大部分为无定形聚合物。增塑聚氯乙烯(PVC-P) 或软质PVC 用于医疗应用,因为它在增塑后具有多种特性,包括柔韧性、强度、透明度、抗扭结性、耐刮擦性、透气性、生物相容性、易于与常见溶剂或黏合剂黏合以及伽马、环氧乙烷或电子束灭菌等过程中的稳定性。

- 在医疗行业,TPV 用于製造各种医疗设备的 O 形环、软触握把、蠕动泵管、注射器尖端、滴管、止动密封件和垫圈、阀门、隔膜和管道。它们还在医疗行业中用作注射器柱塞上的垫圈。

由于上述因素,全球医疗产业对热塑性弹性体的需求很可能会影响市场。

亚太地区将主导市场

- 在亚太地区,中国和印度是有望主导市场的两个主要经济体。

- 过去五年,中国投入公立医院的资金翻了一番,达到 380 亿美元。它的目标是到 2030 年将医疗保健产业的价值提高到 2.3 兆美元,是目前规模的两倍多。

- 此外,中国政府已启动政策支持和鼓励国内医疗器材创新,为所研究的市场提供了机会。 「中国製造2025」提高了产业效率、产品品质和品牌声誉,将刺激国内医疗器材製造商的发展,并增强竞争力。

- 中国是全球第二大医疗保健市场。然而,该国从已开发经济体进口技术高端的植入物。该国的公立医院是该国医疗器材的主要消费者。 2021年,卫生公共支出1.92兆元。

- 在印度,2021年底,联邦卫生部长宣布了印度政府改善该国医疗设施的多项计画。政府计划在未来六年内在医疗保健领域投资 6,418 亿卢比。政府计划透过发展初级、二级和三级医疗保健系统和机构检测和治疗新出现疾病的能力来加强现有的「国家卫生使命」。

- 由于 COVID-19 爆发,各种医疗应用的需求不断增加,预计将在预测期内推动医用弹性体市场的发展。

医用弹性体行业概况

全球医用弹性体市场本质上是分散的,少数大型企业占据主导地位,但也存在许多本土企业。市场上一些主要的参与者包括(排名不分先后)巴斯夫股份公司、塞拉尼斯公司、陶氏化学、索尔维和杜邦等。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 对安全无卤聚合物的需求增加

- 其他司机

- 限制

- 减少一次性设备的使用

- 硅胶价格上涨

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章:市场细分

- 类型

- 热塑性弹性体

- 苯乙烯嵌段共聚物 (SBC)

- 热塑性聚氨酯 (TPU)

- 增塑聚氯乙烯 (PVC)

- 热塑性硫化橡胶 (TPV)

- 其他热塑性弹性体

- 热固性弹性体

- 有机硅

- 液体硅橡胶(LSR)

- 高稠度橡胶(HCR)

- 其他有机硅

- 天然橡胶(乳胶)

- 丁基橡胶

- 其他热固性弹性体

- 热塑性弹性体

- 应用

- 医疗管

- 导管

- 注射器

- 不织布和薄膜

- 手套

- 医疗袋

- 植入物

- 其他应用

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市占率(%)**/排名分析

- 领先企业采取的策略

- 公司简介

- Arkema Group

- AVANTOR Inc.

- Avient

- BASF SE

- Biomerics

- Celanese Corporation

- Covestro AG

- DOW

- DSM

- DuPont de Nemours inc.

- Eastman Chemical Company

- ExxonMobil Corporation

- Foster Corporation

- Hexpol AB

- Kraton Corporation

- Kuraray Co.Ltd.

- Momentive

- Romar

- RTP Company

- Solvay

- Sumitomo Rubber Industries Ltd.

- Tekni-Plex

- Teknor Apex

- The Rubber Group

第 7 章:市场机会与未来趋势

- 生物基热塑性弹性体上市

The Medical Elastomers Market size is estimated at 3.5 Million tons in 2024, and is expected to reach 4.94 Million tons by 2029, growing at a CAGR of 7.12% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. The nationwide lockdowns and stringent social distancing mandates led to supply chain disruptions across different segments of the market. However, the market is expected to grow steadily owing to increasing investments in healthcare.

Key Highlights

- The demand for safe, halogen-free polymers and the shift in the medical industry toward wearable health devices and medical tools that can talk to each other from the outside are the main things driving the market.

- Decreasing usage of single-use devices and the increasing prices of silicone are the factors that may slow down the market's growth. The medical elastomer industry is moving toward sustainable and green projects as environmental awareness grows.

- The development of bio-based thermoplastic elastomers is the key market opportunity.

Asia-Pacific dominated the market across the globe, with the largest consumption in countries such as China, India, etc.

Medical Elastomers Market Trends

Thermoplastic Elastomers (TPE) Segment to Register Fastest Growth

- Among the types, the thermoplastic elastomers (TPE) segment is the largest market shareholder in the medical elastomers market.

- In the medical industry, Styrenic Block Copolymers (SBCs) are mainly used in medical tubing and film applications. They are also used in the manufacturing of medical bags, wound care, equipment, packaging, and diagnostic products, including surgical drapery, needle shields, dental dams, drip chambers, exercise bands, syringe plunger tips, respiratory equipment, orthopedic parts, medical patches, and others.

- Thermoplastic polyurethanes (TPU) are long-chain linear polymers, which allow the polyurethane to be melted to form parts, and then the parts are solidified. The usage of TPU in medical applications is consistently increasing, owing to its high-performance characteristics, resistance to chemicals and oils, improved mechanical properties, and enhanced durability.

- Polyvinyl chloride (PVC) is a linear, thermoplastic, mostly amorphous polymer. Plasticized Polyvinyl Chloride (PVC-P) or flexible PVC is used for medical applications as it offers various properties when plasticized, including flexibility, strength, transparency, kink resistance, scratch resistance, gas permeability, biocompatibility, ease of bonding with common solvents or adhesives, and stability during gamma, ethylene oxide, or E-beam sterilization, among others.

- In the medical industry, TPVs are used in the manufacturing of O-rings, soft touch grips, peristaltic pump tubes, syringe tips, bottle droppers, stop seals and gaskets, valves, diaphragms, and tubing for various medical devices. They are also used in the medical industry as a gasket on syringe plungers.

Due to the aforementioned factors, the demand for thermoplastic elastomers in the global medical industry is likely to affect the market.

Asia-Pacific Region to Dominate the Market

- In the Asia-Pacific region, China and India are two major economies that are expected to dominate the market.

- China has doubled the amount, it had been pouring into public hospitals in the last five years, to USD 38 billion. It aims to raise the healthcare industry's value to USD 2.3 trillion by 2030, more than twice its size now.

- Furthermore, the Chinese government has started policies to support and encourage domestic medical device innovation providing opportunities for the market studied. The 'Made in China 2025' initiative improves industry efficiency, product quality, and brand reputation, which will spur the development of domestic medical device manufactures and will increase competitiveness.

- China is the second-largest healthcare market in the world. However, the country imports technologically high-end implants from advanced economies. The public hospitals in the country are leading consumers of medical devices in the country. In 2021, the public expenditure done on healthcare was 1.92 trillion yuan.

- In India, in late 2021, the Union Health Minister announced various plans of the Indian government to improve healthcare facilities in the country. The government plans to invest INR 64,180 crore in healthcare sector over the next six years in the country. The government plans to strengthen the existing 'National Health Mission' by developing capacities of primary, secondary, and tertiary healthcare systems and institutions for detection and cure of new and emerging diseases.

- The increasing demand from various medical applications due to the COVID-19 outbreak is estimated to drive the market for medical elastomers during the forecast period.

Medical Elastomers Industry Overview

The global medical elastomer market is fragmented in nature with the dominance of a few large players and the existence of many local players. Some of the major players in the market include (not in any particular order) BASF SE, Celanese Corporation, DOW, Solvay, and DuPont, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rise in Demand for Safe and Halogen-free Polymers

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Decreasing Usage of Single-Use Devices

- 4.2.2 Increases Prices of SIlicone

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Thermoplastic Elastomer

- 5.1.1.1 Styrenic Block Copolymers (SBC)

- 5.1.1.2 Thermoplastic Polyurethane (TPU)

- 5.1.1.3 Plasticized Polyvinyl Chloride (PVC)

- 5.1.1.4 Thermoplastic Vulcanizate (TPV)

- 5.1.1.5 Other Thermoplastic Elastomers

- 5.1.2 Thermoset Elastomer

- 5.1.2.1 Silicones

- 5.1.2.1.1 Liquid silicone rubber (LSR)

- 5.1.2.1.2 High consistency rubber (HCR)

- 5.1.2.1.3 Other Silicones

- 5.1.2.2 Natural Rubber (Latex)

- 5.1.2.3 Butyl Rubber

- 5.1.2.4 Other Thermoset Elastomers

- 5.1.1 Thermoplastic Elastomer

- 5.2 Application

- 5.2.1 Medical Tubes

- 5.2.2 Catheters

- 5.2.3 Syringes

- 5.2.4 Non-wovens and Films

- 5.2.5 Gloves

- 5.2.6 Medical Bags

- 5.2.7 Implants

- 5.2.8 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema Group

- 6.4.2 AVANTOR Inc.

- 6.4.3 Avient

- 6.4.4 BASF SE

- 6.4.5 Biomerics

- 6.4.6 Celanese Corporation

- 6.4.7 Covestro AG

- 6.4.8 DOW

- 6.4.9 DSM

- 6.4.10 DuPont de Nemours inc.

- 6.4.11 Eastman Chemical Company

- 6.4.12 ExxonMobil Corporation

- 6.4.13 Foster Corporation

- 6.4.14 Hexpol AB

- 6.4.15 Kraton Corporation

- 6.4.16 Kuraray Co.Ltd.

- 6.4.17 Momentive

- 6.4.18 Romar

- 6.4.19 RTP Company

- 6.4.20 Solvay

- 6.4.21 Sumitomo Rubber Industries Ltd.

- 6.4.22 Tekni-Plex

- 6.4.23 Teknor Apex

- 6.4.24 The Rubber Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Introduction of Bio-based Thermoplastic Elastomer in Market