|

市场调查报告书

商品编码

1687348

抗反射膜:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Anti-Reflective Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

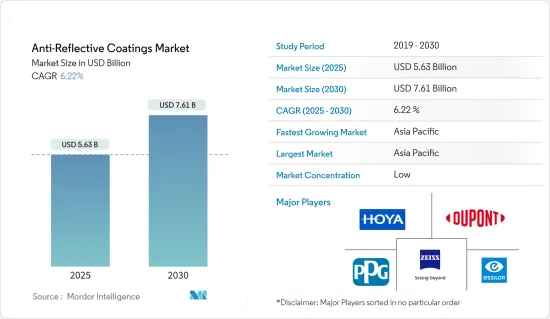

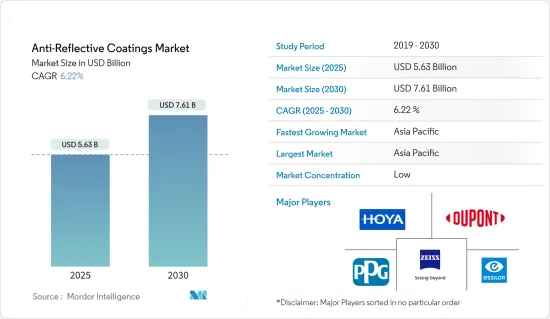

抗反射膜市场规模预计在 2025 年为 56.3 亿美元,预计到 2030 年将达到 76.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.22%。

由于各国实施某些规则和规定,新冠疫情期间各行业的需求放缓。不过,2021年产业復苏,市场需求回升。

主要亮点

- 短期内,眼镜应用需求的增加以及太阳能产业需求的增加预计将推动市场成长。

- 此外,抗反射膜的高成本和严格的环境法规预计将阻碍市场成长。

- 然而,薄膜製造技术的发展可能为市场提供有利的成长机会。

- 预计亚太地区将主导抗反射膜市场,并成为预测期内成长最快的市场。

抗反射膜市场趋势

眼镜需求不断成长

- 防反射玻璃提供了一种经济实惠的解决方案,可以减少各种电子显示器(包括电脑萤幕、电视和平板)的眩光。

- 这些涂层可减少眩光、增强显示可读性、减轻眼睛疲劳并提高视觉清晰度。

- 根据美国卫生与公众服务部的数据,美国40 岁以上人口中约有 23.9% 患有近视(约 3,400 万人)。

- 根据世界卫生组织(WHO)的数据,截至2023年8月,全球约有22亿人患有近视或远视。此外,全球因视力障碍造成的生产力损失估计为 4,110 亿美元。

- 美国视觉委员会估计,到 2023 年,美国眼镜市场的价值将达到 656 亿美元,这进一步凸显了其重要性。美国拥有约 44,850 家实体店,93% 的美国成年人经常戴着某种类型的眼镜产品。

- 因此,解决这些障碍有望刺激对相应眼镜片的需求,从而进一步刺激该国对抗反射膜的需求。

中国可望主宰亚太地区

- 由于对半导体、电子设备、太阳能板和其他製造业务的需求不断增加,亚太地区在全球市场占据主导地位。中国的太阳能产业蓬勃发展,但却受到产能过剩和贸易紧张局势升级的困扰。西方国家担心可能出现供应过剩,并向北京施压,要求限制出口。根据国家能源局的资料,2023年中国安装的太阳能板数量超过其他国家。这项成就进一步巩固了中国在全球可再生能源领域的主导地位。令人惊讶的是,中国预计将在 2023 年增加 216.9 吉瓦的太阳能发电量,高于 2022 年的 87.4 吉瓦。

- 截至 2024 年第一季,中国仍保持着太阳能板安装的势头,但与 2023 年 154% 的增幅相比有所放缓。根据国家能源局报告,到 2024 年 3 月,中国的累积太阳能装置容量将达到 660 吉瓦,而到 2023 年底,美国的累计太阳能装置容量将达到 179 吉瓦。

- 中国是全球最大的电子产品生产基地,其电子产业成长最为迅速,包括智慧型手机、电视、电线电缆、可携式运算设备、游戏系统和其他个人电子设备等电子产品。该国不仅满足国内对电子设备的需求,也向其他国家出口电子产品。

- 2023年,中国半导体产业成长强劲,积体电路(IC)产量总计达3,514亿块,与前一年同期比较去年同期成长6.9%(据工业及资讯化部)。

- 此外,半导体产业协会也强调了中国在半导体製造业的进步。预测显示,到 2024 年,中国在全球半导体产能的份额可能会飙升 13%,达到每月 860 万片晶圆。

- 因此,由于上述因素,中国有望保持在亚太市场的主导地位。

抗反射膜产业概况

抗反射膜市场由杜邦、PPG工业公司、豪雅视力保健公司、蔡司国际和依视路等主要企业(排名不分先后)瓜分。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 眼镜需求增加

- 太阳能产业需求不断成长

- 其他的

- 限制因素

- 抗反射膜成本高

- 严格的环境法规

- 其他的

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 依成膜方法

- 化学沉淀沉积

- 电子束沉淀

- 溅镀

- 其他的

- 按应用

- 半导体

- 电子设备

- 眼镜

- 太阳能板

- 车载显示萤幕

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介(概况、财务状况、产品与服务、最新发展)

- AccuCoat Inc.

- AGC Inc.

- Beneq

- DuPont

- Edmund Optics Inc.

- EKSMA Optics UAB

- ESSILOR OF AMERICA INC.

- Honeywell International Inc.

- HOYA

- Majestic Optical Coatings LLC

- Optical Coatings Japan

- Optics Balzers AG

- Optimum RX Group

- PPG Industries Inc.

- Spectrum Direct

- Torr Scientific Ltd

- ZEISS

- Zygo

第七章 市场机会与未来趋势

- 薄膜製造技术的发展

- 其他机会

The Anti-Reflective Coatings Market size is estimated at USD 5.63 billion in 2025, and is expected to reach USD 7.61 billion by 2030, at a CAGR of 6.22% during the forecast period (2025-2030).

Due to specific rules and regulations imposed by countries, the demand in various sectors slowed during the COVID-19 pandemic. However, the industry recovered in 2021, rebounding the demand in the market.

Key Highlights

- Over the short term, the increasing demand for eyewear applications and rising demand from the solar power generation industry are expected to boost the market's growth.

- Additionally, the high cost of anti-reflective coatings and stringent environmental regulations are expected to hinder the market's growth.

- However, developing thin-film fabrication technologies will likely create lucrative growth opportunities in the market.

- Asia-Pacific is expected to dominate the anti-reflective coatings market and be the fastest-growing market during the forecast period.

Anti-Reflective Coatings Market Trends

The Demand for Eyewear Applications is Increasing

- Anti-reflective glasses offer an affordable solution to glare from various electronic displays, including computer screens, televisions, and flat panels.

- These coatings reduce glare, enhance display readability, lessen eye strain, and improve visual clarity.

- According to the US Department of Health & Human Services, nearsightedness affects about 23.9% of the United States's population over 40 (about 34 million people).

- According to the World Health Organization (WHO), as of August 2023, around 2.2 billion people worldwide had near or distant vision impairment. Moreover, the global costs of productivity losses associated with vision impairment are estimated to be USD 411 billion.

- The Vision Council highlights that the United States optical market was valued at USD 65.6 billion in 2023, further underlining its significance. The country boasts approximately 44,850 brick-and-mortar optical retail outlets, with a striking 93% of US adults regularly sporting some form of eyewear.

- This is expected to enhance the demand for respective eye lenses while addressing these impairments, further enhancing the demand for anti-reflective coatings in the country.

China is Expected to Dominate the Asia-Pacific Region

- Asia-Pacific has dominated the global market due to the increasing demand for semiconductors, electronics, solar panels, and other manufacturing operations. While China's solar industry is experiencing a boom, it grapples with overcapacity and escalating trade tensions. Western nations are pressuring Beijing to limit exports, fearing a potential oversupply. According to data from the National Energy Administration (NEA), in 2023, China installed more solar panels than any other nation. This achievement bolstered its already leading position in the global renewable energy landscape. In a remarkable display, China added 216.9 gigawatts of solar power in 2023, surpassing its 2022 record of 87.4 gigawatts.

- Also, as of the first quarter of 2024, China maintained its momentum in solar panel installations, albeit slower than the 154% surge seen in 2023. In March 2024, China's cumulative solar capacity reached 660 gigawatts, a stark contrast to the United States' 179 gigawatts by the end of 2023, as reported by the NEA.

- China has the world's largest electronics production base, which includes electronic products, such as smartphones, TVs, wires, cables, portable computing devices, gaming systems, and other personal electronic devices, and recorded the highest growth in the electronics segment. The country serves the domestic demand for electronics and exports electronic output to other countries.

- In 2023, China's semiconductor industry witnessed robust growth, with the total output of integrated circuits (ICs) reaching 351.4 billion pieces, marking a 6.9% increase from the previous year, as per the Ministry of Industry and Information Technology.

- Additionally, the Semiconductor Industry Association highlights China's strides in semiconductor manufacturing. Projections suggest that China's global semiconductor capacity share could surge by 13% in 2024, reaching 8.6 million monthly wafers.

- Thus, due to the above-mentioned factors, China is poised to maintain its dominance in the Asia-Pacific market.

Anti-Reflective Coatings Industry Overview

The anti-reflective coatings market is fragmented due to major players, including DuPont, PPG Industries Inc., Hoya Vision Care Company, Zeiss International, and Essilor (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Eyewear Applications

- 4.1.2 Rising Demand from the Solar Power Generation Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of Anti-reflective Coatings

- 4.2.2 Stringent Environmental Regulations

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Deposition Method

- 5.1.1 Chemical Vapor Deposition

- 5.1.2 Electronic Beam Deposition

- 5.1.3 Sputtering

- 5.1.4 Other Deposition Methods

- 5.2 By Application

- 5.2.1 Semiconductors

- 5.2.2 Electronic Devices

- 5.2.3 Eyewear

- 5.2.4 Solar Panels

- 5.2.5 Automotive Displays

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles (Overview, Financials, Products and Services, and Recent Developments)

- 6.4.1 AccuCoat Inc.

- 6.4.2 AGC Inc.

- 6.4.3 Beneq

- 6.4.4 DuPont

- 6.4.5 Edmund Optics Inc.

- 6.4.6 EKSMA Optics UAB

- 6.4.7 ESSILOR OF AMERICA INC.

- 6.4.8 Honeywell International Inc.

- 6.4.9 HOYA

- 6.4.10 Majestic Optical Coatings LLC

- 6.4.11 Optical Coatings Japan

- 6.4.12 Optics Balzers AG

- 6.4.13 Optimum RX Group

- 6.4.14 PPG Industries Inc.

- 6.4.15 Spectrum Direct

- 6.4.16 Torr Scientific Ltd

- 6.4.17 ZEISS

- 6.4.18 Zygo

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Thin Film Fabrication Technologies

- 7.2 Other Opportunities