|

市场调查报告书

商品编码

1445940

柠檬酸钙 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Calcium Citrate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

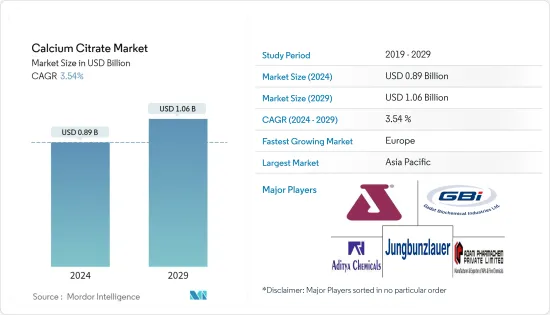

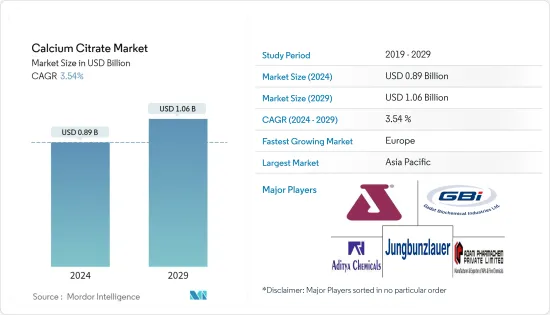

2024年柠檬酸钙市场规模预计为8.9亿美元,预计到2029年将达到10.6亿美元,在预测期内(2024-2029年)CAGR为3.54%。

该市场是由其在多个最终用户行业的不同应用推动的,从其在食品和饮料中作为酸度调节剂、乳化剂和防腐剂的作用,到在药品中作为利尿剂和化痰剂的作用。柠檬酸钙工业应用广泛,大部分地区都有使用。越来越多的千禧世代选择钙补充剂。对补充剂和营养素的需求的增长,特别是婴儿潮一代人群的需求,预计将扩大柠檬酸钙的市场。柠檬酸钙主要以粉末形式存在。然而,由于其特性,微粉化粉末出现了显着的增长。

在已开发国家和发展中国家,消费者购买力的上升和快节奏的生活方式推动了包装食品的销售。 《商业标准》的一篇文章称,人口红利、电子商务繁荣和经济成长都可能促使印度包装食品产业在未来 5-10 年内规模翻倍。在许多包装食品中,柠檬酸钙是一种常见的食品添加物。由于健康饮食习惯的趋势,使用柠檬酸钙去除包装中的水分并延长食品保质期的包装食品也越来越受欢迎。这可能会推动预测期内柠檬酸钙市场的成长。

生活方式疾病发病率的不断上升导致製药业显着成长。例如,根据国家投资促进和便利化局发布的报告,到2022年,印度製药业预计将达到3,720亿美元,CAGR为39%。癌症、爱滋病毒或爱滋病以及结核病等疾病的出现激增了开发高效药物的研发活动,其中柠檬酸钙被用作药物製剂开发的利尿剂和化痰剂。预计这些因素将在预测期内促进市场需求。

柠檬酸钙市场趋势

对补充剂的需求增加

柠檬酸钙市场主要依赖极易发生骨损伤和骨折的老化人口。老化或老年人口是全球骨关节保健品製造商最重要的目标群体之一。维持健康的生活方式和预防与年龄相关的骨骼疾病,尤其是老年骨骼疾病,使得消费者为这些补充剂支付高价,因为它们具有健康益处,针对人体特定部位的治疗。根据世界银行资料,2021年,17.04%的人口年龄在65岁以上,而64.72%的人口年龄在15岁至64岁之间。根据世界卫生组织(WHO)的数据,2021年,近2,200万人处于老年状态。欧洲和美国有 1400 万人患有骨质疏鬆症。根据国家医学图书馆的数据,2021 年,超过 10.33 亿人患有骨质疏鬆症。这些令人震惊的数字为所研究的市场带来了巨大的动力。

越来越多的千禧世代选择钙补充剂。女性,尤其是 30 多岁的女性,对维持骨骼健康的钙补充剂表现出更大的兴趣,进一步推动了柠檬酸钙市场的发展。以柠檬酸钙为基础的补充剂的主要技术优势是其高吸收效率 - 柠檬酸钙不需要任何额外的胆汁酸(在消化过程中分泌)即可吸收。近年来,市面上出现了各种形式的柠檬酸钙补充剂,包括片剂、胶囊、咀嚼片、液体和粉末,以应对骨骼退化和骨质疏鬆等疾病,骨关节保健品的需求,如图所示,将见证可观的成长率。众所周知,钙对骨骼和关节健康有益,是主要的生长促进因子。

亚太地区仍是最大市场

由于中国和印度等主要经济体,亚太地区是重要的市场。中国仍然是该地区最大的柠檬酸钙消费国和出口国,国内几家小型企业以具有竞争力的价格提供多个等级的柠檬酸钙。多年来,该国生产柠檬酸钙的新进者数量一直在增加,这反映出市场对该化合物的需求不断增长。柠檬酸钙在食品和饮料、製药和动物饲料等各行业的广泛应用正在推动该国柠檬酸钙市场的发展。这些化合物有粉末、固体、液体和颗粒形式,非常适合每个最终用户产业,导致市场多年来不断成长。该地区对该化合物作为食品和饮料行业的添加剂和防腐剂有着巨大的潜在需求。对化妆品和个人护理产品的需求不断增长可能会推动该地区对柠檬酸钙的需求。

柠檬酸钙产业概况

柠檬酸钙市场高度活跃且分散。市场上一些知名的参与者包括 Adani Pharmachem Private Limited、Aditya Chemicals Limited、Gadot Biochemical Industries Ltd、Jungbunzlauer、Jost Chemical 和 Dr. Paul Lohmann GmbH KG。市场上有许多自有品牌,它们共同促进了柠檬酸钙的生产繁荣,这是导致该行业分散的主要因素之一。产品创新采用高端技术,使产品在吸收和储存稳定性方面实现高效率,一直是该行业的主要驱动力,并被 Jungbunzlauer 和 Jost Chemical 等主要企业所采用。合作伙伴关係是参与者为获得市场份额而采取的第二常见策略。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 形式

- 微粉

- 粉末

- 颗粒状

- 应用

- 农业

- 食品与饮品

- 卫生保健

- 其他应用

- 地理

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 义大利

- 英国

- 法国

- 俄罗斯

- 西班牙

- 欧洲其他地区

- 亚太

- 印度

- 中国

- 澳洲

- 日本

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 中东和非洲其他地区

- 北美洲

第 6 章:竞争格局

- 市占率分析

- 最常用的策略

- 公司简介

- Adani Pharmachem Private Limited

- Aditya Chemicals Limited

- Dr. Paul Lohmann GmbH KG

- Daffodil Pharmachem Private Limited

- Jungbunzlauer Suisse AG

- Jost Chemical Co.

- Gadot Biochemical Industries Ltd

- Sucroal SA

- Nantong Feiyu Food Technology Co. Ltd

- Panvo Organics Pvt. Ltd

第 7 章:市场机会与未来趋势

The Calcium Citrate Market size is estimated at USD 0.89 billion in 2024, and is expected to reach USD 1.06 billion by 2029, growing at a CAGR of 3.54% during the forecast period (2024-2029).

The market is driven by its varied application in several end-user industries, ranging from its role as an acidity regulator, emulsifier, and preservative in food and beverage to its role as a diuretic and phlegm agent in pharmaceuticals. Calcium citrate has wide industry applications, and it is being used in most regions. An increasing number of millennials are opting for calcium-based supplements. The growth in the demand for supplements and nutrients, particularly among the baby boomer population, is expected to augment the market for calcium citrate. Calcium citrate is mostly found in powder. However, micronized powder witnessed significant growth due to its properties.

In established and developing countries, the rise in consumer purchasing power and fast-paced lifestyles drive the sales of packaged food products. According to a Business Standard article, the demographic dividend, e-commerce boom, and economic growth may all contribute to India's packed food industry doubling in size over the next 5-10 years. In many packaged food items, calcium citrate is a ubiquitous food additive. The popularity of packaged foods, which use calcium citrate to remove moisture from the packaging and extend the shelf life of food products, has also increased due to trends toward healthier eating habits. This may propel the growth of the calcium citrate market during the forecast period.

The growing incidence of lifestyle diseases has led the pharmaceutical sector to witness significant growth. For instance, according to a report published by the National Investment Promotion & Facilitation Agency, the Indian pharmaceutical sector was expected to reach USD 372 billion by 2022, at a CAGR of 39%. The emergence of diseases such as cancer, HIV or AIDS, and tuberculosis have surged the R&D activities for developing highly efficient drugs where calcium citrate is used as a diuretic and phlegm agent for pharmaceutical formulation development. Such factors are anticipated to foster the demand for the market during the forecast period.

Calcium Citrate Market Trends

Increased Demand for Supplements

The calcium citrate market primarily depends on the aging population that is highly susceptible to bone injuries and fractures. The aging or geriatric population is one of the most significant target segments for global bone and joint health supplement manufacturers. Maintaining a healthy lifestyle and preventing age-related bone diseases, particularly at an older age, is making consumers pay premium prices for these supplements, as they impart health benefits, targeting treatment of a specific segment of the human body. According to World Bank data, in 2021, 17.04% of the population was over 65 years old, while 64.72% were between the ages of 15 and 64. According to the World Health Organization (WHO), in 2021, almost 22 million individuals in Europe and 14 million in the United States had osteoporosis. According to the National Library of Medicine, in 2021, it was observed that more than 1033 million people had osteoporosis. These alarming figures have given significant momentum to the market studied.

An increasing number of millennials are opting for calcium-based supplements. Women, especially in their mid-30s, have shown greater interest in calcium-based supplements to maintain their bone health, further fueling the calcium citrate market. The major technological advantage in favor of calcium citrate-based supplements is their high absorption efficiency - calcium citrate does not require any extra bile acids (secreted during digestion) for its absorption. The market has recently witnessed the emergence of calcium citrate supplements in various forms, including tablets, capsules, chews, liquids, and powders due the diseases such as bone deterioration and osteoporosis, The demand for bone and joint health supplements, as evident from the graph, is set to witness a decent growth rate. As it is well-known for bone and joint health, calcium is a main growth-promoting factor.

Asia-Pacific Remains the Largest Market

The Asia-Pacific region is a prominent market due to major economies such as China and India. China remains the largest consumer and exporter of calcium citrate in the region, with several small domestic players offering calcium citrate in multiple grades at competitive pricing. The number of new entrants producing calcium citrate in the country has been increasing over the years, which reflects the growing demand for the compound in the market. The broad spectrum of applications of calcium citrate in various industries, such as food and beverages, pharmaceutical, and animal feed, is driving the market for calcium citrate in the country. The compounds' availability in powder, solid, liquid, and granular forms suits well with every end-user industry, leading to market growth over the years. The region offers huge potential demand for the compound as an additive and preservative in the food and beverage industry. The increasing demand for cosmetics and personal care products is likely to propel the demand for calcium citrate in the region.

Calcium Citrate Industry Overview

The calcium citrate market is highly dynamic and fragmented. Some of the prominent players in the market include Adani Pharmachem Private Limited, Aditya Chemicals Limited, Gadot Biochemical Industries Ltd, Jungbunzlauer, Jost Chemical, and Dr. Paul Lohmann GmbH KG. The market exhibits many private-label brands that collectively contribute to the production boom of calcium citrate, which is one of the major contributing factors to the fragmented nature of the industry. Product innovation, using high-end technology that results in high efficiency of the product in terms of absorption and storage stability, has been the major driving force for the industry, adopted by key players like Jungbunzlauer and Jost Chemical. Partnership is the second-most common strategy players are adopting to gain market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Form

- 5.1.1 Micronized Powder

- 5.1.2 Powder

- 5.1.3 Granular

- 5.2 Application

- 5.2.1 Agriculture

- 5.2.2 Food and Beverage

- 5.2.3 Healthcare

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 Italy

- 5.3.2.3 United Kingdom

- 5.3.2.4 France

- 5.3.2.5 Russia

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Adopted Strategies

- 6.3 Company Profiles

- 6.3.1 Adani Pharmachem Private Limited

- 6.3.2 Aditya Chemicals Limited

- 6.3.3 Dr. Paul Lohmann GmbH KG

- 6.3.4 Daffodil Pharmachem Private Limited

- 6.3.5 Jungbunzlauer Suisse AG

- 6.3.6 Jost Chemical Co.

- 6.3.7 Gadot Biochemical Industries Ltd

- 6.3.8 Sucroal SA

- 6.3.9 Nantong Feiyu Food Technology Co. Ltd

- 6.3.10 Panvo Organics Pvt. Ltd