|

市场调查报告书

商品编码

1642960

医用包装薄膜:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Medical Packaging Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

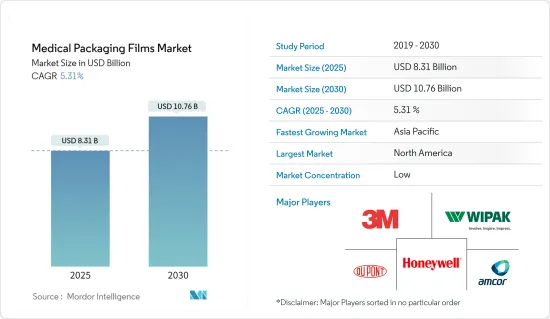

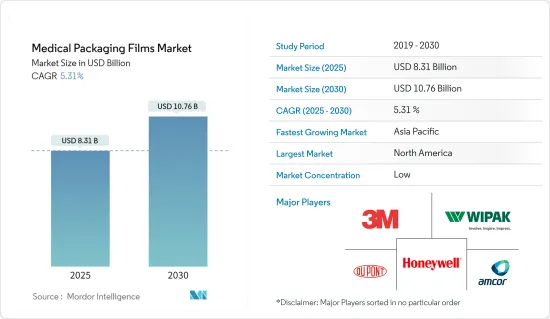

预计 2025 年医疗包装薄膜市场规模为 83.1 亿美元,到 2030 年将达到 107.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.31%。

此市场规模反映了医疗包装产业各个应用领域的包装膜产品的价值,并按实际计算。包装薄膜由聚乙烯、聚丙烯、双向拉伸聚对苯二甲酸乙二醇酯、聚亚苯醚、聚氯乙烯、EVOH、聚苯乙烯(PS)、尼龙等塑胶材料製成,各种金属均视为市场研究范围。

主要亮点

- 世界各国政府正大力投资医疗和医药产品及解决方案,以对抗疫情造成的伤害并防止新冠肺炎疫情復发。例如,根据美国卫生指标与评估研究所(IHME)2021年9月的报告,2019年全球人均医疗支出为1,129美元,预计2050年将增加到1,515美元。创新包装和积极主动的措施正在成为医疗产业的常态,预计这将推动对医疗包装薄膜的需求。

- 该市场是包装行业中成长最快的领域,在供应链安全问题、监管要求不断变化的以及供需失衡等挑战中,许多驱动因素加速了该市场的成长。在预测期内,由于各市场参与者采取多项倡议来限制塑胶材料的使用,生质塑胶塑胶薄膜的份额预计将扩大。然而,由于所研究市场的挑战性,与塑胶薄膜的其他终端用户产业相比,这些倡议可能对以永续包装薄膜取代塑胶薄膜的影响较小,从而维持市场成长。

- 由于用于治疗癌症等慢性疾病的药物数量的增加,以及对这些药物的小袋、小药囊和小包装的需求不断增加,预计市场将显着增长。此外,人口老化和糖尿病发病率预计将为市场扩张提供新的机会。

- 市场成长面临的主要挑战包括原材料价格波动、持续的永续性动力(包括用生物分解性材料取代塑胶包装产品)以及强制在塑胶包装中使用消费后回收(PCR)塑胶。通常,该行业的原材料成本占销售额的55-60%。因此,盈利很容易受到原物料价格波动的影响。软包装薄膜的主要投入成本是原油衍生性商品,而原油衍生性商品本身就具有波动性。

- 在持续近一到两年的新冠疫情期间,包装薄膜製造商面临大量问题。封锁的影响包括供应链中断、劳动力短缺、製造过程中所用原材料的短缺、价格波动导致最终产品产量膨胀并超出预算以及运输问题。

医用包装薄膜的市场趋势

生质塑胶材料和可回收包装的需求不断增长,推动了医疗包装薄膜市场的发展

- 研究市场正在使用生质塑胶来减少对环境的影响。由于工业中大量使用塑料,导致废弃物数量急剧增加。因此,将生物分解性塑胶用于医疗应用有助于保护环境。

- 医用袋广泛应用于医疗应用,特别是在需要大量、低成本包装时,因为其主要优点包括保护医疗产品、便于运输和品牌推广。这些袋子通常用于存放急救箱、药品和医疗设备。这些小袋还可以用来储存工具和液体药物。

- 此外,包装薄膜製造商正专注于使用可回收材料创新医疗包装解决方案,以实现其产品的更高永续性。例如,2021 年 11 月,永续包装解决方案提供商 Coveris 推出了一系列基于医疗包装单膜的可回收单 PE 薄膜,品牌为 Flexopeel T 和 Formpeel T。该公司将杜邦公司的未涂层Tyvek 1073B 与 Coveris 公司的基于 PE 树脂的单结构薄膜结合在一起。

- 包装产业对生质塑胶材料的需求不断增长,推动了市场研究。包装製造商可以使用生质塑胶来取代聚合物基塑胶。生质塑胶的使用将减轻医疗包装禁令的影响,而永续性的担忧预计将导致聚合物树脂基包装使用量的下降。据欧洲生物塑胶协会称,2021年全球软质包装用生质塑胶产能为66.5万吨。

- 研究市场中的主要企业正在推出新产品,以跟上不断变化的消费者偏好并保持与市场需求的相关性。例如,加拿大包装和药物分配公司 Jones Healthcare Group 于 2021 年 12 月透过永续包装产品扩展了其药房的 Qube 和 FlexRx 药物依从性产品线。该公司推出了由医学认可的生质塑胶Bio-PET 製成的 Qube Pro、FlexRx One 和 FlexRx Reseal泡壳包装。

亚太地区可望成为成长最快的市场

- 由于中阶人口不断增长、可支配收入不断提高以及中国、印度、印尼和马来西亚等新兴经济体对医疗保健和药品的需求不断增加,亚太地区预计将在接受调查的市场中以最高的增长率扩张。该地区蓬勃发展的药品生产极大地推动了该地区阻隔膜市场的成长。

- 亚洲肾臟疾病发生率的不断上升,迫使人们开发新的治疗方法,包括先进的设备来改善治疗。由于糖尿病和高血压发病率的上升,亚洲肾臟疾病的盛行率正在上升。此外,对延长医疗设备和产品的保质期以及消除细菌和病毒污染的可能性的重视正在推动医疗保健行业对包装薄膜的需求。

- 由于医用包装薄膜解决方案具有节省成本、永续性和包装产品安全性等优势,预计中国和印度等人口众多的新兴国家的医用包装薄膜需求将大幅增加。此外,由于强大的工业基础、对永续包装解决方案不断增长的需求以及主要製造商的存在,预计亚太地区将在金额和数量方面引领市场。

- 植入式设备需求的不断增长和医疗保健市场的蓬勃发展也推动了医用包装薄膜的需求。由于中国和印度等新兴市场对植入式设备的需求不断增长以及公众意识不断增强,市场规模不断扩大。

- 随着医疗卫生领域的扩大,中国的医疗设备市场正以惊人的速度成长。这个特定产业是中国成长最快的产业之一。在动态法规的推动下,该产业正以两位数的速度成长,其中近70%的成长来自医院。传统上,中国医疗设备市场以低端耗材、机械治疗设备及辅助器具数量较多着称。传统上,必要的高端消耗品的采购严重依赖进口,因为这些产品不是本地生产的。

- 目前,高价值、高风险的医疗设备正在向国内转移生产,可望带动中国医用包装薄膜市场的发展。此外,人口老化也是中国高端医疗设备需求增加的驱动力之一。根据世界卫生组织(WHO)的数据,到2040年,中国60岁以上人口预计将达到28%。预计这一不断增长的人口将比以前变得更加富裕,并且能够负担得起医疗保健服务。

医用包装薄膜产业概况

医用包装薄膜市场主要参与者如下:霍尼韦尔、3M、安姆科等公司都采用了新产品发布、合资、合作、收购等各种策略来扩大其在该市场的影响力。

- 2022 年 4 月-负责任包装解决方案开发和生产的全球领导者 Amcor 宣布将在其药品包装产品组合中添加永续的高屏蔽层压板。新的低碳、可回收包装选择在两个方面实现,满足行业所需的阻隔性和性能要求,同时支持製药公司的可回收目标。

- 2022 年 1 月 - 再生材料产品和阻隔性保护包装领域的主要企业Klockner Pentaplast 宣布计划进行一项重大投资,以扩大其在北美的消费后回收 (PCR) PET 生产能力,从而进一步扩大其在消费者健康、医药和食品包装市场的永续创新产品。该公司拥有使用 PCR 材料生产 20% 以上产品的能力。此次扩建将增加一条挤出生产线和两台热成型机,总合新 rPET 或 PET 产能达到 15,000 吨。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 对生质塑胶和可回收包装材料的需求不断增加

- 医疗设施支出增加主要是因为慢性病发生率上升

- 市场限制

- 原物料价格波动

第六章 市场细分

- 依材料类型

- 塑胶薄膜

- PE

- PP

- PVC

- PC

- 金属薄膜

- 塑胶薄膜

- 按应用

- 包包和小袋

- 管子

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Honeywell International Inc.

- 3M Company

- Wipak Oy

- Amcor Plc

- DuPont de Nemours, Inc.

- Renolit Medical

- PolyCine GmbH

- Glenroy, Inc.

- Toray Industries, Inc.

- Klockner Pentaplast Group

- Dunmore Corporation

- Covestro AG

第八章投资分析

第九章 市场机会与未来趋势

The Medical Packaging Films Market size is estimated at USD 8.31 billion in 2025, and is expected to reach USD 10.76 billion by 2030, at a CAGR of 5.31% during the forecast period (2025-2030).

The market size reflects the value of packaging film products across medical packaging industry applications and is computed in the real term. Packaging films are made from plastic materials, such as polyethylene, polypropylene, biaxially oriented polyethylene terephthalate, polyphenylene ether, polyvinyl chloride, EVOH, polystyrene (PS), nylon, and various metals are considered as per the scope of the market study.

Key Highlights

- Governments worldwide are heavily investing in medical and pharmaceutical products and solutions in damage control and the prevention of any potential resurgence of the COVID-19 pandemic. For instance, according to the Institute for Health Metrics and Evaluation (IHME), published in September 2021, the global per capita health expenditure was USD 1,129 in 2019, and it is projected to increase to USD 1,515 by 2050. Innovative packaging and preemptive measures are expected to become the norm in the medical industry, driving the demand for medical packaging films.

- The market studied is a burgeoning segment of the packaging sector, with many drivers accelerating the growth amid the challenges in the form of supply chain security woes, changing regulatory demands, and supply and demand imbalances. During the forecast period, bioplastic films are expected to increase their share on account of several initiatives taken by various market entities to curb the use of plastic materials. However, owing to the severe nature of the market studied, these initiatives are likely to have less impact on replacing plastic films with sustainable packaging films compared to other end-user industries of plastic films, thereby sustaining the market growth.

- The market is expected to experience significant growth, owing to the increase in therapeutics for chronic illnesses, such as cancer and the increasing demand for pouches, bags, and sachets for therapeutic medicines. Additionally, the aging population and the incidence of diabetes are projected to present new opportunities for market expansion.

- Some of the major challenges for the market growth are the volatility of raw material prices, the ongoing drive for sustainability, which includes replacing plastic-based packaging products with biodegradable materials, and mandates of using post-consumer recycled (PCR) plastics in plastic packaging. Usually, raw material costs are attributed to 55-60% of sales in this industry. Therefore, profitability is vulnerable to volatility in raw material prices. The key input cost for flexible packaging film is crude derivatives, which have been inherently volatile.

- During the COVID-19 pandemic, packaging film manufacturers were flooded with a pool of issues that lasted long for nearly one or two years. Some of the effects of lockdown included supply chain disruptions, labor shortages, lack of availability of raw materials used in the manufacturing process, fluctuating prices that caused the production of the final product to inflate and go beyond budget, transportation problems, etc.

Medical Packaging Films Market Trends

Increasing Demand for Bioplastic Material and Recyclable Packaging Material Drives the Medical Packaging Films Market

- Bioplastics are being used in the market studied to reduce environmental impact. The amount of waste increased dramatically due to the extensive use of plastics in the industry. Thus, using biodegradable plastic in medical applications contributes to environmental protection.

- Medical bags are widely used in medical applications, particularly when low-cost packaging in large quantities is required, owing to the primary benefits, such as medical product protection, ease of transportation, and brand promotion. These bags are frequently used to store first aid kits, medications, and medical equipment. Pouches can be used to store tools or liquid medications.

- Moreover, packaging film manufacturers are focusing on innovating medical packaging solutions with recyclable materials to achieve greater sustainability in their product offerings. For instance, in November 2021, Coveris, a sustainable packaging solution provider, launched recyclable mono-PE film based on mono films branded Flexopeel T and Formpeel T for medical packaging. The company combined an uncoated Tyvek 1073B from DuPont and a mono-structure film from Coveris, based on PE resins.

- The increasing demand for bioplastic material in the packaging segment has been driving the market study, as packaging product producers have alternatives for polymer-based plastic in the form of bioplastic. Using bioplastic reduced the impacts of bans and an anticipated reduction in polymer plastic-based packaging usage in medical packaging, owing to sustainability concerns. According to European Bioplastics, in 2021, the global production capacity of bioplastics for flexible packaging was 665,000 metric tons.

- Key players in the market studied are launching new products to cater to changing consumer preferences and stay relevant to market demand. For instance, the Canadian packaging and medication dispenser company Jones Healthcare Group expanded the Qube and FlexRx medication adherence product lines for pharmacies with sustainable packaging products in December 2021. The company launched Qube Pro, FlexRx One, and FlexRx Reseal blister packs made of Bio-PET, a bioplastic that received medical approval.

Asia Pacific is Expected to be the Fastest Growing Market

- The Asia Pacific is expected to expand with the highest growth rate in the market studied, majorly due to the increasing middle-class population, disposable incomes, and demand for medical and pharmaceutical products in developing economies such as China, India, Indonesia, and Malaysia. The booming pharmaceutical production in the region is significantly driving the growth of the barrier film market in the region.

- The increasing prevalence of kidney disease in Asia necessitated the development of new therapies, including sophisticated devices to improve treatment. The prevalence of kidney disease in Asia is increasing due to increasing rates of diabetes and hypertension. Furthermore, the emphasis on extending the shelf life of medical devices and products and eliminating the possibility of bacterial or viral contamination increased the demand for packaging film in the medical and healthcare industries.

- As medical packaging film solutions offer benefits, like cost savings, sustainability, and safety of packaged products, significant growth has been seen for medical packaging films from populated developing countries, such as China and India. Moreover, the Asia-Pacific region is anticipated to lead the market studied in terms of value and volume due to the solid industrial base, increased demand for sustainable packaging solutions, and the presence of key manufacturers in the region.

- The demand for medical packaging films is also fueled by the increasing demand for implantable devices and the booming healthcare market. The market expanded due to the escalating demand for implantable devices and increasing public awareness in developing nations like China and India.

- Along with the expanding healthcare sector, China's medical device market is increasing at an incredible pace. This specific sector is one of the fastest-increasing sectors in China. The sector is increasing at a double-digit growth rate, driven by dynamic regulations, nearly 70% of which was contributed to by hospital procurement. Traditionally China's medical devices market is well known for large volumes of low-end consumables, mechanotherapy devices, and aids. There has been large dependence on imports for procuring required high-end consumables as they were not traditionally manufactured in the country.

- Currently, there has been a shift toward domestically made high-value and high-risk medical devices, which are expected to drive the Chinese medical packaging film market. Moreover, the aging population is one of the driving factors for the increase in demand for high-end Chinese devices. According to the World Health Organization (WHO), the population aged more than 60 years is expected to reach 28% in China by 2040. This increasing demographic, which is increasingly affluent, is expected to be able to spend more on healthcare services than before.

Medical Packaging Films Industry Overview

The Medical Packaging Films Market is fragmented in nature, and the major players such as Honeywell, 3M, Amcor, etc. have used various strategies such as new product launches, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market.

- April 2022 - Amcor, one of the global leaders in developing and producing responsible packaging solutions, announced the addition of sustainable high shield laminates to its pharmaceutical packaging portfolio. The new low carbon, recycle-ready packaging options deliver on two fronts, providing the high barrier and performance requirements needed for the industry while supporting pharmaceutical companies' recyclable objectives.

- January 2022 - Klockner Pentaplast, a leading company in recycled content products and high-barrier protective packaging, announced its plans to expand its post-consumer recycled content (PCR) PET capacity in the North America region with a significant investment to further increase its sustainable innovation offering in consumer health and pharmaceutical food packaging markets. The company has the capacity, with more than 20% of its volumes made from PCR material. The expansion is set to add an extrusion line and two thermoformers, providing a total of 15,000 metric tons of new rPET or PET capacity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Bioplastic and Recyclable Packaging Material

- 5.1.2 Increased Spending on Healthcare Facilities, Primarily Owing to Increase in Chronic Diseases

- 5.2 Market Restraints

- 5.2.1 Fluctuation in the Prices of Raw Materials

6 MARKET SEGMENTATION

- 6.1 Material Type

- 6.1.1 Plastic Film

- 6.1.1.1 PE

- 6.1.1.2 PP

- 6.1.1.3 PVC

- 6.1.1.4 PC

- 6.1.2 Metallic Film

- 6.1.1 Plastic Film

- 6.2 Application

- 6.2.1 Bags & Pouches

- 6.2.2 Tubes

- 6.2.3 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 3M Company

- 7.1.3 Wipak Oy

- 7.1.4 Amcor Plc

- 7.1.5 DuPont de Nemours, Inc.

- 7.1.6 Renolit Medical

- 7.1.7 PolyCine GmbH

- 7.1.8 Glenroy, Inc.

- 7.1.9 Toray Industries, Inc.

- 7.1.10 Klockner Pentaplast Group

- 7.1.11 Dunmore Corporation

- 7.1.12 Covestro AG