|

市场调查报告书

商品编码

1445974

液压设备 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Hydraulic Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

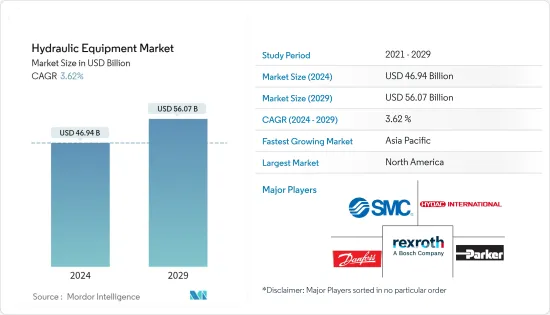

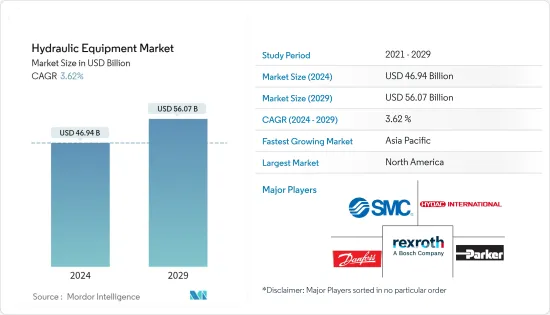

2024年液压设备市场规模预估为469.4亿美元,预估至2029年将达560.7亿美元,预测期内(2024-2029年)CAGR为3.62%。

主要亮点

- 液压设备包含各种组件,为各种工业应用提供许多好处。这些工具通常利用加压流体产生的力,透过系统将力作为能量传递,以完成各种任务和应用。此外,由于流体不可压缩,液压设备可以比类似尺寸的气动工具产生更大的力,这使得液压系统能够在更高的压力水平下运作。因此,液压工具通常用于重型工业应用。

- 用于智慧移动和资料收集感测器的电子设备正迅速成为液压设备的标准配置。物联网如今也用于流体动力系统,儘管其典型应用围绕电力系统。製造商透过提供各种具有数位介面和感测器智慧的电动液压模组和组件来鼓励液压产品的数位化。它们还有助于液压系统的智慧设计、配置和精确控制,这是目前液压应用技术所允许的。

- 在过去的 70 年里,物料搬运经历了不同的变革,改变了产业的面貌。物料搬运机器和机器人已经取代了个别工人。由于这种转变,许多产业得到了发展,特别是汽车产业,成长了10倍。

- 阻碍液压设备市场发展的主要挑战是设备使用寿命内维护费用的波动。不銹钢、铁矿石、铝、青铜等金属合金等原料成本的变化,造成液压设备配置成本的波动,进而造成供需缺口。

- 预计不断扩大的建筑业将在预测期内增加液压设备市场的需求。例如,根据统计和计画实施部 (MOSPI) 的数据,2022 年第四季印度建筑业的价值超过 3 兆印度卢比(367 亿美元),与 2020 年相比大幅成长,2020 年该价值因冠状病毒(COVID-19)大流行。此外,该国的建筑业和製造业是当时受创最严重的行业之一。不过,该行业很快就復苏,再次恢復到危机前的水平。在液压设备的其他主要最终用户产业也观察到了类似的趋势。因此,这些产业的復苏将为所研究的市场创造机会。

液压设备市场趋势

建筑业将显着成长

- 液压设备透过加压流体来操作和执行任务。施加在受限流体上的压力不会减弱。加压流体作用于容纳容器的一部分的每个部分并产生力或功率。随着这项技术的不断成熟,液压技术使其有可能实现更精确的运动。这种精度为更好地优化施工流程提供了动力。

- 建筑业引入液压技术可以快速完成更多工作,提高生产力。液压科学使设备能够完成运动范围并提高固定精度。液压动力是当前建筑业的重要组成部分,持续的技术进步将使液压设备在未来变得更加必要。

- 液压设备可以承受和传递高负荷。与其他依赖机械部件的系统相比,液压设备的移动和承载部件较少。液压油、马达和帮浦位于两端以控制大多数功能限制。利用智慧阀门、智慧型帮浦和其他零件可以提高液压设备的运作和管理性能。此外,它还有助于实现流程自动化。

- 建筑业是印度经济的强劲驱动力。该行业对推动印度整体发展负有积极责任。政府面临极大的压力,必须推出政策,为该国提供有时限的世界级基础设施设计。儘管印度的建筑业出现了混乱,但透过适合推动大型专案的倡议和策略,未来仍是积极的。例如,2022年4月,霍尼集团宣布了33个项目,其中24个在安得拉邦,9个在特伦甘纳邦,一日之内为建筑业树立了标竿。该公司透过利用多种创新技术来开发、建造和管理建筑物来实现这一目标。

- 此外,预计建筑业的崛起将在预测期内增加液压缸市场的需求。例如,根据 MOSPI 的数据,2022 财年,印度各地建筑业的实际总价值增加了 10% 以上。

北美预计将占据最大的市场份额

- 北美液压设备市场主要由提供强大液压设备、长期合作伙伴关係和全面分销管道的一级公司主导。然而,利基竞争对手可以透过针对不同行业领域的客製化产品来获得市场份额。

- 该地区的石油和天然气产业正在强劲成长,支撑了对液压设备的需求。根据美国能源情报署 (EIA) 的数据,2022 年美国干天然气产量有所增长,10 月和 11 月平均产量超过 1000 亿立方英尺/秒,超过了 2019 年疫情爆发前的月度产量记录。

- 此外,由于俄罗斯入侵乌克兰,许多国家禁止从俄罗斯进口原油,这使得该地区有机会成为这些国家的主要原油出口国。该地区仍然是石油和天然气的主要生产地。随着旧资源的枯竭,新的石油资源正在被发现。根据英国石油公司2022年世界能源统计年鑑,美国是最大的石油生产国,2021年产量为7.111亿吨。

- 该地区的主要趋势之一是将产业与物联网融合。该地区注意到最终用户行业越来越多地采用工业自动化。整合液压设备提供了增强营运和降低能源成本的机会。

- 此外,区域参与者正在采取不同的措施并进行策略性投资,以吸引更广泛的客户群。自 2022 年 6 月起,Motion Industries Inc. 宣布创建其流体动力业务品牌 Mi Fluid Power Solutions。该公司预计将专注于液压、润滑、过滤、製程泵浦、气动、精密工业工具和工厂自动化产品。

液压设备产业概况

液压设备市场竞争激烈程度中等。由于博世力士乐股份公司 (ROBERT BOSCH GMBH)、派克汉尼汾公司、贺德克国际有限公司、丹佛斯公司、SMC 公司等市场上的几家知名企业,预计在预测期内该数字将会增加。这些参与者也采取併购策略来获得市场份额。

2023 年 4 月,博世力士乐推出了 Hagglunds Quantum 系列液压马达,旨在增强扭力和速度能力,同时保持重型设备直接驱动应用的效率。此外,这些马达的最大速度超过 150 rpm,最大扭力超过 350 kNm。设计和所用材料的变化可以提高速度和扭矩并延长使用寿命,同时确保高效运作。

2022年11月,卡特彼勒宣布推出两款新型液压挖土机,分别是卡特彼勒340和352。卡特彼勒表示,新型卡特彼勒340液压挖土机拥有更强劲的引擎、更宽的履带和7.5 吨配重,生产率比上一代提高了10%。2020 年 Cat 336。另一方面,新型Cat 352 液压挖掘机结合了更好的动力和更重的配重,可与更大的工具配合使用。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 科技趋势

- 产业价值链/供应链分析

- COVID-19 对市场的影响

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场动态

- 市场驱动因素

- 物料搬运设备的需求不断增加

- 透过政府措施和投资增加建筑业的需求

- 市场限制

- 设备使用寿命内维护成本高

第 6 章:市场细分

- 按组件

- 泵浦

- 阀门

- 汽缸

- 马达

- 过滤器和累加器

- 传染

- 其他产品类型

- 按最终用户产业

- 建造

- 农业

- 物料搬运

- 航太和国防

- 机械工具

- 油和气

- 油压机

- 塑胶

- 汽车

- 其他最终用户产业

- 按地理

- 北美洲

- 欧洲

- 亚太

- 世界其他地区

第 7 章:竞争格局

- 公司简介

- Bosch Rexroth AG (ROBERT BOSCH GMBH)

- Parker-Hannifin Corporation

- Hydac International Gmbh

- Danfoss AS

- SMC Corporation

- Festo SE (Festo Beteiligungen GmbH & Co. KG)

- Norgren Limited (IMI PLC)

- Bucher Hydraulics (Bucher Industries AG)

- HAWE

- Linde Hydraulics GmbH & Co.

- Vendor Ranking

- List of Key Vendors By Region

第 8 章:市场的未来

The Hydraulic Equipment Market size is estimated at USD 46.94 billion in 2024, and is expected to reach USD 56.07 billion by 2029, growing at a CAGR of 3.62% during the forecast period (2024-2029).

Key Highlights

- Hydraulic equipment encompasses various components and offers many benefits for various industrial applications. These tools usually use the force created by pressurized fluids, transferring the force as energy through the system to complete a wide range of tasks and applications. Furthermore, hydraulic equipment can generate much greater force than pneumatic tools of a similar size, as fluids are incompressible, which gives hydraulic systems the ability to operate at much higher pressure levels. Hence, hydraulic tools are often used in heavy-duty industrial applications.

- Electronics for intelligent mobility & data collection sensors are becoming rapidly standard in hydraulic equipment. IoT is also utilized nowadays in fluid power systems, even though its typical applications revolve around electric systems. Manufacturers encourage the digitization of hydraulic goods by providing a broad range of electro-hydraulics modules and components with digital interfaces & sensor intelligence. They also aid in the smart design, configuration, & precision control for hydraulic systems that current technology in hydraulic applications permits.

- Over the past 70 years, material handling has experienced different transformations that have transformed the industry's outlook. Material-handling machines & robots have substituted individual workers. Due to this transformation, many industries have developed, especially the automotive industry, which has undergone a 10-fold growth.

- The main challenge impeding the hydraulic equipment market's development is the volatility in maintenance expenses over the equipment's lifespan. Changes in the costs of raw materials like stainless steel, iron ore, aluminum, bronze, & other metal alloys have induced volatility in the arrangement cost of hydraulic equipment, which, in turn, has led to a demand-supply gap.

- The expanding construction industry is anticipated to augment the hydraulic equipment market need over the forecast period. For instance, according to the Ministry of Statistics & Programme Implementation (MOSPI), India's construction industry was valued at over INR 3 trillion (USD 36.70 billion) in Q4 of 2022, a significant increase compared to 2020, when the value shrank due to the coronavirus (COVID-19) pandemic. Also, the country's construction & manufacturing industries were among the worst hit then. However, the industry recovered quickly and returned to pre-crisis level again. A similar trend has been observed across other major end-user industries of hydraulic equipment. Hence, the recovery of these industries will create opportunities in the studied market.

Hydraulic Equipment Market Trends

Consutruction Segment to Witness Significant Growth

- Hydraulic equipment operates and executes tasks through a pressurized fluid. The pressure applied to a confined fluid is transferred undiminished. That pressurized fluid acts upon each part of a section of the holding vessel & builds force or power. As the technology persisted in maturing, hydraulics created it likely to reach far more precise motions. Such precision has attained momentum for better optimization of the construction processes.

- The introduction of hydraulics in the construction industry has let more jobs be completed quickly, improving productivity. The science of hydraulics allowed the equipment to complete the range of motion and be held with increased precision. Hydraulic power is an essential part of the current construction industry, and persisting technological advancements will make utilizing hydraulic equipment even more necessary in the future.

- The hydraulic equipment can resist and transmit high loads. Hydraulic equipment has lesser moving and load-bearing parts than other systems that depend on mechanical components. The hydraulic fluid, motors, & pumps are at either end to control most functional limitations. Utilizing smart valves, smart pumps, and other parts provides more efficient operation and managing performance of the hydraulic equipment. Furthermore, it assists in automating the process.

- The construction sector is a robust driver of the Indian economy. The industry is favorably responsible for propelling India's overall development. It has extreme stress on the government to initiate policies that would provide the country's time-bound design of world-class infrastructure. While India's construction sector has seen disturbances, there is positiveness for the future with the initiatives & strategies adapted to drive large-scale projects. For instance, in April 2022, Honeyy Group announced 33 projects, of which 24 were in Andhra Pradesh and 9 in Telangana, setting a bar for the construction industry in one day. The company has accomplished this by utilizing several innovative techniques to develop, construct, & manage buildings.

- Furthermore, the rising construction industry is anticipated to increase the hydraulic cylinders market need over the forecast period. For instance, according to MOSPI, in FY 2022, the real gross value in the construction industry around India increased by more than 10%.

North America Is Expected to Hold Largest Market Share

- The North American hydraulic equipment market is dominated mainly by Tier 1 companies delivering powerful hydraulic equipment, long-standing partnerships, and comprehensive distribution channels. However, niche competitors can acquire market share with customized offerings for distinguishing industry sectors.

- The region's oil and gas industry is witnessing robust growth, supporting the demand for hydraulic equipment. According to the Energy Information Administration (EIA), dry natural gas production in the US grew during 2022, averaging over 100 billion ft3/s in October & November, exceeding pre-pandemic monthly production records from 2019.

- Furthermore, due to Russia's invasion of Ukraine, numerous countries have prohibited the import of crude oil from Russia, providing the region an opportunity to be the leading exporter of crude oil to these countries. The region persists in being a key producer of oil & gas. As old resources are being exhausted, new sources of oil are being located. According to the Statistical Review of World Energy by British Petroleum in 2022, the US was the biggest oil producer, producing 711.1 million tons in 2021.

- One of the major trends in the region is merging the industry with IoT. The region is noticing the growing adoption of industrial automation across end-user industries. Integrated hydraulic equipment delivers an opportunity to enhance operations and lower energy costs.

- Further, regional players are taking different initiatives and creating strategic investments to catch the wider client base. As of June 2022, Motion Industries Inc. unveiled the creation of its fluid power business brand, Mi Fluid Power Solutions. The company is anticipated to concentrate on hydraulics, lubrication, filtration, process pumps, pneumatics, precision industrial tooling, & factory automation products.

Hydraulic Equipment Industry Overview

The intensity of competitive rivalry in the hydraulic equipment market is moderately high. It is expected to increase over the forecast period due to several prominent players such as Bosch Rexroth AG (ROBERT BOSCH GMBH), Parker-Hannifin Corporation, Hydac International GmbH, Danfoss A/s, SMC Corporation, among others in the market. These players are also adopting merger and acquisition strategies to gain market share.

In April 2023, Bosch Rexroth unveiled its Hagglunds Quantum range of hydraulic motors, designed to enhance torque and speed capabilities while retaining efficiency for direct drive applications in heavy-duty equipment. Also, these motors provide a maximum speed of over 150 rpm & maximum torque of more than 350 kNm. Changes to the design and materials used allowed the boost in speed and torque and a longer lifespan while ensuring efficient operation.

In November 2022, Caterpillar announced the launch of two new hydraulic excavators, namely Caterpillar 340 and 352. According to Caterpillar, the new Cat 340 Hydraulic Excavator had a stronger engine, wider track, and 7.5-ton counterweight to improve productivity by 10% over the 2020 model year Cat 336. On the other hand, the new Cat 352 Hydraulic Excavator combined better power and a heavier counterweight to work with bigger tools.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Technological Trends

- 4.3 Industry Value Chain/ Supply Chain Analysis

- 4.4 Impact of COVID-19 on the Market

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Material Handling Equipment

- 5.1.2 Increasing Demand From the Construction Industry via Government Initiatives and Investments

- 5.2 Market Restraints

- 5.2.1 High Maintenance Cost Over the Equipment's Lifespan

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Pumps

- 6.1.2 Valves

- 6.1.3 Cylinders

- 6.1.4 Motors

- 6.1.5 Filters and Accumulators

- 6.1.6 Transmission

- 6.1.7 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Construction

- 6.2.2 Agriculture

- 6.2.3 Material Handling

- 6.2.4 Aerospace and Defense

- 6.2.5 Machine Tools

- 6.2.6 Oil and Gas

- 6.2.7 Hydraulic Press

- 6.2.8 Plastics

- 6.2.9 Automotive

- 6.2.10 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bosch Rexroth AG (ROBERT BOSCH GMBH)

- 7.1.2 Parker-Hannifin Corporation

- 7.1.3 Hydac International Gmbh

- 7.1.4 Danfoss AS

- 7.1.5 SMC Corporation

- 7.1.6 Festo SE (Festo Beteiligungen GmbH & Co. KG)

- 7.1.7 Norgren Limited (IMI PLC)

- 7.1.8 Bucher Hydraulics (Bucher Industries AG)

- 7.1.9 HAWE

- 7.1.10 Linde Hydraulics GmbH & Co.

- 7.2 Vendor Ranking

- 7.3 List of Key Vendors By Region