|

市场调查报告书

商品编码

1519858

刚玉 -市场占有率分析、产业趋势与统计、成长预测(2024-2029)Corundum - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

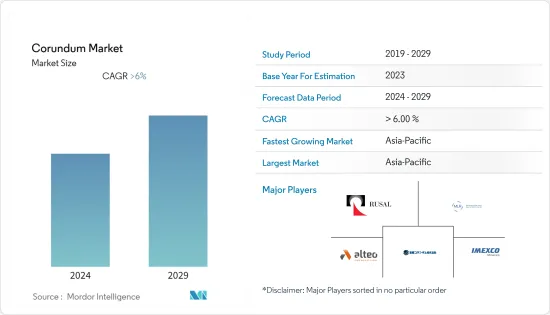

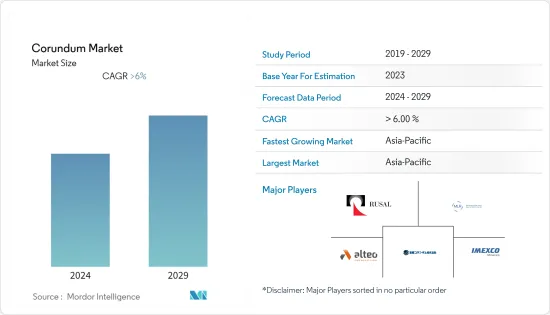

预计2024年刚玉市场规模将达30.7亿美元,2029年将达42.5亿美元,预测期内(2024-2029年)复合年增长率将超过6%。

由于供应链中断和奢侈品需求减少,COVID-19 大流行最初扰乱了刚玉市场。然而,随着经济復苏、产业适应新常态,在电子、磨料磨俱、珠宝首饰需求增加的带动下,刚玉市场开始重新回升,为全球经济整体復苏做出了贡献。

主要亮点

- 推动市场的主要因素是抛光应用中对合成刚玉的高需求以及珠宝饰品业对工程刚玉的需求。

- 然而,电熔氧化铝和碳化硅正在限制市场成长。

- 然而,其耐热性和导电性导致其在电气和电子领域的新兴应用,这可能在预测期内为该行业提供新的成长机会。

- 亚太地区占据最大的市场份额,预计未来几年将继续如此。

刚玉市场趋势

珠宝饰品领域占市场主导地位

- 刚玉的主要用途是在珠宝饰品。继钻石之后,刚玉矿物可能是最受欢迎的宝石。

- 刚玉有多种颜色,但红色被称为红宝石,所有其他颜色都被归类为蓝宝石。这些宝石因其鲜艳的色彩、耐用性和高屈光而具有价值,非常适合用于戒指、耳环、项炼和其他珠宝。

- 蓝宝石有多种颜色,包括蓝色、粉红色、黄色和绿色。这种多功能性使珠宝设计师能够创造出具有多样化且吸引人的色彩组合的作品。

- 刚玉的硬度和耐刮擦性使其适合各种珠宝镶嵌,例如宝石容易磨损的戒指和手镯。

- 根据经济分析局统计,2022年美国珠宝饰品零售额达915亿美元,较前一年的864亿美元大幅成长。

- 刚玉,尤其是合成蓝宝石,在手錶中至关重要,用于防刮水晶、透明底盖和轴承,使奢华手錶耐用、防水且美观。

- 根据德国联邦统计局统计,2022 年德国手錶和珠宝饰品销售额为 53.2 亿欧元(57.7 亿美元),为刚玉市场提供了支撑。

- 根据中国珠宝首饰协会统计,中国是全球第一大珠宝饰品进口国和全球第二大珠宝饰品出口国。 2022年,中国贵金属珠宝饰品进口额达1,037亿美元,较上年资料33.9%。

- 因此,珠宝业的这种有利趋势可能会增加预测期内对刚玉的需求。

亚太地区主导市场

- 由于中国、日本和印度等国家的高需求,亚太地区主导全球刚玉市场。

- 刚玉的重要生产国包括印度、泰国、韩国和日本。缅甸、阿富汗、斯里兰卡和越南等国也开采了大量刚玉。

- 由于其优异的电绝缘性能、高熔点和耐热性,刚玉在电气和电子工业中作为电气元件的绝缘材料、半导体製造的基板和电子设备的保护涂层得到了有价值的应用。

- 近年来,我国电气电子产业取得了长足发展。随着技术创新和品牌建立能力不断增强,中国消费电子产销量位居全球第一。

- 根据中国国家统计局的数据,2023年12月,中国电力和家用电子电器零售额约为772.5亿元人民币(107.3亿美元)。

- 预计到2025年,印度的数位经济将达到1兆美元。印度电子系统设计与製造(ESDM)产业预计到 2025 年将产生超过 1,000 亿美元的经济价值。印度製造、国家电子政策、电子产品净零进口和零缺陷零效应等多项政策正在努力发展国内製造业,减少进口依赖,并促进出口和製造业。

- 印度商工部数据显示,2022年4月至12月,印度电子产品出口额为66.7亿美元,去年同期为109.9亿美元,成长率为51.56%。

- 根据JEITA(电子情报技术产业协会)的资料,2022年11月电子产业总产值为70.9834亿美元,2022年12月日本电子产品出口额为83.9545亿美元。

- 此外,2022年,一家总部位于杜拜的公司提案以1亿美元的竞标斯里兰卡发现的最大天然蓝色蓝宝石刚玉“亚洲女王”,从而扩大其在亚太刚玉市场的影响力。

- 因此,由于上述因素,亚太地区很可能在预测期内主导调查市场。

刚玉业概况

刚玉市场部分整合,因为大部分市场占有率被少数参与者瓜分。市场主要企业包括ALTEO、Mineralmuhle Leun、RusAL、HENGE Services GmbH、Rau GmbH &Co.KG、淄博金基源磨料磨俱等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 抛光应用对工程刚玉的需求很大

- 珠宝领域对人造刚玉的需求不断增长

- 其他的

- 抑制因素

- 与电熔氧化铝和碳化硅的竞争

- 其他的

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 按类型

- 金刚砂

- 红宝石

- 蓝宝石

- 按用途

- 珠宝饰品

- 磨料

- 耐火材料

- 矿物

- 电力/电子

- 其他用途(切削工具、医疗等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- ALTEO

- HENGE Services GmbH

- K. A Refractories Co. Ltd

- Mineralmuhle Leun, Rau GmbH & Co. KG

- RIKEN CORUNDUM CO. LTD

- RusAL

- Zibo Jinjiyuan Abrasives Co. Ltd

第七章 市场机会及未来趋势

- 电气电子领域新应用

The Corundum Market size is estimated at USD 3.07 billion in 2024, and is expected to reach USD 4.25 billion by 2029, growing at a CAGR of greater than 6% during the forecast period (2024-2029).

The COVID-19 pandemic initially disrupted the corundum market due to supply chain interruptions and reduced demand for luxury goods. However, as economies recovered and industries adapted to the new normal, the corundum market began to rise again, driven by increased demand for electronics, abrasives, and gemstones, contributing to the overall rebound of the global economy.

Key Highlights

- The major factors driving the market are the high demand for synthetic corundum in abrasion applications and the demand for artificial corundum in the jewelry sector.

- However, the fused alumina and silicon carbide are restraining the market's growth.

- Nevertheless, the emerging applications in the electrical and electronics sector, due to their resistance to heat and electrical conductivity, are likely to offer new growth opportunities to the industry during the forecast period.

- Asia-Pacific had the most significant share of the market, and it is expected to continue to do so for the next few years.

Corundum Market Trends

Jewelry Segment to Dominate the Market

- The major application of corundum is in jewelry. After diamonds, corundum minerals are probably the most sought-after precious stones.

- Corundum comes in various colors, but the red variety is known as ruby, while all other colors are classified as sapphires. These gemstones are valuable because of their vibrant colors, durability, and high refractive index, making them ideal for use in rings, earrings, necklaces, and other jewelry.

- Sapphires exhibit a wide range of colors, from blue and pink to yellow, green, and more. This versatility allows jewelry designers to create pieces with diverse and attractive color combinations.

- Corundum's hardness and resistance to scratches make it suitable for various jewelry settings, including rings and bracelets, where gemstones may be subject to more wear and tear.

- According to the Bureau of Economic Analysis, the retail sales of jewelry in the United States reached USD 91.5 billion in 2022 and registered huge growth compared to USD 86.4 billion in the previous year.

- Corundum, specifically synthetic sapphire, is integral to watchmaking, being utilized for highly scratch-resistant crystals, transparent case backs, and bearings, enhancing durability, water resistance, and aesthetic appeal in high-end watches.

- As per the Statistisches Bundesamt (a federal authority of Germany), the revenue from watches and jewelry in Germany was EUR 5.32 billion (USD 5.77 billion) in 2022, thereby supporting the corundum market.

- According to the China Jewelry Association, China is one of the world's top jewelry import destinations and the second-largest jewelry exporter. The value of precious metals and jewelry products imported to China was USD 103.7 billion in 2022, registering a growth rate of 33.9% compared to the previous year's data.

- Hence, such favorable trends in the jewelry industry are likely to enhance the demand for corundum during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominates the global corundum market owing to high demand from countries like China, Japan, and India.

- Some of the significant manufacturers of corundum are India, Thailand, Korea, and Japan. A significant amount of corundum is also mined in countries like Myanmar, Afghanistan, Sri Lanka, and Vietnam.

- Corundum finds valuable applications in the electrical and electronics industry, serving as an insulating material in electrical components, a substrate for semiconductor manufacturing, and a protective coating for electronic devices due to its excellent electrical insulating properties, high melting point, and resistance to heat.

- In China, the electrical and electronics industry has witnessed significant growth in recent years. China ranks first in the global production and sales of consumer electronics, which is due to the country's improved innovation and brand-building capacity.

- According to the National Bureau of Statistics of China, in December 2023, retail sales of household appliances and consumer electronics in China accounted for about CNY 77.25 billion (USD 10.73 billion).

- India is expected to have a digital economy of USD 1 trillion by 2025. The Indian electronics system design and manufacturing (ESDM) sector is expected to generate more than USD 100 billion in terms of economic value in 2025. Several policies, such as Make in India, National Policy of Electronics, Net Zero Imports in Electronics, and Zero Defect Zero Effect, offer a commitment to growth in domestic manufacturing, lowering import dependence, and energizing exports and manufacturing.

- In India, as per the Commerce and Industry Ministry, the exports of electronic goods recorded USD 6.67 billion between April and December 2022, whereas they were USD 10.99 billion during the same period last year, registering a growth rate of 51.56%.

- As per JEITA (Japan Electronics and Information Technology Industries Association) data, the electronics industry registered a total production of USD 7,098.34 million in November 2022, while Japan exported electronics valued at USD 8,395.45 million in December 2022.

- Furthermore, in 2022, a Dubai-headquartered firm proposed a USD 100 million bid for the "Queen of Asia," the largest naturally occurring blue sapphire corundum discovered in Sri Lanka, demonstrating heightened interest and investment in the corundum market in Asia-Pacific.

- Hence, owing to the factors mentioned above, Asia-Pacific is likely to dominate the market studied during the forecast period.

Corundum Industry Overview

The corundum market is partially consolidated as most of the market share is divided among a few players. Some of the key players in the market include (not in any particular order) ALTEO, Mineralmuhle Leun, RusAL, HENGE Services GmbH, Rau GmbH & Co. KG, and Zibo Jinjiyuan Abrasives Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 High Demand for Synthetic Corundum in Abrasion Applications

- 4.1.2 Growing Demand of Artificial Corundum in Jewelry Sector

- 4.1.3 Others

- 4.2 Restraints

- 4.2.1 Competition from Fused Alumina and Silicon Carbide

- 4.2.2 Others

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Type

- 5.1.1 Emery

- 5.1.2 Ruby

- 5.1.3 Sapphire

- 5.2 By Application

- 5.2.1 Jewelry

- 5.2.2 Abrasive

- 5.2.3 Refractory

- 5.2.4 Mineral

- 5.2.5 Electrical and Electronics

- 5.2.6 Other Applications (Cutting Tools, Medical, and Others)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ALTEO

- 6.4.2 HENGE Services GmbH

- 6.4.3 K. A Refractories Co. Ltd

- 6.4.4 Mineralmuhle Leun, Rau GmbH & Co. KG

- 6.4.5 RIKEN CORUNDUM CO. LTD

- 6.4.6 RusAL

- 6.4.7 Zibo Jinjiyuan Abrasives Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications in the Electrical and Electronics Sector