|

市场调查报告书

商品编码

1519872

汽车智慧钥匙:市场占有率分析、产业趋势、成长预测(2024-2029)Automotive Smart Key - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

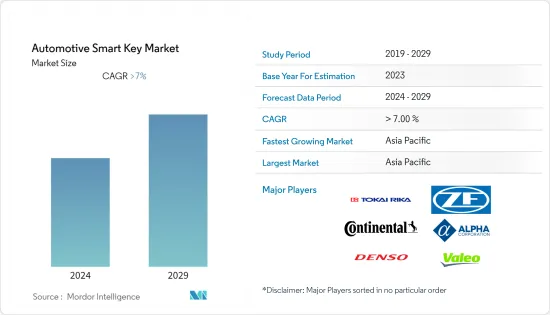

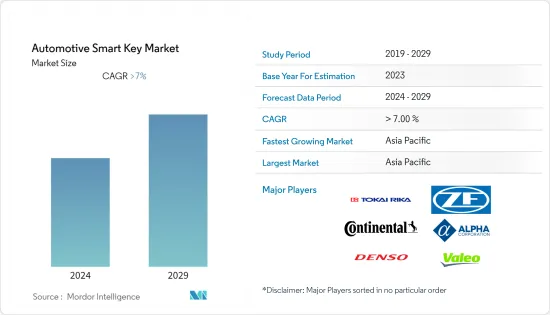

预计2024年汽车智慧钥匙市场规模为79亿美元,2029年预计将达120.9亿美元,在预测期间(2024-2029年)复合年增长率为8.88%。

汽车智慧钥匙市场稳定成长。这种增长是由于对车辆先进安全功能、便利性和安全性的需求不断增长而推动的。此外,RFID(无线射频识别)、NFC(近场通讯)和蓝牙低功耗(BLE)等技术的重大发展增强了智慧钥匙的功能,使其更安全、更实用。

此外,最新的智慧钥匙除了锁门和开锁之外还提供多种功能。这包括远端引擎启动、GPS 追踪、座椅和镜子的单独设置,甚至与智慧家居系统的整合。

成长模式因地区而异。由于汽车销售的增加和先进技术的采用增加,亚太地区,特别是中国和印度,呈现出最高的成长速度。由于消费者对豪华车的高需求和严格的汽车安全法规,北美和欧洲也占据了重要的市场占有率。

汽车智慧钥匙市场正在动态发展,受到技术进步、消费者偏好变化和竞争格局的影响。对增强车辆安全性和便利性的功能的需求不断增长,以及汽车行业的成长,特别是在新兴国家,显示该市场的持续扩张趋势。

汽车智慧主要市场趋势

远端无钥匙进入预计将推动市场成长

远端免钥出入控管系统通常比被动免钥出入控管系统更具成本效益。这种实惠性使得远端无钥匙进入能够被更广泛的消费者所接受,这是其主导的关键因素,特别是在中檔和一些入门级汽车领域。远端免钥出入控管系统的设计和操作比被动免钥出入控管系统更简单。这种简单性意味着高可靠性和低维护成本,这对消费者和製造商都有吸引力。

此外,远端免钥出入控管系统在设计和操作上比被动免钥出入控管系统更简单。这种简单性意味着更高的可靠性和更低的维护成本,使其对消费者和製造商都有吸引力。远端免钥出入控管系统广泛应用于从经济型汽车到豪华车的各个车辆领域。这种广泛的采用使其在市场上具有优势。

与被动免钥出入控管系统系统相比,将远端无钥匙进入系统整合到车辆中的技术障碍更低。这种易于整合的方式正在推动更多製造商在其车辆中采用远程免钥出入控管系统。远端免钥出入控管系统还可以轻鬆整合到较旧的车型中,而被动免钥出入控管系统则并非总是如此。与如此广泛的车型相容扩大了远端免钥出入控管系统的市场范围。

远端免钥出入控管系统在汽车智慧钥匙市场中的主导地位很大程度上是由于其成本效益、简单性、广泛可用性以及消费者对熟悉且可靠技术的偏好。

亚太地区预计将经历最高成长

在亚太地区,中国、印度、日本等国家在全球汽车生产和销售中扮演重要角色。在这些国家,由于中产阶级人口的成长和可支配收入的增加,对汽车的需求不断增加,直接推动了对智慧钥匙等先进汽车技术的需求。

此外,亚太地区拥有强大的技术基础设施,是多家领先科技公司的所在地。物联网、RFID 和蓝牙等技术的进步对于智慧钥匙的功能至关重要,在该地区尤其突出。这创造了一个适合采用智慧钥匙的环境。亚太地区的消费者越来越喜欢安全性高、便利性高的汽车。智慧钥匙提供无钥匙进入和点火器、远端启动和增强安全性等功能,越来越受到该地区消费者的青睐。

亚太地区的豪华汽车市场正在快速成长。该细分市场的成长直接推动了对智慧钥匙的需求,因为它们是大多数豪华汽车的标准配备。

此外,许多全球汽车製造商在亚太地区设有生产设施。这种本地化降低了智慧钥匙系统的成本并提高了供应链效率。此外,强大的本地供应商网路的存在,能够以具有竞争力的成本製造智慧钥匙系统的各种组件,进一步支持了成长。

汽车智慧钥匙产业概况

汽车智慧钥匙市场分散,市场参与者众多。东海理化是汽车智慧钥匙市场的主要企业。此外,东海理化、Denso和阿尔法公司是日本丰田和日产电子钥匙、智慧钥匙和无钥匙系统的主要供应商。每家公司的各种措施和产品创新正在增强市场影响力。

- 2023 年 4 月 Car Keys Express 为硬体零售商推出了创新解决方案,推出了第一款名为「Keys NOW!」的全自动「免持」汽车钥匙复製机。该机器旨在简化汽车钥匙复製和编程过程,解决硬体零售商在现代汽车钥匙市场中面临的挑战。现在就钥匙!该系统具有自动钥匙复製过程,让消费者可以使用基于应用程式的便利介面轻鬆配对新钥匙,从而提供更有效率、更友善的体验。

- 2022 年 7 月:澳洲丰田宣布对其旗舰皮卡 HiLux Rogue 4x4 的性能和功能进行重大改进。在自动SR5级及以上车型上,转向柱锁已更换为ID盒防盗防盗器,进一步提高了智慧钥匙启动时的安全等级。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 对车辆安全的兴趣日益浓厚推动市场成长

- 市场限制因素

- 区域供应链中断可能预示市场成长

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 目的

- 单一功能

- 多功能的

- 科技

- 远程无钥匙进入

- 被动无钥匙进入

- 安装

- OEM

- 售后市场

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Tokai Rika Co. Ltd

- Continental AG

- Denso Corporation

- ZF Friedrichshafen AG

- Alpha Corp.

- Minda Corp. Ltd

- Huf Hulsbeck & Furst GmbH & Co. KG

- Honda Lock Mfg Co. Ltd

- Valeo SA

- HELLA GmbH & Co. KGaA

- Silicon Laboratories Inc.

第七章 市场机会及未来趋势

第8章 定制

- 供应商资讯

The Automotive Smart Key Market size is estimated at USD 7.90 billion in 2024, and is expected to reach USD 12.09 billion by 2029, growing at a CAGR of 8.88% during the forecast period (2024-2029).

The automotive smart key market has been growing steadily. This growth is fueled by the increasing demand for advanced safety features, convenience, and security in automobiles. Also, key developments in technologies like RFID (Radio-Frequency Identification), NFC (Near Field Communication), and Bluetooth Low Energy (BLE) have enhanced the capabilities of smart keys, making them more secure and functional.

Moreover, modern smart keys offer a range of features beyond just locking and unlocking doors. These include remote engine start, GPS tracking, personalized settings for seating and mirrors, and even integration with home automation systems.

Different regions show varying growth patterns. Asia-Pacific, particularly China and India, shows the highest growth due to rising automobile sales and increased adoption of advanced technologies. North America and Europe also have significant market shares driven by high consumer demand for luxury vehicles and stringent automotive safety regulations.

The automotive smart key market is dynamic and evolving, shaped by technological advancements, changing consumer preferences, and a competitive landscape. The increasing demand for enhanced vehicle security and convenience features, coupled with the growth in the automotive sector, especially in emerging economies, points toward a continuing upward trend for this market.

Automotive Smart Key Market Trends

Remote Keyless Entry is Projected to Propel the Growth of the Market

Remote keyless entry systems are generally more cost-effective compared to passive keyless entry systems. This affordability makes remote keyless entry more accessible to a broader range of consumers and is a key factor in its dominance, especially in mid-range and some entry-level vehicle segments. Remote keyless entry systems are simpler in design and operation compared to passive keyless entry systems. This simplicity translates to greater reliability and lower maintenance costs, which appeal to both consumers and manufacturers.

Furthermore, remote keyless entry systems are simpler in design and operation compared to passive keyless entry systems. This simplicity translates to greater reliability and lower maintenance costs, which is appealing to both consumers and manufacturers. The remote keyless entry system is widely available across various vehicle segments, from economy to luxury cars. This widespread availability has led to its dominance in the market.

Integrating remote keyless entry into vehicles involves lower technological barriers compared to passive keyless entry systems. This ease of integration encourages more manufacturers to adopt remote keyless entry systems in their vehicles. Remote keyless entry systems can be easily integrated into older vehicle models, which is not always the case with passive keyless entry systems. This compatibility with a wider range of vehicles enhances the market reach of remote keyless entry systems.

The dominance of the remote keyless entry system in the automotive smart key market is largely due to its cost-effectiveness, simplicity, widespread availability, and consumer preference for familiar and reliable technology.

Asia-Pacific is Expected to Witness the Highest Growth

In Asia-Pacific, countries like China, India, and Japan are significant players in global vehicle production and sales. The increasing demand for automobiles in these countries, driven by growing middle-class populations and rising disposable incomes, directly boosts the demand for advanced automotive technologies like smart keys.

Moreover, Asia-Pacific has a robust technological infrastructure and is home to several leading technology companies. The advancement in technologies such as IoT, RFID, and Bluetooth, which are integral to smart key functionality, is more pronounced in this region. This fosters a conducive environment for the adoption of smart keys. There is a growing preference among consumers in Asia-Pacific for vehicles equipped with advanced safety and convenience features. Smart keys offer features like keyless entry and ignition, remote start, and enhanced security, which are increasingly favored by consumers in this region.

The luxury vehicle segment in Asia-Pacific is growing rapidly. Since smart keys are a standard feature in most luxury cars, the growth in this segment directly propels the demand for smart keys.

Additionally, many global automotive manufacturers have established production facilities in Asia-Pacific. This localization reduces costs and improves supply chain efficiency for smart key systems. Moreover, the presence of a strong network of local suppliers who can manufacture various components of the smart key system at a competitive cost further drives growth.

Automotive Smart Key Industry Overview

The automotive smart key market is fragmented, with various players existing in the market. Tokai Rika Co. Ltd is the leading player in the automotive smart key market. Additionally, Tokai Rika, Denso, and Alpha Corporation have been the major suppliers of electronic keys/smart keys/keyless systems to Toyota and Nissan in Japan. Various initiatives and product innovations by the companies have led them to strengthen their presence in the market.

- April 2023: Car Keys Express introduced an innovative solution for hardware retailers with the launch of their first fully automated 'hands-free' car key duplication machines named 'Keys NOW!'. These machines are designed to streamline the process of car key duplication and programming, removing the challenges that hardware retailers previously faced in the modern car key market. The Keys NOW! system features an automated key duplication process and allows consumers to easily pair their new keys using a convenient app-based interface, facilitating a more efficient and user-friendly experience.

- July 2022: Toyota Australia announced significant performance and capability enhancements to its flagship HiLux Rogue 4x4 pick-up. On automatic SR5 grades and higher, the steering column lock was replaced by an ID Box anti-theft immobilizer, which adds an extra level of security when starting the car with a smart key.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increased Vehicle Security Concerns Propelling The Market Growth

- 4.2 Market Restraints

- 4.2.1 Supply Chain Disruptions In Regions Can Anticipate The Market Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Single Function

- 5.1.2 Multi-function

- 5.2 Technology

- 5.2.1 Remote Keyless Entry

- 5.2.2 Passive Keyless Entry

- 5.3 Installation

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Tokai Rika Co. Ltd

- 6.2.2 Continental AG

- 6.2.3 Denso Corporation

- 6.2.4 ZF Friedrichshafen AG

- 6.2.5 Alpha Corp.

- 6.2.6 Minda Corp. Ltd

- 6.2.7 Huf Hulsbeck & Furst GmbH & Co. KG

- 6.2.8 Honda Lock Mfg Co. Ltd

- 6.2.9 Valeo SA

- 6.2.10 HELLA GmbH & Co. KGaA

- 6.2.11 Silicon Laboratories Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 CUSTOMIZATION

- 8.1 SUPPLIER INFORMATION