|

市场调查报告书

商品编码

1519877

分子筛:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Molecular Sieves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

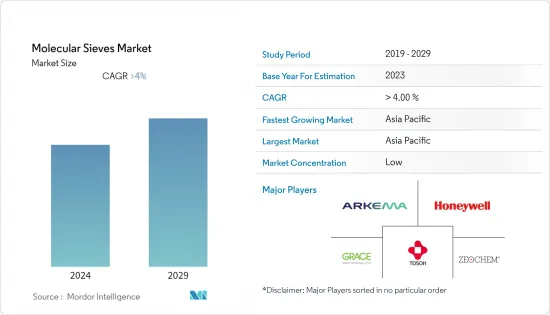

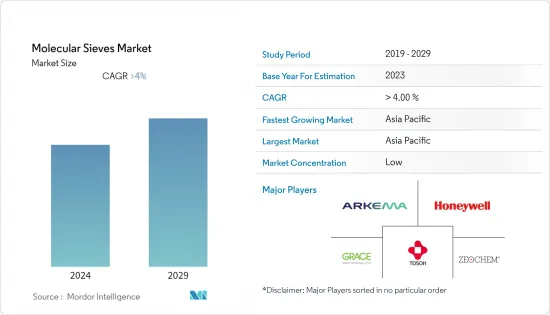

预计2024年分子筛市场规模将达40.2亿美元,2029年将达到50.6亿美元,在预测期间(2024-2029年)复合年增长率将超过4.5%。

2020 年市场受到 COVID-19 的负面影响。受疫情影响,许多分子筛製造商和原材料製造商延长了其製造地的所有营运关闭时间。然而,大流行后产业已恢復速度,预计这一趋势将在预测期内持续下去。

短期内,推动市场成长的主要因素包括人们对污水中有害有机物质处理的认识不断提高以及在石油和石化产品中广泛用作催化剂。

相反,化学合成物、酵素和其他替代品的威胁将阻碍市场成长。

抗菌沸石分子筛的发展似乎是个机会。

亚太地区主导全球市场,其中中国和印度等国家的消费量最高。

分子筛市场趋势

精製和石化领域占市场主导地位

- 分子筛广泛应用于炼油精製。分子筛用于石化应用,例如乙烯、丙烯、丁二烯和其他原料的脱水和精製、裂解气体和液体的脱水、石脑油进料的脱水以及乙炔转换器的氢气干燥。

- 沸石用作将原油精製成石油产品的催化剂。由于其优异的选择性,沸石催化剂通常是将炼油厂物流转化为高辛烷值汽油混合原料的最有效和最具成本效益的技术。

- 根据BP《2022年世界能源统计年鑑》显示,全球炼油厂总吞吐量约79,229,000桶/日,与前一年同期比较成长5%。美国的炼油厂吞吐量最高,每天 15,148,000 桶,其次是中国。

- 与上年相比,全球石油产量也出现小幅成长。根据BP全球能源统计年鑑,2022年全球精製量达近1.02亿桶/日,2021年产量约42.21亿吨。总体而言,全球炼油产能在过去 50 年中几乎翻了一番,其中成长最快的时期出现在 1970 年代。

- 石油和天然气工业的前景建议石油勘探的长期发展和分子筛的增加使用。

- 所有上述因素预计将在预测期内影响调查市场。

亚太地区主导市场

- 亚太地区在分子筛市场上占据主导地位,并且由于其炼油和精製、汽车、製药、工业气体生产和水处理等各个行业的製造业务蓬勃发展,预计未来将继续占据主导地位。

- 根据中国国家统计局统计,截至2023年8月,中国每月生产塑胶製品约636万吨。

- 中国也是化妆品的主要消费国之一。 2022年,中国批发和零售企业的化妆品零售额约为3,936亿元人民币(约570亿美元)。然而,根据中国国家统计局的数据,这比上年略有下降,当时零售总额约为 4,026 亿元人民币(约 586 亿美元)。

- 印度的化妆品和个人护理产业约占该国快速消费品产业总量的51%。对产品的需求不断增长,导致许多公司製定了在该国立足的策略,包括业务扩张和产品创新。例如,2022 年 7 月,Godrej Consumer Products 推出了印度首款混合沐浴乳Godrej Magic Body Wash,售价仅 45 印度卢比(0.57 美元)。

- 根据BP《2022年世界能源统计年鑑》显示,中国石油总产量是亚太地区最高的,2021年产量接近2亿吨,其次是印度,仍占中国总产量的最大份额。

- 此外,根据BP统计审查,2022年天然气产量份额为5.5%,而2021年为5.2%,成为亚太地区最高生产国,仅次于印度。

- 因此,预计全部区域各行业的投资和成长将在预测期内对分子筛市场产生正面影响。

分子筛产业概况

分子筛市场分散。主要企业(排名不分先后)包括 Honeywell International Inc.、Arkema、Zeochem AG、WR Grace & Co.-Conn. 和 Tosoh Corporation。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 提高污水中有害有机物处理的意识

- 作为石油和石化产品的催化剂有着广泛的应用

- 其他司机

- 抑制因素

- 合成化学品、酵素和其他替代品的威胁

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 生产分析

- 价格分析

第五章市场区隔(基于以金额为准的市场规模)

- 形状

- 颗粒

- 串珠的

- 粉末

- 尺寸

- 微孔的

- 介孔的

- 大孔的

- 产品类别

- 碳

- 黏土

- 多孔玻璃

- 硅胶

- 沸石

- 最终用户产业

- 车

- 化妆品和清洁剂

- 油和气

- 製药

- 废弃物和水处理

- 其他最终用户产业(建筑、化工)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲/纽西兰

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Arkema

- Axens

- BASF SE

- CarboTech

- Clariant

- Desicca Chemical Pvt. Ltd

- Hengye Inc.

- Honeywell International Inc.

- JIUZHOU CHEMICALS

- KNT Group

- Kuraray Co. Ltd

- Merck KGaA

- OMRON Healthcare Inc.

- Palmer Holland

- Resonac Holdings Corporation

- Sorbead India

- Tosoh Corporation

- WR Grace & Co.-Conn.

- Zeochem AG

- Zeolyst International

第七章 市场机会及未来趋势

- 抗菌沸石分级筛的研製

- 医用氧气浓缩用奈米沸石分子筛

The Molecular Sieves Market size is estimated at USD 4.02 billion in 2024, and is expected to reach USD 5.06 billion by 2029, growing at a CAGR of greater than 4.5% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. Due to the pandemic, many molecular sieve manufacturers and raw material manufacturers extended the closure of all their operations at their manufacturing locations. However, the industries picked up speed in the post-pandemic era and were expected to keep doing so during the forecast period.

Over the short term, major factors driving the market's growth include rising awareness for treating hazardous organic materials in wastewater and their extensive application as catalysts in petroleum and petrochemical products.

Conversely, the threat from chemical composites, enzymes, and other substitutes will hinder the market's growth.

Developing anti-microbial zeolite molecular sieves is likely to be an opportunity.

Asia-Pacific dominated the global market, with the largest consumption from countries such as China and India.

Molecular Sieves Market Trends

Petroleum Refining and Petrochemicals Segment to Dominate the Market

- The petroleum refining business makes extensive use of molecular sieves. They are utilized in petrochemical applications such as ethylene, propylene, butadiene, and other feedstock dehydration and purification, cracked gas and liquid dehydration, naphtha feed dehydration, and drying hydrogen gas for acetylene converters.

- Zeolites are used as catalysts to refine crude oil into finished petroleum products. Zeolite catalysts are often the most efficient and cost-effective technique for converting refinery streams into high-octane gasoline blending stock due to their excellent selectivity.

- According to the BP Statistical Review of World Energy 2022, total oil refinery throughput worldwide was roughly 79,229 thousand barrels per day, a 5% increase over the previous year. The United States had the largest oil refinery throughput, with 15,148 thousand barrels daily, followed by China.

- A modest volume gain was also when comparing world oil output to the previous year. According to the BP Statistical Review of Global Energy, the world's oil refinery capacity almost reached 102 million barrels per day in 2022, and approximately 4,221 million metric tonnes of volume were produced in 2021. Overall, global refinery capacity has nearly doubled in the past fifty years and experienced the largest growth during the 1970s.

- The prospectus for the future development of the oil and gas business recommends that oil exploration will proceed to develop in the long term and utilize molecular sieves.

- All the factors mentioned above, in turn, are expected to impact the market studied during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the molecular sieves market and is expected to continue doing so due to the region's extensive manufacturing operations for various industries such as petroleum refining and petrochemicals, automotive, pharmaceutical, industrial gas production, water treatment, and many more.

- According to the National Bureau of Statistics of China, as of August 2023, China produced roughly 6.36 million metric tons of plastic products every month.

- China is also one of the major consumers of cosmetics. In 2022, wholesale and retail companies' retail sales of cosmetics in China totaled about CNY 393.6 billion (~USD 57 billion). This, though, indicated a slight decrease compared to the previous year, which had a total retail sale of about CNY 402.6 billion (~USD 58.6 billion), as stated by the National Bureau of Statistics of China.

- India's cosmetics and personal care segment accounts for about 51% of the country's total FMCG sector. Due to the growing demand for the products, many companies have developed strategies to have a strong foothold in the country, including expansion and product innovation. For instance, in July 2022, Godrej Consumer Products unveiled Godrej Magic Bodywash, India's first ready-to-mix body wash, at just INR 45 (USD 0.57).

- According to the BP Statistical Review of World Energy 2022, the total oil production in China was the highest in the Asia-Pacific region, accounting for nearly 200 million tons of production in 2021, followed by India, which only produced a sixth of the total production in China.

- Moreover, in 2022, the natural gas production share was 5.5%, whereas in 2021, it was 5.2% and had the highest production in the Asia-Pacific region, followed by India, as stated by the BP statistical review.

- Therefore, with all the investments and the growth in the various industries across the region, a positive impact is expected on the molecular sieves market during the forecast period.

Molecular Sieves Industry Overview

The Molecular Sieves Market is fragmented in nature. The major players (not in any particular order) include Honeywell International Inc., Arkema, Zeochem AG, W. R. Grace & Co.-Conn., and Tosoh Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Awareness About Treatment of Hazardous Organic Materials in Wastewater

- 4.1.2 Extensive Application as a Catalyst in Petroleum and Petrochemical Products

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Threat from Chemical Composites, Enzymes, and Other Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Production Analysis

- 4.6 Price Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Shape

- 5.1.1 Pelleted

- 5.1.2 Beaded

- 5.1.3 Powdered

- 5.2 Size

- 5.2.1 Microporous

- 5.2.2 Mesoporous

- 5.2.3 Macroporous

- 5.3 Product Type

- 5.3.1 Carbon

- 5.3.2 Clay

- 5.3.3 Porous Glass

- 5.3.4 Silica Gel

- 5.3.5 Zeolite

- 5.4 End-user Industry

- 5.4.1 Automotive

- 5.4.2 Cosmetics and Detergent

- 5.4.3 Oil and Gas

- 5.4.4 Pharmaceutical

- 5.4.5 Waste and Water Treatment

- 5.4.6 Other End-user Industries ( Construction and Chemical)

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Australia & New Zealand

- 5.5.1.6 Malaysia

- 5.5.1.7 Thailand

- 5.5.1.8 Indonesia

- 5.5.1.9 Vietnam

- 5.5.1.10 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.2.4 Rest of North America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Russia

- 5.5.3.6 Spain

- 5.5.3.7 NORDIC

- 5.5.3.8 Turkey

- 5.5.3.9 Russia

- 5.5.3.10 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Qatar

- 5.5.5.5 Egypt

- 5.5.5.6 UAE

- 5.5.5.7 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Axens

- 6.4.3 BASF SE

- 6.4.4 CarboTech

- 6.4.5 Clariant

- 6.4.6 Desicca Chemical Pvt. Ltd

- 6.4.7 Hengye Inc.

- 6.4.8 Honeywell International Inc.

- 6.4.9 JIUZHOU CHEMICALS

- 6.4.10 KNT Group

- 6.4.11 Kuraray Co. Ltd

- 6.4.12 Merck KGaA

- 6.4.13 OMRON Healthcare Inc.

- 6.4.14 Palmer Holland

- 6.4.15 Resonac Holdings Corporation

- 6.4.16 Sorbead India

- 6.4.17 Tosoh Corporation

- 6.4.18 W. R. Grace & Co.-Conn.

- 6.4.19 Zeochem AG

- 6.4.20 Zeolyst International

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Anti-microbial Zeolite Molecular Sieves

- 7.2 Nano-size Zeolite Molecular Sieves for Medical Oxygen Concentration