|

市场调查报告书

商品编码

1519883

电动车无线充电:市场占有率分析、产业趋势与成长预测(2024-2029)Wireless Charging For Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

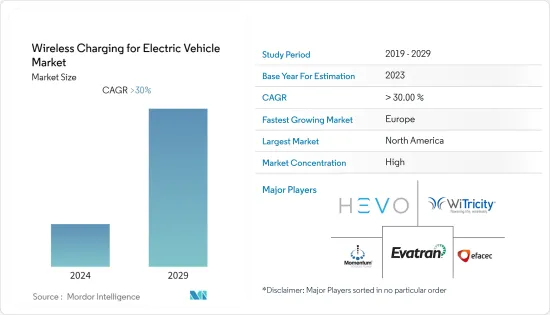

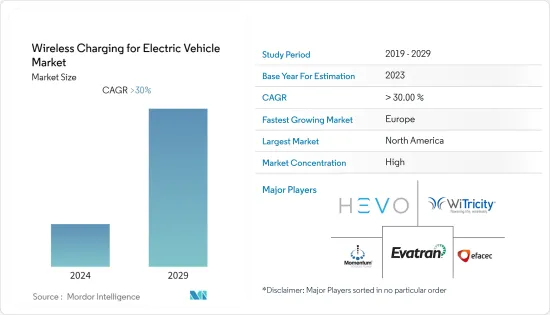

电动车无线充电市场规模预计到 2024 年为 1.523 亿美元,预计到 2029 年将达到 7.625 亿美元,预测期内(2024-2029 年)复合年增长率为 38.40%。

无线电动汽车 (EV) 充电是一项创新技术,无需车辆与充电站之间的实体连接即可实现电动车充电。与传统的有线充电相比,无线电动汽车充电具有多种优势。首先,它消除了对繁琐且耗时的电缆和连接器的需求。其次,降低了因电缆损坏或连接不当而导致触电或火灾的风险。最后,服务商提供了更简化和用户友好的充电体验,因为您只需将汽车停在充电垫片,充电过程就会自动开始。

*无线充电是目前正在开发的最新技术之一,将推动电动车产业的发展。

*在都市区安装充电站和充电器时,确保土地通常是一个问题。随着无线充电的推出,随着挑战的缓解,充电器业者的销售表现也有所改善。

*儘管无线充电是电动车的必需品,但也存在一些缺点需要考虑,例如充电过程中的能量损失、缺乏适当的充电基础设施以及高成本。

*随着电动车在世界各地普及,无线充电站的需求预计将会增加。世界各国政府正在向英国、挪威、日本和美国等国家以及中国等新兴经济体的买家提供奖励。

*少数国家正在致力于电动车无线充电。例如,2022年9月,一家日本建设公司宣布与Denso公司合作,协助建造道路路面,到年终将为电动车提供无线充电点。这是由于认识到需要建造合适的车站(包括土地)的结果。

电动车无线充电市场趋势

乘用车销售成长带动市场成长

随着越来越多的人意识到传统汽油车对环境的影响,对电动车的兴趣与日俱增。此外,燃油价格上涨正在减缓汽车产业电动车的采用,这在刺激充电站需求方面发挥着重要作用。

这迫使汽车製造商增加电动车研发支出,最终使他们能够在未来销售电动车。这项策略对人们产生了强烈影响,他们的购买模式发生了很大变化,从传统内燃机汽车转向电动车。这项变革在不减少内燃机汽车销售的情况下,为现在和未来的电动车创造了一个充满希望的市场。

全球整体,2022年电动车销量较2021年成长约55.5%,虽然车辆销量低于上年,但首次突破1,000万辆。因此,根据国际能源总署 (IEA) 的数据,到 2022 年,全球购买的七分之一的乘用车将是电动车。

此外,叫车和汽车共享市场预计将增加对充电站的需求。与私家车相比,叫车和汽车共享车辆的使用时间通常更长,利用率更高。这意味着它们需要更频繁地充电,从而增加了对充电站的需求。

现在,电动车在性能、维护和初始购买成本方面与内燃机汽车相当(有时甚至超过)。

搭乘用电动车的成长预计将增加对充电设备和无线充电的需求,据称这将减少充电所需的劳动力。无线充电预计将在不久的将来普及,市场规模将会扩大。

欧洲是一个快速成长的市场

欧洲是最大的製造地,预计将成为无线充电站的最大市场。这种增长归因于支持电动车销售的可行基础设施的可用性。电动车被认为是汽车购买者的可行选择。过去五年来,欧洲的电动车销量一直在成长。随着销量的预期成长,电动车无线充电基础设施等技术的机会正在出现。

德国、英国和法国由于规模经济、高所得和汽车製造中心的结合,可能成为最大的无线充电市场。在比利时和英国等国家,研究显示货车、公车和计程车更有可能接受无线充电。

此外,2023 年 3 月,ABT e-Line 和 WiTricity 宣布计划在欧洲提供售后无线电动汽车充电服务。 ABT e-Line 最初计划升级 VW ID.4 以支援 WiTricity 无线充电,目标发布日期为 2024 年初。之后,我们计划扩展到其他电动车款。

无线充电的市场基础已经显现,德国、荷兰、英国等欧洲国家的电动车销售量逐年成长。

电动车无线充电产业概况

高通、WiTricity、Momentum Dynamics、Hevo、Primove(庞巴迪)和大陆集团等领先公司在市场上获得了相当大的份额。这些领先公司专注于合作伙伴关係、新产品发布以及研发,以渗透当地市场。例如

*2023 年 11 月,Electron 宣布与密西根州交通部合作,将无线充电引入公共道路。采用 Electron 技术,感应式充电线圈将安装在底特律 Marantette 街和 Dalzell 街之间的第 14 街,为配备 Electron接收器的电动车在路上行驶时充电。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 电动车的扩张

- 政府支持和奖励

- 市场限制因素

- 高成本可能阻碍市场成长

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按车型分类

- 客车

- 商用车

- 按应用程式类型

- 住宅

- 商业的

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 世界其他地区

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Hella Aglaia Mobile Vision

- Witricity Corporation

- Momentum Dynamics Corporation

- Elix Wireless Inc.

- Mojo Mobility

- EFACEC

- ZTE Corporation

- Evatran Group Inc.

- HEVO Inc.

- Tgood Electric Co

- Continental AG

- Robert Bosch GmbH

- Hella Kgaa Hueck & Co.

- Toyota Motor Corporation

- Toshiba Corporation

第七章 市场机会及未来趋势

- 协作与伙伴关係

- 技术进步

The Wireless Charging For Electric Vehicle Market size is estimated at USD 152.30 million in 2024, and is expected to reach USD 762.5 million by 2029, growing at a CAGR of 38.40% during the forecast period (2024-2029).

Wireless electric vehicle (EV) charging is an innovative technology that enables EVs to be charged without needing a physical connection between the vehicle and the charging station. Wireless EV charging has several advantages over traditional wired charging. Firstly, it eliminates the need for cables and connectors, which can be inconvenient and time-consuming to handle. Secondly, it reduces the risk of electric shock or fire hazards caused by damaged cables or improper connections. Finally, it offers a more streamlined and user-friendly charging experience, as drivers can simply park their vehicle over the charging pad, and the charging process begins automatically.

* Wireless vehicle charging is one of the latest technologies that is being significantly developed, and it is also likely to boost the electric car industry.

* Setting up a charging station and chargers often increases land availability challenges in urban areas. With the inception of wireless charging, the challenges have been eased, and thus, charger operators have witnessed improved sales bars.

* Even though wireless charging is a must-have for electric vehicles, a few drawbacks need to be considered, like energy loss while charging, lack of availability of proper charging infrastructure, and high cost.

* The increase in the sale of electric vehicles across the globe is anticipated to drive the demand for wireless charging stations. Governments across the world, in countries like the United Kingdom, Norway, Japan, and the United States, as well as in developing countries like China, are providing purchasers with incentives.

* A limited number of countries are working on wireless charging for electric vehicles. For instance, in September 2022, a Japanese construction company announced the joining of cooperation with Denso Corporation to help build road pavement offering wireless EV charging points by the end of 2025. This came after realizing the necessity of constructing a proper station that includes the land.

Wireless Charging For Electric Vehicle Market Trends

Increasing Passenger Car Sales To Propel The Market Growth

As more people become aware of the environmental impacts of traditional gasoline-powered cars, there is a growing interest in electric cars. Additionally, rising fuel prices have slowed the penetration of electric vehicles in the automobile industry, which plays a significant role in stimulating the demand for charging stations.

This has forced automakers to increase their expenditure on R&D of electric vehicles, which eventually allowed them to market electric vehicles in the future. This strategy strongly impacted people, as there was a considerable change in the purchase pattern from conventional IC engine vehicles to electric vehicles. The change has not decreased the sales of IC engine vehicles but created a promising market for electric vehicles in the present and future.

Globally, the sales of electric cars increased by around 55.5% in 2022 compared to 2021, crossing 10 million for the first time, even though car sales were less than the previous year. As a result, 1 in every 7 passenger cars bought globally in 2022 was an EV, according to the International Energy Agency (IEA).

Further, the ride-hailing and car-sharing markets are expected to increase the demand for charging stations. Ride-hailing and car-sharing vehicles are typically used for longer periods and experience higher utilization rates than privately owned vehicles. This means that they need to be charged more frequently, which increases the demand for charging stations.

Electric vehicles have reached par (sometimes surpassed) with IC engine vehicles in terms of performance, maintenance, and the initial cost of purchase.

The growth of passenger electric vehicles is anticipated to increase the need for charging equipment and wireless charging, which claims to reduce the effort put into charging the vehicle. Wireless charging is expected to gain popularity and have a growing market in the near future.

Europe is the Fastest Growing region in the Market

Europe is expected to be the largest manufacturing hub and the largest market for wireless charging stations. This growth owes to the availability of viable infrastructures to support electric vehicle sales. Electric vehicles are considered a viable option for customers who purchase a vehicle. The sales of electric cars in the European region have been on the rise for the last five years. The sales are forecasted to increase, thereby opening opportunities for technologies like wireless charging infrastructure for electric vehicles.

Germany, the United Kingdom, and France will be the biggest markets for wireless charging due to a combination of economies of scale, high levels of income, and being an automotive manufacturing hub. In countries like Belgium and the United Kingdom, surveys have demonstrated that vans, buses, and taxis are more likely to accept wireless charging of vehicles, as these particular segments require a high range with convenient charging methods.

Moreover, in March 2023, ABT e-Line and WiTricity had announced plans to deliver aftermarket wireless EV charging in Europe. ABT e-Line plans to initially upgrade the VW ID.4 to support wireless charging from WiTricity, with the availability targeted for early 2024. The company plans to expand to additional EV models thereafter.

The foundation for the market for wireless charging is already visible from the yearly increasing sales of electric vehicles in European countries, like Germany, the Netherlands, and the United Kingdom, among many others.

Wireless Charging For Electric Vehicle Industry Overview

Some of the major players, like Qualcomm, WiTricity, Momentum Dynamics, Hevo, Primove (Bombardier), Continental, etc., have captured significant shares in the market. These major players focus on partnerships, the launching of new products, and R&D to achieve a higher penetration into the regional markets. For instance,

* In November 2023, Electron, in partnership with the Michigan Department of Transportation, announced the deployment of a wireless-charging public roadway. Using technology from Electreon, Detroit's 14th Street is now equipped with inductive-charging coils between Marantette and Dalzelle streets that will charge electric vehicles equipped with Electreon receivers as they drive on the road.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increased Adoption Of Electric Vehicles

- 4.1.2 Government Support And Incentives

- 4.2 Market Restraints

- 4.2.1 Higher Cost May hinder the Market Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Application Type

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 Australia

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Hella Aglaia Mobile Vision

- 6.2.2 Witricity Corporation

- 6.2.3 Momentum Dynamics Corporation

- 6.2.4 Elix Wireless Inc.

- 6.2.5 Mojo Mobility

- 6.2.6 EFACEC

- 6.2.7 ZTE Corporation

- 6.2.8 Evatran Group Inc.

- 6.2.9 HEVO Inc.

- 6.2.10 Tgood Electric Co

- 6.2.11 Continental AG

- 6.2.12 Robert Bosch GmbH

- 6.2.13 Hella Kgaa Hueck & Co.

- 6.2.14 Toyota Motor Corporation

- 6.2.15 Toshiba Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Collaboration And Partnerships

- 7.1.1 Technological Advancements