|

市场调查报告书

商品编码

1641871

混合动力解决方案 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Hybrid Power Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

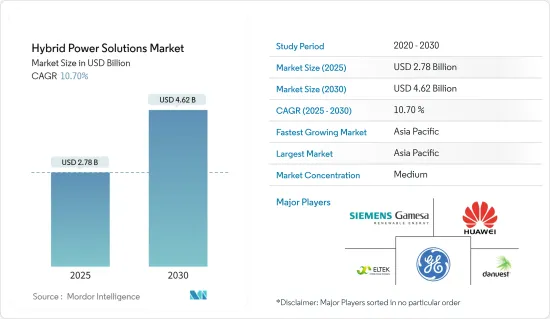

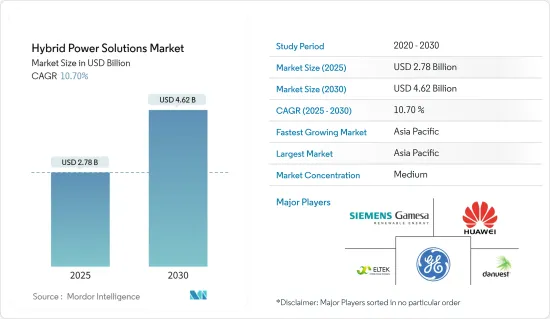

混合动力解决方案市场规模预计在 2025 年为 27.8 亿美元,预计到 2030 年将达到 46.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.7%。

关键亮点

- 从中期来看,预计对碳排放的日益增长的关注和政府的支持措施将在预测期内推动市场研究。

- 然而,预计预测期内高额的初始资本投资将阻碍市场成长。

- 全球正在进行的都市化活动预计将为混合动力解决方案市场创造重大机会。

- 由于能源需求不断增加以及基础设施开发活动活性化,亚太地区预计将成为市场主导地区。

混合电源解决方案市场趋势

太阳能发电机混合市场占据主导地位

- 由于战略优势和不断发展的太阳能市场动态,太阳能发电机混合市场有望主导混合动力解决方案市场。这一优势的关键驱动因素是人们对环境问题的日益关注和监管的必要性。

- 光电混合动力发电代表了可再生太阳能与辅助电力的结合,正在帮助产业应对日益增长的生态问题和更严格的环境法规。积极遵循此类永续实践已成为企业寻求提高太阳能混合动力汽车市场竞争力和加强企业社会责任的重要工具。

- 根据能源研究所《2023年世界能源统计评论》,自2012年以来,太阳能发电量大幅增加。 2022年全球太阳能发电总量将达到1322.6兆瓦时,较2021年增长近25%,2012年至2022年的年增长率约为29%,是太阳能发电史上最大的增幅。发生了显着变化。

- 此外,太阳能发电机混合动力的多功能性为各个工业和家庭领域带来了多方面的效用。它在偏远和离网地区的适应性,以及它在电网整合和需求面管理方面的潜力,使其成为解决能源取得差距和电网稳定性问题的关键解决方案。

- 例如,阿特拉斯科普柯于 2022 年 4 月推出了一系列新型储能係统,可与太阳能混合系统和柴油发电机结合使用。它们可以部署在没有常规电网的偏远地区。

- 因此,如上所述,预计在预测期内,太阳能发电机混合部分的需求将主导混合发电系统市场。

亚太地区占市场主导地位

- 亚太地区在混合动力解决方案市场中快速成长的主导地位是多方面市场动态和策略需要共同作用的结果。事实证明,植根于区域能源消费模式的战略要务是有利的。亚太经济体的快速都市化、工业扩张和不断增长的电力需求正在推动对永续和多样化能源来源的需求。

- 混合动力解决方案能够优化能源效率并增强可再生资源,这凸显了它们与该地区能源安全目标和资源限制协同效应的重要性。

- 此外,监管支持和市场奖励正在巩固该地区的主导地位。政府倡导可再生能源整合和减少排放的倡议,加上有利的政策框架和财政奖励,推动了混合能源解决方案的采用。

- 例如,印度製定了一个雄心勃勃的目标,即到 2030 年安装近 500 吉瓦的可再生能源容量,其中大部分预计来自太阳能。在成本下降和政府支持措施的推动下,这刺激了该国太阳能产业的成长。

- 中国的目标是到2025年将非化石能源消费比重提高到20%,到2030年提高到25%。此外,政府还计划在2030年安装超过1,200吉瓦的风能和太阳能发电容量。这些新兴市场的发展预计将推动混合动力解决方案市场的需求。

- 该地区强大的创新生态系统加上广泛的研究和开发倡议,将加速混合动力解决方案的进步。亚太地区正成为尖端混合动力技术的培育地,本地创新可提高系统效率、可靠性和成本竞争力。

- 因此,亚太地区对电力的需求不断增长,加上可再生能源的整合和混合动力系统的创新,预计将在整个预测期内成为混合电力解决方案最重要且成长最快的市场。

混合动力解决方案产业概览

混合动力解决方案市场规模减少了一半。该市场的主要企业(不分先后顺序)包括西门子歌美飒可再生能源公司、通用电气公司、华为投资控股、Eltek Ltd 和 Danvest BV。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 人们对环境问题的兴趣日益浓厚

- 政府支持措施

- 限制因素

- 初期资本投入高

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 作品

- 太阳能发电机

- 风力发电机

- 太阳能加风能加发电机

- 其他的

- 最终用户

- 商业和工业

- 住宅

- 公共产业

- 2028 年市场规模与需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 埃及

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Siemens Gamesa Renewable Energy SA

- General Electric Company

- Huawei Investment & Holding Co. Ltd

- Eltek Ltd

- Danvest BV

- Engie SA

- Silver Power Systems

- SMA Solar Technology AG

- Vergnet SA

第七章 市场机会与未来趋势

- 都市化进程加速

简介目录

Product Code: 61057

The Hybrid Power Solutions Market size is estimated at USD 2.78 billion in 2025, and is expected to reach USD 4.62 billion by 2030, at a CAGR of 10.7% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing concerns over carbon emissions and supportive government policies are expected to drive the market studied during the forecast period.

- On the other hand, high initial capital investments are expected to hinder the growth of the market studied during the forecast period.

- Nevertheless, the ongoing urbanization activities across the globe are expected to create huge opportunities for the hybrid power solutions market.

- The Asia-Pacific region is expected to be a dominant region for the market due to the increasing energy demand coupled with increasing infrastructure developmental activities in the region.

Hybrid Power Solutions Market Trends

Solar Generator Hybrid Segment to Dominate the Market

- The projected ascendancy of the solar generator hybrid segment within the hybrid power solutions market originates from the convergence of strategic advantages and evolving solar energy market dynamics. The primary factor driving the dominance is the height of environmental concerns and regulatory imperatives.

- Solar generator hybrids epitomize the amalgamation of renewable solar energy with auxiliary power sources, aiding the industry's response to mounting ecological concerns and stringent environmental regulations. This proactive alignment with sustainable practices augments the marketability of solar generator hybrids and positions them as pivotal instruments for corporations seeking to fortify their corporate social responsibility endeavors.

- According to the Energy Institute Statistical Review of World Energy 2023, the electricity generated from solar energy has constantly increased significantly since 2012. The total electricity generated through solar energy globally in 2022 was 1322.6 terawatt hours, an increase of almost 25% compared to 2021, while an annual growth rate between 2012 and 2022 was recorded at around 29%, signifying the significant growth of solar energy in recent years.

- Moreover, the versatility of solar generator hybrids instills in them a multifaceted utility across diverse industrial and domestic sectors. Their adaptability in remote and off-grid contexts, coupled with the potential for grid integration and demand-side management, positions them as a critical solution for addressing energy access disparities and grid stability concerns.

- For instance, in April 2022, Atlas Copco launched its new series of energy storage systems that can be coupled with solar energy hybrid system diesel generator power systems. These can be deployed in remote locations that do not have access to regular grid supply.

- Therefore, as discussed above, the demand for the solar generator hybrid segment is expected to dominate the hybrid power systems market during the forecast period.

Asia-Pacific to Dominate the Market

- The burgeoning dominance of the Asia-Pacific region in the hybrid power solution market emerges as a culmination of multifaceted market dynamics and strategic imperatives. Strategic imperatives routed in regional energy consumption patterns substantiate the anticipated dominance. Rapid urbanization, industrial expansion, and growing electricity demand within the Asia Pacific economies collectively amplify the need for sustainable and diversified energy sources.

- The capacity of hybrid power solutions to optimize energy efficiency and hardness renewable resources synergizes with the region's energy security goals and resource constraints, substantiating their paramount significance.

- Furthermore, regulatory support and market incentives fortify the region's leadership position. Government initiatives advocating for renewable energy integration and emissions reduction coupled with favorable policy frameworks and financial incentives catalyzed the adoption of hybrid power solutions.

- For instance, India has set up an ambitious target of installing nearly 500 GW of renewable capacity by 2030, a large share of which is expected to come from solar energy. This has propelled the growth of the country's solar sector, which falling costs and supportive government incentives have buoyed.

- China strives to increase the share of non-fossil energy consumption to 20% by 2025 and 25% by 2030. The country also aims to install more than 1200 GW of wind and solar power capacities by 2030. Such developments are anticipated to drive the demand for the hybrid power solutions market.

- The region's robust ecosystem for technological innovation, coupled with the proliferation of research and development initiatives, is poised to yield accelerated advancements in hybrid power solutions. As local innovation begets superior system efficiency, enhanced reliability, and cost competitiveness, the Asia-Pacific region emerges as a crucible for fostering cutting-edge hybrid technologies.

- Therefore, with ever-increasing power demand coupled with the integration of renewable energy and innovation in hybrid power systems, Asia-Pacific is expected to be the most significant and fastest-growing hybrid power solutions market throughout the forecast period.

Hybrid Power Solutions Industry Overview

The hybrid power solutions market is semi-fragmented. Some of the key players in this market (in no particular order) are Siemens Gamesa Renewable Energy SA, General Electric Company, Huawei Investment & Holding Co. Ltd, Eltek Ltd, and Danvest BV.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Environmental Concerns

- 4.5.1.2 Supportive Government Policies

- 4.5.2 Restraints

- 4.5.2.1 High Initial Capital Investment

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Configuration

- 5.1.1 Solar Plus Generator

- 5.1.2 Wind Plus Generator

- 5.1.3 Solar Plus Wind Plus Generator

- 5.1.4 Other Types

- 5.2 End-User

- 5.2.1 Commercial and Industrial

- 5.2.2 Residential

- 5.2.3 Utility

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Italy

- 5.3.2.4 France

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Egypt

- 5.3.5.4 South Afrcia

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens Gamesa Renewable Energy SA

- 6.3.2 General Electric Company

- 6.3.3 Huawei Investment & Holding Co. Ltd

- 6.3.4 Eltek Ltd

- 6.3.5 Danvest BV

- 6.3.6 Engie SA

- 6.3.7 Silver Power Systems

- 6.3.8 SMA Solar Technology AG

- 6.3.9 Vergnet SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Urbanization Activities

02-2729-4219

+886-2-2729-4219