|

市场调查报告书

商品编码

1519900

苯乙烯嵌段共聚物(SBC)的全球市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Styrenic Block Copolymers (SBCs) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

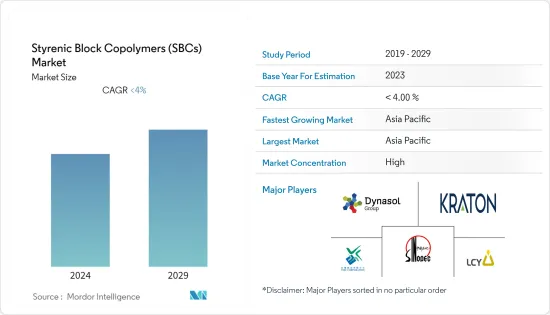

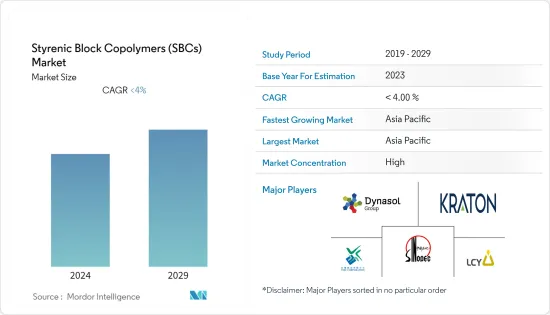

就产量而言,全球苯乙烯嵌段共聚物(SBC)市场规模到2024年将达到289万吨,2024-2029年预测期间复合年增长率为3.92%,2029年将达到362万吨。增加到1000万吨。

COVID-19大流行阻碍了苯乙烯嵌段共聚物市场。考虑到这种情况,在封锁期间,建筑建设活动暂时停止,以遏制病毒的传播。根据欧盟统计局的数据,欧盟 19 个国家的建设业下降了 28.4%,欧盟 27 个国家的建筑业下降了 24%,聚丁二烯(SBS) 的需求下降。然而,由于沥青改性(铺路和屋顶)和製鞋产业的需求增加,放鬆管制后市场出现显着成长。

短期内,沥青改性应用的增加和製鞋行业采用的增加预计将刺激市场需求。

然而,对无沥青道路和屋顶建设的日益关注预计将抑制市场成长。

黏剂的成长机会可能会在未来几年创造市场机会。

亚太地区在市场上占据主导地位,预计在预测期内仍将保持最高的复合年增长率。

苯乙烯嵌段共聚物(SBC)的市场趋势

沥青改性领域占据市场主导地位

- 沥青是道路、机场跑道、滑行道、自行车道等的重要建筑材料。

- 黏合剂改质剂(SBC) 等改质剂可提高沥青路面的抗热裂、车辙和剥落等路面破坏能力,从而提高沥青路面的性能并延长其使用寿命。

- 近年来,沥青用改性沥青的需求量不断增加。这项需求与正在进行的道路建设活动直接相关。道路和人行道每天都承受重载,因此承受着持续的压力。它们需要维护并且需要不时进行维修。此外,道路的建设和维护方式对车辆在其上滚动和爬行所消耗的能量有重大影响。

- 世界各国政府花钱修復和拓宽已开发国家现有的道路,并在开发中国家中国家建造全新的道路。

- 例如,2022年9月,欧盟委员会将透过欧洲互联互通基金(CEF)投资50亿欧元用于基础建设计划,包括道路和人行道,主要针对跨欧洲运输网路(TEN-T网路)和多式联运运输(52.9 亿美元)。

- 此外,美国沥青路面市场的 65% 是公共资助的高速公路计划,住宅和住宅建筑占剩余的 35%。各级政府(联邦/州/地方)每年在高速公路、道路和桥樑上的资本支出约为 800 亿美元,其中约一半来自联邦政府。

- 此外,联邦公路管理局 (FHWA) 并未追踪大量使用 SBC 的 189 万英里当地道路的路面类型。

- 印度品牌资产基金会(IBEF)的报告显示,印度高速公路建设将从2022年的10,457公里增加到2023年的10,993公里。

- 所有这些因素预计将增加对沥青改性的需求,从而增加预测期内苯乙烯嵌段共聚物的成长。

亚太地区主导市场

- 亚太地区是全球苯乙烯嵌段共聚物市场最大的区域市场。该地区苯乙烯嵌段共聚物的主要消费国家包括中国、印度和日本。

- 最近在中国主要城市爆发新冠肺炎 (COVID-19) 疫情后,中国正在加强投资和高速公路建设力度,努力稳定经济。根据国家统计局数据,2023年1月至8月中国资本投资达28.59兆元人民币(约3.91兆美元),较2022年同期成长6.8%。

- 国家发展和改革委员会、运输部在联合记者会上宣布,到2035年,将建成功能齐全、高效安全的高速公路网。此外,中国计划在2035年建成46.1万公里的高速公路网,并于2050年将其扩展为世界上最好的高速公路网之一。

- 中国是最大的鞋类製造商、消费国和供应商。根据《世界鞋业年鑑2023》显示,2022年,中国生产鞋类约130.47亿双,消费量39.3亿双,占全球鞋类消费量的17.9%。同年,印度出口鞋类约93.08亿双,约占全球鞋类出口额的61.3%。

- 印度道路运输和公路部长表示,印度的建筑业目前位居世界第三,未来五年可能成为世界第一。据国家投资促进和便利化局称,到2025年印度建筑业预计将达到1.4兆美元,以支撑苯乙烯嵌段共聚物的需求。

- 根据印度包装工业协会(PIAI)的数据,印度包装产业在经济中排名第五。该协会预测,到2025年,包装产业的产值将达到2,048.1亿美元。这种情况可能会在预测期内提振受调查市场的需求。

- 日本的包装产业,包括食品和药品包装,预计在未来几年将成长。在目前的市场情况下,日本是世界上人均包装材料消费量最高的国家。在亚洲,日本的包装食品消费份额则位居第二,仅次于中国。对于食品和饮料包装专业人士来说,这是一个巨大的商机。

- 根据日本包装研究所 (JPI) 的数据,2022 年日本包装产业的总出货收益将约为6.58 兆日圆(约500 亿美元),而前一年约为6.17 兆日圆(约合500 亿美元)。根据Statista预测,食品饮料产业预计2024年将达到6,271万美元,2027年将达到8,053万美元。食品和饮料行业的这些趋势预计将在未来几年增加所调查市场对包装和聚合物改性应用的需求。

- 由于上述因素,亚太苯乙烯嵌段共聚物市场预计在预测期内将显着成长。

苯乙烯嵌段共聚物(SBC)产业概况

苯乙烯嵌段共聚物 (SBC) 市场因其性质而得到部分整合。该市场的主要企业包括中国石化集团公司(SINOPEC)、李长荣集团、台橡公司、戴纳索集团和科腾公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 增加沥青改性的使用

- 鞋业就业增加

- 抑制因素

- 越来越关注道路和屋顶的无沥青施工

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 价格概览(2019-2029)

第五章市场区隔(市场规模:基于数量)

- 类型

- 聚丁二烯(SBS)

- 苯乙烯-异戊二烯-苯乙烯 (SIS)

- 氢化SBC (汇丰银行)

- 目的

- 沥青改性(铺路/屋顶)

- 鞋类

- 聚合物改性

- 黏剂/密封剂

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 西班牙

- 土耳其

- 北欧国家

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 埃及

- 奈及利亚

- 南非

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟和协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Avient Corporation

- China Petrochemical Corporation(Sinopec)

- Grupo Dynasol

- INEOS

- Kraton Corporation

- Kuraray Co. Ltd

- LCY Group

- LG Chem

- TSRC

- Versalis SPA

- Zeon Corporation

第七章 市场机会及未来趋势

- 黏剂的成长机会

The Styrenic Block Copolymers Market size in terms of production volume is expected to grow from 2.89 Million tonnes in 2024 to 3.62 Million tonnes by 2029, at a CAGR of 3.92% during the forecast period (2024-2029).

The COVID-19 pandemic hampered the styrenic block copolymers market. Considering this scenario, building and construction activities were stopped temporarily during the lockdown to curb the spread of the virus. According to Eurostat, the construction industry declined by 28.4% in the EU-19 countries and by 24% in the European Union (EU-27) countries, thereby witnessing a reduction in demand for styrene-butadiene-styrene (SBS). However, the market registered a significant growth rate after the restrictions were lifted due to the increasing demand from asphalt modification (paving and roofing) and footwear industries.

Over the short term, increasing applications in bitumen modification and the rising adoption in the footwear industry are expected to stimulate market demand.

However, the growing focus on asphalt-free construction of roads and roofing is expected to restrain market growth.

Growth opportunities in hot-melt adhesives are likely to create market opportunities in the coming years.

Asia-Pacific is expected to dominate the market and is likely to witness the highest CAGR during the forecast period.

Styrenic Block Copolymers (SBCs) Market Trends

The Asphalt Modification Segment to Dominate the Market

- Asphalt is an important construction material for roads, airport runways, taxiways, bicycle paths, etc.

- Modifiers, such as binder modifiers (SBCs), improve the performance of asphalt pavements by increasing their resistance to pavement distresses, such as thermal cracking, rutting, stripping, etc., thereby prolonging their service life.

- In recent years, the demand for modified bitumen used in asphalt has been witnessing steady growth. This demand directly correlates with ongoing road construction activities. Roadways and walkways are under continuous stress as they are subjected to heavy loads daily. They require maintenance and are subject to repair from time to time. Moreover, how roads are built and maintained significantly impacts the energy that is burned by the vehicles that roll or crawl on the surface.

- Governments worldwide are spending money to restore or expand existing roadways in the developed world and construct entirely new ones in the developing world.

- For instance, in September 2022, the European Commission released EUR 5 billion (USD 5.29 billion) through the Connecting Europe Facility (CEF) in infrastructure projects, which will include roadways and walkways, targeting mainly the trans-European transport network (TEN-T network) and multimodal transport.

- Moreover, 65% of the asphalt pavement market in the United States can be accounted for publicly funded highway projects, with residential and non-residential construction making up the remaining 35%. Capital spending on highways, roads, and bridges by all levels of government (federal/state/local) is around USD 80 billion annually, about half of which comes from federal funding.

- Furthermore, the Federal Highway Administration (FHWA) does not track pavement type for 1.89 million miles of local roads where the use of SBC is significant.

- As per the report of the Indian Brand Equity Foundation (IBEF), highway construction in India increased from 10,457 km in 2022 to 10,993 km in 2023.

- All such factors are likely to increase the demand for asphalt modification, which will, in turn, increase the growth of styrenic block copolymers during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific represents the largest regional market for styrenic block copolymers market globally. The major countries responsible for the consumption of styrenic block copolymers in the region include China, India, and Japan.

- China is stepping up investment and highway construction as it scrambles to stabilize its economy following the recent outbreak of COVID-19 in major Chinese cities. According to the National Bureau of Statistics, China's capital investment reached CNY 28.59 trillion (~USD 3.91 trillion) in the first eight months of 2023, up by 6.8% compared to the same period in 2022.

- The National Development and Reform Commission (NDRC) and the Ministry of Transport announced in a joint news briefing that they would build a highway network that is fully functional, efficient, and safe by 2035. Moreover, China plans to build a 461,000 km highway network by 2035 and expand it into a world-class network by 2050.

- China is the largest manufacturer, consumer, and supplier of footwear. According to the World Footwear Yearbook 2023, in 2022, the country produced about 13,047 million pairs of footwear, while consumption was about 3,930 million, representing 17.9% of the total global footwear consumption. In the same year, the country exported about 9,308 million pairs of footwear, representing about 61.3% of the global exports of footwear.

- The construction sector in India, which is currently the third largest in the world, has the capability to become the largest in the world in the next 5 years, as per the Union Minister for Road Transport & Highways. According to the National Investment Promotion and Facilitation Agency, the construction Industry in India is expected to reach USD 1.4 trillion by 2025, thus supporting the demand for styrenic block copolymers from the industry.

- According to the Packaging Industry Association of India (PIAI), the country's packaging sector is the fifth largest sector in its economy. The association has predicted that the packaging sector will reach USD 204.81 billion by 2025. This scenario may boost the demand for the market studied during the forecast period.

- The Japanese packaging industry, including food and pharmaceutical packaging, is expected to grow in the coming years. In the present market scenario, Japan has the world's highest per capita consumption of packaging materials. In Asia, Japan holds the second-highest packaged food consumption share, next to China. This is a good business opportunity for food and beverage packaging professionals.

- As per the Japan Packaging Institute (JPI), the total shipment value of the Japanese packaging industry was around JPY 6.58 trillion (~USD 0.05 trillion) in 2022 compared to around JPY 6.17 trillion (~USD 0.05 trillion) in the previous year. The food and beverage industry is expected to reach USD 62.71 million in 2024 and is projected to reach USD 80.53 million by 2027, as per Statista forecast. Such trends in the food and beverage industry are expected to boost the demand for packaging, uplifting the polymer modification application of the market studied in the coming years.

- Owing to the factors mentioned above, the market for styrenic block copolymers in Asia-Pacific is projected to grow significantly during the forecast period.

Styrenic Block Copolymers (SBCs) Industry Overview

The styrenic block copolymers (SBCs) market is partially consolidated in nature. Some of the major players in the market include China Petrochemical Corporation (SINOPEC), LCY Group, TSRC Corporation, Dynasol Group, and Kraton Corporation (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in Bitumen Modification

- 4.1.2 Rising Adoption in the Footwear Industry

- 4.2 Restraints

- 4.2.1 Growing Focus on Asphalt-free Construction of Roads and Roofing

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Overview (2019-2029)

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Styrene-Butadiene-Styrene (SBS)

- 5.1.2 Styrene-Isoprene-Styrene (SIS)

- 5.1.3 Hydrogenated SBC (HSBC)

- 5.2 Application

- 5.2.1 Asphalt Modification (Paving and Roofing)

- 5.2.2 Footwear

- 5.2.3 Polymer Modification

- 5.2.4 Adhesives and Sealants

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Spain

- 5.3.3.7 Turkey

- 5.3.3.8 Nordic Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 Nigeria

- 5.3.5.6 South Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Avient Corporation

- 6.4.2 China Petrochemical Corporation (Sinopec)

- 6.4.3 Grupo Dynasol

- 6.4.4 INEOS

- 6.4.5 Kraton Corporation

- 6.4.6 Kuraray Co. Ltd

- 6.4.7 LCY Group

- 6.4.8 LG Chem

- 6.4.9 TSRC

- 6.4.10 Versalis SPA

- 6.4.11 Zeon Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth Opportunities in Hot-melt Adhesives