|

市场调查报告书

商品编码

1519901

全球高速钢市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)High Speed Steel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

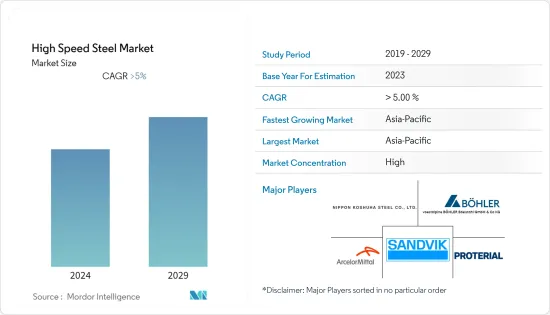

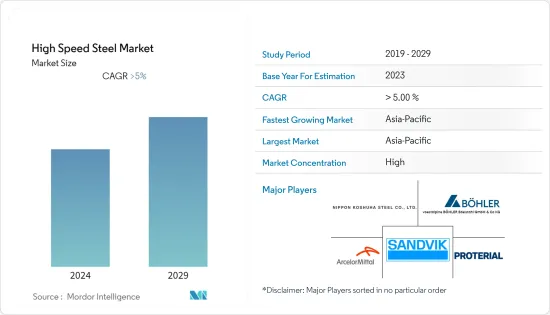

预计2024年全球高速钢市场规模将达到31.3亿美元,并在2024-2029年预测期内以超过4%的复合年增长率成长,到2029年将达到31.4亿美元。

COVID-19 大流行对全球高速钢(HSS)市场产生了重大影响,导致供应链中断和需求下降。但2021年以来,随着经济重新开放、工业活动恢復,市场逐渐復苏。人们重新关注供应链的弹性。随着汽车、航太等产业重拾动力,高速钢需求预计将增加,市场可望进一步復苏。

主要亮点

- 市场成长的主要因素是工业应用的增加和航太业需求的增加。

- 在各种最终用途领域越来越多地使用硬质合金切削刀具可能会抑制市场成长。

- 未来几年,由于技术的快速变化,高速钢市场预计将成长。

- 预计亚太地区将在预测期内主导高速钢市场。

高速钢市场趋势

汽车产业可望主导市场

- 高速钢在汽车工业中有多种用途,包括使汽车更轻、更坚固,并且在某些地方能更好地吸收能量。

- 高速钢具有多种性能,这些性能增加了汽车行业的需求,例如机械性能和范围、厚度和宽度能力、热轧和轧延可用性、涂层规格和化学成分规格。

- 在汽车工业中,钢材的强度通常由其化学成分、热历史和微观结构决定,而微观结构则根据其在生产过程中所经历的变形过程而变化。

- 高速钢比普通钢具有许多优势,特别是在重量对燃料利用率影响很大的汽车产业。可焊性、疲劳性、静态强度、阴极保护和抗氢脆性等机械性能对于汽车工业非常有用。

- 高速钢用于结构应用,例如凸轮轴和曲轴链轮、连桿、同步器环、轴承盖和油泵齿轮。这些应用中使用的不銹钢还包括引擎阀座。 Fe-Cr-Mn-Si等铁合金材料用于避震器零件、液压系统过滤器、歧管法兰、排气转换器出口法兰、废气再循环系统等。

- 自大流行以来,汽车产业对传统汽车和电动车的需求激增。

- 根据国际工业协会(OICA)统计,2022年全球汽车产量约8,501万辆,较2021年的8,020万辆成长5.99%。

- 在北美,根据OICA的数据,2022年汽车产量为14,798,146辆,比2021年的13,467,065辆成长9.88%。此外,在北美,2022 年电动车销量为 1,108,000 辆,而 2021 年为 748,000 辆。

- 在欧洲,德国是主要的汽车製造商之一。德国汽车製造业是整个欧洲地区汽车生产的大股东。该国是主要汽车製造品牌的所在地,包括大众、梅赛德斯-奔驰、奥迪、宝马和保时捷。

- 根据国际汽车製造商组织(OICA)的数据,2022年该国汽车产量为3,677,820辆,比2021年的3,308,692辆成长11%。

- 总体而言,增加使用高速钢来提高燃油效率和汽车轻量化将推动汽车产业的成长。

亚太地区预计将主导市场

- 预计亚太地区将成为未来几年最大的高速钢市场。在中国和印度等国家,由于汽车和航太等行业的成长,对高速钢的需求正在迅速增加。

- 亚太地区的生产和销售主要由中国、印度和日本等国家主导,这些国家拥有主要汽车製造商和大量生产基地。

- 根据中国工业协会预测,2022年汽车产量将达到2,700万辆,比2021年成长3.4%,使中国成为全球最重要的汽车生产基地。

- 在中国,重点是扩大电动车的生产和销售。该国的目标是到2025年每年生产700万辆电动车。目标是到2025年中国新车产量的20%是电动车。

- 印度成为该地区第二大汽车製造商。印度汽车工业协会(SIAM)的数据显示,2022-23财年,汽车数量较2021-2022财年增加约12.55%,达到创纪录的25,931,867辆。

- 根据日本工业协会(JAMA)统计,2023财年日本国内汽车产量成长14.84%,达8,998,538辆。

- 这些变化可能会增加预测期内对高速钢的需求。

高速钢业概况

高速钢市场因其性质而部分整合。市场上的主要企业包括 Sandvik AB、voestalpine BOHLER Edelstahl GmbH & Co. KG、NIPPON KOSHUHA STEEL、PROTERIAL Ltd、ArcelorMittal。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大在各种工业应用的应用

- 航太业的需求增加

- 其他司机

- 抑制因素

- 硬质合金切削刀具在各种最终用途领域的使用不断增加

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:以金额为准)

- 类型

- 钨高速钢

- 钼高速钢

- 其他类型

- 产品类别

- 金属切削工具

- 冷加工工具

- 其他产品类型

- 最终用户产业

- 汽车产业

- 航太

- 塑胶

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)分析/排名分析

- 主要企业策略

- 公司简介

- ArcelorMittal

- CRS Holdings LLC

- ERASTEEL

- Friedr. Lohmann GmbH

- NACHI-FUJIKOSHI CORP.

- NIPPON KOSHUHA STEEL CO. LTD

- PROTERIAL Ltd

- Sandvik AB

- thyssenkrupp AG

- VILLARES METALS SA

- voestalpine BOHLER Edelstahl GmbH & Co. KG

第七章 市场机会及未来趋势

- 科技进步迅速

- 其他机会

The High Speed Steel Market size is estimated at USD 3.13 billion in 2024, and is expected to reach USD 3.14 billion by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

The COVID-19 pandemic significantly impacted the global high-speed steel (HSS) market, causing disruptions in supply chains and reducing demand. However, since 2021, the market has been gradually recovering as economies reopened and industrial activities resumed. There is a renewed focus on supply chain resilience. As industries like automotive and aerospace regain momentum, the demand for HSS is expected to increase, driving further recovery in the market.

Key Highlights

- The major factors driving the market's growth are the growing number of industrial uses and the increasing demand from the aerospace industry.

- The growing use of carbide-based cutting tools in different end-use sectors is likely to slow the market's growth.

- In the coming years, the high-speed steel market is expected to grow due to the rapid changes in technology.

- Asia-Pacific is expected to dominate the high-speed steel market over the forecast period.

High Speed Steel Market Trends

The Automotive Industry is Expected to Dominate the Market

- High-speed steel is used in many ways in the automotive industry to make vehicles lighter, stiffer, and better at absorbing energy in some places.

- High-speed steel has various properties that enhance its demand in the automotive industry, such as mechanical properties and ranges, thickness and width capabilities, hot- and cold-rolled availability, coating specifications, and chemical composition specifications.

- In the automotive industry, steel's strength is usually determined by its microstructure, which varies based on its chemical makeup, its history with heat, and the deformation processes it goes through during its production schedule.

- High-speed steel has a lot of advantages over regular steel, especially in the automotive industry, where weight is a significant factor in how well fuel is used. The mechanical properties, such as weldability, fatigue, static strength, cathodic protection, and resistance to hydrogen embrittlement, are useful to the auto industry.

- High-speed steel is used in structural applications such as camshaft and crankshaft sprockets, connecting rods, synchronizer rings, bearing caps, oil pump gears, etc. The stainless steel used in these applications includes engine valve seats. Ferrous-based alloys, such as Fe-Cr-Mn-Si materials, are used in shock absorber parts, filters for hydraulic systems, manifold flanges, exhaust converter outlet flanges, and exhaust gas recirculation systems.

- The automotive industry has been witnessing an upsurge in demand for both conventional and electric vehicles post-pandemic, primarily due to the increased traveling activities of people across the globe.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, around 85.01 million vehicles were produced worldwide, showcasing a growth rate of 5.99% compared to 80.20 million vehicles in 2021.

- In North America, according to the OICA, automotive production in 2022 accounted for 14,798,146 units, an increase of 9.88% compared to the show in 2021, which was reportedly 13,467,065 units. Additionally, in North America, the sales of electric vehicles in 2022 accounted for 1,108 thousand units, compared to 748 thousand unit sales in 2021.

- In Europe, Germany is among the key manufacturers of vehicles. The automobile manufacturing industry in Germany is a prominent shareholder of the overall automotive production in the European region. The country hosts major car-making brands, including Volkswagen, Mercedes-Benz, Audi, BMW, Porsche, etc.

- According to the Organization Internationale des Constructeurs d'Automobiles (OICA), in 2022, the country produced 3,677,820 vehicles, which increased by 11% compared to 3,308,692 cars in 2021.

- Overall, the increasing usage of high-speed steel for better fuel efficiency and lighter vehicles will boost the growth of the automotive industry.

Asia-Pacific is Expected to Dominate the Market

- During the next few years, the Asia-Pacific region is expected to be the largest market for high-speed steel. In countries like China and India, the growth of industries like automotive, aerospace, and others has caused the demand for high-speed steel to surge.

- The production and sales in the Asia-Pacific region are primarily dominated by countries like China, India, and Japan, which consist of large automotive manufacturers and a vast number of production bases within the countries.

- According to the China Association of Automobile Manufacturers (CAAM), China had the most significant automotive production base globally, with a total vehicle production of 27 million units in 2022, an increase of 3.4% compared to 2021.

- In China, the main focus is to increase production and sales of electric vehicles. The country has set a target to produce 7 million electric vehicles per year by 2025. By 2025, the goal is to have electric vehicles comprise 20% of total new vehicle production in China.

- India has become the second-largest automotive vehicle manufacturer in the region. According to the Society of Indian Automobile Manufacturers (SIAM), in FY 2022-23, the total number of automobile manufacturers in the country grew by about 12.55% compared to FY 2021-2022, recording 25,931,867 units.

- According to the Japan Automobile Manufacturers Association (JAMA), motor vehicle production in the country in 2023 grew by 14.84%, recording 8,998,538 units.

- During the forecast period, these changes are likely to increase the need for high-speed steel.

High Speed Steel Industry Overview

The high-speed steel market is partially consolidated in nature. Some of the major players in the market include Sandvik AB, voestalpine BOHLER Edelstahl GmbH & Co. KG, NIPPON KOSHUHA STEEL CO. LTD, PROTERIAL Ltd, and ArcelorMittal.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage in Different Industrial Applications

- 4.1.2 Increasing Demand from Aerospace industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 The Rising Use of Carbide-based Cutting Tools Across Various End-use Sectors

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Tungsten High Speed Steel

- 5.1.2 Molybdenum High Speed Steel

- 5.1.3 Other Types (Cobalt High-Speed Steel, Chromium High-Speed Steel, and Vanadium High-Speed Steel)

- 5.2 Product Type

- 5.2.1 Metal Cutting Tools

- 5.2.2 Cold Working Tools

- 5.2.3 Other Product Types (Milling Tools, Drilling Tools, etc.)

- 5.3 End-user Industry

- 5.3.1 Automotive

- 5.3.2 Aerospace

- 5.3.3 Plastics

- 5.3.4 Other End-user Industries (Mining, Manufacturing, Tool Making, etc)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 CRS Holdings LLC

- 6.4.3 ERASTEEL

- 6.4.4 Friedr. Lohmann GmbH

- 6.4.5 NACHI-FUJIKOSHI CORP.

- 6.4.6 NIPPON KOSHUHA STEEL CO. LTD

- 6.4.7 PROTERIAL Ltd

- 6.4.8 Sandvik AB

- 6.4.9 thyssenkrupp AG

- 6.4.10 VILLARES METALS SA

- 6.4.11 voestalpine BOHLER Edelstahl GmbH & Co. KG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rapid Technological Improvement

- 7.2 Other Opportunities