|

市场调查报告书

商品编码

1519905

聚氨酯接着剂和密封剂的全球市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Polyurethane Adhesives And Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

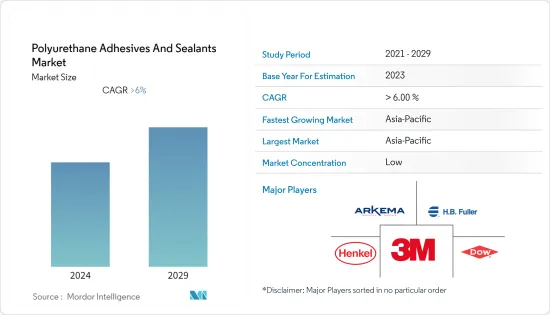

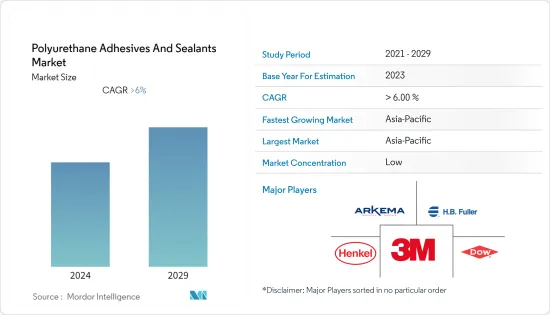

预计2024年全球聚氨酯接着剂和密封剂市场规模将达到175.3亿美元,并在2024-2029年预测期内以超过6%的复合年增长率增长,到2029年将达到235亿美元。

COVID-19 大流行对全球聚氨酯 (PU)黏剂和密封剂市场产生了重大影响。封锁和旅行限制扰乱了原材料和製成品的供应链,导致供不应求和价格上涨。疫情期间,政府和企业优先考虑医疗保健和其他重要部门,导致建筑、汽车和其他严重依赖这些产品的行业的投资减少。然而,市场已从 COVID-19 的最初影响中恢復,并从长远来看继续以温和的速度成长。

主要亮点

- 在亚洲,由于都市化和基础设施发展以及包装行业的增长而增加的建设活动预计将推动对黏剂和密封剂的需求。

- 然而,政府对挥发性有机化合物使用的严格环境法规预计将阻碍市场扩张。

- 在更广泛的 PU黏剂和密封剂市场中,对生物基聚氨酯 (PU) 热熔黏剂的需求正在稳步增长,预计将为全球市场创造利润丰厚的成长机会。

- 亚太地区是最大的市场,预计将成为预测期内成长最快的市场。这是由于中国、印度和东南亚国协的消费增加。

聚氨酯接着剂和密封剂的市场趋势

建筑业主导市场

- 建筑业的黏剂和密封剂消费量最高。由于其弹性和结构特性,聚氨酯接着剂和密封剂对混凝土、木材、塑胶和玻璃等许多基材表现出良好的黏合力。这些特性加上不断的技术进步,增加了聚氨酯接着剂和密封剂在住宅建筑中的使用。

- 亚太地区的建筑业是世界上最大的。由于该地区人口不断增长、中等收入群体不断壮大以及都市化加快,该行业呈现出健康的成长速度。

- 中国政府推出了「十四五」期间(2021-2025年)建筑业全面发展蓝图。该计画旨在使这一重要产业走上更环保、技术更先进、更安全的轨道。根据住宅部编製的指导意见,预计2025年,建筑业对国内生产总值(GDP)的贡献率将维持在6%左右。

- 中国的建筑业是世界上最大的建筑业,从业人员超过5,300万人。根据国家统计局的数据,2022 年中国建筑业产值将达到 31.2 兆元(约 4.57 兆美元),而 2021 年为 29.31 兆元(约 4.29 兆美元),增幅为6 %。 2022年中国建筑业对GDP的贡献率约为6.9%。

- 据住宅部预测,2025年后中国建筑业预计将维持GDP的6%。

- 根据国际贸易组织的数据,中国是世界上最大的建筑市场,也是世界上都市化最高的国家。美国建筑师学会(AIA)上海分会的资料显示,到2025年,中国将建成自1990年代以来10个纽约大小的城市。

- 预计2030年,中国的建筑支出将达到约13兆美元,市场前景光明。该国是全球最大的建筑市场,占全球整体建筑投资的20%。

- 根据美国人口普查,北美地区 2022 年的建筑支出约为 17,929 亿美元,比 2021 年的年度建筑支出高出 10%。这表明该地区的建筑业呈上升趋势。

- 此外,根据欧盟统计局的数据,由于欧盟復苏基金的新投资,欧洲建筑业在 2022 年成长了 2.5%。到2022年,非住宅(办公大楼、医院、饭店、学校、工业建筑)将占主体建设计划的31.3%。

- 由于这些原因,我们相信未来几年会有更多的人想要购买聚氨酯接着剂和密封剂。

亚太地区主导市场

- 亚太地区主导全球市场。中国、印度和日本等国家的包装、建筑、汽车和医疗保健等行业不断增长的需求正在推动所研究的市场。

- 中国正积极推动和维持目前的都市化趋势,目标是到2030年都市化达到70%。因此,中国等国家建设活动的活性化预计将推动该地区黏剂产业的成长。总的来说,这些因素导致全部区域对黏剂的需求不断增长。

- 据印度投资局称,到 2025 年,印度建筑业预计将达到 1.4 兆美元,印度建筑业已透过跨部门合作和 PMAY-U 技术提交确定,涵盖 250子部门,涵盖全球 250 多个行业。的创新建筑技术,我们将开启印度建筑业的新时代。

- 聚氨酯接着剂和密封剂在製鞋行业中发挥重要作用,可确保鞋子的耐用性、舒适性和美观性。它用于製鞋的各个阶段,从粘合鞋面和鞋底到密封接缝和连接装饰物品。

- 中国是全球最大的PU消费国,也是全球最大的鞋类生产国。中国是世界上最大的鞋类製造和出口国,正在席捲全球。 2022年中国鞋靴出货量将超过130亿双。

- 另一方面,中国是全球最大的汽车生产国和采购国。根据OICA统计,中国是全球最大的汽车生产基地,预计2022年汽车产量将达到2,702万辆,比去年的2,608万辆成长3%。

- 因此,预计此类市场趋势将在预测期内对该地区黏剂和密封剂市场的成长产生重大影响。

聚氨酯接着剂和密封剂产业概况

聚氨酯接着剂和密封剂市场分散。主要企业(排名不分先后)包括 3M、HB Fuller Company、Arkema (Bostik)、Dow 和 Henkel AG & Co. KGaA。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 亚洲建筑业需求不断成长

- 包装产业的成长

- 其他司机

- 抑制因素

- 加强有关有害物质和环境问题的法规

- 原物料价格波动

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:金额)

- 科技

- 水基的

- 溶剂型

- 热熔胶

- 其他技术

- 最终用户产业

- 建筑/施工

- 卫生保健

- 汽车/交通

- 包装

- 鞋类/皮革

- 电力/电子

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 土耳其

- 北欧国家

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 卡达

- 阿拉伯聯合大公国

- 埃及

- 阿尔及利亚

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- 3M

- Arkema

- Beijing Comens New materials Co. Ltd

- Dow

- HBFuller Company

- Henkel AG & Co.KGaA

- Hubei Huitian New Materials Co. Ltd

- Huntsman International LLC

- Jowat SE

- Kangada New Materials(Group)Co. Ltd

- MAPEI SpA

- NANPAO RESINS CHEMICAL GROUP

- Pidilite Industries Ltd

- Sika AG

- Soudal Holding NV

第七章 市场机会及未来趋势

- 对生物基PU黏剂的需求不断增长

The Polyurethane Adhesives And Sealants Market size is estimated at USD 17.53 billion in 2024, and is expected to reach USD 23.5 billion by 2029, growing at a CAGR of greater than 6% during the forecast period (2024-2029).

The COVID-19 pandemic had a significant impact on the global polyurethane (PU) adhesives and sealants market. Lockdowns and travel restrictions caused disruptions in the supply chain for raw materials and finished products, leading to shortages and price increases. Governments and businesses prioritized healthcare and other essential sectors during the pandemic, leading to reduced investment in construction, automotive, and other industries that rely heavily on these products. However, the market has recovered from the initial impact of COVID-19 and continues to grow at a moderate pace in the long run.

Key Highlights

- Increased construction activities in the Asian region, driven by urbanization and infrastructure development, along with the growth in the packaging industry, are expected to propel the demand for adhesives and sealants.

- However, strict environmental regulations set by the government on the use of volatile organic compounds are anticipated to hamper the expansion of the market studied.

- The demand for bio-based polyurethane (PU) hot-melt adhesives is steadily rising within the broader PU adhesives and sealants market, which is expected to create lucrative growth opportunities in the global market.

- The Asia-Pacific region represents the largest market and is also expected to be the fastest growing market over the forecast period. This is due to the increase in consumption from China, India, and ASEAN Countries.

Polyurethane Adhesives And Sealants Market Trends

Building and Construction Industry to Dominate the Market

- The construction sector has the highest consumption of adhesives and sealants. Polyurethane adhesives and sealants offer good adhesion to numerous substrates, such as concrete, wood, plastic, and glass, due to their elasticity and structural properties. Together with ongoing technical advancement, these characteristics have increased the use of polyurethane adhesive and sealant in residential construction.

- The construction sector in the Asia-Pacific region is the largest in the world. The sector is growing at a healthy rate due to the region's rising population, increase in middle-class incomes, and urbanization.

- As per the Government of China, China introduced a comprehensive development blueprint for its construction sector during the 14th Five-Year Plan period (2021-2025). This plan aims to steer the pivotal industry towards a more environmentally responsible, technologically advanced, and safer trajectory. As per the guidelines outlined by the Ministry of Housing and Urban-Rural Development, the construction industry is expected to uphold its contribution at 6 percent of the nation's GDP through 2025.

- China's construction sector is the largest construction industry in the world, employing more than 53 million people. According to the National Bureau of Statistics, the Chinese construction sector output was CNY 31.20 trillion (~USD 4.57 trillion) in 2022, compared to CNY 29.31 trillion (~USD 4.29 trillion) in 2021, registering a 6% growth. China's construction industry contributed around 6.9% to its GDP in 2022.

- As per the Ministry of Housing and Urban-Rural Development forecast, China's construction sector is expected to maintain a 6% share of the country's GDP moving into 2025.

- According to the International Trade Organization, China is the world's largest construction market, with the highest urbanization rate globally. According to data from the American Institute of Architects (AIA) Shanghai, by 2025, China will have built a city equivalent to 10 in New York since the 1990s.

- China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive outlook for the market. The country has the largest construction market in the world, encompassing 20% of all construction investments globally.

- In North America, according to the US Census, around USD 1,792.9 billion was spent on construction in 2022, a considerable amount and 10% higher than the annual spending on construction in 2021. This indicates an upward trend for buildings and construction in the region.

- Furthermore, according to Eurostat, the European construction sector grew by 2.5% in 2022 due to new investments from the EU Recovery Fund. The major construction projects in 2022 accounted for non-residential construction (offices, hospitals, hotels, schools, and industrial buildings), accounting for 31.3% of total activity.

- All of these things are likely to make more people want to buy polyurethane adhesives and sealants over the next few years.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominated the global market. The increasing demand from industries such as packaging, construction, automotive, healthcare, etc., in countries such as China, India, and Japan is driving the market studied.

- China is actively promoting and sustaining an ongoing urbanization trend, aiming for an anticipated rate of 70% by the year 2030. Consequently, the heightened construction activities in countries such as China are expected to propel growth in the adhesive industry within the region. These factors collectively contribute to an elevated demand for adhesives across the region.

- As per Invest India, the Indian construction industry is expected to reach USD 1.4 trillion by 2025, and the construction industry in India works across 250 sub-sectors with linkages across sectors and over 54 global innovative construction technologies identified under a Technology Sub-Mission of PMAY-U to start a new era in the Indian construction sector.

- Polyurethane (PU) adhesives and sealants play a crucial role in the footwear industry, ensuring the durability, comfort, and aesthetic appeal of shoes. They are used in various stages of shoe manufacturing, from bonding the upper to the sole to sealing seams and attaching embellishments.

- China is the largest consumer of PU and the largest producer of footwear globally. China is the world's largest footwear manufacturer and exporter, dominating worldwide. China shipped more than 13 billion pairs of shoes and boots in 2022.

- On the other hand, China is the world's greatest producer and purchaser of automobiles. According to OICA, China has the largest automotive production base in the world, with a total vehicle production of 27.02 million units in 2022, registering an increase of 3% compared to 26.08 million units produced last year.

- Hence, such market trends are expected to significantly impact the growth of the adhesives and sealants market in the region during the forecast period.

Polyurethane Adhesives and Sealants Industry Overview

The polyurethane adhesives and sealants market is fragmented in nature. The major players (not in any particular order) include 3M, H.B. Fuller Company, Arkema (Bostik), Dow, and Henkel AG & Co. KGaA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Construction Industry in the Asian Region

- 4.1.2 Growth in the Packaging Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stricter Regulations on Hazardous Materials and Environmental Concerns

- 4.2.2 Fluctuating Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Technology

- 5.1.1 Water-based

- 5.1.2 Solvent-based

- 5.1.3 Hot-melt

- 5.1.4 Other Technologies (Bio-based, Nano-PU adhesives, etc.)

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Healthcare

- 5.2.3 Automotive and Transportation

- 5.2.4 Packaging

- 5.2.5 Footwear and Leather

- 5.2.6 Electrical and Electronics

- 5.2.7 Other End-user Industries (Woodworking and Furniture, Consumer Goods, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Malaysia

- 5.3.1.7 Thailand

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Turkey

- 5.3.3.8 NORDIC Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Qatar

- 5.3.5.4 United Arab Emirates

- 5.3.5.5 Egypt

- 5.3.5.6 Algeria

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Beijing Comens New materials Co. Ltd

- 6.4.4 Dow

- 6.4.5 H.B.Fuller Company

- 6.4.6 Henkel AG & Co.KGaA

- 6.4.7 Hubei Huitian New Materials Co. Ltd

- 6.4.8 Huntsman International LLC

- 6.4.9 Jowat SE

- 6.4.10 Kangada New Materials (Group) Co. Ltd

- 6.4.11 MAPEI SpA

- 6.4.12 NANPAO RESINS CHEMICAL GROUP

- 6.4.13 Pidilite Industries Ltd

- 6.4.14 Sika AG

- 6.4.15 Soudal Holding NV

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for Bio-based PU Hot-melt Adhesives

![全球特种粘合剂市场聚氨酯 (PU) 粘合剂:趋势、机遇和竞争分析 [2023-2028]](/sample/img/cover/42/1289708.png)