|

市场调查报告书

商品编码

1519906

聚氨酯(PU)涂料的全球市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Polyurethane (PU) Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

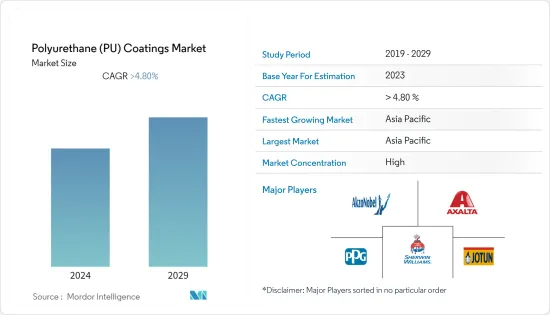

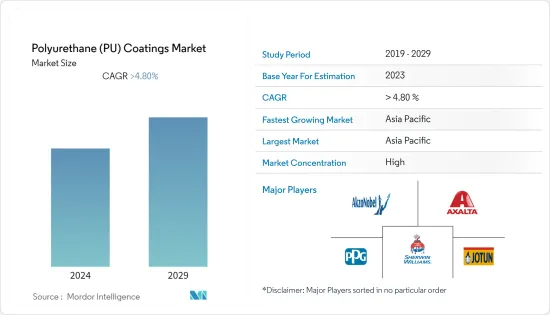

预计2024年全球聚氨酯涂料市场规模将达211.5亿美元,2029年将达268.8亿美元,2024年至2029年复合年增长率超过4%。

2020 年市场受到 COVID-19 的负面影响。大流行的情况已使世界上多个国家处于封锁状态。结果,所有製造和建设活动都停止了,对聚氨酯涂料的需求产生了负面影响。不过,情况有所好转,聚氨酯涂料市场的成长已经恢復。

主要亮点

- 建筑业正在推动市场成长,因为聚氨酯涂料被用作外墙涂料、内墙涂料、地板材料、屋顶和隔热材料。此外,木材和金属等轻质建筑材料的日益普及也推动了聚氨酯涂料市场的发展。

- 用于生产 PU 涂料的原料(例如异氰酸酯和多元醇)的价格波动较大,波动较大。这会影响 PU 涂料製造商的盈利。

- 此外,PU涂层也用于涂覆植入、导管等医疗设备。它也用于提高医疗设备的生物相容性。

- 亚太地区占据聚氨酯涂料消费量的主要份额。预计该地区将在预测期内实现最快的成长。

聚氨酯涂料市场发展趋势

汽车产业主导市场

- 汽车工业是全球聚氨酯涂料最大的消费领域。汽车漆中使用的底漆大多采用阴极电涂装工艺,近90%为阴极电涂装漆。聚氨酯电泳漆在这个过程中发挥了极好的作用。

- PU漆用于OEM和重涂。环氧聚酰胺聚氨酯和丙烯酸聚氨酯涂料是该产业通常优选的涂料。

- 过去十年,汽车产业经历了一段充满希望的成长时期,但近年来这种势头有所放缓。

- 全球许多地区的新车销售和生产都受到影响,包括欧洲、亚太地区和美国。在大多数国家,先前一直在成长的汽车生产受到了影响。然而,随着全球情势的改善,全球生产正在復苏。

- OICA资料显示,2021年全球汽车销量较2020年成长约5%。 2022年销量为81,628,533辆,2021年为82,755,197辆,较2021年仅下降1.3%。

- 根据OICA预测,2022年全球汽车产量为8,501万辆,与前一年同期比较成长6%,达8,014万辆。

- 所有上述因素预计都会影响聚氨酯涂料在汽车应用中的使用。

中国在亚太市场占主导地位

- 中国是PU材料的最大市场。这强大的消费群使其在全球PU涂料市场占有重要地位。

- 根据中国工业协会(CAAM)2002年的报告,儘管中国乘用车销量因COVID-19大流行而下降,但市场乘用车总销量已恢復。 2022年销量将超过2,350万台,为过去四年来的最高数字。 PU 涂料有潜力推动 PU 涂料市场,因为它们用于保护汽车免受腐蚀和其他损坏。它也用于改善汽车的外观。

- 根据中国国家统计局预测,2022年,中国建筑业产值将超过31兆元(4.6兆美元),与前一年同期比较增长6%,产值达29.31兆元人民币(4.36兆美元)。亿美元)。与 10 年前相比,它也增加了近 100%,对 PU 涂料市场和建筑行业保护建筑物免受自然灾害影响的技术趋势产生了积极影响。它也用于提高建筑物的能源效率。

- 近年来,随着环保要求和意识的增强,我国水性PU涂料产业发展迅速,其成长速度远超过整个PU材料产业。

- 据欧洲涂料公司称,2023 年 10 月,研究人员展示了用于木器涂料应用的香草醛基紫外线固化聚氨酯分散体的合成。

- 中国的科思创最近在上海建成了聚氨酯分销设施,以满足亚太地区不断增长的需求。

- 严格的环保监督为国内水性PU涂料的发展开闢了新的空间。

- 由于上述因素,预计在预测期内该地区对聚氨酯涂料的需求将会增加。

聚氨酯涂料产业概况

聚氨酯涂料市场具有综合性。主要企业(排名不分先后)包括 Akzo Nobel NV、Jotun、Axalta Coating Systems、PPG Industries Inc. 和 The Sherwin-Williams Company。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建筑业的需求不断增加

- 汽车产业需求增加

- 交通运输业需求增加

- 抑制因素

- 原物料价格不稳定

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:金额)

- 科技

- 粉末

- 溶剂型

- 水系统

- 辐射固化

- 最终用户产业

- 车

- 运输

- 建筑学

- 电力/电子

- 木材/家具

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Akzo Nobel NV

- Asian Paints

- Axalta Coating Systems

- BASF SE

- IVM Chemicals SRL

- Jotun

- Polycoat Products

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

第七章 市场机会及未来趋势

- PU涂料在航太和医疗产业的新应用

- 奈米技术与 PU 涂料融合的发展

The Polyurethane Coatings Market size is estimated at USD 21.15 billion in 2024, and is expected to reach USD 26.88 billion by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

The market was negatively impacted due to COVID-19 in 2020. Owing to the pandemic scenario, several countries around the world went into lockdown. It halted all manufacturing and construction activities, thus creating a negative impact on the demand for polyurethane coatings. However, the condition recovered, thereby restoring the growth of the polyurethane coatings market.

Key Highlights

- The construction industry is driving the market's growth as PU coatings are used as exterior coatings, interior coatings, flooring, roofing, and insulation. Moreover, the increasing popularity of lightweight construction materials such as wood and metal is also driving the PU coatings market.

- The prices of raw materials used in the production of PU coatings, such as isocyanates and polyols, are volatile and can fluctuate significantly. It can impact the profitability of PU coatings manufacturers.

- In addition, PU coatings are being used to coat medical devices, such as implants and catheters. They are also being used to make medical devices more biocompatible.

- Asia-Pacific holds the major share in the consumption of polyurethane coatings. The region is also expected to witness the fastest growth during the forecast period.

Polyurethane Coatings Market Trends

Automotive Industry to Dominate the Market

- The automotive industry is the largest consumer of polyurethane coatings across the world. The majority of the primers used in automotive coatings utilize a cathodic electric deposit process, which constitutes almost 90% cathode electrophoretic paint. Polyurethane electrophoretic paint plays an excellent role in the process.

- PU coatings are used for both OEM and refinish applications. Epoxy polyamide polyurethane and acrylic polyurethane coats are the commonly preferred coatings in the industry.

- Despite an encouraging term of growth in the automotive sector during the past decade, the momentum slowed down in recent years.

- The sales and production of new vehicles were affected in various parts of the world, including Europe, Asia-Pacific, and the United States. It affected the previously growing automotive production in most nations. However, with the improving global scenario, production is recovering around the globe.

- According to the OICA data, global automotive sales increased by around 5% in 2021 compared to 2020. In 2022, there was only a 1.3% decline when compared to 2021, with sales of 8,16,28,533 and 8,27,55,197 in 2022 and 2021, respectively.

- As per OICA, the global production of automotive accounted for 85.01 million units in 2022, which is an increase of 6% compared to the previous year by 80.14 million units.

- All the factors above are expected to affect the usage of polyurethane coatings in automotive applications.

China to Dominate the Market in the Asia-Pacific Region

- China is the largest market for PU materials. This strong consumer base enables it to take a key position in the global PU coatings market.

- According to the China Association of Automobile Manufacturers (CAAM) 2002 report, despite the recent decline in passenger car sales in China during the COVID-19 pandemic, total passenger car sales in the market bounced back. In 2022, the sales exceeded 23.5 million units, making it the highest figure in the past four years. It includes the potential to drive the PU coating market as it is used to protect cars from corrosion and other damage. They are also being used to improve the appearance of cars.

- In 2022, as per the National Bureau of Statistics of China, the construction industry in China generated an output of over CNY 31 trillion (USD 4.6 trillion) with an increase of 6% from the previous year, accounting for CNY 29.31 trillion (USD 4.36 trillion). It also represented an increase of almost 100 % from a decade ago, with a positive impact on the PU coating market and the growing technological trends in the construction industry to protect buildings from the elements. They are also being used to improve the energy efficiency of buildings.

- Moreover, in recent years, due to the improvement of environmental protection requirements and awareness, China's water-borne PU coatings industry developed rapidly, with the growth rate far exceeding the overall PU materials industry.

- In October 2023, according to European Coatings, researchers demonstrated the synthesis of vanillin-based UV-curable polyurethane dispersions for wood coating applications.

- Covestro in China recently completed a polyurethane dispersion facility in Shanghai to meet rising demand in the Asia Pacific region.

- Strict environmental supervision opened up a new development space for water-borne PU coatings in the country.

- All the factors above, in turn, are projected to increase the demand for polyurethane coatings in the region during the forecast period.

Polyurethane Coatings Industry Overview

The polyurethane coatings market is consolidated in nature. The major players (not in any particular order) include Akzo Nobel NV, Jotun, Axalta Coating Systems, PPG Industries Inc., and The Sherwin-Williams Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Construction Industry

- 4.1.2 Increase in Demand from the Automotive Industry

- 4.1.3 Growing Demand from the Transportation Industry

- 4.2 Restraints

- 4.2.1 Volatile Raw Material Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Technology

- 5.1.1 Powder

- 5.1.2 Solvent-borne

- 5.1.3 Water-borne

- 5.1.4 Radiation Cured

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Transportation

- 5.2.3 Construction

- 5.2.4 Electrical and Electronics

- 5.2.5 Wood and Furniture

- 5.2.6 Others End-user Industries (Aerospace, Industrial, and Textile)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Asian Paints

- 6.4.3 Axalta Coating Systems

- 6.4.4 BASF SE

- 6.4.5 IVM Chemicals SRL

- 6.4.6 Jotun

- 6.4.7 Polycoat Products

- 6.4.8 PPG Industries Inc.

- 6.4.9 RPM International Inc.

- 6.4.10 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 New applications for PU coatings in Aerospace and Medical Industries

- 7.2 Development in Integration of Nanotechnology and PU coatings