|

市场调查报告书

商品编码

1519917

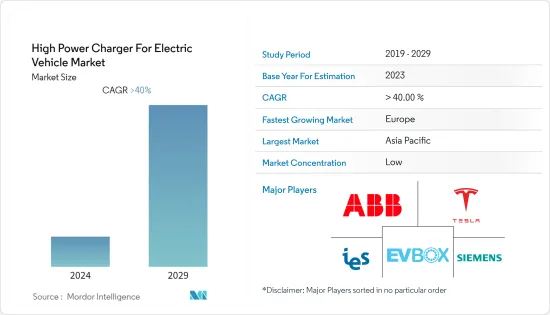

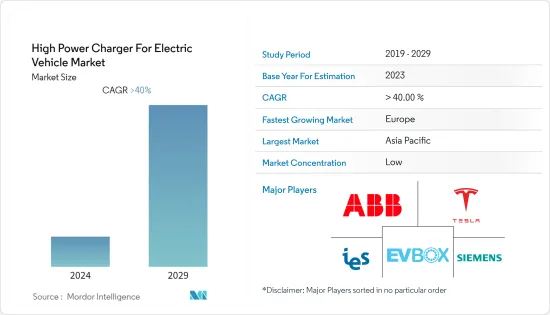

全球电动汽车高功率充电器市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)High Power Charger For Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计2024年全球电动车高功率充电器市场规模将达223.6亿美元,2024-2029年复合年增长率将超过33.30%,2029年将达到941.3亿美元。

纯电动车 (BEV) 和插电混合动力电动车 (PHEV) 销量的增加以及动力传动系统成本的降低推动了电动车高功率充电器的发展。世界各国政府制定了各种制度和政策来鼓励采用电动车而不是传统汽车。

到2022年,全球电动车销量将超过1,000万辆。这一势头预计将持续到 2023 年,销量将再增长 35%,达到约 1,400 万台。

到2030年,电动车预计将占全球整体汽车销量的40%以上,达到约4,000万辆。

此外,主要的不可可再生能源公司正在多样化其投资组合,以应对日益增长的汽车电气化趋势,他们的投资和收购活动预计将在未来几年推动市场成长。

电动车的日益普及和销售、各国政府为促进电动车的采用而实施的越来越严格的安全标准以及采用高功率能力(高功率技术)製造的电动汽车的先进技术的引进将继续增加预计未来几年这将导致电动车高功率充电器市场的成长。

快速充电器製造中透过云端运算平台控制的RFID技术部署电子付款方式等技术进步可能为市场提供未来的成长机会。

电动汽车高功率充电器市场趋势

50-150kW功率类型占市场主导地位

在电动车高功率充电机市场中,50-150kW充电机类别已成为主导细分市场。该细分市场非常适合不同地区的大多数电动车景观,因为它在充电速度和基础设施要求之间提供了平衡,使其成为当前电动车部署的理想选择。这些充电器是中国和印度等经济体最合适的选择。

电池技术和充电基础设施的技术进步使电动车的充电速度更快、更有效率。 50 至 150 kW 的功率版本处于这项技术进步的最前沿。

此外,政府和私人公司正在对电动车充电基础设施进行大量投资,特别是在 50-150kW 范围内。这项投资将加速该功率范围内高功率充电器的推出,使电动车驾驶员更容易使用它们。

在印度,政府根据 FAME 印度计划第二阶段批准了 800 亿印度卢比的巨额资金。该拨款专门针对印度石油公司 (IOCL)、巴拉特石油公司 (BPCL) 和印度斯坦石油公司 (HPCL) 等石油行销公司 (OMC),在全国建立 7,432 个公共快速充电站。

亚太地区引领市场

由于电动车市场的快速成长、政府支持、技术进步以及主要企业不断增加的研发投资等因素,亚太地区在高功率电动车充电器市场上处于领先地位。中国是全球最大的电动车市场,日本、韩国、印度等其他亚太国家对电动车的需求也快速成长。对电动车日益增长的需求推动了对能够快速且有效率地为电动车充电的高功率充电器的需求。

中国对电动和混合动力汽车製造商实施了配额,要求其占新车销量的比例至少为 10%。此外,为了鼓励民众转换电动车,北市每月只发放1万张内燃机汽车登记许可证。

中国政府鼓励使用电动车。该国已经宣布计划逐步淘汰拖拉机和施工机械中使用的柴油。其目的是到 2040 年禁止所有柴油和汽油汽车。

此外,中国政府正在鼓励使用电动车。该国已经宣布计划逐步淘汰拖拉机和施工机械中使用的柴油。该国计划在2040年完全淘汰柴油和汽油汽车。

此外,亚太地区的公司正在建立策略合作伙伴关係,以扩大其影响力和能力。各大公司也在研发方面投入巨资,开发先进的电动车充电技术。

2023年8月,宁德时代宣布推出新型超快速充磷酸铁锂电池「深行」。新星发热量低,采用全新先进的电池管理系统(BMS),相容于所有车款。

电动汽车高功率充电机产业概况

电动车高功率充电器市场集中度中等,参与者较少,没有明显的赢家。市场主要企业包括ABB Ltd、Ev-Box BV、IES Synergy、Garo AB、XCharge Inc.、Tesla Inc.等,占了30%以上的市占率。

每家公司正在采取的各种措施都有助于提高其在市场上的影响力。例如

2023 年 9 月,日立工业产品公司宣布推出高容量多埠电动车充电器(250kW 和 500kW)。透过增加可同时充电的设备数量,这将缩短充电时间并消除充电拥塞。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 扩大电动车销售推动市场成长

- 市场限制因素

- 缺乏适当的充电基础设施是一个问题

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 输出类型

- 50 kW 至 150 kW 以下

- 150 kW~350 kW

- 350度以上

- 车辆类型

- 客车

- 商用车

- 连接器类型

- CHAdeMO

- SAE 组合充电系统

- 增压器

- GB/T

- 目的

- 公共

- 私人的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Royal Dutch Shell PLC(Acquired NewMotion)

- ABB Ltd

- XCharge Inc.

- Total SA(Acquired G2Mobility)

- Fastned BV

- IES Synergy

- EVgo Services LLC

- EVBOX

- Siemens AG

- Allego BV

- Phoenix Contact

- Tesla Inc.

- Garo AB

- ENSTO INDIA PRIVATE LIMITED

第七章 市场机会及未来趋势

- 政府加大支持和奖励提供成长机会

The High Power Charger For Electric Vehicle Market size is estimated at USD 22.36 billion in 2024, and is expected to reach USD 94.13 billion by 2029, growing at a CAGR of greater than 33.30% during the forecast period (2024-2029).

The high power charger for the electric vehicle market is being driven by increased sales of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), along with lower costs of powertrain components. Governments worldwide are launching various schemes and policies to encourage the adoption of EVs over conventional vehicles.

* More than 10 million electric cars were sold worldwide in 2022. The momentum was expected to continue into 2023, with sales projected to grow by another 35%, reaching approximately 14 million vehicles.

* Globally, EVs are expected to represent over 40% of auto sales in 2030, equating to around 40 million vehicles.

In addition, investments and acquisition activities of non-renewable energy giants that are diversifying their portfolios to meet the escalating vehicle electrification trend are likely to drive the market's growth in the coming years.

The growth in terms of adoption and sales of electric vehicles, increasing stringent safety norms promoting the adoption of electric vehicles by the government, and the introduction of advanced technology (high-power technology) for electric vehicles manufactured with high-power capabilities are expected to lead to a growth in the high-power charger for electric vehicles market in the coming years.

Technological advancements, such as the deployment of electronic payment methods through RFID technology, controlled by a cloud-computing platform in fast charger manufacturing, shall provide future growth opportunities for the market.

EV High Power Charger Market Trends

50-150 kW Power Type Segment is Dominating the Market

The 50-150 kW charger category is emerging as the dominant segment in the high-power charger for EV market. The segment is best suited for most of the EV landscape in different regions, offering a balance between charging speed and infrastructure requirements, making them ideal for the present EV adoption. These chargers are the most suitable option for economies like China and India.

Technological advancements in battery technology and charging infrastructure are making it possible to charge EVs faster and more efficiently. The 50-150 kW power type segment is at the forefront of this technological advancement.

Further, governments and private companies are investing heavily in EV charging infrastructure, particularly in the 50-150 kW power type segment. This investment is driving the deployment of high-power chargers in this power range, making them more accessible to EV drivers.

* In India, the government has sanctioned a substantial amount of INR 800 crores under the FAME India Scheme Phase II. This allocation is specifically directed towards the PSU Oil Marketing Companies (OMC) - namely Indian Oil (IOCL), Bharat Petroleum (BPCL), and Hindustan Petroleum (HPCL) - to facilitate the establishment of 7,432 public fast charging stations across the nation.

Asia Pacific is Leading The Market Concerned

Asia-Pacific is leading the market for high-power EV (Electric Vehicle) chargers driven by factors such as the rapid growth of the EV market, government support, technological advancements, and growing investment in R&D by key players. China is the world's largest market for electric vehicles, and the demand for EVs is growing rapidly in other countries in the Asia Pacific region, such as Japan, South Korea, and India. This growing demand for EVs is driving the need for high-power chargers that can charge EVs quickly and efficiently. For instance,

* China has imposed a quota on manufacturers of electric or hybrid vehicles, which must represent at least 10% of total new sales. Also, the city of Beijing only issues 10,000 permits for the registration of combustion engine vehicles per month to encourage its inhabitants to switch to electric vehicles.

The Chinese government is encouraging people to use electric vehicles. The country has already announced plans to phase out diesel fuel used in tractors and construction equipment. By 2040, the country intends to outlaw all diesel and gasoline vehicles.

Moreover, the Chinese government is encouraging people to use electric vehicles. The country has already announced plans to phase out diesel fuel used in tractors and construction equipment. By 2040, the country intends to outlaw all diesel and gasoline vehicles.

Further, companies in Asia-Pacific are forming strategic partnerships to expand their reach and capabilities. Key players are also investing heavily in R&D to develop advanced EV charging technologies.

* In August 2023, CATL unveiled its new ultra-fast charging LFP battery called Shenxing, which will be made commercially available in the first quarter of 2024. Shenxing has reduced heat generation and is equipped with a new advanced battery management system (BMS), making it fit for any vehicle type.

High Power Charger For Electric Vehicle Industry Overview

The high-power charger for electric vehicles market is moderately concentrated, with few players having no clear winner in the market. Key players in the market include ABB Ltd, Ev-Box BV, IES Synergy, Garo AB, XCharge Inc., and Tesla Inc., which constitute over 30% of the market.

Various initiatives done by companies have led them to strengthen their presence in the market. For example,

* In September 2023, Hitachi Industrial Products announced the launch of a high-capacity multi-port EV charger (250 kW and 500 kW). This will enable to shorten the charging time and eliminate charging congestion by increasing the number of vehicles to be charged simultaneously.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing EV Sales is Driving the Market Growth

- 4.2 Market Restraints

- 4.2.1 Lack of Proper Charging Infrastructure is a Chgallenge

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Power Output Type

- 5.1.1 50 kW - Less than 150 kW

- 5.1.2 150 kW - 350 kW

- 5.1.3 350 kW and Above

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Connector Type

- 5.3.1 CHAdeMO

- 5.3.2 SAE Combo Charging System

- 5.3.3 Supercharger

- 5.3.4 GB/T

- 5.4 Application

- 5.4.1 Public

- 5.4.2 Private

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Netherlands

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Royal Dutch Shell PLC (Acquired NewMotion)

- 6.2.2 ABB Ltd

- 6.2.3 XCharge Inc.

- 6.2.4 Total SA(Acquired G2Mobility)

- 6.2.5 Fastned BV

- 6.2.6 IES Synergy

- 6.2.7 EVgo Services LLC

- 6.2.8 EVBOX

- 6.2.9 Siemens AG

- 6.2.10 Allego BV

- 6.2.11 Phoenix Contact

- 6.2.12 Tesla Inc.

- 6.2.13 Garo AB

- 6.2.14 ENSTO INDIA PRIVATE LIMITED

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Government Support and Incentives Offer Growth Opportunities