|

市场调查报告书

商品编码

1519918

六氟化硫的全球市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Sulfur Hexafluoride - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

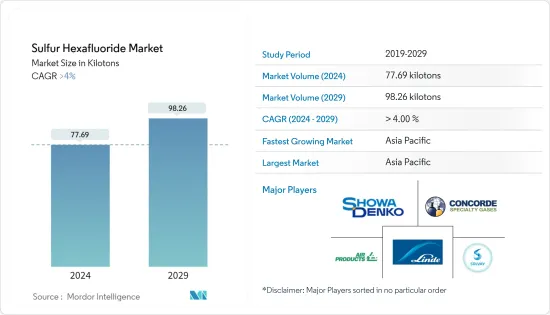

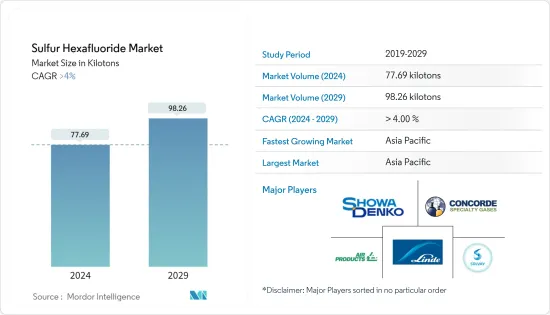

预计2024年全球六氟化硫市场规模将达77.69千吨,2024年至2029年复合年增长率超过4%,2029年将达到98.26千吨。

由于电力需求大幅减少,六氟化硫市场受到COVID-19大流行的影响。世界各国政府被迫减少商业活动,以尽量减少 COVID-19 的影响。新冠疫情大流行改变了全球的生活方式,人们主要留在家里并在家工作。结果,住宅负荷需求大幅增加,而商业和工业负荷大幅下降。然而,由于新冠疫情后供应过剩,能源市场目前处于历史低点,预计将影响六氟化硫市场的需求。

主要亮点

- 新兴国家对电力需求的增加以及医疗领域应用的扩大预计将推动六氟化硫市场的发展。

- 对六氟化硫的严格环境法规预计将阻碍市场成长。

- 新兴市场采用高压直流(HVDC)输电预计将在预测期内为市场创造机会。

- 预计亚太地区将主导市场。此外,电力、能源和电子最终用户产业对六氟化硫的需求不断增长,预计在预测期内复合年增长率最高。

六氟化硫市场趋势

电力与能源应用领域占市场主导地位

- 六氟化硫具有独特的介电性能。因此在电力系统中用于输配电中的电流中断、电压电气绝缘、灭弧等。

- 六氟化硫适合在 33kV 至 800kV 范围内运行,是断路器中理想的电介质。六氟化硫可用于製造大量不同工作条件和范围的电器产品。

- 各国人口成长和用电量增加预计将增加电力消耗并推动输电线路中使用的六氟化硫的需求。根据Enerdata的数据,2022年全球电力消耗量25,530太瓦时(上一年为25,343太瓦时),成长率为2%。

- 北美地区的电力消耗正在增加,这正在推动当前的研究市场。在美国,照明、暖气、冷气、冷气和其他用途的电力需求不断增加。 IEA预计,2022年总电力消耗量将增加至4.5兆千瓦时,较2021年成长2.6%。因此,电力消耗的增加将进一步推升输电线路需求,带动六氟化硫市场。

- 一些国家采用高压直流输电可能会进一步增加对六氟化硫的需求,因为它有助于製造高压输电系统和设备。例如,根据中央电力局(CEA)的数据,2022-2023年印度电力消耗量将达到15,036.5亿度,与前一年同期比较增9.5%,主要得益于经济活动的增加。

- 因此,电力和能源应用领域预计将在预测期内主导六氟化硫市场。

亚太地区主导市场

- 由于电力和能源、电子、金属製造和医疗应用的需求增加,亚太地区对六氟化硫的需求正在增加。中国、日本和印度等国家对六氟化硫的需求正在增加。

- 在中国,经济成长和快速都市化正在增加用电量。据中国最大的国有电力公司-国家电网公司(SGCC)称,2030年中国的能源需求预计将超过10拍瓦时(PWh)。因此,能源需求的增加将进一步增加国家的电力传输需求,带动六氟化硫市场。

- 中国是该地区最大的电子市场之一。根据中国国家统计局的数据,2023 年 4 月,中国电力和家用电子电器零售额达到近 610 亿元(85.2 亿美元)。因此,消费电子产业的成长预计将增加该国对六氟化硫的需求。

- 根据电力部和中央电力管理局(CEA)的报告,2022财年发电总装置容量为1624亿千瓦,较上年的1491亿千瓦装置成长8.7%单位。因此,发电容量的增加将有利于输电线路的安装,带动六氟化硫市场。

- 印度的电子市场正在成长。在2023年联邦预算中,政府向电子与资讯科技部拨款20亿美元。此外,印度电子製造业预计到2025年将达到5,200亿美元。电子产品的需求预计将从 2020 财年的 330 亿美元增至 2025 财年的 4,000 亿美元。因此,电子产业的成长预计将推动该国的六氟化硫需求。

- 同样,2022 年日本电子产业的国内产量预计为 851.9 亿美元(11.1243 兆日圆),较 2021 年成长 2%。因此,电子产业的成长预计将推动该国对六氟化硫的需求。

- 由于这些因素,该地区的六氟化硫市场预计在预测期内将成长。

六氟化硫产业概况

六氟化硫市场部分分散。市场的主要参与者包括 SHOWA DENKO KK、Solvay、Air Products Inc.、Concorde Specialty Gases, Inc. 和 Linde Plc。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 新兴国家电力需求不断成长

- 扩大在医疗领域的应用

- 其他司机

- 抑制因素

- 严格的环境法规

- 其他限制因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:基于数量)

- 产品类别

- 电子/技术级

- 超高纯度等级

- 目的

- 电力/能源

- 电子产品

- 金属製造

- 医疗保健

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Advanced Specialty Gases

- AIR LIQUIDE

- Air Products and Chemicals, Inc

- Concorde Specialty Gases, Inc

- Fujian Yongjing Technology Co., Ltd

- Honeywell International Inc.

- Kanto Denka Kogyo Co., Ltd

- Linde plc

- MATHESON TRI-GAS INC

- SHOWA DENKO KK

- Solvay

第七章 市场机会及未来趋势

- 开发中国家采用高压直流(HVDC)输电

- 其他机会

The Sulfur Hexafluoride Market size is estimated at 77.69 kilotons in 2024, and is expected to reach 98.26 kilotons by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

The Sulfur Hexafluoride market was affected by the COVID-19 pandemic as the electricity demand has been reduced significantly. Governments around the globe were compelled to reduce business activity in response to minimize the impact of coronavirus. The COVID pandemic changed lifestyles globally as people mainly stayed at home and worked from home. Hence, there is a significant increase in residential load demand while there is a substantial decrease in commercial and industrial loads. However, post-COVID pandemic in recent years with surplus supplies, the energy market is presently at a historic low, which is expected to affect the demand for the sulfur hexafluoride market.

Key Highlights

- The growing demand for electricity in developing countries and the increasing applications in the medical sector are expected to drive the market for sulfur hexafluoride.

- The stringent environmental regulations against sulfur hexafluoride are expected to hinder the market's growth.

- The adoption of high-voltage direct current (HVDC) transmission in developing nations is expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period due to the rising demand for sulfur hexafluoride in the power, energy, and electronics end-user industries.

Sulfur Hexafluoride Market Trends

Power and Energy Application Segment to Dominate The Market

- Sulfur Hexafluoride offers unique dielectric properties. Thus, it is used in electric power systems for current interruption, voltage electrical insulation, and arc quenching in the transmission and distribution of electricity.

- Sulfur hexafluoride is suitable for operating in a range of 33 kV to 800 kV, which makes it an ideal dielectric medium for circuit breakers. A large number of appliances with varied operating conditions and operating ranges can be made with the help of sulfur hexafluoride.

- The rising population and increasing usage of electricity across various countries are expected to increase the consumption of electricity, thereby driving the demand for Sulfur hexafluoride used in power transmission lines. According to Enerdata, the global electricity consumption reached 25530 Tetrawatt-hours in 2022, as compared to 25343 Tetrawatt-hours electricity consumed in the previous year at a growth rate of 2%.

- In the North American region, electricity consumption is increasing, thereby driving the current studied market. In the United States, the demand for electricity is increasing from lighting, heating, cooling, refrigeration, and other applications. According to IEA, in 2022, total electricity consumption will increase to 4.05 trillion kWh at a growth rate of 2.6% compared to 2021. Thus, the rising electricity consumption will further drive the demand for power transmission lines, thereby driving the market for Sulfur hexafluoride.

- The adoption of HVDC transmission in some countries can further increase the demand for sulfur hexafluoride, as it is helpful in manufacturing high-voltage transmission systems and equipment. For instance, according to the Central Electricity Authority (CEA), electricity consumption in India increased by 9.5% to 1503.65 billion units year-on-year in 2022-2023, mainly due to increasing economic activities.

- Thus, the power and energy application segment will dominate the market for Sulfur hexafluoride during the forecast period.

Asia-Pacific Region to Dominate the Market

- The demand for sulfur hexafluoride is increasing in the Asia-Pacific region due to rising demand from power and energy, electronics, metal manufacturing, and medical applications. The demand for sulfur hexafluoride is increasing in countries such as China, Japan, and India.

- In China, the usage of electricity is increasing due to the growth of the economy and rapid urbanization. According to the State Grid Corporation of China (SGCC), the largest of China's two state-owned utility corporations, China's energy demand in 2030 is expected to exceed 10 Petawatt hours (PWh). Thus, the increasing demand for energy will further increase the power transmission demand in the country, thereby driving the market for sulfur hexafluoride.

- China is one of the largest electronics markets in the region. According to the National Bureau of Statistics of China, retail sales of household appliances and consumer electronics in China amounted to almost CNY 61 billion (USD 8.52 billion) in April 2023. Thus, the growth of the consumer electronics segment is expected to increase the demand for sulfur hexafluoride in the country.

- As per the reports by the Ministry of Power and the Central Electricity Authority (CEA), in FY 2022, the total installed generation capacity registered at 1624 billion units, at a growth rate of 8.7% as compared to the installed power generation capacity of 1491 billion units in the previous year. Thus, the increasing power generation capacity will drive the installation of more power transmission lines, thereby driving the market for sulfur hexafluoride.

- The electronics market is growing in India. In the union budget FY 2023, the government allocated USD 2 billion for the Ministry of Electronics and Information Technology. Furthurmore, the Indian electronics manufacturing industry is projected to reach USD 520 billion by 2025. The demand for electronic products is expected to rise to USD 400 billion by 2025 from USD 33 billion in FY 2020. Thus, the growth in the electronics industry is expected to drive the demand for sulfur hexafluoride in the country.

- Similarly, in 2022, the domestic production by the Japanese electronics industry is estimated at USD 85.19 billion (JPY 11,124.3 billion) in 2022, witnessing a growth rate of 2% as compared to 2021. Thus, the growth in the electronics industry is expected to drive the demand for sulfur hexafluoride in the country.

- Due to all such factors, the market for sulfur hexafluoride in the region is expected to grow during the forecast period.

Sulfur Hexafluoride Industry Overview

The sulfur hexafluoride market is partially fragmented in nature. Some of the major players in the market include (not in any particular order) SHOWA DENKO K.K., Solvay, Air Products Inc., Concorde Specialty Gases, Inc., and Linde Plc, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Electricity in Developing Countries

- 4.1.2 Increasing Application in Medical Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Electronic/Technical Grade

- 5.1.2 Ultra-high Purity Grade

- 5.2 Application

- 5.2.1 Power and Energy

- 5.2.2 Electronics

- 5.2.3 Metal Manufacturing

- 5.2.4 Medical

- 5.2.5 Other Applications (Window Insulation, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Advanced Specialty Gases

- 6.4.2 AIR LIQUIDE

- 6.4.3 Air Products and Chemicals, Inc

- 6.4.4 Concorde Specialty Gases, Inc

- 6.4.5 Fujian Yongjing Technology Co., Ltd

- 6.4.6 Honeywell International Inc.

- 6.4.7 Kanto Denka Kogyo Co., Ltd

- 6.4.8 Linde plc

- 6.4.9 MATHESON TRI-GAS INC

- 6.4.10 SHOWA DENKO K.K.

- 6.4.11 Solvay

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of High-voltage direct current (HVDC) Transmission in Developing Nations

- 7.2 Other Opportunities