|

市场调查报告书

商品编码

1519929

虚拟感测器的全球市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Virtual Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

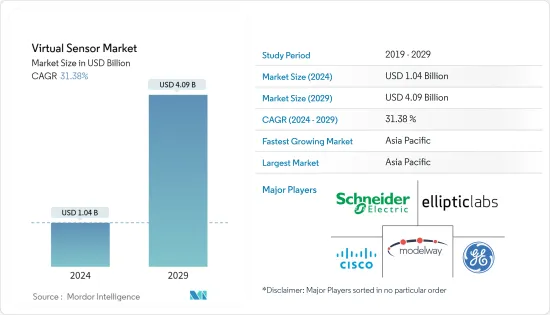

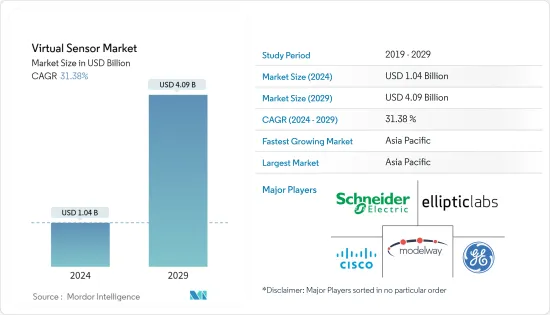

预计2024年全球虚拟感测器市场规模将达10.4亿美元,2024-2029年预测期间复合年增长率为31.38%,2029年将达到40.9亿美元。

虚拟感测器市场具有显着扩大的潜力,并将成为许多与实体感测器相关的未来应用的关键组成部分。这些感测器的日益普及主要是因为它们为各个行业带来了好处。

主要亮点

- 虚拟感测器也称为软感测器,是使用物理感测器的多个输出读数的数学模型开发的基于软体的解决方案。透过引入这种虚拟感测器可以克服实体感测器的限制。单一虚拟感测器可以预测各种参数,例如速度、温度、位置、压力等。

- 其结果是物联网、云端、安全、分析、流程工业、石油和天然气、运输、汽车、消费性电子、医疗保健、国防和航太等产业的成本效益和应用。感测器和控制行业的进步将推动虚拟感测器市场的成长。

- 领先的製造商正在采用云端基础的虚拟感测解决方案作为他们的标准平台。在云端平台上实施虚拟感测器有几个优点,例如增强用户和感测器云端伺服器之间的资料连接。

- 此外,这些解决方案还有助于高效的交通监控、准确的天气预报、改进的军事行动和增强的医疗服务。该云端平台还允许最终用户降低总体拥有成本并扩展其资料储存能力。

- 在製造业中,对具有成本效益的解决方案和提高业务效率的需求不断增长,这推动了行业中最尖端科技的采用。为了保持竞争力并降低生产成本,各种规模的製造公司都不断致力于发现和应用新策略。透过优化成本结构,您可以避免将大部分市场输给盈利更高的竞争对手,或者在最坏的情况下,避免被淘汰。公司一直在寻找创造性的方法来减少开支而不牺牲生产力或效率。

- 此外,随着数位转型的兴起,各组织对云端运算的需求呈现爆炸性成长。与本地部署相比,云端提供了广泛的优势,这推动了云端服务的采用。自成立以来一直基于云端的小型企业和新兴企业的激增正在影响对云端运算技能的需求。

虚拟感测器市场趋势

交通运输和汽车行业作为最终用户的快速成长

- 数位双胞胎技术在交通运输行业中的日益普及预计将推动对虚拟感测器的需求。数位双胞胎已成为交通领域的最新技术现象。将数位双胞胎引入供应链正在提高本地和全球范围内供应链网路的效率。资料使运输公司能够准确预测其营运。这项创新技术也产生了宝贵的见解,以增强企业策略。

- 虚拟感测器由于其多功能性而对汽车行业变得越来越重要。虚拟感测器在行业中的日益普及预计将在预测期内获得市场的关注。在昂贵的感测器不断膨胀的背景下,虚拟感测器的采用得到了广泛的应用。

- 虚拟感测器涉及用车辆电控系统中嵌入的软体替换实体感测器。其目的是无需物理组件即可获取必要的资讯。许多车辆零件,包括轮胎、引擎和驾驶室,都配备了这些虚拟感测器。虚拟感测广泛应用于汽车应用,例如乘客热舒适度、轮胎压力监测系统、动力传动系统应用和弹簧品质状况估计。

- 汽车产业严重依赖感测技术来实现安全、娱乐、交通管理、导航和引导等各种功能。随着我们向自动驾驶汽车迈进,感测设备的使用预计将会扩大。虽然车辆中的实体感测器可能高成本且不可靠,但虚拟感测器正在成为汽车製造商的一种经济高效的解决方案。这些虚拟感测器可作为实体感测器的辅助安全措施,在增强驾驶员辅助系统 (ADAS) 并最终实现自动驾驶功能方面发挥关键作用。

- 汽车产业对 ADAS 功能的需求不断增长预计将推动该细分市场的成长。世界各国政府已采取各种措施来促进 ADAS 技术的采用,以确保车辆安全。此外,自动驾驶和自动驾驶汽车的成长趋势也有助于扩大市场。例如,英特尔预测,到 2030 年,全球汽车销售将超过 1.014 亿辆,其中自动驾驶汽车约占同年汽车註册量的 12%。

- 此外,人工智慧(AI)已在包括汽车行业在内的各个行业中变得至关重要。该领域的一项关键创新是 ADAS(高级驾驶员辅助系统)的创建,旨在提高车辆安全性并在各种驾驶情况下为驾驶员提供协助。 ADAS 技术具有减少事故和促进道路安全的潜力,因此德国、中国和印度等国家越来越多地采用该技术。这些驱动 ASAD 技术的因素可能会在市场上创造重大机会。

亚太地区预计将经历显着成长

- 虚拟感测器对于促进智慧型装置的操作和自动化非常重要。虚拟感测器透过增强互联设备和物联网系统的能力和功能,对于推动物联网 (IoT) 需求至关重要。

- 在中国,人工智慧(AI)和物联网(IoT)的持续技术进步和投资正在推动所研究市场的需求。 《中国製造2025》等政府措施重点关注物联网等高科技产业的发展。政府的支持正在加速物联网研究和创新,使其在多个经济领域中得到采用。

- 组织可以在云端基础架构上部署虚拟感测器,无需专用的硬体或实体安装,从而减少部署时间和营运成本。由于从本地到云端基础的持续迁移以及对特定于云端的系统的需求不断增加,日本的云端采用率正在显着增长。例如,2024 年1 月,亚马逊网路服务宣布,到2027 年将在东京和大阪现有的云端基础设施上投资2.26 兆日圆(152.4 亿美元),以满足日本客户对云端服务日益增长的需求。根据 AWS 日本经济影响研究 (EIS),这项投资预计将为日本 GDP 增加 5.57 兆日圆(376 亿美元)。

- 汽车产业严重依赖感测技术来执行各种安全相关任务、交通管理、导航和指导。虚拟感测器进一步保护实体感测器,并在 ADAS(高级驾驶员辅助系统)以及最终自动驾驶汽车的开发中发挥关键作用。

- 印度汽车产业一直是经济表现的可靠指标,因为它在经济成长和技术进步中发挥关键作用。 ADAS(高级驾驶员辅助系统)透过预防或最大程度地减少潜在事故的影响来提高车辆安全性,在印度汽车市场中越来越重要。当今市场对 ADAS 等先进安全功能的需求至关重要。例如,2024 年 1 月,Mobileye Global Inc. 将为 Mahindra & Mahindra Ltd. 的下一代车辆提供先进的驾驶辅助技术,以扩大其在印度汽车行业的影响力。

- 虚拟感测器透过增强导航能力、飞机健康监测和自主系统来推动航太和国防领域的需求。此外,对航太和国防领域智慧工厂的投资透过实现品管、预测性维护和供应链集成,正在推动对虚拟感测器的需求。例如,2024年2月,GE航空航太公司宣布将投资1,500万新元(1,100万美元)将其位于新加坡的飞机引擎维修设施升级为创新型智慧工厂。

虚拟感测器产业概述

虚拟感测器产业既有大型国际公司,也有小型公司,导致市场高度分散。该领域的主要企业包括施耐德电气 SE、Elliptic Labs ASA、Modelway SRL、思科系统公司和通用电气公司。这些公司采取建立合作伙伴关係和收购等策略来扩大其产品范围并在市场上获得竞争优势。

- 2024 年 3 月 - Elliptic Labs 宣布在 Vivo 智慧型手机 V30 上搭载 AIAVirtual 接近感测器 INNER BEAUTY,目前已部署在超过 5 亿台装置上。

- 2024 年 1 月 - IntelliDynamics 宣布东欧天然气生产商重新为其 Intellict 系统提供支援和维护。 IntelliDynamics 提供虚拟称重和抗水合物估算。该系统即时传达您生产的气体、冷凝油和水的数量,并计算在生产线和中央处理中的多个点注入的甲醇/乙醇水合物抑製剂的量,以防止系统结冰。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- 关键绩效指标

- 虚拟感测器使用案例分析

- 官方与客製化解决方案

- 价格分析

- 产业吸引力-波特五力分析

第四章市场动态

- 市场驱动因素

- 物联网和云端平台的采用增加预计将推动市场发展

- 製造业对提高成本效益和业务效率的需求日益增长

- 市场挑战

- 缺乏熟练的人力资源和技术知识

- 资料安全和隐私问题

第五章市场区隔

- 按安装类型

- 云

- 本地

- 按最终用户产业

- 油和气

- 製造业

- 交通/汽车

- 金属/矿业

- 航太/国防

- 电子/消费性技术

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 亚洲

- 中国

- 日本

- 印度

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 世界排名分析

- 公司简介

- Schneider Electric SE

- Elliptic Labs ASA

- Modelway SRL

- Cisco Systems Inc.

- General Electric Company

- Siemens AG

- Korber AG

- Intelli Dynamics(Biocomp Systems, Inc.)

- Andata Ltd

第 7 章 进入市场 (GTM) 策略

- 市场区隔与目标受众

- 价值提案

- 分销通路策略

- 竞争格局

- 回应市场问题

- 结论/建议

第八章市场展望

The Virtual Sensor Market size is estimated at USD 1.04 billion in 2024, and is expected to reach USD 4.09 billion by 2029, growing at a CAGR of 31.38% during the forecast period (2024-2029).

The virtual sensors market has the potential to expand significantly and become a key component in numerous future applications related to physical sensors. The growing adoption of these sensors is primarily driven by the benefits they offer to various industries.

Key Highlights

- Virtual sensors, also known as soft sensors, are software-based solutions developed using a mathematical model of multiple output readings from physical sensors. The limitations of physical sensors can be overcome by deploying these virtual sensors. A single virtual sensor can predict various parameters such as speed, temperature, position, and pressure.

- As a result, they offer cost benefits and find applications in industries such as IoT, Cloud, security, analytics, process industry, oil & Gas, transportation, automotive, consumer electronics, healthcare, and defense & aerospace. Advancements in the sensor and control industry will drive the growth of the virtual sensor market.

- Leading manufacturers are adopting a cloud-based virtual sensing solution as a standard platform. Implementing virtual sensors on a cloud platform offers several benefits, such as enhancing data connectivity between users and the sensor-cloud server.

- Moreover, these solutions facilitate efficient transportation monitoring, accurate weather forecasting, improved military activities, and enhanced healthcare services. The cloud platform also enables end-users to reduce overall ownership costs and expand data storage capabilities, consequently contributing to the growth of the virtual sensor market.

- The increasing demand for cost-efficient solutions and improved operational efficiency in the manufacturing sector fuels the adoption of cutting-edge technologies in the industry. To keep their competitive edge and reduce production costs, manufacturing companies of all sizes constantly focus on discovering and applying new tactics. If they optimize their cost structures, they can avoid losing a sizable portion of the market to competitors who can operate more profitably or, worse still, become obsolete. Businesses constantly seek creative ways to cut expenses without sacrificing productivity or efficiency.

- Furthermore, due to increased digital transformation, cloud computing demand has skyrocketed across organizations. The cloud offers extensive benefits over the on-premise deployment, which fuels the adoption of cloud services. The prevalence of new small-scale companies and startups based on the cloud from their inception influences the demand for cloud computing skills.

Virtual Sensors Market Trends

Transportation and Automotive Industry to be the Fastest Growing End User

- The increasing usage of digital twin technology in the transportation industry is expected to drive the demand for virtual sensors. Digital twins have emerged as the most recent technological phenomenon in the transportation sector. The implementation of digital twins in supply chains is enhancing the efficiency of supply chain networks on both local and global scales. By utilizing the data, transportation companies can accurately predict their operations. Significantly, this innovative technology also generates valuable insights to enhance corporate strategies.

- Virtual sensors are increasingly becoming crucial for the automotive industry due to their wide variety of applications. The growing adoption of virtual sensors in the industry will enable the market to gain traction over the forecast period. Amidst this costly sensory inflation, adopting virtual sensors has become prevalent.

- Virtual sensors entail replacing a physical sensor with software embedded in the vehicle's electronic control unit. The objective is to acquire essential information without needing a physical component. Numerous vehicle parts, including tires, engines, and cabins, are embedded with these virtual sensors. Virtual sensing is widely employed in automotive applications, such as passenger thermal comfort, tire pressure monitoring systems, powertrain applications, estimation of sprung mass state, and others.

- The automotive sector depends significantly on sensing technology for various functions such as safety, entertainment, traffic management, navigation, and guidance. With the advancement towards autonomous vehicles, sensing device usage is expected to grow. Despite the high cost and occasional unreliability of physical sensors in vehicles, virtual sensors are emerging as a cost-effective solution for car makers. These virtual sensors serve as a secondary safety measure to physical sensors and play a crucial role in enhancing driver assistance systems (ADAS) and ultimately achieving autonomous driving capabilities.

- The growing demand for ADAS features in the automotive industry is expected to drive the segment's growth. Several governments worldwide are implementing various measures to boost the adoption of ADAS technology to ensure vehicle safety. Furthermore, the increasing trend of autonomous or self-driving vehicles also plays a role in expanding the market. As an illustration, Intel predicts worldwide car sales will exceed 101.4 million units by 2030, with autonomous vehicles projected to make up approximately 12% of car registrations by the same year.

- Furthermore, Artificial Intelligence (AI) has become vital in various industries, including the automotive sector. A significant innovation in this field is the creation of advanced driver assistance systems (ADAS), which are designed to enhance vehicle safety and assist drivers in different driving situations. The adoption of ADAS technology is increasing in countries such as Germany, China, and India, as it has the potential to reduce accidents and promote road safety. Such factors in boosting ASAD technology may present significant opportunities for the market.

Asia Pacific Expected to Witness Significant Growth

- Virtual sensors are significant in facilitating the operation of smart devices and automation. Virtual sensors are crucial in driving demand for IoT (Internet of Things) by enhancing the capabilities and functionalities of connected devices and IoT systems.

- China's continuous technological progress and investments in Artificial Intelligence (AI) and IoT (Internet of Things) fuel the demand for the market studied. Government Initiatives like the "Made in China 2025" plan have placed a strong emphasis on advancing high-tech industries, such as IoT ((Internet of Things). This support from the government has accelerated the research and innovation in IoT, leading to its adoption in multiple sectors of the economy.

- Organizations can deploy virtual sensors on cloud infrastructure without needing dedicated hardware or physical installations, reducing the deployment time and operational costs. Cloud adoption in Japan is experiencing significant growth due to the continuous transition from on-premise to cloud-based systems and increasing demand for cloud-focused systems. For instance, in January 2024, Amazon Web Services announced its plans to invest JPY 2.26 trillion (USD 15.24 Billion) into its current cloud infrastructure in Tokyo and Osaka by 2027 to address the increasing customer demand for cloud services in Japan. According to the AWS Economic Impact Study (EIS) for Japan, this investment is projected to add JPY 5.57 trillion (USD 37.6 Billion) to Japan's GDP.

- The automotive sector depends hugely on sensing technology for various safety-related tasks, traffic management, navigation, and guidance. Virtual sensors offer an additional layer of protection to physical sensors and play a crucial role in advancing ADAS (Advanced driver assistance systems) and, ultimately, in creating autonomous vehicles.

- The automotive sector of India has always been a reliable gauge of economic performance, as it is a crucial player in both economic growth and technological progress. ADAS (Advanced driver assistance systems) enhances vehicle safety by preventing or minimizing the impact of potential accidents and is gaining importance in the Indian automotive market. The demand for advanced safety features like ADAS is vital in the current market. For instance, in January 2024, Mobileye Global Inc. plans to provide advanced driver assistance technology for upcoming Mahindra & Mahindra Ltd vehicles to expand its presence in India's automotive industry.

- Virtual sensors fuel demand in the aerospace and defense sector by enhancing navigation capabilities, aircraft health monitoring, and autonomous systems. Additionally, the investments in aerospace and defense smart factories drive demand for virtual sensors by enabling quality control, predictive maintenance, and supply chain integration. For instance, In February 2024, GE Aerospace declared that it would be investing SGD 15 million (USD 11 Million) to upgrade the aircraft engine repair facility in Singapore into an innovative Smart Factory aimed at modernizing engine repair practices and enhancing the advancements in technology.

Virtual Sensors Industry Overview

The virtual sensors industry is marked by a diverse mix of large international firms and smaller, medium-sized businesses, resulting in a highly fragmented market. Leading companies in this sector include Schneider Electric SE, Elliptic Labs ASA, Modelway SRL, Cisco Systems Inc., and General Electric Company. These companies are engaging in strategies like forming partnerships and pursuing acquisitions to expand their product ranges and secure a competitive edge in the market.

- March 2024 - Elliptic Labs announced that it is currently deployed in over 500 million devices and is shipping the AIAVirtual Proximity Sensor INNER BEAUTYon Vivo's V30 smartphone.

- January 2024 - IntelliDynamics announced that a gas producer in Eastern Europe has renewed its support and maintenance for its Intellect systems. IntelliDynamics will Provide virtual metering and hydrate inhibitor estimation. The system tells them in real-time how much gas, condensate, and water they are producing and calculates the amount of methanol/ethanol hydrate inhibitor to inject in multiple points in their production train and central processing to prevent their system from icing up.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Overview

- 3.1.1 Industry Attractiveness - Porter's Five Forces Analysis

- 3.1.1.1 Bargaining Power of Suppliers

- 3.1.1.2 Bargaining Power of Buyers

- 3.1.1.3 Threat of New Entrants

- 3.1.1.4 Threat of Substitute Products

- 3.1.1.5 Degree of Competition

- 3.1.2 Industry Value Chain Analysis

- 3.1.3 Key Performance Indicators

- 3.1.4 Analysis of Use Cases of Virtual Sensors

- 3.1.5 Official Vs Customized Solutions

- 3.1.6 Pricing Analysis

- 3.1.1 Industry Attractiveness - Porter's Five Forces Analysis

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Adoption of IoT and Cloud Platform Is Expected to Drive the Market

- 4.1.2 Growing Need For Enhanced Cost-effectiveness and Operational Efficiency in Manufacturing

- 4.2 Market Challenges

- 4.2.1 Lack of Skilled Manpower and Technical Knowledge

- 4.2.2 Data Security and Privacy Concerns

5 MARKET SEGMENTATION

- 5.1 By Deployment Type

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By End-user Industry

- 5.2.1 Oil and Gas

- 5.2.2 Manufacturing

- 5.2.3 Transportation and Automotive

- 5.2.4 Metal and Mining

- 5.2.5 Aerospace and Defense

- 5.2.6 Electronics and Consumer Technologies

- 5.2.7 Other End User Industries

- 5.3 By Geography***

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.3 Asia

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.4 Australia and New Zealand

- 5.3.5 Latin America

- 5.3.6 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Global Rankings Analysis

- 6.2 Company Profiles*

- 6.2.1 Schneider Electric SE

- 6.2.2 Elliptic Labs ASA

- 6.2.3 Modelway SRL

- 6.2.4 Cisco Systems Inc.

- 6.2.5 General Electric Company

- 6.2.6 Siemens AG

- 6.2.7 Korber AG

- 6.2.8 Intelli Dynamics (Biocomp Systems, Inc.)

- 6.2.9 Andata Ltd

7 GO-TO-MARKET (GTM) STRATEGY

- 7.1 Market Segmentation and Target Audience

- 7.2 Value Proposition

- 7.3 Distribution Channel Strategies

- 7.4 Competitive Landscape

- 7.5 Addressing Market Challenges

- 7.6 Conclusion and Recommendations