|

市场调查报告书

商品编码

1519937

环戊烷:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Cyclopentane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

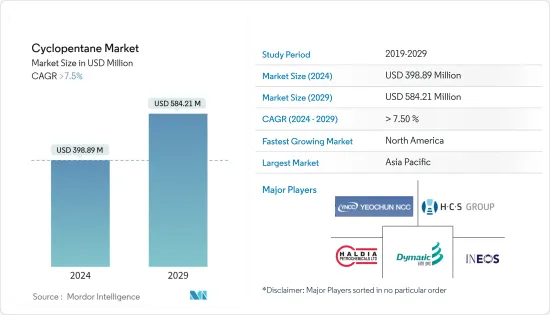

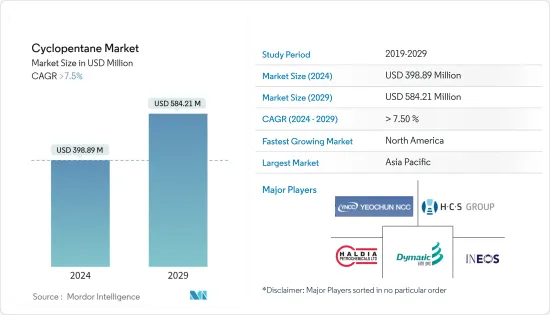

环戊烷市场规模预计将从2024年的3.9889亿美元增至2029年的5.8421亿美元,在预测期内(2024-2029年)复合年增长率超过7.5%。

COVID-19 大流行阻碍了环戊烷市场。由于多个国家的国家封锁、严格的社交距离措施以及全球供应链网路的中断,冷媒产业受到大多数生产工厂和产业关闭的严重影响。然而,限制解除后,市场却出现了显着的成长。由于环戊烷在冷冻、绝缘和化学溶剂等各种应用中的使用量不断增加,市场出现了成长。

主要亮点

- 聚氨酯製造中发泡应用对环戊烷的需求不断增加,以及冷冻应用中环戊烷的使用量不断增加,预计将推动环戊烷市场的发展。

- 另一方面,更好的替代品的可用性和与环戊烷相关的健康相关问题预计将阻碍市场成长。

- 发泡在建筑和汽车应用中的使用增加预计将在预测期内为市场创造机会。

- 由于冷冻、绝缘和化学溶剂应用对环戊烷的需求不断增加,亚太地区预计将主导市场。

环戊烷市场趋势

冷冻应用领域占据市场主导地位

- 环戊烷是由环己烷在氧化铝存在下在高温高压下分解而製得。环戊烷主要用作聚氨酯生产中的发泡,也用于冰箱、冷冻库等的生产。

- 食品和饮料行业对冰箱的需求正在增加。在稳定温度下保存食品的需求不断增长,推动了食品和饮料行业对冰箱和冷冻库的需求。

- 此外,在製药业,医院、药房、诊所和诊断中心对安全储存血液、血液衍生材料和温度敏感药物的需求不断增长,推动了医疗保健和製药行业对冷冻的需求。

- 在欧洲地区,冰箱製造商使用环戊烷作为聚氨酯泡棉隔热材料的发泡,而不是CFC(氟氯化碳)和HCFC(氟烃塑胶)。由于对 HCFC 化合物使用的严格规定,环戊烷在冷冻应用中的使用正在增加。

- 同样,亚太地区、中东和非洲以及拉丁美洲地区的政府也推出了各种政策,逐步淘汰冷冻应用中 HCFC(氟烃塑胶)的使用。这些地区的人口成长以及住宅冷冻和建筑应用需求的增加推动了对环戊烷的需求。

- 2022年,LG电子冰箱产量达到约977万台。 LG 电子冰箱在韩国、印度、墨西哥和中国製造。 LG电子冰箱产量较去年同期下降15.19%。然而,预计冰箱产量在预测期内将进一步增加,从而推动环戊烷市场。

- 因此,冷冻应用领域将在预测期内主导市场。

亚太地区主导市场

- 预计亚太地区将在预测期内主导环戊烷市场。在中国和印度等国家,由于环戊烷在家用和商用冰箱中的使用量不断增加,其需求量也不断增加。

- 中国是氟烃塑胶(HFCs)最大的生产国和消费国。由于与 HCFC 相关的环境问题,预计将逐步淘汰 HCFC。这似乎为包括环戊烷在内的非氟氯烃发泡提供了充足的机会。

- 根据中国国家统计局统计,中国家用冰箱产量为8,664万台。这与上年度8992万台的产量相比略有下降。然而,随着中国都市化的快速发展,产量预计将会增加,从而推动当前的研究市场。

- 同样,在日本,家用冰箱产量正从上年度的126万台增加到2022年的128万台,成长率为1.59%。因此,冰箱产量的增加将带动国内环戊烷市场。

- 此外,随着化学市场的扩大,对环戊烷作为化学溶剂的需求也不断增加。例如,印度化工产业多年来投资稳健,2000 年 4 月至 2022 年 12 月期间外国直接投资流入量达 209.6 亿美元。此外,政府在2023-24年联邦预算中向化学和石化部拨款2,093万美元,以促进国内化学品製造。

- 总体而言,冰箱和化学工业对环戊烷的需求不断增加可能会在预测期内推动该地区的市场。

环戊烷产业概况

环戊烷市场得到巩固。市场主要企业(排名不分先后)包括 Dymatic Chemicals, Inc、Haldia Petrochemicals Limited、HCS Group GmbH、INEOS 和 YEOCHUN NCC。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 作为生产聚氨酯发泡的需求不断增加

- 冷冻应用需求增加

- 其他司机

- 抑制因素

- 更好的替代方案的可用性

- 与环戊烷相关的健康问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔:市场规模(以金额为准)

- 功能

- 发泡/冷媒

- 溶剂/试剂

- 其他特性(橡胶黏剂、树脂等)

- 目的

- 冷冻的

- 隔热材料

- 化学溶剂

- 其他用途(个人护理、燃料添加剂等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Dymatic Chemicals, Inc

- Haldia Petrochemicals Limited

- HCS Group GmbH

- INEOS

- Liaoning Yufeng Chemical Co., Ltd.

- Meilong Cyclopentane Chemical Co.,Ltd.

- Merck KGaA

- PURECHEM.CO.KR

- SINTECO SRL

- TRECORA RESOURCES

- YEOCHUN NCC CO., LTD

第七章 市场机会及未来趋势

- 发泡在建筑和汽车应用的使用增加

- 其他机会

The Cyclopentane Market size is estimated at USD 398.89 million in 2024, and is expected to reach USD 584.21 million by 2029, growing at a CAGR of greater than 7.5% during the forecast period (2024-2029).

The COVID-19 pandemic hampered the cyclopentane market. Due to nationwide lockdowns in several countries, strict social distancing measures, and disruption in global supply chain networks, the refrigerant industry was severely hit as most of the production plants and industries were shut down. However, the market registered a significant growth rate well after the restrictions were lifted. The market registered a growth rate due to the rising usage of cyclopentane in various applications, such as refrigeration, insulation, and chemical solvents.

Key Highlights

- The growing demand for cyclopentane in blowing agent applications to manufacturing polyurethane and the increasing usage in refrigeration applications are expected to drive the market for cyclopentane.

- On the flip side, the availability of better substitute products and health-related issues associated with cyclopentane is expected to hinder the growth of the market.

- The increasing use of blowing agents in construction and automotive applications is expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market owing to the rising demand for cyclopentane from refrigeration, insulation, and chemical solvent applications.

Cyclopentane Market Trends

Refrigeration Application Segment to Dominate the Market

- The cyclopentane is formed by cracking cyclohexane in the presence of alumina at high pressure and temperature. Cyclopentane is majorly used as a foam-blowing agent in the production of polyurethane, which is further used in the manufacture of refrigerators, freezers, etc.

- The demand for refrigerators is increasing in the food and beverage sectors. The rising demand for storing food products at stable temperatures is fueling the demand for refrigerators and freezers in the food and beverage sector.

- Furthermore, in the pharmaceutical sector, the increase in the demand for safe storage of blood and blood derivatives and temperature-sensitive medicines from hospitals, pharmacies, clinics, and diagnostic centers is also propelling the demand for refrigeration in the healthcare and pharmaceutical industry.

- In the European region, refrigerator manufacturers are using cyclopentane as a blowing agent in polyurethane foam insulation in place of CFC (Chlorofluorocarbon) and HCFC (hydrochlorofluorocarbon). Due to the stringent regulations on the usage of HCFC compounds, the usage of cyclopentane is increasing in refrigeration applications.

- Similarly, in Asia Pacific, Middle-East and Africa, and Latin America regions, the governments introduced various policies to phase out the usage of HCFC (hydrochlorofluorocarbon) in refrigerator applications. The demand for cyclopentane is being driven by a growth in population and an increase in demand for residential refrigerators and building applications in these regions.

- In 2022, the production volume of refrigerators by LG Electronics amounted to around 9.77 million. LG Electronics' refrigerators were manufactured in South Korea, India, Mexico and China. The production volume of refrigerators by LG Electronics decreased by 15.19% as compared to the previous year. However, the production volume of refrigerators is further expected to increase over the forecast period, thereby driving the market for cyclopentane.

- Thus, the refrigeration application segment will dominate the market during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for cyclopentane during the forecast period. In countries like China and India, owing to increasing use in residential and commercial refrigerators, the demand for cyclopentane is increasing in the region.

- China is the largest producer & consumer of hydrochlorofluorocarbons (HFCs). It is expected to phase out HCFCs due to the environmental concerns associated with them. It will create ample opportunities for the non-HCFC foaming agents, including cyclopentane.

- According to the National Bureau of Statistics of China, the production volume of household refrigerators in China is registered at 86.64 million units. It is slightly declined as compared to 89.92 million units manufactured in the previous year. However, the production volume is expected to increase with the rapid urbanization across China, thereby driving the current studied market.

- Similarly, in Japan, the production volume of residential refrigerators increased at a growth rate of 1.59% to 1.28 million units in 2022, as compared to 1.26 million units manufactured in the previous year. Thus, the increasing production volume of refrigerators will drive the market for cyclopentane in the country.

- Furthermore, the demand for cyclopentane as a chemical solvent is increasing in the region, with an increasing chemical market. For instance, the Indian chemical sector witnessed healthy investments over the years, as evidenced by the FDI inflows that reached USD 20.96 billion between April 2000 and December 2022. Further, the government allocated USD 20.93 million to the Department of Chemicals and Petrochemicals under the Union Budget 2023-24, thereby boosting chemical manufacturing in the country.

- Overall, the increasing demand for cyclopentane from refrigerators and chemical industries is likely to drive the market in the region during the forecast period.

Cyclopentane Industry Overview

The Cyclopentane market is consolidated. Some of the major players (not in any particular order) in the market include Dymatic Chemicals, Inc., Haldia Petrochemicals Limited, HCS Group GmbH, INEOS, and YEOCHUN NCC CO., LTD, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand in Blowing Agent Application to Manufacture Polyurethane

- 4.1.2 Increasing Demand in Refrigeration Application

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Better Substitute Products

- 4.2.2 Health Related Issues Associated with Cyclopentane

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Function

- 5.1.1 Blowing Agent & Refrigerant

- 5.1.2 Solvent & Reagent

- 5.1.3 Other Functions (Rubber Adhesives, Resins, etc.)

- 5.2 Application

- 5.2.1 Refrigeration

- 5.2.2 Insulation

- 5.2.3 Chemical Solvent

- 5.2.4 Other Applications (Personal Care, Fuel Additives, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Dymatic Chemicals, Inc

- 6.4.2 Haldia Petrochemicals Limited

- 6.4.3 HCS Group GmbH

- 6.4.4 INEOS

- 6.4.5 Liaoning Yufeng Chemical Co., Ltd.

- 6.4.6 Meilong Cyclopentane Chemical Co.,Ltd.

- 6.4.7 Merck KGaA

- 6.4.8 PURECHEM.CO.KR

- 6.4.9 SINTECO S.R.L

- 6.4.10 TRECORA RESOURCES

- 6.4.11 YEOCHUN NCC CO., LTD

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of Blowing Agents in Construction and Automotive Applications

- 7.2 Other Opportunities