|

市场调查报告书

商品编码

1519944

三硝基甲苯(TNT):市场占有率分析、行业趋势和统计、成长预测(2024-2029)Trinitrotoluene (TNT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

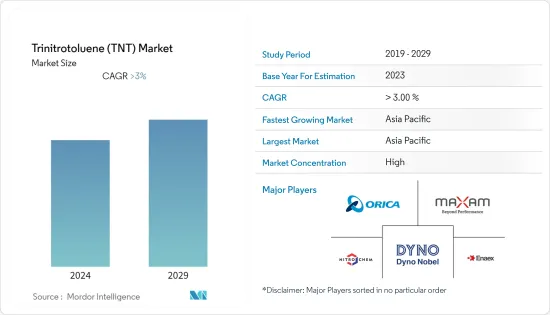

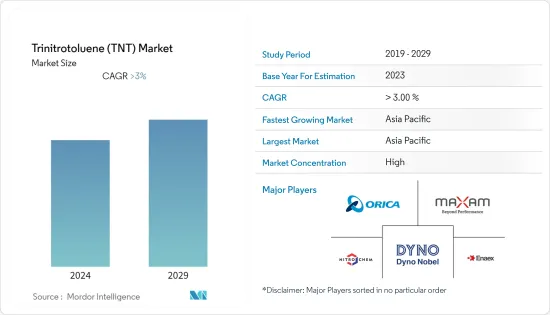

三硝基甲苯市场规模预计到2024年将达到29.11千吨,2029年达到35.80千吨,在预测期内(2024-2029年)复合年增长率超过5%。

2020 年,COVID-19 大流行导致全球多个计划延迟和暂停。这同时影响了TNT的需求,导致全球范围内的下降。然而,2021年,由于全球经济復苏的努力,TNT的需求开始復苏。

主要亮点

- 推动市场的主要因素之一是世界各国政府活性化的国防活动。

- 另一方面,对替代产品的关注预计将阻碍市场成长。

- 在页岩地层压裂中越来越多地使用炸药来提取石油和天然气,这可能会成为未来几年市场成长的机会。

- 亚太地区主导了全球市场,其中中国和印度的消费量最高。

三硝基甲苯(TNT)市场趋势

各国政府活性化国防活动

- 三硝基甲苯 (TNT) 对衝击相对敏感。由于它在没有雷管的情况下不会爆炸,因此是一种爆炸性化学品,广泛应用于世界各地的军事、采矿和建筑等各个行业。

- 世界各国政府国防活动支出的增加以及武器和弹药产业的成长可能会刺激火药和烟火产业的发展。印度、美国和中国等国也正在增加武器弹药的整体支出,以增强其军事武库。此外,技术进步和对智慧武器的需求将推动火药和烟火产业的发展。

- 根据2023财年国防授权法案,美国政府向国防部拨款8,167亿美元。空军部提案2023年预算请求为1,940亿美元,比2022年预算请求增加202亿美元(11.7%)。

- 中国政府2023年国防预算为2,248亿美元,较2022年名目增加7.2%。

- 为了满足安全需求,需要更安全的炸药来取代高能量炸药和推进剂,正促使军事和国防设备製造商大规模使用2,4,6-三硝基甲苯。由于国家安全的加强和恐怖主义相关活动的增加,国防工业可能会在预测期内增加三硝基甲苯的使用量。

亚太地区预计将主导市场

- 预计亚太地区将在预测期内主导 TNT 市场。中国、印度和日本等国家的国防行动对 TNT 炸药的需求不断增加,预计将推动该地区的市场。

- 印度和中国等亚太地区国家增加对国家安全的投资,以打击日益增加的恐怖主义相关活动,将有助于三硝基甲苯市场的成长。三硝基甲苯也用作采矿、建设业和其他杂项应用中的炸药。

- 由于金属矿物通常是仅在世界地质有利地区发现的低品位矿石,预计在预测期内,冶金采矿对三硝基甲苯的消耗量将增加。

- 据估计,中国和印度等亚太国家的采石场材料中炸药的消耗量将会增加。采石场的建筑石材产量和水泥产量占全球炸药开采市场的 16%。

- 在中国和印度不断扩大的住宅建筑市场的推动下,亚太地区预计将出现最高的成长。预计到2030年,这两个国家将占世界中等收入群体的43%以上。中国是全球最大的建筑市场,占全球建筑投资的20%。预计到2030年,中国将在建筑方面花费约13兆美元,为三硝基甲苯市场创造了积极的市场前景。此外,从长远规划来看,中国政府预计到2035年将建成高速公路16.2万公里。

- 2022年,中国财政部和国家发展部设立了约750亿美元的国家基础设施投资基金,以刺激基础设施支出并重振疲软的经济。由于上述因素,亚太地区TNT市场预计在预测期内将出现正成长。

三硝基甲苯(TNT)产业概况

三硝基甲苯 (TNT) 市场本质上是整合的,只有少数几家大型企业占据市场主导地位。主要公司包括 Orica Limited、Maxamcorp、Axamcorp Holding、Dyno Nobel、Nitro-Chemca-CHEM SA 和 Enaex。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 采矿业对炸药的需求增加

- 各国政府活性化国防活动

- 抑制因素

- 转向其他替代产品

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

第五章市场区隔:市场规模(基于数量)

- 目的

- 军队

- 矿业

- 建造

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 马来西亚

- 越南

- 印尼

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 西班牙

- 土耳其

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Austin Powder

- BME Mining(Omnia Group)

- China Gezhouba(Group)Corporation

- China Poly Group Corporation

- Dyno Nobel

- Enaex

- MAXAMCORP HOLDING SL

- NITRO-CHEM SA

- NOF CORPORATION

- Orica Limited

- Solar Industries India Limited

- Sichuan Yahua Industrial Group Co. Ltd

第七章 市场机会及未来趋势

- TNT 在页岩地层压裂中用于油气回收

The Trinitrotoluene Market size is estimated at 29.11 kilotons in 2024, and is expected to reach 35.80 kilotons by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

The COVID-19 pandemic led to delays and halts across multiple projects in different countries worldwide in 2020. This simultaneously affected the demand for TNT and led to a decline on a global scale. However, in 2021, the demand for TNT began to recover due to global initiatives for economic recovery.

Key Highlights

- One of the main factors driving the market is the increasing defense activities by various governments worldwide.

- On the other hand, the focus on alternative products is expected to hinder the market's growth.

- Increasing the use of explosives in the fracturing of shale formations to extract oil and gas is likely to act as an opportunity for market growth in the coming years.

- Asia-Pacific dominated the global market, with China and India registering the most significant consumption.

Trinitrotoluene (TNT) Market Trends

Various Governments are Increasing Their Defense Activities

- Trinitrotoluene (TNT) is relatively insensitive to shock. It cannot explode without a detonator, which makes it a widely used explosive chemical around the world by various industries, such as military, mining, and construction.

- Increased spending on defense activities by global government bodies and the growing arms and ammunition sector will likely spur the explosives and pyrotechnics industry. Countries such as India, the United States, and China have also increased their overall spending on arms and ammunition to strengthen their armed forces. In addition, technological advancements and the need for smart weapons will propel the explosive and pyrotechnics industry.

- As per the Fiscal 2023 National Defense Authorization Act, the US government allotted USD 816.7 billion to the country's Defense Department. The Department of Air Force had proposed a budget request of USD 194 billion for 2023, a USD 20.2 billion or 11.7% increase from the 2022 budget request.

- The Chinese government's defense budget was USD 224.8 billion in 2023, a nominal year-on-year increase of 7.2% compared to 2022.

- The need for safer explosives to replace highly energetic explosives and propellants to meet safety needs is prompting the manufacturers of military and defense equipment to use 2,4,6-trinitrotoluene on a large scale. Due to the increase in national security and the rise in terrorist-related activities, the defense industry is likely to witness an increase in the usage of trinitrotoluene during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the market for TNT during the forecast period. Rising demand for TNT explosives in defense activities in countries like China, India, and Japan is expected to drive the market in this region.

- Increasing investments by countries in the Asia-Pacific region, like India and China, for national security to combat growing terrorist-related activities will contribute to the growth of the trinitrotoluene market. Trinitrotoluene is also used as explosives by the mining and construction industries, as well as for other miscellaneous applications.

- The global consumption of trinitrotoluene as explosives by the metal mining industry is projected to increase during the forecast period, as metallic minerals are generally low-grade ores found only in geologically favorable areas of the world.

- Consumption of explosives in quarrying materials is estimated to increase in various Asia-Pacific countries, like China and India. The production of stone for construction and the production of cement from quarrying operations accounted for an additional 16% of the global mining market for explosives.

- The highest growth is expected to be registered in the Asia-Pacific region, owing to China and India's expanding housing construction markets. These two countries are expected to represent over 43% of the global middle-income group by 2030. China has the largest construction market in the world, comprising 20% of all construction investments globally. China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive market outlook for the trinitrotoluene market. Additionally, regarding long-term plans, the Chinese government expected to have 162,000 km of expressways by 2035.

- In 2022, China's Ministry of Finance and National Development set up a state infrastructure investment fund worth around USD 75 billion to spur infrastructure spending and revive a flagging economy. Owing to the above-mentioned factors, the market for TNT in the Asia-Pacific region is projected to experience positive growth during the forecast period.

Trinitrotoluene (TNT) Industry Overview

The trinitrotoluene (TNT) market is consolidated in nature, with only a few major players dominating the market. Some of the major companies include Orica Limited, Maxamcorp, Axamcorp Holding, Dyno Nobel, Nitro-Chemca-CHEM SA, and Enaex.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Explosives in the Mining Industry

- 4.1.2 Increasing Defence Activities by Various Government

- 4.2 Restraints

- 4.2.1 Shifting Focus Toward Other Alternative Products

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Military

- 5.1.2 Mining

- 5.1.3 Construction

- 5.1.4 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Thailand

- 5.2.1.6 Malaysia

- 5.2.1.7 Vietnam

- 5.2.1.8 Indonesia

- 5.2.1.9 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Russia

- 5.2.3.6 Spain

- 5.2.3.7 Turkey

- 5.2.3.8 Nordic Countries

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Nigeria

- 5.2.5.4 Qatar

- 5.2.5.5 Egypt

- 5.2.5.6 United Arab Emirates

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Austin Powder

- 6.4.2 BME Mining (Omnia Group)

- 6.4.3 China Gezhouba (Group) Corporation

- 6.4.4 China Poly Group Corporation

- 6.4.5 Dyno Nobel

- 6.4.6 Enaex

- 6.4.7 MAXAMCORP HOLDING SL

- 6.4.8 NITRO-CHEM SA

- 6.4.9 NOF CORPORATION

- 6.4.10 Orica Limited

- 6.4.11 Solar Industries India Limited

- 6.4.12 Sichuan Yahua Industrial Group Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of TNT in Fracturing of Shale Formation to Recover Oil and Gas