|

市场调查报告书

商品编码

1519947

液体屋顶涂料:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Liquid Roofing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

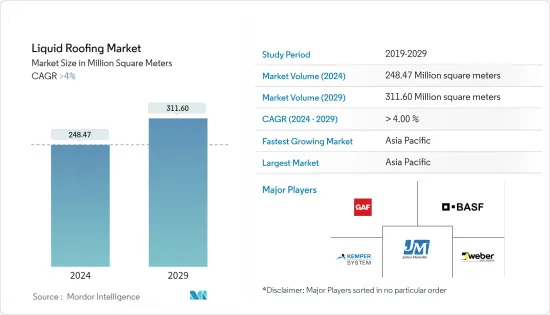

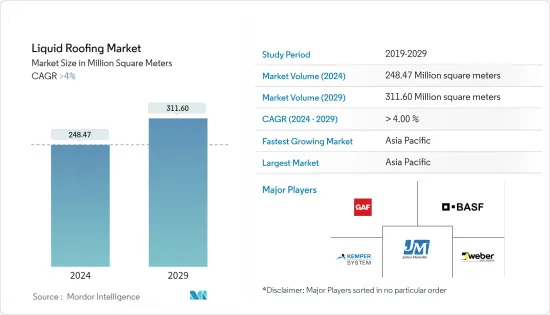

液体屋顶涂料市场规模预计在2024年达到2.4847亿平方米,2029年达到3.116亿平方米,在预测期(2024-2029年)复合年增长率将超过4%。

COVID-19的第一个影响是2020年液体屋顶市场需求疲软。不过,2021年和2022年市场出现復苏迹象,长期前景看好。

消费者对延长使用寿命、降低温度和易于维护等优点的认识不断提高,正在推动液体屋顶市场的住宅需求。

然而,原材料成本的波动可能会在不久的将来阻碍液体屋顶市场的成长。

由于全球减少碳排放的需求日益增长,未来五年可能会为液体屋顶市场提供者机。

由于中国、印度等国家液体屋顶消费量的增加,亚太地区主导了液体屋顶市场。

液体屋顶市场趋势

住宅产业主导市场

- 由于建筑业液体屋顶的大量消耗,住宅领域占据了市场主导地位。

- 液体屋顶具有更长的使用寿命、更低的维护成本以及透过降低生命週期成本来增加价值等优点。消费者对液体屋顶的认识和接受程度的提高预计将推动市场成长。

- 硅胶涂料用于结构和建筑物的屋顶,因为它们比其他液体薄膜具有优势,例如耐候性、防紫外线、耐挥发性有机化合物和耐用性,这使得它们对建筑商来说价格昂贵。替代屋顶更换项目。

- 旧建筑的维修和重建预计将增加建设产业的投资,并有助于未来几年市场需求的增加。

- 中国、印度和韩国等亚太国家的建筑和装修活动成长强劲,预计该地区在预测期内对液体屋顶市场的需求将增加。

- 主要经济体向都市区快速迁移、政府在房地产市场上住宅建设支出增加以及豪华住宅需求上升等因素预计将有利于建设产业的成长。

- 2022年,中国建筑业产值达到高峰约31.2兆元。

- 在北美,美国在建设产业中占有很大份额。在美国以外,加拿大和墨西哥是建筑业投资的主要贡献者。

- 2022年美国住宅年金额为9,080亿美元,比2021年的8,030亿美元成长13%。

- 在加拿大,各种政府计划,如经济适用房倡议(AHI)、加拿大新建筑计划 (NBCP) 和加拿大製造,将大力支持该行业的扩张。 2022年8月,加拿大政府宣布将在三项关键倡议上投资超过20亿美元。这三项倡议将总合支持全国约 17,000 套家庭住宅的开发,其中包括数千套经济适用住宅。

- 根据美国建筑师协会 (AIA) 共识建筑预测,预计 2022 年建筑物建筑支出将成长 9%,2023 年将再成长 6%。这前景比我们 2022 年初的预测稍微乐观一点。这主要是由于製造业的强劲成长和零售业的强劲成长。

- 由于欧盟復苏基金的新投资,欧洲建筑业在 2022 年成长了 2.5%。儘管大多数欧盟建设公司面临价格压力,但景气预计将在 2022 年初恢復并达到 COVID-19 之前的水平。此外,随着 COVID-19 危机的缓解以及建筑商越来越不愿意投资新建筑或维修现有房产,非住宅建筑预计将加快步伐并支持整体建筑市场的成长。

亚太地区主导市场

- 根据牛津经济研究院预测,2020 年至 2030 年全球建设产业预计将成长 4.5 兆美元(42%)。此外,2020年至2030年,中国、印度、美国和印尼预计将占全球建筑成长的58.3%。

- 住宅和商业建筑领域的扩张等因素预计将推动该地区的市场成长。

- 液体屋顶系统非常耐用,维护成本低,证明比其他防水系统更耐用,使用寿命更长。

- 越来越多的促进基础设施发展的政府计划,如越南的社会经济发展计划、印尼的国家中期发展计划和菲律宾的发展计划,预计将成为市场开拓的驱动力。

- 对节能结构的需求不断增长,人们对液体屋顶成本效益的认识不断提高,以及全球建设活动的活性化,可能会在预测期内进一步加速液体屋顶市场的发展。

- 2022 年第四季度,印度建筑业估值超过 3 兆印度卢比。与 2020 年相比,这一数字显着增加,2020 年金额因 COVID-19 大流行而减少。当时,该国的建设业和製造业是受灾最严重的产业之一。然而,该行业似乎已迅速復苏,并再次恢復到危机前的水平。

- 中国的建设产业是世界上最大的建筑业之一,近几十年来经历了显着的成长。中国正在经历快速的都市化和工业化,住宅、商业和基础设施建设等建设活动不断增加。然而,最近的事态发展表明,建设产业不断受到房地产开发人员去槓桿化努力的压力,推动更永续的建筑实践。

- 截至2022年5月,中国已开发实施基础建设计划价值超过2,500万美元,总规模超过5兆美元。美国和印度紧随其后,价值约 2 兆美元的基础设施计划上榜。另一方面,印度的大型基础设施计划数量最多。

- 因此,预计此类市场趋势将在预测期内推动该地区液体屋顶市场的需求。

液体屋顶产业概述

液体屋顶市场部分分散。主要参与者(排名不分先后)包括 Kemper System Ltd、Johns Manville(波克夏海瑟威)、GAF、Saint-Gobain Weber 和BASF SE。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 不断成长的住宅市场

- 消费者对液体屋顶涂料的认识不断增强

- 其他司机

- 抑制因素

- COVID-19 疫情造成的不利情况

- 其他阻碍因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔:市场规模(基于数量)

- 种类

- 聚氨酯漆

- 丙烯酸涂料

- 沥青涂层

- 硅胶漆

- 环氧涂层

- 其他类型(改质硅烷聚合物、三元乙丙橡胶、合成橡胶体膜、水泥膜、环氧涂料)

- 目的

- 圆顶屋顶

- 斜屋顶

- 屋顶平台

- 最终用户产业

- 住宅

- 商业的

- 工业/设施

- 基础设施

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Akzo Nobel NV

- Alumasc Building Products

- BASF SE

- BMI UK & Ireland

- GAF

- GreenShield

- Johns Manville(A Berkshire Hathaway Company)

- Kemper System Ltd

- Laydex

- Liquid Roofing Systems LTD

- Saint-Gobain Weber

- SIG Design and Technology(Part of SIG PLC)

- Sika AG

- Langley

第七章 市场机会及未来趋势

- 减少碳足迹的需求日益增长

- 其他机会

The Liquid Roofing Market size is estimated at 248.47 Million square meters in 2024, and is expected to reach 311.60 Million square meters by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

The initial impact of COVID-19 was a demand slump in the liquid roofing market in 2020. However, the market showed signs of recovery in 2021 and 2022, and the long-term outlook appears positive.

Increasing consumer awareness of benefits such as lifespan extension, temperature reduction, and ease of maintenance is driving the residential demand for the liquid roofing market.

However, the volatility in the cost of the raw material may hinder the growth of the liquid roofing market in the near future.

The growing need to reduce carbon footprints across the globe is likely to provide opportunities for the liquid roofing market over the next five years.

The Asia-Pacific region dominates the liquid roofing market, owing to the increasing consumption of liquid roofing from countries like China, India, etc.

Liquid Roofing Market Trends

Residential Segment to Dominate the Market

- The residential sector stands to be the dominating segment owing to the large-scale consumption of liquid roofing in the construction industry.

- Beneficial attributes like long-term roofs, lower maintenance costs, and more value as life cycle costs decrease with liquid roofing. Increasing awareness and acceptability among consumers regarding liquid roofing is expected to drive market growth.

- Among types, the silicone coating is utilized in structures and building roofs due to its advantages over other fluid membranes, such as weathering resistance, UV protection, volatile organic compound tolerance, and durability, and provides construction owners with an alternative to an expensive re-roofing project.

- Refurbishing and renovation of old buildings have increased investments in the building and construction industry and are anticipated to contribute to a rise in market demand in the upcoming years.

- Asia-Pacific countries like China, India, and South Korea have been registering strong growth in construction and remodeling activities, and the requirement for a liquid roofing market is projected to increase in this region in the forecast period.

- Factors such as rapid urban migration in major economies, increased government spending in the real estate market for residential construction, and the growing demand for high-class residential homes are likely to benefit the growth of the construction industry.

- In 2022, the construction output value in China achieved its peak at around CNY 31.2 trillion.

- In North America, the United States has a major share in the construction industry. Besides the United States, Canada and Mexico contribute significantly to the construction sector investments.

- The annual value of residential construction in the United States was valued at USD 908 billion in 2022, an increase of 13% compared to USD 803 billion in 2021.

- In Canada, various government projects, including the Affordable Housing Initiative (AHI), New Building Canada Plan (NBCP), and Made in Canada, are set to hugely support the sector's expansion. In August 2022, the Canadian government announced a significant investment of more than USD 2 billion to fund three important initiatives that will collectively help to develop approximately 17,000 houses for families across the nation, including thousands of affordable housing units.

- In 2022, according to the American Institute of Architects (AIA) Consensus Construction Forecast, construction spending on buildings grew by an estimated 9% in 2022, and it is anticipated to grow by an additional 6% in 2023. This outlook is slightly more optimistic than forecasted at the beginning of 2022. This was largely due to strong growth in the manufacturing sector and growing strength in retail facilities.

- Europe's construction sector grew by 2.5% in 2022, owing to new investments from the European Union Recovery Fund. Business confidence picked up in early 2022 and is expected to reach pre-COVID-19 levels despite price pressures at most EU construction firms. Moreover, as the COVID-19 crisis abates and builders become less reluctant to invest in new corporate buildings and renovate existing properties, non-residential construction is expected to pick up the pace, thus supporting overall growth in the construction market.

Asia-Pacific Region to Dominate the Market

- According to Oxford Economics, the global construction industry is expected to grow by USD 4.5 trillion, or 42%, between 2020 and 2030. Additionally, China, India, the United States, and Indonesia are expected to account for 58.3% of global growth in construction between 2020 and 2030.

- Factors such as expansion in the residential and commercial construction sector will drive the market growth in the region.

- Liquid roofing systems are highly tenable, lower maintenance costs, are proven to be more durable than other waterproofing systems, are long-lasting, and aid in the prevention of uneven spots, bumps, any overlaps over the roof surface, etc.

- Rising government plans for advancing infrastructures, such as Vietnam's Socio-Economic Development Plan, Indonesia's National Medium-Term Development Plan, Philippine Development Plan, and other country's plans are expected to drive market growth.

- Emerging demand for energy-efficient structures, expanding awareness about the cost-effectiveness of liquid roofing, and increasing construction activities worldwide will further accelerate the liquid roofing market in the forecast period.

- India's construction industry was valued at over three trillion Indian rupees in the fourth quarter of 2022. This was a significant increase compared to 2020 when the value shrank due to the COVID-19 pandemic. The country's construction and manufacturing industries were among the worst hit at the time. However, the industry seemed to recover quickly and returned to pre-crisis level again.

- China's construction industry, one of the world's largest, has experienced significant growth in recent decades. China is undergoing rapid urbanization and industrialization, increasing construction activities such as residential, commercial, and infrastructure construction. In recent years, however, the construction industry has been under constant pressure from property developers' deleveraging measures, leading to more sustainable construction practices.

- In China, the infrastructure projects in development or execution of over USD 25 million as of May 2022 were worth over USD 5 trillion. The United States and India were the following countries on the list, with around USD 2 trillion worth of infrastructure projects. In contrast, the country with the highest number of big infrastructure projects was India.

- Hence, all such market trends are expected to drive the demand for liquid roofing market in the region during the forecast period.

Liquid Roofing Industry Overview

The Liquid Roofing Market is partially fragmented in nature. The major players (not in any particular order) include Kemper System Ltd, Johns Manville (Berkshire Hathaway Company), GAF, Saint-Gobain Weber, and BASF SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Residential Segment

- 4.1.2 Increasing Consumer Awareness for Liquid Roofing

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Polyurethane Coatings

- 5.1.2 Acrylic Coatings

- 5.1.3 Bituminous Coatings

- 5.1.4 Silicone Coatings

- 5.1.5 Epoxy Coatings

- 5.1.6 Other Types (Modified Silane Polymers, EPDM Rubbers, Elastomeric Membranes, Cementitious Membranes, and Epoxy Coatings)

- 5.2 Application

- 5.2.1 Domed Roofs

- 5.2.2 Pitched Roof

- 5.2.3 Flat Roofed

- 5.3 End-user Industry

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial/Institutional

- 5.3.4 Infrastructure

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 UAE

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Alumasc Building Products

- 6.4.3 BASF SE

- 6.4.4 BMI UK & Ireland

- 6.4.5 GAF

- 6.4.6 GreenShield

- 6.4.7 Johns Manville (A Berkshire Hathaway Company)

- 6.4.8 Kemper System Ltd

- 6.4.9 Laydex

- 6.4.10 Liquid Roofing Systems LTD

- 6.4.11 Saint-Gobain Weber

- 6.4.12 SIG Design and Technology (Part of SIG PLC)

- 6.4.13 Sika AG

- 6.4.14 Langley

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Need to Reduce Carbon Footprints

- 7.2 Other Opportunities