|

市场调查报告书

商品编码

1519952

氯化聚乙烯:市场占有率分析、产业趋势、成长预测(2024-2029)Chlorinated Polyethylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

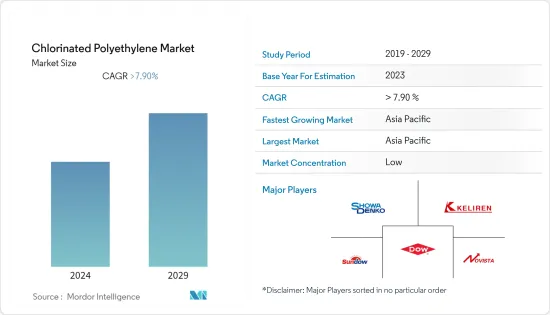

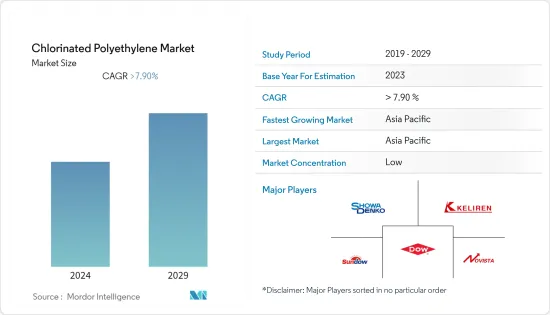

氯化聚乙烯市场规模预计到2024年为577.28千吨,预计到2029年将达到815.35千吨,在预测期内(2024-2029年)复合年增长率超过7%。

在 COVID-19 大流行期间,氯化聚乙烯市场出现了一些瓶颈和供需中断。在物流和供应链问题上加上政府法规,氯化聚乙烯供应商在采购生产原材料和劳动力问题方面面临挑战。然而,随着世界从大流行中恢復,由于疫苗接种和政府策略的增加,市场活动开始復苏,氯化聚乙烯市场开始恢復到先前的市场状态。

对高性能聚乙烯产品的需求不断增长预计将推动氯化聚乙烯市场的成长。

原油等原材料价格的波动以及各国对聚乙烯使用的严格监管预计将阻碍预测期内的市场成长。

然而,与先进和永续氯化聚乙烯的开发相关的研究和开发预计将为市场提供利润丰厚的机会。

亚太地区占据了最高的市场占有率,并且很可能在预测期内主导市场。

氯化聚乙烯市场趋势

抗衝改质剂主导市场

- 全球建筑和重组活动的不断增加,加上氯化聚乙烯的广泛应用,使得抗衝改质剂成为氯化聚乙烯市场的主要应用领域。

- 对 PVC墙板、管道、窗型材、门和栅栏的巨大需求正在推动抗衝改质剂在该市场的成长,特别是在建设产业。

- 由于其优异的延展性,CPE 135A 越来越多地用于特种聚氯乙烯导线管和高填充化合物。 CPE 135A 全球市场的开拓很大程度上是由于 CPE 135A 类别在抗衝击改质剂应用中的使用不断增加。

- 这种抗衝改质剂广泛用于包装应用,因为它能够在包装应用中提供抗皱泛白性和透明度的理想平衡。各种最终用途公司塑胶包装使用量的快速增加预计将推动对抗衝改质剂的需求。例如,根据经济合作暨发展组织(OECD) 的数据,到 2029 年,全球包装塑胶使用量可能比 2022 年增加 20.1%。

- 由于减重和降低成本的需求,世界各地工业中塑胶的使用不断增加,预计也将推动对抗衝改质剂以及氯化聚乙烯的需求。例如,根据《我们的数据世界》的数据,预计2029年全球塑胶产量将达到近57,342万吨,而2022年为47,539万吨。

- 所有上述因素和市场推动因素预计将在预测期内提高抗衝击改质剂应用领域在市场中的主导地位。

亚太地区主导市场

- 建设业是氯化聚乙烯最大的最终用户产业。氯化聚乙烯广泛用于建筑和建筑材料,如隔热材料、防水膜、管道密封件和地板材料,具有耐候性、耐化学性和耐热性。

- 亚太地区在氯化聚乙烯市场上占据主导地位,因为该地区拥有世界上最繁忙、规模最大的建筑业。例如,根据Seaasia.co统计,亚太地区有7,500多栋高层建筑,占全球高层建筑总数的80%以上。

- 中国、印度、日本、印尼和韩国等国家支持该地区建设产业的规模。

- 此外,根据联合国贸易和发展会议(UNCTAD)的预测,预计亚太地区的都市区增长最快,到 2050 年,城市人口将比 2022 年居住10.33 亿。这可能会导致该地区各类建筑和基础设施的建设量增加。因此,亚太地区在氯化聚乙烯市场的主导地位预计将在预测期内维持下去。

- 氯化聚乙烯在汽车工业中也有广泛的应用,广泛用于汽车密封件、门饰件、防护罩等。此外,亚太地区是世界领先的汽车生产国。

- 因此,从上述趋势和资料来看,亚太地区预计将在预测期内主导氯化聚乙烯市场。

氯化聚乙烯行业概况

全球氯化聚乙烯市场本质上是分散的,因为市场参与者众多,但市场占有率不高。市场主要企业(排名不分先后)包括昭和电工株式会社、杭州科力化学有限公司、山东诺维斯塔化学有限公司、陶氏化学公司和山道聚合物公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对高性能聚乙烯产品的需求不断增长

- 抑制因素

- 原物料价格波动

- 关于聚乙烯使用的严格规定

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔:市场规模(基于数量)

- 产品

- CPE 135A

- CPE 135B

- 其他产品

- 目的

- 抗衝击改质剂

- 电线/电缆护套

- 软管

- 黏剂

- 红外线吸收

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率/排名分析

- 主要企业策略

- 公司简介

- Dow

- Dycon Chemicals

- Hangzhou Keli Chemical Co., Ltd.

- Jiangsu Tianteng Chemical Industry Co., Ltd.

- Aurora Plastics LLC

- Shandong Gaoxin Chemical Co., Ltd.

- Shandong Novista Chemicals Co.,Ltd(Novista Group)

- Shandong Xiangsheng New Materials Technology Co.,Ltd.

- Shandong Xuye New Materials Co., Ltd.

- Resonac Holdings Corporation

- Sundow Polymers Co., Ltd.

- Weifang Yaxing Chemical Co., Ltd.

第七章 市场机会及未来趋势

- 在开发高级等级之前进行研究和开发

The Chlorinated Polyethylene Market size is estimated at 577.28 kilotons in 2024, and is expected to reach 815.35 kilotons by 2029, growing at a CAGR of greater than 7% during the forecast period (2024-2029).

The chlorinated polyethylene market witnessed several hurdles and interruptions in terms of supply and demand during the COVID-19 pandemic. Owing to the logistical and supply chain issues combined with government restrictions, chlorinated polyethylene suppliers faced challenges in procuring raw materials for production, as well as labor issues. However, as the market activities started to restore with the worldwide recovery from the pandemic because of an increase in vaccinations combined with government strategies, the chlorinated polyethylene market started to get back to the previous market states.

The increasing demand for high-performance polyethylene products is projected to drive the growth of the chlorinated polyethylene market.

Fluctuations in raw materials prices like crude oil and the laying down of strict regulations regarding the use of polyethylene from various countries are expected to hinder the market's growth during the forecast period.

Nevertheless, research and development pertaining to the development of advanced and sustainable grades of chlorinated polyethylene are expected to offer lucrative opportunities to the market.

Asia-Pacific accounted for the highest market share and is also likely to dominate the market during the forecast period.

Chlorinated Polyethylene Market Trends

Impact Modifier to Dominate the Market

- Impact modifier stands to be the dominating application segment for the chlorinated polyethylene market owing to increasing global construction and reconstruction activities, coupled with the wide applicability of chlorinated polyethylene.

- Huge demand for PVC siding, pipes, window profiles, doors, and fences is driving the growth of impact modifiers in this market, among others from the building & construction industry.

- The growing use of CPE 135A in specialty polyvinyl chloride electrical conduits and highly filled compounds is witnessed owing to its superior ductility. Development in the global market segment of CPE 135A is majorly due to the increased use of the CPE 135A category in the application of impact modifiers.

- The impact modifier is widely used in packaging applications owing to its ability to offer an ideal balance between crease-whitening resistance and clarity for packaging applications. A fast increment in the use of plastic packaging in different end-use enterprises is expected to drive the demand for impact modifiers. For instance, according to the Organisation for Economic Co-operation and Development (OECD), the global plastic use for packaging can grow up to 20.1% in volume by 2029 compared to 2022.

- The growing incorporation of plastics across industries worldwide due to the requirement of improved weight and cost reductions is also expected to propel the demand for impact modifiers and, thus, ultimately, chlorinated polyethylene. For instance, according to Our World in Data, the global plastics production volume is expected to reach nearly 573.42 million tons in 2029 compared to 475.39 million tons in 2022.

- All the factors above and drivers are expected to increase the impact modifier application segment's dominance in the market during the forecast period.

Asia-Pacific Region to Dominate the Market

- Building and construction is the largest end-user industry for chlorinated polyethylene. Chlorinated polyethylene is extensively used in construction and building materials, such as thermal insulation materials, waterproofing membranes, pipe seals, flooring materials, etc., to provide them with weather resistance, chemical resistance, and heat resistance.

- The Asia-Pacific region majorly dominates the chlorinated polyethylene market, as it has the world's busiest and largest building and construction industry. For instance, according to Seasia.co, Asia-Pacific has over 7,500 skyscrapers, which is more than 80% of the world's total number of skyscrapers.

- Countries such as China, India, Japan, Indonesia, and South Korea, among others, are responsible for the large size of the region's building and construction industry.

- Moreover, according to the United Nations Conference on Trade and Development (UNCTAD), the Asia-Pacific is projected to witness the highest growth in urban population, with an increase of 1,033 million more people residing in urban areas by 2050 compared to 2022. This will likely increase the construction volume of all kinds of buildings and infrastructure in the region. Hence, the dominance of the Asia-Pacific region over the chlorinated polyethylene market will be sustained during the forecast period.

- Chlorinated polyethylene is also extensively used in the automotive industry due to its vast applications in automotive seals, door trims, protective covers, etc. Moreover, Asia-Pacific is the leading producer of automotives globally.

- Hence, owing to the trends mentioned above and the data, the Asia-Pacific region is projected to dominate the chlorinated polyethylene market during the forecast period.

Chlorinated Polyethylene Industry Overview

The global chlorinated polyethylene market is fragmented in nature owing to the presence of numerous players with no significant market share. Some of the major players in the market (not in any particular order) include SHOWA DENKO K.K., Hangzhou Keli Chemical Co., Ltd., Shandong Novista Chemical Ltd., Dow, and Sundow Polymers Co., Ltd., amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for High Performance Polyethylene Products

- 4.2 Restraints

- 4.2.1 Fluctuating Raw Material Prices

- 4.2.2 Strict Regulations Regarding the Use of Polyethylene

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product

- 5.1.1 CPE 135A

- 5.1.2 CPE 135B

- 5.1.3 Other Products

- 5.2 Application

- 5.2.1 Impact Modifier

- 5.2.2 Wire and Cable Jacketing

- 5.2.3 Hose and Tubing

- 5.2.4 Adhesives

- 5.2.5 Infrared Absorption

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Dow

- 6.4.2 Dycon Chemicals

- 6.4.3 Hangzhou Keli Chemical Co., Ltd.

- 6.4.4 Jiangsu Tianteng Chemical Industry Co., Ltd.

- 6.4.5 Aurora Plastics LLC

- 6.4.6 Shandong Gaoxin Chemical Co., Ltd.

- 6.4.7 Shandong Novista Chemicals Co.,Ltd (Novista Group)

- 6.4.8 Shandong Xiangsheng New Materials Technology Co.,Ltd.

- 6.4.9 Shandong Xuye New Materials Co., Ltd.

- 6.4.10 Resonac Holdings Corporation

- 6.4.11 Sundow Polymers Co., Ltd.

- 6.4.12 Weifang Yaxing Chemical Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Research and Development Pretaining to the Development of Advanced Grades