|

市场调查报告书

商品编码

1521312

3D列印粉末:市场占有率分析、产业趋势与统计、成长预测(2024-2029)3D Printing Powder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

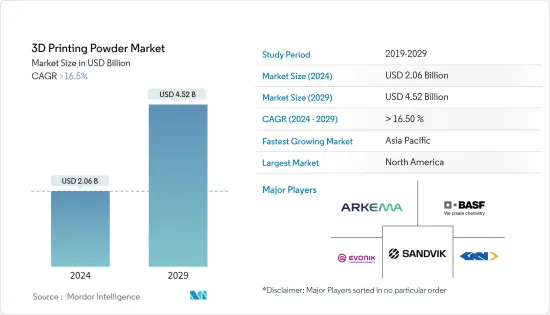

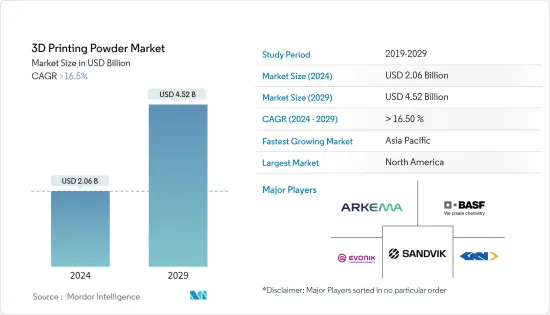

3D列印粉末市场规模预计到2024年为20.6亿美元,预计到2029年将达到45.2亿美元,在预测期内(2024-2029年)复合年增长率超过16.5%。

COVID-19 大流行对 3D 列印粉末市场产生了各种影响,带来了挑战,但也创造了创新和成长的机会。此次疫情加速了3D列印在包括医疗保健在内的各行业的接受度,预计其长期影响将是正面的。因为公司正在投资 3D 列印技术和材料,以加强业务和弹性。

主要亮点

- 疫情加速了对医疗应用中使用的 3D 列印粉末的需求。医疗设备原型设计和个人防护设备(PPE)製造是该市场的主要驱动力。

- 儘管 3D 列印具有变革潜力,但该技术的广泛采用受到 3D 列印粉末高昂的材料和后处理成本的阻碍。

- 在一个过程中使用多种材料进行列印的能力使得製造具有更复杂结构和功能的产品成为可能,并且越来越受欢迎。支援多材料列印製程的 3D 列印粉末可能会带来机会。

- 亚太地区主导3D列印粉末市场,其中中国、印度和日本对市场需求贡献显着。

3D列印粉末市场趋势

汽车产业的需求不断增加

- 汽车产业是利用该技术的主要产业,在最终用户产业中占据很大份额。多年来,汽车行业广泛采用该技术来快速製造原型设备和小型自订产品。它的广泛应用在汽车和目的地设备製造商 (OEM) 的轻量化零件生产中尤为明显。

- 3D 列印粉末用于增材製造的各种製程。主要用于汽车、航太和国防产品。 3D 列印硬体透过选择性沉积连续的优质粉末层来建构物件。

- 3D列印中通常使用不同的材料和不同形式的粉末沉积。其中包括尼龙、生质塑胶、陶瓷、蜡、青铜、不锈钢、钴铬合金和钛。

- 3D列印粉末在汽车领域有应用,如壳体、支架、涡轮增压器、轮胎模具、传动板、控制阀和帮浦。还包括冷却通风口、车身面板、仪表板、座椅框架和原型製作、保险桿和其他引擎部件的应用。

- 3D 列印粉末还有助于车辆减重过程,有助于提高车辆性能和效率。

- 根据OICA称,与2021年相比,2022年全球汽车产业目前将出现6%的显着成长。 2022年,全球各个已开发国家和开发中国家的汽车产量均增加,包括中国、德国、韩国、英国和义大利。 2022年,汽车产量超过8502万辆。

- 中国的汽车製造业是全世界最大的。 2021年产销量小幅成长,2022年成长3%。根据中国工业协会统计,2022年乘用车产量较2021年成长11.2%。

- 快速原型製作市场的开拓、航太领域需求的增加以及发展中地区汽车技术的进步将推动未来几年对3D列印粉末市场的需求。

亚太地区主导市场

- 由于中国、韩国、日本和印度汽车产业高度发达,亚太地区预计将主导全球市场。再加上该地区多年来为推进医疗和航太技术而持续进行的投资。

- 根据印度汽车工业协会统计,印度汽车工业总合生产汽车2593万辆。 2022年4月至2023年3月期间包括乘用车、商用车、三轮车、两轮车、四轮车,2021年4月至2022年3月产量为2,304万辆。

- 3D列印粉末可用于製造航太领域的各种零件。包括过渡导管、引擎零件、飞机起落架旋翼叶轮、喷桿、机架支架、衬套、承载环、耐腐蚀零件等。

- 近年来,亚太地区航太零件生产和组装基地数量不断增加,预计在不久的将来打开3D列印零件和粉末的消费前景。

- 根据通用航空工业协会公告,2022年活塞飞机交付数量将较2021年增加8.2%,总合达1,524架。涡轮螺旋桨飞机数量增加10.4%,达到582架,喷射机数量略有增加,从710架增加到712架。 2022 年飞机总交付为 229 亿美元。这与前一年同期比较增长了约5.8%。

- 在亚太地区,开发中国家的医疗技术成长巨大。对牙冠、助听器和整形外科替换部件等客製化植入的需求正在推动医疗产业的扩张。

- 中国、日本、韩国和印度航太和国防领域的发展带动了新兴国家建筑业的发展。医疗产业的巨大成长预计将在未来几年推动 3D 列印粉末市场。

3D列印粉末产业概况

3D列印粉末市场因其性质而部分整合。主要企业(排名不分先后)包括 Sandvik AB、Arkema、 BASF SE、GKN Powder Metallurgy 和 Evonik Industries AG。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 航太和汽车产业的应用不断增加

- 医疗领域需求不断扩大

- 其他司机

- 抑制因素

- 材料成本和后处理成本高

- 危险的本质

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 粉末型

- 塑胶粉末

- 金属粉末

- 陶瓷粉

- 玻璃粉

- 其他类型(如复合粉末)

- 最终用户产业

- 车

- 航太/国防

- 医疗保健

- 建筑学

- 其他最终用户产业(消费品、工业等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Arkema

- BASF SE

- ERASTEEL

- Evonik Industries AG

- ExOne

- GENERAL ELECTRIC

- GKN Powder Metallurgy

- Hoganas AB

- Metalysis

- Sandvik AB

第七章 市场机会及未来趋势

- 建筑创新

- 多材料列印的需求不断增长

The 3D Printing Powder Market size is estimated at USD 2.06 billion in 2024, and is expected to reach USD 4.52 billion by 2029, growing at a CAGR of greater than 16.5% during the forecast period (2024-2029).

The COVID-19 pandemic had a mixed impact on the 3D printing powder market, presenting challenges but also creating opportunities for innovation and growth. The pandemic accelerated the acceptance of 3D printing in various industries, such as healthcare, and the long-term impact is expected to be positive. It is because companies invest in 3D printing technologies and materials to enhance their operations and resilience.

Key Highlights

- The pandemic spurred demand for 3D printing powders used in medical applications. It is a major driving factor for this market, such as creating prototypes of medical devices and manufacturing personal protective equipment (PPE).

- Despite the transformative potential of 3D printing, the widespread adoption of this technology is hindered by the high material and post-processing cost of 3D printing powder.

- The ability to print with multiple materials in a single process is gaining traction, allowing the creation of products with more complex structures and functionalities. It will provide an opportunity for 3D printing powders that are compatible with multi-material printing processes.

- The Asia-Pacific region dominated the market for 3D printing powder, with China, India, and Japan being the major contributors to the market demand.

3D Printing Powders Market Trends

Growing Demand from Automobile Sector

- The automotive industry is a primary industry that utilizes this technology, holding a significant share in the end-user industries segment. Over the years, the automotive sector extensively employed this technology for the rapid production of prototype equipment and small custom products. Its widespread use is particularly notable in the manufacturing of lightweight components for both automobiles and Original Equipment Manufacturers (OEMs).

- 3D printing powder is used in different processes in additive manufacturing. It is being majorly used in automobile, aerospace, and defense products. 3D printing hardware builds an object by selectively sticking together successive layers of excellent powder.

- Various forms of powder adhesion are commonly used to 3D print, using a wide range of materials. These include nylon, bio-plastics, ceramics, wax, bronze, stainless steel, cobalt chrome, and titanium.

- 3D printing powder finds applications in the automobile sector in the form of housing and brackets, turbochargers, tire molds, transmission plates, and control valves and pumps. It also includes applications in cooling vents, body panels, dashboards, seat frames and prototyping, bumpers, and other engine components.

- Also, 3D printing powder helps in vehicle weight reduction processes that support increasing the performance and efficiency of the vehicles.

- As per OICA, the Global Automotive Industry is currently growing at a substantial rate of 6% in 2022 over 2021. In 2022, various developed and developing countries across the world, including China, Germany, South Korea, Canada, the United Kingdom, and Italy, experienced an increase in automotive production. In 2022, over 85.02 million units of Motor vehicles were manufactured.

- The Chinese automotive manufacturing industry is the largest in the world. The industry witnessed a slight increase in 2021, with a 3% increase in 2022, wherein production and sales inclined. According to the China Association of Automobile Manufacturers (CAAM), the production of passenger cars increased by 11.2% in 2022 over 2021.

- Increasing applications for rapid prototyping, growing demand for the aerospace sector, and technological advancements in automobiles in developing regions are driving the demand for the 3D printing powder market through the years to come.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the global market owing to the highly developed automobile sector in China, Korea, Japan, and India. It is coupled with the continuous investments done in the region to advance medical and aerospace technologies through the years.

- As per the Society of Indian Automobile Manufacturers, the Automotive Industry in India manufactured a combined total of 25.93 million vehicles. The vehicles include passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles during the period from April 2022 to March 2023, in comparison to 23.04 million units produced from April 2021 to March 2022.

- 3D printing powder can be used for manufacturing various components in the aerospace sector. It includes transition ducts, engine components, aircraft landing gear rotor blades, spray bars, flame holders, liners, carrier rings, and corrosion-resistant components.

- The growing production and assembly bases for aerospace components in the Asia-Pacific regions in recent years are expected to provide scope for the consumption of 3D-printed components and powders in the near future.

- As per the General Aviation Manufacturers Association, there was an 8.2% rise in piston airplane deliveries in 2022 compared to 2021, totaling 1,524 units. Turboprop airplane deliveries increased by 10.4%, reaching 582 units, while business jet deliveries experienced a marginal increase from 710 to 712 units. The total value of airplane deliveries in 2022 amounted to approximately USD 22.9 billion. It reflected a growth of around 5.8% over the previous year.

- In Asia-Pacific, the growth in medical technology in developing countries is immense. The need for customized implants like tooth crowns, hearing aids, and orthopedic replacement parts is supporting the expansion of the medical industry.

- The growth in aerospace and defense sectors in China, Japan, Korea, and India increased the architectural and construction industries in developing countries. The tremendous growth in the medical sector is expected to drive the market for 3D printing powder through the years to come.

3D Printing Powders Industry Overview

The 3D printing powder market is partially consolidated in nature. The major players (not in any particular order) include Sandvik AB, Arkema, BASF SE, GKN Powder Metallurgy, and Evonik Industries AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications in Aerospace and Automobile Industries

- 4.1.2 Growing Demand from Medical Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 HIgh Material and Post Processing Cost

- 4.2.2 Hazardous in Nature

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Powder Type

- 5.1.1 Plastic Powder

- 5.1.2 Metal Powder

- 5.1.3 Ceramic Powder

- 5.1.4 Glass Powder

- 5.1.5 Other Types (Composite Powder, etc.)

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Medical

- 5.2.4 Architecture

- 5.2.5 Other End-user Industries (Consumer Goods, Industrial, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 BASF SE

- 6.4.3 ERASTEEL

- 6.4.4 Evonik Industries AG

- 6.4.5 ExOne

- 6.4.6 GENERAL ELECTRIC

- 6.4.7 GKN Powder Metallurgy

- 6.4.8 Hoganas AB

- 6.4.9 Metalysis

- 6.4.10 Sandvik AB

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovations in Architectural Sector

- 7.2 Increasing Demand for Multi-Material Printing