|

市场调查报告书

商品编码

1521327

Mercury:市场占有率分析、产业趋势与统计资料、成长预测(2024-2029)Mercury - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

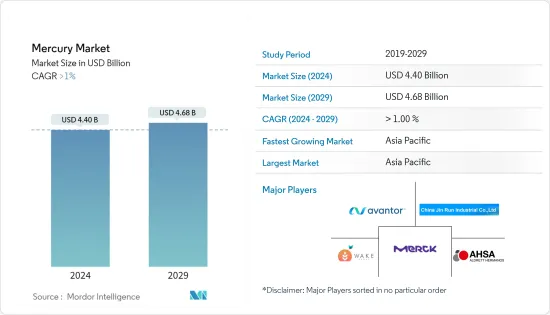

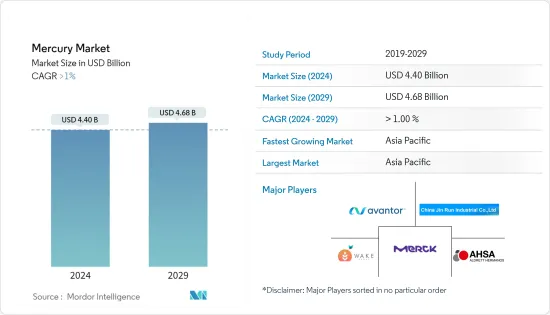

汞市场规模预计到 2024 年为 44 亿美元,预计到 2029 年将达到 46.8 亿美元,在预测期内(2024-2029 年)复合年增长率超过 1%。

新冠疫情大流行对汞市场产生了多种影响。一方面,经济活动的下降减少了一些行业的汞需求,例如製造业和建设业。另一方面,疫情也导致对汞检测服务的需求增加,因为政府和企业力求确保其产品和环境不受汞污染。总体而言,COVID-19 对汞市场的影响预计相对较小。

推动所研究市场的主要因素是对测量和控制设备的需求。

汞的危险性可能会成为成长抑制因素。由于其危险性,许多国家已禁止使用含汞的电池、体温计、气压计和血压计,这对所研究的市场产生了影响。

由于尚无替代品的特定利基应用的需求不断增加,例如化学过程中的催化剂和某些医疗设备,汞市场正在不断增长。

预计亚太地区将占据全球市场的大部分,其中大部分需求来自中国和塔吉克。

汞市场趋势

测控设备成为最大细分市场

- 汞用于各种设备,包括温度计、汽车零件、恆温器探头、气压计、真空计、火焰感测器、流量计、比重计、湿度计/湿度计、压力计、高温计和医疗设备。

- 血压计大量使用汞来测量血压。血压测量对于各种临床状况的诊断和监测也很重要。传统上,血压是使用血压计进行非侵入性测量。这至今仍被公认为血压测量的「黄金标准」。

- 2022 年,全球估计生产了 2,200 吨汞。汞主要用于电气电子产品和工业化学品的生产。

- 然而,对汞的环境担忧已导致一些欧洲国家颁布禁令,英国目前正在限制其对医疗保健的供应。汞被世界卫生组织 (WHO) 认定为引起重大公共卫生问题的十大化学物质或化学物质组之一。

亚太地区主导市场

- 最大的汞市场是亚太地区。在亚太地区,中国和吉尔吉斯斯坦是汞的主要生产国。除此之外,中国还拥有世界上最大的汞矿产量和蕴藏量。此外,在中国,汞化合物被用作从煤生产氯乙烯单体的催化剂。

- 因此,中国将在2022年成为全球最大的汞生产国,矿场产量将达到2,000吨。塔吉克是第二大汞生产国,同年产量约 120 吨。

- 在全球范围内,有 10 至 2000 万人在手工和小规模采金 (ASGM) 行业工作,其中许多人每天都使用汞。

- 手工和小规模采金业 (ASGM) 是世界上最大的人为汞排放源 (37.7%),其次是煤炭固定燃烧 (21%)。

- 据美国地质调查局称,中国、吉尔吉斯、墨西哥、秘鲁、俄罗斯、斯洛维尼亚、西班牙和乌克兰持有世界上大部分汞资源,估计为60万吨。

- 此外,手工和小规模金矿开采 (ASGM) 业务广泛,遍及亚洲、南美洲和非洲的 55 个国家。儘管手工和小规模采金是这些国家的微观经济来源,但手工和小规模采金对环境和健康产生了负面影响。

- 在中国,牙科汞合金的使用可以追溯到西元1000年。如今,牙科汞合金由汞和银、锡和铜的金属合金组成。

- 所有上述因素预计都会增加该地区的汞消耗量。

汞产业概况

汞市场部分分散。主要参与者(排名不分先后)包括 Avantor Inc. (Thermo Fisher Scientific)、AHSA、Aldrett Hermanos SA de CV、Merck KGaA、Wake Group 和中国金润实业。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 测控设备的需求

- 血压计测量血压的需求

- 广泛用于采矿领域提金

- 抑制因素

- 汞的危险特性

- 其他限制

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 产品类别

- 金属

- 合金

- 化合物

- 目的

- 电池

- 牙科应用

- 测量/控制设备

- 灯

- 电气/电子设备

- 黄金加工

- 其他用途(医疗保健、製药、电池)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率/排名分析

- 主要企业策略

- 公司简介

- Aldrett Hermanos

- Antares Chem Private Limited

- Avantor Performance Materials

- Bethlehem Apparatus Co. Inc.

- China Jin Run Industrial Co. Ltd

- Mayasa

- Merck KGaA

- Powder Pack Chem

- Special Metals

- Tamilnadu Engineering Instruments

- Wake Group

第七章 市场机会及未来趋势

第 8 章 利基应用中不断扩大的汞需求

第9章 其他机会

The Mercury Market size is estimated at USD 4.40 billion in 2024, and is expected to reach USD 4.68 billion by 2029, growing at a CAGR of greater than 1% during the forecast period (2024-2029).

The COVID pandemic had a mixed impact on the mercury market. On the one hand, the decline in economic activity led to a decrease in demand for mercury in some industries, such as the manufacturing and construction sectors. On the other hand, the pandemic also led to an increase in demand for mercury testing services, as governments and businesses sought to ensure that their products and environments were free of mercury contamination. Overall, the impact of COVID-19 on the mercury market is expected to be relatively modest.

The major factor driving the market studied is the demand for measuring and controlling devices.

The hazardous properties of mercury are likely to act as a restraint to the growth of the market. Owing to its hazardous nature, many countries have banned mercury-containing batteries, thermometers, barometers, and blood pressure monitors, thus affecting the market studied.

The mercury market is experiencing growth due to increasing demand in specific niche applications, such as catalysts in chemical processes and certain medical devices, where alternatives are not yet available.

Asia-Pacific is expected to dominate the global market, with the majority of the demand coming from China and Tajikistan.

Mercury Market Trends

Measuring and Controlling Devices to be the largest segment

- Mercury is used in various devices such as thermometers, automotive parts, thermostat probes, barometers, vacuum gauges, flame sensors, flowmeters, hydrometers, hygrometers/psychrometers, manometers, pyrometers, medical devices, and more.

- Mercury is used on a large scale in the sphygmomanometer for the measurement of blood pressure. Also, the measurement of blood pressure is important in the diagnosis and monitoring of a wide range of clinical conditions. Traditionally, blood pressure is measured non-invasively using a sphygmomanometer. This is still recognized as the 'gold standard' for the measurement of blood pressure.

- In 2022, an estimated 2,200 metric tons of mercury was produced worldwide. It is mainly used in the manufacturing of electrical and electronic goods and industrial chemicals.

- However, environmental concerns regarding mercury have led to the imposition of bans in some European countries, and the supply of healthcare in the United Kingdom is now restricted. Mercury is considered by the World Health Organisation (WHO) as one of the top 10 chemicals or groups of chemicals of major public health concern.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is the largest market for mercury. In the Asia-Pacific region, China and Kyrgyzstan are the major producers of mercury. In addition to this, China has the world's largest mine production and reserves of mercury. Also, Mercury compounds were used as catalysts in the coal-based manufacture of vinyl chloride monomers in China.

- Therefore, China is the world's largest producer of mercury in 2022, with a mine production volume of 2,000 metric tons. The second leading producer of mercury, Tajikistan, produced approximately 120 metric tons in the same year.

- Globally, 10-20 million people work in the Artisanal and Small-Scale Gold Mining (ASGM) sector, and many of them use mercury on a daily basis.

- Artisanal and Small-Scale Gold Mining (ASGM) is the largest source of anthropogenic mercury emissions (37.7%) globally, followed by stationary combustion of coal (21%).

- According to USGS, China, Kyrgyzstan, Mexico, Peru, Russia, Slovenia, Spain, and Ukraine have most of the world's estimated 600,000 tons of mercury resources.

- Furthermore, Artisanal Small-Scale Gold Mining (ASGM) has extensive operations spanning over 55 countries across Asia, South America, and Africa. ASGM acts as a microeconomic source for these countries; however, ASGM has adverse environmental and health impacts.

- In China, the use of dental amalgams dates back to 1000 AD; today, dental amalgams consist of mercury and a metal alloy of silver, tin, and copper.

- All the aforementioned factors, in turn, are expected to augment the consumption of mercury in the region.

Mercury Industry Overview

The mercury market is partially fragmented in nature. The major players (not in any particular order) include Avantor Inc. (Thermo Fisher Scientific), AHSA, Aldrett Hermanos SA de CV, Merck KGaA, Wake Group, and China Jin Run Industrial Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Demand from Measuring and Controlling Devices

- 4.1.2 Demand for Sphygmomanometer for the Measurement of Blood Pressure

- 4.1.3 Widely Used in the Mining Sector for the Extraction of Gold

- 4.2 Restraints

- 4.2.1 Hazardous Properties of Mercury

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Metal

- 5.1.2 Alloy

- 5.1.3 Compounds

- 5.2 Application

- 5.2.1 Batteries

- 5.2.2 Dental Applications

- 5.2.3 Measuring and Controlling Devices

- 5.2.4 Lamps

- 5.2.5 Electrical and Electronics Devices

- 5.2.6 Processing of Gold

- 5.2.7 Other Applications (Healthcare, Pharmaceuticals, and Batteries)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.6 Saudi Arabia

- 5.3.7 South Africa

- 5.3.8 Nigeria

- 5.3.9 Qatar

- 5.3.10 Egypt

- 5.3.11 UAE

- 5.3.12 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aldrett Hermanos

- 6.4.2 Antares Chem Private Limited

- 6.4.3 Avantor Performance Materials

- 6.4.4 Bethlehem Apparatus Co. Inc.

- 6.4.5 China Jin Run Industrial Co. Ltd

- 6.4.6 Mayasa

- 6.4.7 Merck KGaA

- 6.4.8 Powder Pack Chem

- 6.4.9 Special Metals

- 6.4.10 Tamilnadu Engineering Instruments

- 6.4.11 Wake Group