|

市场调查报告书

商品编码

1521350

化学品物流:全球市场占有率分析、产业趋势/统计、成长预测(2024-2029)Global Chemical Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

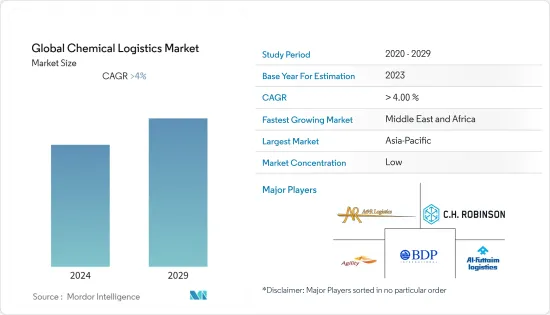

全球化学品物流市场预计在预测期内复合年增长率将超过4%

预计 2023 年至 2028 年期间,全球化学品物流市场将以超过 4% 的复合年增长率成长。

主要亮点

- 近年来,製造各种化学品的需求大幅增加。作为能源工业原料的页岩气需求不断增长,增加了页岩气运输的需求。运输化学品必须小心谨慎,因为意外事故可能会导致重大环境问题。因此,化学品需求的成长和安全运输的要求是预计推动化学品物流市场成长的一些因素。

- 化学品製造业的激增预计将推动化学品物流业向前发展。化学品生产向食品製造、药品製造、汽车製造和工程等多种供应领域的扩展将导致对安全部门运输和配送服务的需求增加。例如,根据美国工业理事会的数据,美国化学品产量2021年成长1.4%,2022年成长3.2%,出货量2021年成长8.1%,2022年成长8.2%。此外,印度政府预测2022财年印度化学工业(包括化肥和药品)将成长18-23%。

- 化学物流行业的领先公司之间正在建立伙伴关係和合作,以创造新颖且技术改进的产品。例如,化学品和先进材料专家阿科玛 SA 于 2021 年 7 月与瑞士贸易技术先驱 Nexxiot 合作,利用 Nexxiot 的尖端物联网设备和智能云平台,计划对阿科玛的 isotank(槽式货柜)和铁路货车车队数位化。此次合作将为阿科玛客户提供端到端的见解,使他们能够提高品质标准并转变整个服务体验。此外,科威特物流公司 Agility Logistics 将与美国数位物流平台 Shipa 合作,于 2021 年 2 月创建一个连接海湾合作委员会企业和消费者的保税快速公路货运网路。此次合作将提供一项新服务,为客户提供负载容量(LTL) 和负载容量(FTL) 替代方案,以快速且经济高效地出口小包裹、托盘和货柜货物。

- 化学、製药、化妆品、石油和天然气、特种化学品和食品业等各行业对化学品的需求不断增加,预计将成为市场扩张的驱动力。这些特征也支持了市场的成长,因为製造商在透过公路、铁路、海运等方式将化学品运送到目标地区时非常小心。此外,世界各国政府正大力投资创新和现代化学品物流系统,以避免灾难。因此,所有这些变数预计将对化学品物流行业的成长做出积极贡献。

化工物流市场趋势

化工产业大幅扩大带动市场

2021年,亚太地区成为化学品市场最大的地区。北美是化学品市场的第二大地区。根据美国工业理事会的年终调查,美国美国产业在 2021 年有所改善,不包括药品的产量增加了 1.4%,而 2020 年则下降了 3.5%。为了减少化学品製造对环境的影响,化学工业正逐步采用永续和环保的程序。技术和化学科学的进步使化学公司能够使用替代燃料来生产化学产品。燃料、工业产品和其他化学品是由天然存在的二氧化碳製成的。例如,化学品和涂料巨头阿克苏诺贝尔公司(Akzo Nobel NV)正在考虑对Green Lizard Technologies的专利技术投资七位数,以植物而不是油来製造表面活性剂。

为了扩大化学工业的全球物流领域,对基础设施和併购进行了大量投资。在中东地区,能源巨头阿美正在沙乌地阿拉伯开展两个重大计划。第一个是延布原油製化学品转化(CTC)计划,到2025年将年产900万吨化学品和基油。第二个大型计划是与法国合资的Amiral 150万吨/年计划,计划于2024年在朱拜勒启动。

亚太地区引领全球工业

就市场占有率而言,亚太地区预计将引领化学品物流行业。印度和中国等新兴经济体在该地区的存在是推动市场扩张的主要因素。全部区域是亚太地区新兴经济热点。印度在化工产品进出口方面也是世界领导者,出口排名第14位,进口排名第8位。化学工业很可能仍然是全球性产业,而中国是其最大的单一市场。新兴国家不断关注製造业并建造强大的仓储基础设施,预计将刺激化学品物流业的扩张。

例如,Rhenus India将于2021年10月4日将其在印度各地的仓库空间扩大至220万平方英尺,加强其支持化工产业的能力。 PCB(污染控制委员会)批准的工厂将成为 Lena 为印度南部化学品客户提供服务的主要物流中心,并且还可通往清奈的主要港口以及重要的工业和汽车中心。此外,该行业的持续成长需要在运输和仓储方面增加新的产能。例如,印度投资局预测,到 2025 年,化学产品的需求每年将以 9% 左右的速度成长。

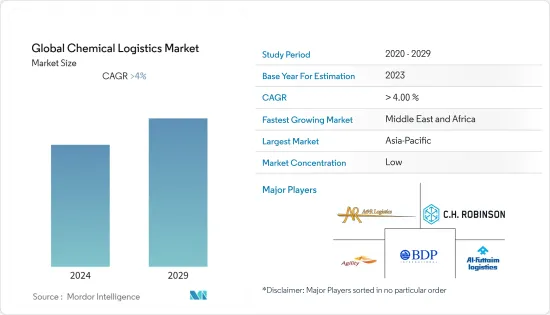

化工物流行业概况

全球化学品物流市场包括各种规模的参与者。这个领域高度分散。近年来,该行业观察到许多创新和数位化趋势,例如巨量资料分析和物联网技术的采用,进一步推动了化学品物流行业的成长。主要参与者包括 A&R Logistics、Agility Logistics、Al-Futtaim Logistics、CH Robinson 和 BDP International, Inc.。

BASF和敏捷物流等领先公司正在大力投资,以在竞争激烈的市场中脱颖而出。例如,2021年4月,经国资委核准,中国国营企业中化监督和中国化工集团合併。一个新的、未命名的实体将成立,由国资委全额资助,中化集团和中国化工集团将成为两个独立的集团。这将使两家公司能够灵活地共用其石油贸易和精製专业知识,以在竞争激烈的市场中最大限度地提高净利率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场动态与洞察

- 市场概况

- 市场驱动因素

- 市场限制因素/问题

- 市场机会

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业创新

- 政府努力吸引对该产业的投资

- 3PL 市场洞察(市场规模和预测)

- COVID-19 对产业的影响

第五章市场区隔

- 按服务

- 运输

- 仓储、交货和库存管理

- 咨询和管理服务

- 清关/安检

- 绿色物流

- 其他的

- 透过交通工具

- 路

- 铁路

- 航空

- 水路

- 管道

- 按最终用户

- 製药业

- 化妆品产业

- 石油和天然气工业

- 特种化学工业

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 孟加拉

- 土耳其

- 韩国

- 澳洲

- 印尼

- 其他亚太地区

- 中东/非洲

- 埃及

- 南非

- 沙乌地阿拉伯

- 其他中东和非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争状况

- 公司简介

- CH Robinson

- A&R Logistics

- BDP International

- Agility Logistics

- Al-Futtaim Logistics

- DHL

- Rhenus Logistics

- Montreal Chemical Logistics

- CEVA Logistics

- Petochem Middle East*

第七章市场机会与未来趋势

第8章附录

- 透过活动正确分配药品

- 洞察资本流动

- 经济统计 - 运输和仓储业对经济的贡献

The Global Chemical Logistics Market is expected to register a CAGR of greater than 4% during the forecast period.

The Global Chemical Logistics Market market is expected to register a CAGR of over 4% during the forecast period of 2023-2028.

Key Highlights

- There has been a huge increase in demand for the manufacture of different chemicals in recent years. The growth in demand for shale gas to be utilized as a feedstock in the energy industry has raised the requirement for shale gas transportation. Chemical transportation should be handled with caution since any unforeseeable incident might result in major environmental problems. As a result, rising chemical demand and the requirement for safe transportation are some of the factors expected to fuel the growth of the chemical logistics market.

- The surge in chemical manufacturing is projected to move the chemical logistics industry forward. An expansion in chemical production to feed diverse sectors like food production, pharmaceutical manufacture, vehicle manufacturing, and engineering leads to an increase in the demand for safe areas of transportation and distribution services. Chemical volumes in the United States, for example, climbed by 1.4% in 2021 and 3.2% in 2022, according to the American Chemistry Council, while shipments increased by 8.1% in 2021 and 8.2% in 2022. Furthermore, the government of India estimates that India's chemical sector (including fertilizers and pharmaceuticals) would rise by 18-23% in FY2022.

- Partnerships and collaborations are being formed by major companies in the chemical logistics industry in order to generate novel and technologically improved goods. For example, Arkema S.A., a specialized chemicals and advanced materials firm, will collaborate with Swiss trade tech pioneer Nexxiot in July 2021 to digitize Arkema's Isotank (Tank Container) and rail freight wagon fleets utilizing Nexxiot's cutting-edge IoT devices and intelligent cloud platform. This collaboration would offer Arkema clients with end-to-end insight, allowing them to raise quality standards and change the entire service experience. Furthermore, Agility Logistics, a Kuwait-based logistics company, will join with Shipa, a US-based digital logistics platform, to build a bonded, expedited road freight network that will link companies and consumers across the GCC in February 2021. This collaboration would result in a new service offering customers less-than-truckload (LTL) and full truckload (FTL) alternatives and a rapid, cost-effective way to export parcels, pallets, or goods containers.

- The rising need for chemicals in various industry verticals such as the chemical industry, pharmaceutical industry, cosmetic industry, oil & gas industry, specialty chemicals industry, food, and others is expected to drive market expansion. Furthermore, the intricacy with which the makers convey the chemicals to their target via roads, railroads, sea, and others is managed with greatest care, and this feature will help to market growth. Furthermore, governments throughout the world are investing considerably in innovative and modern chemical logistics systems in order to avert catastrophes. As a result, all of these variables will contribute favorably to the growth of the chemical logistics industry.

Chemical Logistics Market Trends

Chemical Sector Significant Expansion Driving the market

In 2021, Asia Pacific was the largest region in the chemicals market. North America was the chemicals market's second-largest region. According to a year-end study from the American Chemistry Council, the US chemical sector turned around in 2021, reporting 1.4% rise in production volume, excluding pharmaceuticals, compared to a 3.5% drop in 2020. To reduce the environmental effect of chemical manufacture, chemical industries are progressively embracing sustainable and eco-friendly procedures. Chemical businesses may now make chemical goods using alternative fuels because of advancements in technology and chemical sciences. They are producing fuels, industrial goods, and other chemicals from naturally occurring carbon dioxide. For example, Akzo Nobel N.V., a chemicals and coatings behemoth, is considering a seven-figure investment in Green Lizard Technologies' patented technology for producing surfactants from plants rather than oils.

Significant investments in infrastructure and mergers and acquisitions have been done to expand the global logistics sector in the chemicals industry. In the Middle East region, energy giant Aramco is undertaking two big projects in Saudi Arabia - First is a crude oil-to-chemicals (CTC) project in Yanbu to produce 9 million tonnes/year of chemicals and base oils by 2025. The second massive project is the Amiral 1.5 million tonnes/year joint venture project with France, which is slated to start in 2024 in Jubail.

APAC Region Leads the Global Chemical Industry

In terms of market share, Asia Pacific is predicted to lead the chemical logistics industry. The presence of rising economies in this area, such as India and China, is a prominent driver driving market expansion. The entire Southeast Asia region is the emerging economy hotspot in the Asia Pacific. Also, India is a global leader in chemical exports and imports, ranking 14th in exports and eighth in imports. While chemicals will remain a global industry, with China as its biggest single market. The developing countries are constantly focusing on the manufacturing sector and constructing robust warehouse infrastructures, which is expected to fuel the expansion of the chemical logistics industry.

Rhenus India, for example, will extend its warehouse space across India to 2.2 million square feet on October 4, 2021, strengthening its capabilities in assisting the chemical industry. The PCB (Pollution Control Board)-approved plant will act as the primary Rhenus distribution hub for chemical clients throughout South India, with strong access to Chennai's main ports as well as important industrial and car centers. Furthermore, The sector's ongoing growth necessitates the addition of new capacity in terms of transportation and warehousing. Invest India, for example, predicts that demand for chemical goods would rise by around 9% each year through 2025.

Chemical Logistics Industry Overview

There are multiple big and small players in the global chemical logistics market. The sector is highly fragmented. The sector has been observing many innovative and digital trends in recent years, like adopting big data analytics and IoT technologies to further fuel the growth of the chemical logistics industry. Some of the major players are A&R Logistics, Agility Logistics, Al-Futtaim Logistics, C.H. Robinson, and BDP International, Inc.

Big firms such as BASF and Agility Logistics are investing heavily to stand out in the fiercely competitive market. For instance, in April 2021, Chinese state-owned firms Sinochem and ChemChina merged with approval from the state-owned assets supervision and administration commission (SASAC). A new, unnamed entity wholly owned by Sasac will be created, with the Sinochem and ChemChina groups as two separate subsidies. It gives the companies the flexibility to share oil trading and refining expertise to maximize margins in a competitive market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints/Challenges

- 4.4 Market Opportunities

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Technological Innovations in the industry

- 4.8 Government Initiatives to Attract Investment in the Industry

- 4.9 Insights into the 3PL Market (Market Size and Forecast)

- 4.10 Impact of COVID - 19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Transportation

- 5.1.2 Warehousing, Distribution, and Inventory Management

- 5.1.3 Consulting & Management Services

- 5.1.4 Customs & Security

- 5.1.5 Green Logistics

- 5.1.6 Others

- 5.2 By Mode of Transportation

- 5.2.1 Roadways

- 5.2.2 Railways

- 5.2.3 Airways

- 5.2.4 Waterways

- 5.2.5 Pipelines

- 5.3 By End User

- 5.3.1 Pharmaceutical Industry

- 5.3.2 Cosmetic Industry

- 5.3.3 Oil and Gas Industry

- 5.3.4 Specialty Chemicals Industry

- 5.3.5 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Bangladesh

- 5.4.3.5 Turkey

- 5.4.3.6 South Korea

- 5.4.3.7 Australia

- 5.4.3.8 Indonesia

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 Egypt

- 5.4.4.2 South Africa

- 5.4.4.3 Saudi Arabia

- 5.4.4.4 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration Analysis and Major Player)

- 6.2 Company Profiles

- 6.2.1 C.H. Robinson

- 6.2.2 A&R Logistics

- 6.2.3 BDP International

- 6.2.4 Agility Logistics

- 6.2.5 Al-Futtaim Logistics

- 6.2.6 DHL

- 6.2.7 Rhenus Logistics

- 6.2.8 Montreal Chemical Logistics

- 6.2.9 CEVA Logistics

- 6.2.10 Petochem Middle East*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 GDP Distribution, by Activity

- 8.2 Insights on Capital Flows

- 8.3 Economic Statistics-Transport and Storage Sector, Contribution to Economy